Why Space Data Centers Won’t Scale in 2026: The Two Barriers Beyond Launch Costs

Obsolescence Risk Now a Greater Barrier Than Launch Costs for Space Data Centers

Pilot projects have shifted from proving basic in-orbit computation to testing specific AI applications, but this has simultaneously exposed the critical long-term risks of technological obsolescence and the impossibility of maintenance. These operational risks now overshadow launch costs as the primary barrier preventing the commercial scaling of space-based data centers.

- Between 2021 and 2024, early commercial efforts focused on establishing the foundational viability of placing computing hardware in space. The partnership between Axiom Space, Kepler Space, and Skyloom in December 2023 was a key step toward creating a commercial platform for an orbital data center.

- From 2025 onward, the focus pivoted to application-specific pilots, such as Google’s Project Suncatcher using TPUs for AI and Starcloud’s successful training of an AI model in space in late 2025. This progress confirms technical feasibility but introduces a severe economic challenge related to hardware relevance.

- This new application-specific focus highlights the central problem for scaling: the rapid innovation cycle of GPUs and CPUs. An orbital asset launched in 2027 with current technology, like those planned by Google or Starcloud, faces a high probability of becoming obsolete and uncompetitive long before its operational life ends, creating a massive stranded asset risk that was less apparent in the earlier conceptual phase.

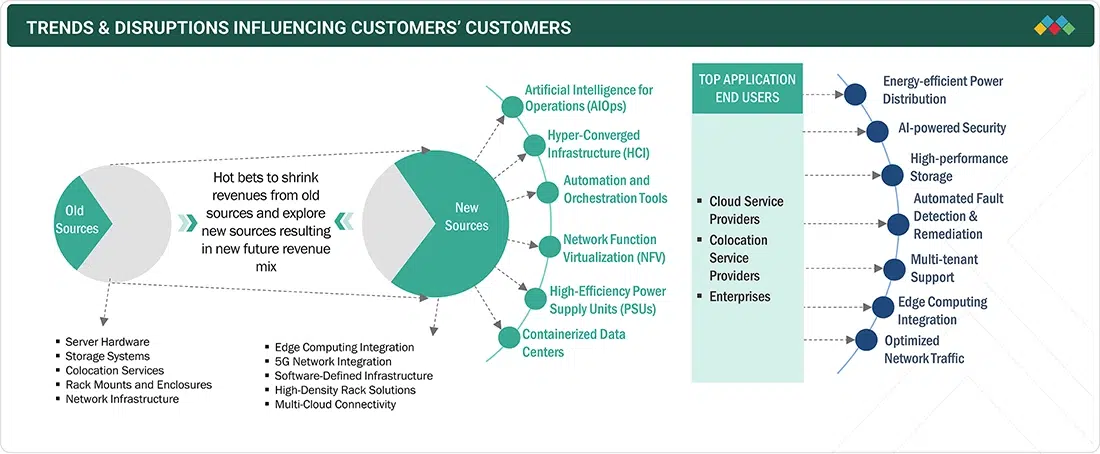

Launch Costs Plummet Over Decades

This chart shows why launch costs are no longer the primary barrier, as the section states, illustrating a dramatic cost decrease that makes other risks like obsolescence more prominent.

(Source: Visual Capitalist)

Investment Signals High Risk, Restricting Capital to Early-Stage Ventures

Investment in space-based data centers remains confined to small, early-stage seed rounds, a stark contrast to the tens of billions of dollars being directed into terrestrial data infrastructure. This disparity signals that institutional capital views the orbital model as too high-risk for large-scale deployment at this time.

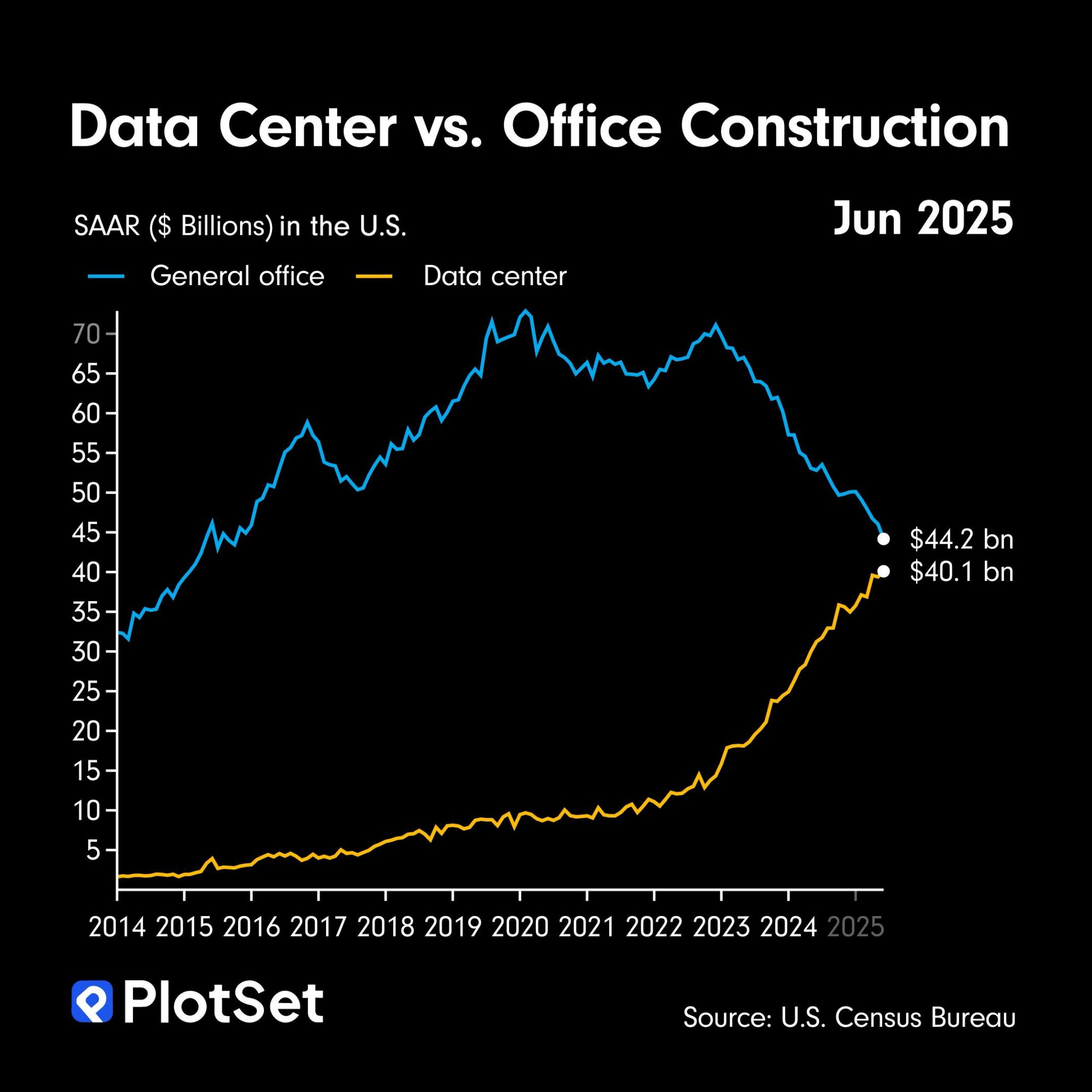

Terrestrial Data Center Spending Surges

This chart quantifies the ‘tens of billions’ being invested in terrestrial infrastructure, providing a stark contrast to the small seed rounds for space-based centers mentioned in the text.

(Source: Reddit)

- Startups like Lumen Orbit (formerly Star Cloud) secured an $11 million seed round in December 2024, demonstrating venture capital interest in the concept and building on its initial $2.4 million fundraise.

- These investments are dwarfed by commitments to the terrestrial market, where AI-driven demand has attracted massive capital. For instance, KKR and ECP announced a $50 billion partnership and Equinix formed a joint venture valued at over $15 billion, both in October 2024, to expand terrestrial data center capacity.

- The valuation gap reveals the market’s risk assessment. While VAST Data, a terrestrial AI data platform, raised $118 million in a Series E round in December 2023, its orbital counterparts are attracting only a fraction of that amount, indicating a perceived limited Serviceable Obtainable Market (SOM) due to unresolved operational and financial risks.

Table: Comparative Investment in Space-Based vs. Terrestrial Data Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Lumen Orbit | Dec 2024 | Raised $11 million in a seed round to fund development of orbital data centers for AI and other technologies. | Lumen Orbit, a Seattle-area startup that wants to put data centers in space raises $11 m |

| KKR & ECP | Oct 2024 | Formed a $50 billion strategic partnership to accelerate the development of data center and power infrastructure on Earth. | ECP Enters into $50 Billion Strategic Partnership with KKR |

| Equinix & CPP Investments | Oct 2024 | Established a joint venture valued at over $15 billion to expand hyperscale data centers in the U.S. to support AI and cloud growth. | Equinix Agrees to Form Greater Than $15 B JV to Expand Hyperscale Data Centers in the U.S. and Support Growing AI and Cloud Innovation |

| VAST Data | Dec 2023 | Secured $118 million in Series E funding, showing strong investor confidence in terrestrial AI data infrastructure platforms. | VAST Closes Series E Funding Round, Nearly Triples … |

Partnerships Evolve from Infrastructure to Application-Specific AI Pilots

Strategic partnerships have matured from establishing basic orbital infrastructure to enabling specific in-orbit AI applications. Cloud providers are now entering the ecosystem to test the viability of extending their services beyond terrestrial boundaries, marking a new phase of commercial exploration.

AI Scaling Predicted via Contextual Intelligence

This chart aligns with the section’s focus on partnerships evolving toward ‘application-specific AI pilots’ by illustrating a conceptual future model for scaling artificial intelligence.

(Source: SiliconANGLE)

- In the 2021–2024 period, collaborations like the one between Axiom Space, Kepler, and Skyloom in December 2023 focused on the foundational challenge of building an orbital platform and providing data connectivity.

- The period from 2025 onward shows a clear shift toward application-level integration. Crusoe’s partnership with Starcloud, announced in October 2025, aims to create the first public cloud service in space, a critical step toward a commercial service model.

- Major technology firms are now forming direct partnerships to test specific use cases. Google’s Project Suncatcher leverages a collaboration with Planet Labs, while Axiom Space is working with IBM/Red Hat to test terrestrial-grade computing systems on orbit, with the first nodes launched in January 2026.

Table: Key Strategic Alliances in Space-Based Data Center Development

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Axiom Space & IBM/Red Hat | Jan 2026 | Launched the first two orbital data center nodes to the ISS to test terrestrial computing systems in a space environment. | Orbital Data Centers |

| Starcloud & Crusoe | Oct 2025 | Partnership to establish the first public cloud platform in space, aiming for a 2027 launch, with a focus on AI workloads. | Crusoe is first cloud in space: Starcloud partnership for AI … |

| Google & Planet Labs | Early 2027 (Planned) | Project Suncatcher plans to equip solar-powered satellites with TPUs to test the feasibility of a scalable, space-based AI infrastructure. | Space-Based Data Centers Will Be “Normal” Within a … |

| Axiom Space, Kepler Space & Skyloom | Dec 2023 | Formed a partnership to build a commercial orbital data center hosted on the Axiom Station, focusing on infrastructure and connectivity. | Axiom Space Partners with Kepler Space and Skyloom to … |

United States Leads Development Amid Global Inactivity on Scaling Space Data Centers

The United States is the clear center of gravity for space-based data center development, a position driven by its concentration of private aerospace leaders, venture capital, and hyperscale technology companies that are initiating the first wave of pilot projects. No other region has demonstrated a comparable level of commercial activity or investment.

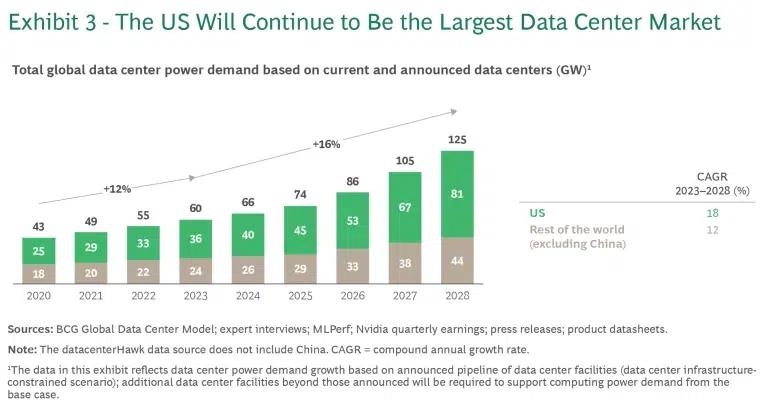

US to Lead Data Center Power Demand Growth

This chart directly supports the section’s claim of US leadership by showing its dominant and fastest-growing role in the related terrestrial data center power market.

(Source: Boston Consulting Group)

- Between 2021 and 2024, US-based companies like Axiom Space (Texas) and Lumen Orbit (Washington) established the initial commercial concepts and secured early-stage funding, laying the groundwork for the sector.

- This dominance solidified from 2025 onward as major US technology and aerospace firms announced significant initiatives. Projects from Google (California), Space X (California/Texas), Blue Origin (Washington), and Starcloud (backed by US-based NVIDIA) confirm US leadership in hardware and platform development.

- In contrast, European activity appears focused on secondary concerns like risk analysis and market standards, as noted in a Scope Ratings report on data center credit risks, rather than pioneering new orbital hardware projects or large-scale deployment strategies.

Technology Advances to In-Orbit Prototypes but Fails to Address Core Scaling Barriers

Space-based data center technology has progressed from a conceptual stage to early in-orbit prototypes, but the critical systems required for commercial scaling, specifically serviceable hardware and efficient large-scale thermal management, remain at a low maturity level and present fundamental physics challenges.

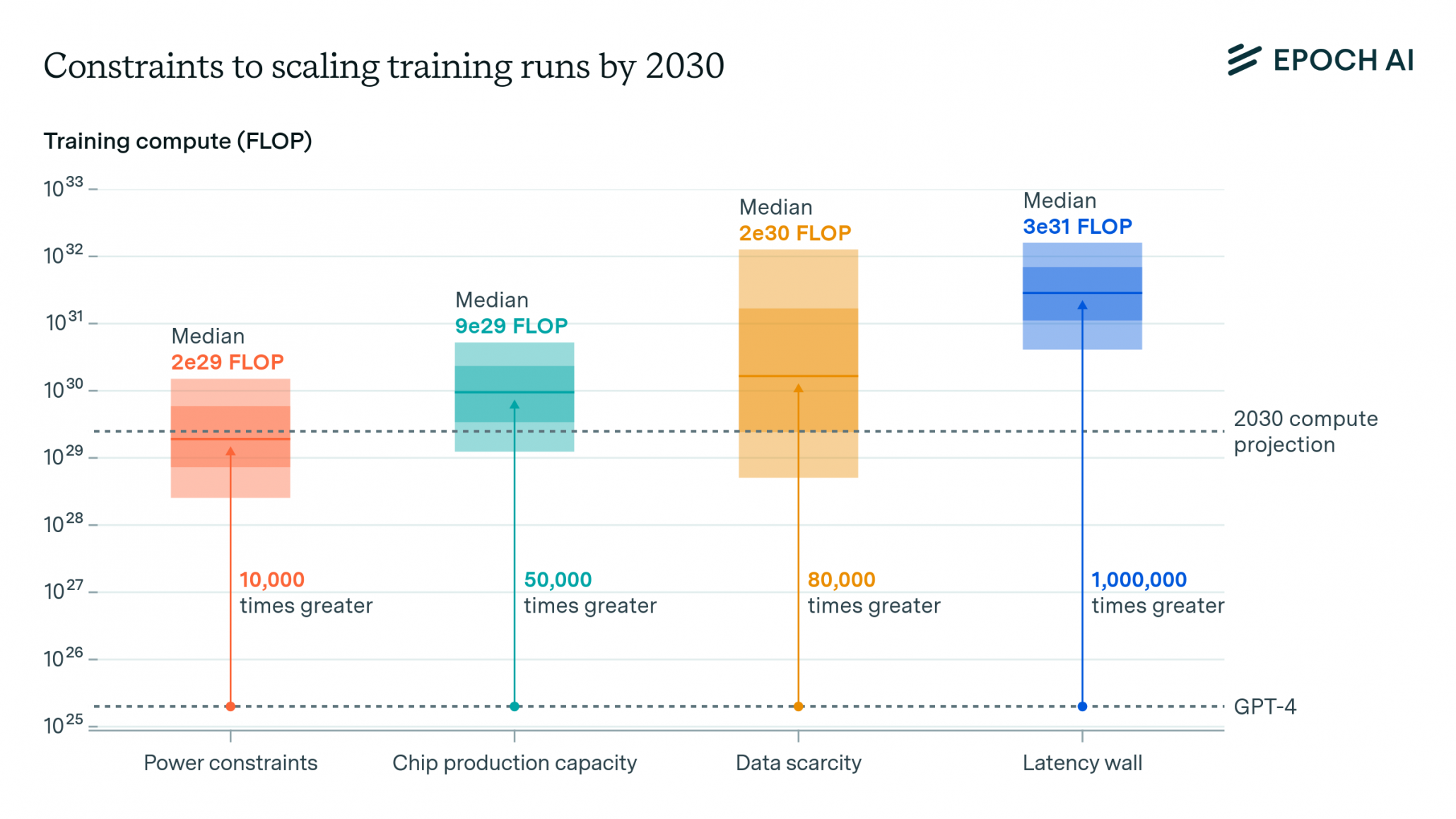

AI Scaling Faces Major Power Constraints by 2030

The chart’s focus on ‘scaling constraints’ directly mirrors the section’s heading about ‘core scaling barriers,’ with the identified power bottleneck relating to the text’s mention of thermal management.

(Source: Epoch AI)

- The period of 2021–2024 was characterized by white papers, simulations, and partnerships aimed at solving first-order problems, primarily assessing the economic viability against high launch costs and ensuring basic hardware survival in orbit.

- The launch of prototype nodes to the ISS by Axiom Space in January 2026 and Starcloud’s successful AI model training in late 2025 mark a transition to in-situ testing. This progress validates that complex computing hardware can function in a space environment.

- Despite this validation, the technology has not solved the core barriers to scaling. The impossibility of physical maintenance or hardware upgrades remains an absolute blocker to long-term economic viability, while heat dissipation in a vacuum requires heavy, costly radiators that inflate launch mass and CAPEX.

SWOT Analysis: Obsolescence Emerges as the Dominant Threat to Scaling

Analysis shows that while the core strength of space-based data centers, access to zero-cost solar energy, remains a constant advantage, the primary threat has evolved. The initial focus on high launch costs has been superseded by the more complex and seemingly insoluble economic risk of stranded assets driven by rapid technological obsolescence.

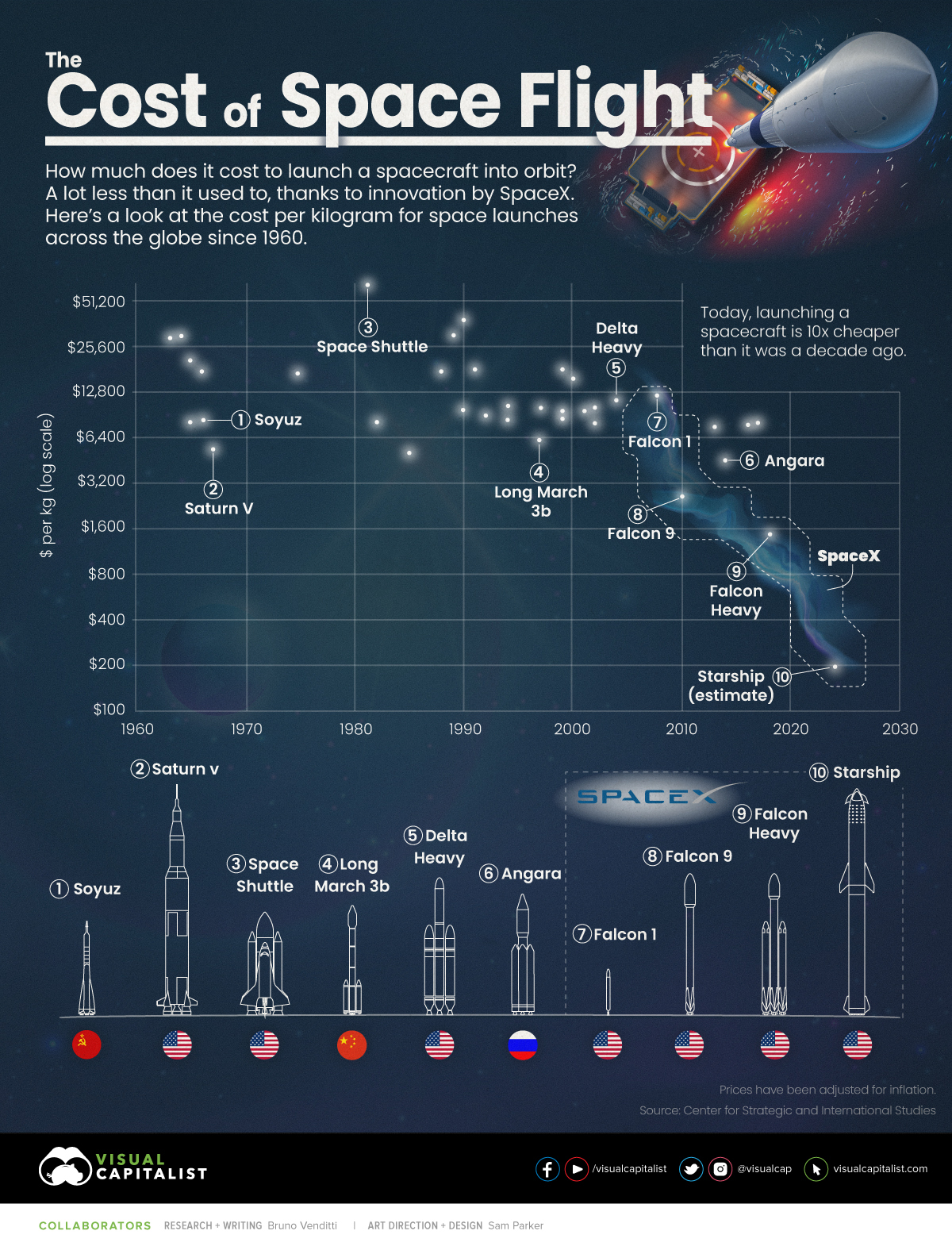

Data Center Market Shifts to New Revenue Sources

This chart’s theme of a market in transition complements the SWOT analysis, which describes an evolving focus from the threat of launch costs to the risk of obsolescence.

(Source: MarketsandMarkets)

- Strength: The primary value proposition is access to unlimited solar energy, which Starcloud projects could result in 10 x lower energy costs compared to terrestrial grids.

- Weakness: The inability to physically maintain or upgrade hardware in orbit creates a critical mismatch with the rapid innovation cycles of terrestrial GPUs and CPUs, which are refreshed every 18-24 months.

- Opportunity: A dramatic reduction in launch costs to the sub-$100/kg range, as projected by some economic models, would remove the initial CAPEX barrier and unlock commercial feasibility, but it does not resolve the subsequent operational risks.

- Threat: Technological obsolescence is the most significant long-term threat, capable of rendering multi-billion-dollar orbital assets uncompetitive and stranded, a risk that intensifies as AI hardware development accelerates.

Table: SWOT Analysis for Scaling Space-Based Data Centers

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Theoretical OPEX advantage from “free” solar power, as outlined in white papers (e.g., Star Cloud). | Energy cost advantage is quantified, with projections of being 10 x lower (Starcloud) or comparable to terrestrial energy costs alone (Google). | The economic benefit of solar energy was validated as a core part of the business model by key players like Google and NVIDIA-backed Starcloud. |

| Weaknesses | Focus on prohibitive CAPEX from launch costs (~$2, 500-$5, 000/kg) and data downlink bottlenecks. | Focus shifts to the “impossible” nature of physical maintenance and the risk of stranded assets due to rapid hardware obsolescence. | Pilots by Axiom/IBM and Google validated that hardware can run in space but simultaneously confirmed the lack of a path for upgrades, elevating obsolescence to the primary weakness. |

| Opportunities | Anticipation of next-generation reusable rockets (e.g., Starship) drastically lowering launch costs. | Launch cost reduction targets are crystallized, with economic models requiring costs below $100-$500/kg for viability. | The path to lower launch costs became clearer with Space X’s progress, but this validated that launch cost is a necessary, not sufficient, condition for success. |

| Threats | Physical risks like orbital debris and high insurance costs. Supplier concentration risk with launch providers like Space X. | Technological obsolescence is identified as the most fundamental economic threat, potentially making the business model untenable even with low launch costs. | The threat of obsolescence was validated as companies began planning to launch specific hardware (e.g., TPUs, GPUs), which have defined and rapid terrestrial refresh cycles. |

Scenario Model: Focus Shifts to Solving the Stranded Asset Problem

For space-based data centers to become more than a niche application for in-orbit processing, the industry must demonstrate a viable solution to the stranded asset problem. Without a clear path to in-orbit serviceability or modular hardware replacement, the economic model remains untenable, even if launch costs approach zero.

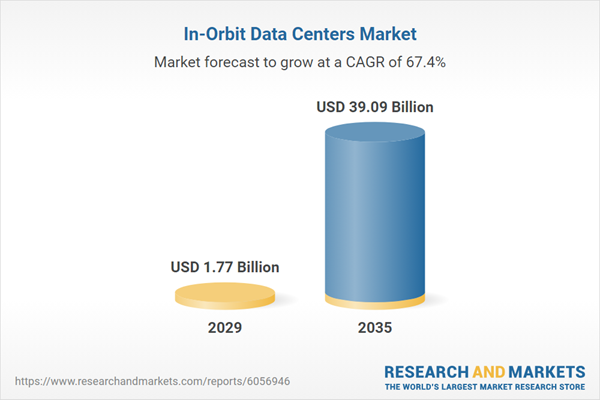

In-Orbit Data Center Market Forecast to Soar

This forecast quantifies the potential future market discussed in the scenario model, illustrating the high-stakes outcome if the ‘stranded asset problem’ is successfully solved.

(Source: GlobeNewswire)

- If launch providers like Space X achieve their aggressive launch cost targets below $100/kg in the coming years, watch for a strategic shift in pilot projects from proving functionality to proving economic service life and upgradability.

- A critical signal to monitor is the development of modular, robotically serviceable hardware architectures designed for the space environment. The absence of such initiatives from projects announced by Google or Space X suggests this problem is not yet being addressed.

- Currently, the market trajectory points toward fragmentation. Space-based computing will likely find a niche processing satellite-generated data “at the edge” to reduce high-cost data downlinks, but it will not compete with terrestrial hyperscale data centers for general-purpose workloads due to the obsolescence and maintenance risks.

- The upcoming pilot projects, including Google’s planned 2027 launch and Space X’s stated plans from November 2025, are pivotal. If these initiatives proceed without a credible strategy for hardware refresh cycles, they will likely validate that technological obsolescence is the ultimate, and perhaps permanent, barrier to scaling.

Frequently Asked Questions

According to the analysis, what are the two main barriers now preventing space data centers from scaling?

The two primary barriers are the high risk of technological obsolescence and the impossibility of physical maintenance or hardware upgrades in orbit. As pilot projects shift to specific AI hardware, the rapid 18-24 month innovation cycle for GPUs and CPUs means an orbital asset could become uncompetitive long before its operational life ends, creating a massive stranded asset risk that now overshadows launch costs.

How does the investment in space data centers compare to investment in terrestrial data centers?

There is a vast difference, signaling high perceived risk for the orbital model. While space startups like Lumen Orbit have raised seed rounds of around $11 million, terrestrial infrastructure has attracted commitments in the tens of billions, such as a $50 billion partnership between KKR and ECP. This disparity shows that institutional capital is not yet ready for large-scale deployment in space.

What has changed in the focus of space data center projects between the 2021-2024 period and today?

The focus has shifted from proving foundational viability to testing application-specific pilots. Early projects (2021-2024) centered on establishing that computing hardware could be placed and connected in orbit. From 2025 onward, projects like Google’s Project Suncatcher and Starcloud’s AI model training are testing specific use cases, which in turn has exposed the core economic challenges of hardware obsolescence and maintenance.

What is the significance of the partnerships between companies like Axiom Space/IBM and Google/Planet Labs?

These partnerships mark a maturation of the sector, moving from building basic infrastructure to enabling specific applications. The Axiom Space and IBM/Red Hat collaboration (Jan 2026) is testing terrestrial-grade computing systems on the ISS, while Google’s planned project (2027) will test TPUs for AI workloads. They validate that complex computing is technically feasible in space but also highlight the absence of a solution for hardware upgrades.

What needs to happen for space-based data centers to overcome the current barriers and become a scalable industry?

The industry must solve the ‘stranded asset problem’ by creating a viable path for in-orbit serviceability and hardware upgrades. Even if launch costs fall below the target of $100/kg, the business model remains untenable without a way to refresh the computing technology. A key signal for progress would be the development of modular, robotically serviceable hardware architectures.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.