Siemens AI Strategy 2025-2026: Inside Top 10 Energy Projects Powering Data Centers and Smart Grids

Siemens is executing a focused strategy to dominate the industrial AI market by embedding artificial intelligence directly into energy infrastructure solutions. The company is leveraging its deep domain expertise in industrial automation and engineering, combined with targeted multi-billion-dollar investments and strategic partnerships, to create an integrated ecosystem that addresses the surging power demands of data centers and the growing complexity of modern energy grids. This approach positions Siemens not as a general AI provider, but as the essential technology partner for applying AI to solve real-world energy challenges.

Siemens AI Commercial Projects 2026: From Pilots to Powering Critical Infrastructure

Siemens has transitioned its AI strategy from foundational research and pilots to the commercial deployment of large-scale solutions for critical energy and industrial infrastructure.

- Between 2021 and 2024, Siemens focused on building its technological foundation through partnerships with cloud and AI leaders like Microsoft, NVIDIA, and Google Cloud. During this period, projects like the AI-driven Railigent X platform, which achieved over 99% service availability for a major rail fleet, served as crucial validation points for applying AI in operational technology environments.

- From 2025 to 2026, the strategy has shifted to direct commercialization and large-scale investment in energy infrastructure. Siemens Energy announced a $1 billion investment in the U.S. to expand manufacturing for electrical equipment specifically to meet the power demands of AI and data centers.

- This commercial push is further evidenced by a January 2026 partnership with VSIP to develop state-of-the-art data center parks in Vietnam and a collaboration with IFS to create solutions for the autonomous grid of the future. These moves demonstrate a clear progression from developing AI capabilities to deploying them in high-value energy markets.

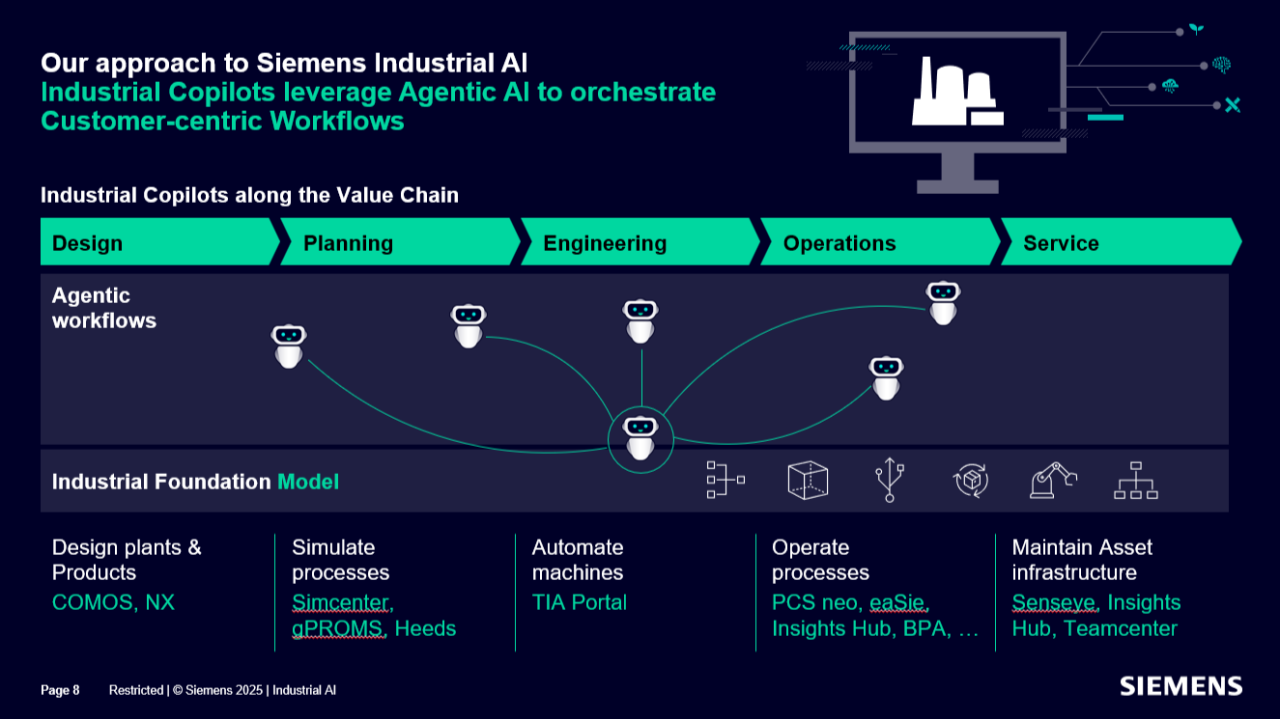

Siemens Maps AI Copilot Strategy

This diagram illustrates the strategy for deploying commercial AI solutions across the value chain, aligning with the section’s focus on moving from pilots to large-scale deployment.

(Source: LinkedIn)

Siemens AI Investment Analysis: Billions Deployed for Energy and Digital Dominance

Siemens‘ investment strategy has matured from broad innovation funding to targeted, multi-billion-dollar capital allocations and strategic acquisitions designed to capture the AI-driven energy and industrial software markets.

- The company’s landmark $10.6 billion acquisition of Altair Engineering in October 2024 was a decisive move to secure a leading position in AI-powered industrial simulation and high-performance computing, directly enhancing its digital twin and energy modeling capabilities.

- In February 2026, Siemens Energy committed $1 billion to expand its U.S. manufacturing footprint, a direct response to the validated, commercial-scale demand for electrical infrastructure to power AI and data centers.

- These large-scale actions were preceded by foundational investments, including a €2 billion global investment strategy announced in June 2023 to bolster innovation and manufacturing capacity, and a CAD$150 million R&D center in Canada announced in March 2025 to develop AI for EV battery production.

Table: Siemens Key AI-Related Investments (2024-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| U.S. Manufacturing Expansion | Feb 2026 | $1 Billion investment by Siemens Energy to expand electrical equipment manufacturing in the U.S. to meet surging power demand from AI and data centers. | Siemens Energy Bets $1 Billion That A.I. Power Demand Will Last |

| Global AI Manufacturing R&D Center | Mar 2025 | CAD$150 Million investment over five years to establish a global R&D center in Ontario, Canada, focused on developing AI technologies for EV battery production. | Siemens to establish global AI Manufacturing … |

| Altair Engineering Inc. | Oct 2024 | $10.6 Billion acquisition to create a comprehensive, AI-powered portfolio for industrial simulation and high-performance computing, strengthening the Siemens Xcelerator platform. | Siemens strengthens leadership in industrial software and AI with … |

Siemens Partnership Strategy: Building an AI Energy Ecosystem with Tech Giants

Siemens has systematically built an industrial AI ecosystem by forming deep, technology-focused partnerships with software, cloud, and hardware leaders to accelerate the deployment of AI in energy and manufacturing.

- The strategy began with foundational alliances to integrate best-in-class technology, including a 2021 partnership with Google Cloud for factory AI and a 2022 agreement with NVIDIA to build the industrial metaverse using its Omniverse platform.

- In 2023, the collaboration with Microsoft to co-develop the Siemens Industrial Copilot using Azure Open AI Service marked a critical step in bringing generative AI to industrial engineering workflows.

- By 2025 and 2026, the partnerships have become more application-specific, targeting key energy verticals. This includes a collaboration with Commonwealth Fusion Systems and NVIDIA to design fusion power plants, a partnership with IFS for autonomous grid management, and an agreement with VSIP to construct data center parks in Vietnam.

Siemens Defines Its AI Tech Stack

This framework shows how Siemens builds its AI solutions and explicitly includes the ‘partner ecosystem’ which is the core topic of this section.

(Source: LinkedIn)

Table: Siemens Strategic AI Partnerships (2024-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Commonwealth Fusion Systems, NVIDIA | Jan 2026 | Leveraging AI-powered digital twins, combining Siemens‘ software with NVIDIA‘s AI capabilities, to design and optimize commercial fusion energy power plants. | Commonwealth Fusion Systems |

| VSIP | Jan 2026 | Strategic partnership to develop state-of-the-art data center parks in Vietnam, leveraging Siemens‘ technology to build out critical digital infrastructure. | Siemens and VSIP announce landmark strategic partnership |

| IFS | Nov 2025 | Strategic partnership to develop solutions for the autonomous grid, uniting Siemens‘ expertise in grid planning with IFS‘s enterprise asset management software. | IFS and Siemens Forge Strategic Partnership to Power the … |

| Physics X | Dec 2024 | Collaboration to build an enterprise AI platform for AI optimization and simulation, integrating generative AI for advanced engineering in renewable energy and aerospace. | Siemens & Physics X collaborate to build AI-based deep physic |

Siemens Global AI Footprint: Expanding from Europe to North America and Asia

Siemens has strategically expanded its AI-driven energy infrastructure activities beyond its traditional European stronghold into high-growth markets in North America and Asia, directly following data center and advanced manufacturing demand.

- While foundational AI development and partnerships between 2021 and 2024 were often global in nature or centered on Siemens‘ advanced manufacturing facilities in Germany, the focus has since shifted to targeted regional investments.

- The United States has become a primary focus, highlighted by the $1 billion investment by Siemens Energy in 2026 to address the acute need for electrical equipment for data centers and the $510 million invested in U.S. manufacturing in 2023.

- Canada is another key region, with a CAD$150 million R&D center for AI in battery manufacturing announced in 2025, positioning Siemens within the North American EV supply chain.

- The company is also targeting growth in Asia, evidenced by the January 2026 partnership with VSIP to build data center parks in Vietnam and a €200 million high-tech factory in Singapore announced in 2023 to serve demand for digitalization in Southeast Asia.

Siemens AI Technology Maturity: From R&D to Commercial-Scale Energy Solutions

The AI technology within Siemens‘ energy portfolio has rapidly progressed from the R&D stage to commercially deployed, scalable solutions that address validated market needs in grid modernization and data center power management.

- Between 2021 and 2024, Siemens focused on developing its core AI platforms and proving their viability. This included launching the AI-enabled Building X suite for net-zero buildings in 2022 and co-developing the Siemens Industrial Copilot with Microsoft in 2023.

- The period from 2025 to 2026 marks a shift to product commercialization and market-driven deployment. The upcoming release of the Digital Twin Composer in mid-2026 provides a tangible tool for building industrial metaverse environments, moving beyond conceptual frameworks.

- The commercial maturity of the technology is validated by both customer adoption and financial commitment. The partnership with Pepsi Co demonstrated quantifiable energy savings of 10-15%, and Siemens Energy’s $1 billion investment is a direct response to proven demand for its AI-related power infrastructure.

Siemens AI Simulates Data Center Energy

This image provides a concrete example of a mature, commercial-scale energy solution, showing a digital twin optimizing a data center’s power and cooling.

(Source: Siemens)

SWOT Analysis: Siemens’ Strategic Position in the AI-Powered Energy Market

Siemens‘ strategic acquisitions and deep-seated domain expertise have created a formidable position in the industrial AI market, though successful integration of new technologies and competition from agile tech giants remain principal factors to monitor.

- The company’s primary strength is its ability to combine deep industrial knowledge with leading-edge AI, a position massively reinforced by key partnerships and acquisitions.

- Its main opportunity lies in the explosive growth of AI-related energy demand, which it is directly addressing with targeted investments and new product offerings.

- However, the complexity of integrating a large portfolio like Altair presents an internal challenge, while external threats from generalist AI providers require Siemens to continuously prove the superior value of its domain-specific solutions.

Siemens Leads in Manufacturing Innovation

This competitive matrix visually confirms Siemens’ leadership position, a key ‘Strength’ discussed in the SWOT analysis summary.

(Source: Blogs – Siemens)

Table: SWOT Analysis for Siemens’ AI in Energy Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Deep industrial domain expertise and a vast installed base of equipment and software. | Domain expertise enhanced with best-in-class simulation and generative AI capabilities through the $10.6 B Altair acquisition and the NVIDIA partnership for the industrial metaverse. | The company successfully translated its industrial knowledge into a powerful, defensible AI ecosystem, moving from a component supplier to an integrated solutions provider. |

| Weaknesses | Perception as a slower-moving industrial giant compared to agile tech companies. Dependence on partners for foundational AI models. | Integration complexity of the massive Altair portfolio into the Siemens Xcelerator platform. Scaling the Industrial Copilot across a diverse customer base is a significant operational challenge. | The core weakness shifted from a technology gap to an execution risk. The challenge is no longer acquiring AI talent but effectively deploying and integrating it at an enterprise scale. |

| Opportunities | Growing awareness of AI’s potential in manufacturing and industrial processes. Early adoption of predictive maintenance. | Explosive growth in power demand from data centers and AI, creating a massive market for advanced electrical equipment and grid management solutions. | The market opportunity has become specific and quantifiable. Siemens validated this with its $1 billion investment to directly serve AI-driven energy demand. |

| Threats | Competition from large technology companies (e.g., Microsoft, Google) entering the industrial space with general AI platforms. | Generalist AI providers continue to pose a threat, but Siemens is creating a “moat” by embedding AI deeply into its domain-specific hardware and software workflows. | The threat has been mitigated by a strategy of co-opetition. By partnering with tech giants like Microsoft, Siemens leverages their AI infrastructure while controlling the industrial application layer. |

Siemens 2026 Outlook: Scaling the Industrial Metaverse for Energy and Manufacturing

The most critical objective for Siemens in 2026 is the successful commercial launch and market adoption of its core industrial metaverse technologies, which will serve as the ultimate validation of its multi-billion-dollar AI strategy.

- The market release of the Digital Twin Composer on the Siemens Xcelerator Marketplace in mid-2026 is the single most important milestone to watch. Its adoption rate by industrial customers will be a direct indicator of the market’s readiness for at-scale industrial metaverse solutions.

- The rollout of the world’s first fully AI-driven adaptive manufacturing site, beginning at the Siemens factory in Amberg, Germany, in 2026, will provide a powerful, real-world blueprint for the factory of the future and a key proof point for its collaboration with NVIDIA.

- Finally, achieving its guided comparable revenue growth of 6% to 8% for fiscal year 2026 will be the key financial test of its AI-centric strategy, particularly after a strong start to the year with 10% order growth in Q 1 FY 26 driven by AI-related demand.

Industrial AI Market Growth Forecast

This market forecast provides crucial context for the ‘2026 Outlook’ section, showing the massive market opportunity Siemens is targeting with its AI strategy.

(Source: IoT Analytics)

Frequently Asked Questions

What is the primary focus of Siemens’ AI strategy for 2025-2026?

Siemens’ strategy is focused on embedding AI directly into energy infrastructure solutions to address the power demands of data centers and the complexity of smart grids. Rather than being a general AI provider, Siemens aims to be the key technology partner applying AI to solve specific, real-world energy and industrial challenges.

What are the most significant investments Siemens has made to support its AI and energy strategy?

Siemens has made several multi-billion-dollar investments, including the $10.6 billion acquisition of Altair Engineering in October 2024 to enhance its industrial simulation and AI capabilities. Additionally, in February 2026, Siemens Energy committed $1 billion to expand U.S. manufacturing of electrical equipment needed to power AI and data centers.

Which major tech companies is Siemens partnering with to build its AI ecosystem?

Siemens has formed strategic partnerships with several technology leaders. Key partners include Microsoft (for the Siemens Industrial Copilot), NVIDIA (to build the industrial metaverse and design fusion power plants), Google Cloud (for factory AI), and IFS (for autonomous grid management).

How has Siemens’ AI strategy evolved from its earlier phase (2021-2024) to its current one (2025-2026)?

Between 2021 and 2024, Siemens focused on foundational research, pilot projects like Railigent X, and forming partnerships to build its technological capabilities. From 2025 to 2026, the strategy has shifted decisively towards direct commercialization, large-scale deployment, and targeted capital investments in high-value energy markets like data center infrastructure.

What are some specific energy projects Siemens is working on as part of its AI strategy?

Key energy projects include a partnership with Commonwealth Fusion Systems and NVIDIA to design commercial fusion power plants using AI-powered digital twins; a collaboration with IFS to create solutions for the autonomous grid of the future; and a partnership with VSIP to develop state-of-the-art data center parks in Vietnam. The company is also investing $1 billion to scale up manufacturing of electrical equipment specifically for data centers.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.