Space-Based AI Data Centers in 2026: The Winners, Losers, and Key Signals for Infrastructure Investors

From Pilots to Commercial Projects: Adoption Signals for Space-Based AI Data Centers

The market for orbital AI data centers has advanced from theoretical research between 2021 and 2024 to the execution of tangible in-orbit pilots and the formation of commercial service partnerships since 2025. This progression confirms early technical viability and signals the beginning of market formation, driven by the need to circumvent terrestrial energy and land constraints.

- Between 2021 and 2024, industry activity focused on component-level validation. Hewlett Packard Enterprise tested its Spaceborne Computer-2 on the International Space Station, proving commercial hardware could operate in space, while startups like Lyte Loop secured funding for conceptual data storage models.

- Since 2025, the focus has shifted to system-level, end-to-end demonstrations. Starcloud, a startup backed by NVIDIA, successfully trained an AI model in orbit using an NVIDIA H 100 processor, a critical proof of concept for in-space processing.

- The emergence of a commercial service layer is the most significant recent development. The partnership between Starcloud and Crusoe aims to launch the first public cloud in space by 2027, moving beyond proprietary use cases toward a multi-tenant commercial offering.

- Near-term platform availability is also materializing with companies like Axiom Space planning to install an Orbital Data Center Node on the ISS in 2027, providing a testbed for other companies to validate their technologies.

Investment Analysis: Strategic Capital Follows Vertical Integration and Commercial Viability

Investment patterns show a clear maturation from early-stage venture funding for conceptual startups before 2025 to strategic capital aimed at building and launching functional orbital infrastructure. The scale of investment has increased, underscored by massive valuation targets from vertically integrated players who control both launch and AI development.

- Before 2025, investments were smaller and speculative, such as Lyte Loop Technologies‘ $40 million private financing in 2021 to develop a novel space-based data storage concept.

- Since 2025, the financial scope has expanded dramatically, best exemplified by Space X reportedly seeking a $1.5 trillion valuation to fund its vertically integrated strategy of building orbital data centers for its own AI workloads at x AI. This figure represents the immense capital required and the perceived market opportunity.

- The scale of terrestrial investment highlights the market orbital solutions aim to disrupt. Hyperscalers like Alphabet, Amazon, Microsoft, and Meta are projected to spend $400 billion on terrestrial data centers in 2026 alone, creating a clear incentive to find lower-cost alternatives for long-term growth.

Table: Investment in Space-Based and Terrestrial AI Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Alphabet, Amazon, Microsoft, Meta | 2026 | A projected $400 billion in terrestrial data center CAPEX represents the massive scale of current investment that could be partially displaced by orbital solutions. | The Data Center Balancing Act: Powering Sustainable AI |

| Space X / x AI | 2025-Today | Seeking a $1.5 trillion valuation to fund the launch of 1 megaton of satellites per year, aiming to add 100 GW of AI compute capacity annually. This shows a commitment to a vertically integrated, large-scale deployment. | Musk’s Next Ambition: Building a Space-Based AI Data … |

| Crusoe / Starcloud | 2025-Today | A $3.4 billion joint venture, initially for terrestrial data centers, now includes a partnership to establish the first public cloud in space, signaling a strategic pivot by an AI cloud infrastructure firm. | Crusoe is first cloud in space: Starcloud partnership for AI … |

| Lumen Orbit | Oct 2024 | Secured $10 million in seed funding to develop orbital data center technology. This represents early-stage venture confidence in the market just before the recent acceleration. | Here’s How a Startup Landed $10 Million to Put AI Data … |

| Lyte Loop Technologies | Feb 2021 | Raised $40 million in private financing to develop a space-based data storage network using lasers. This was an early, conceptual investment in the broader space data ecosystem. | Investors Bet $40 M On Startup Lyte Loop’s Idea to Store … |

Partnership Analysis: The Emerging Ecosystem for Orbital AI Data Centers

Strategic partnerships have matured from hardware validation tests into the formation of an end-to-end commercial ecosystem designed to deliver cloud services directly from orbit. This shift demonstrates that the industry is moving from proving individual components to building a complete value chain.

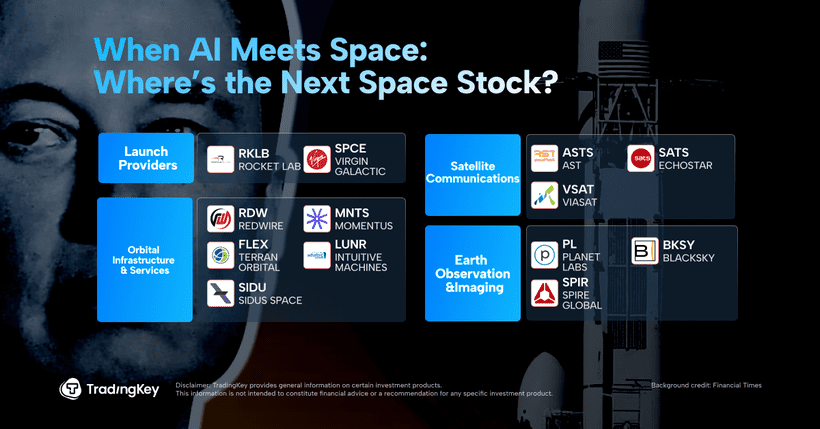

Mapping the Orbital AI Ecosystem

This chart categorizes the key players in the space economy, visually supporting the section’s analysis of the emerging end-to-end commercial ecosystem.

(Source: Trading Key)

- The alliance between Starcloud and Crusoe, announced in late 2025, is the most critical commercial development. It connects an in-orbit compute provider with a public cloud operator, creating a direct path to offering commercial services and establishing a template for future collaborations.

- Google‘s partnership with Planet on Project Suncatcher shows a hyperscaler directly engaging with a space data company to develop its own orbital infrastructure. This move is a strategic response to the threat posed by vertically integrated competitors like Space X.

- The implicit partnership between NVIDIA and Starcloud is foundational, as NVIDIA‘s hardware was used in the first successful in-orbit AI model training. This makes NVIDIA an essential enabler for the entire emerging sector, solidifying its role as the primary supplier of AI processors for both terrestrial and orbital systems.

Table: Key Strategic Partnerships in Space-Based AI Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Crusoe & Starcloud | 2025-Today | Partnership to create the first public cloud in space, aiming for a 2027 launch. This alliance connects in-orbit infrastructure with a commercial cloud operator, creating an end-to-end service. | Crusoe is first cloud in space: Starcloud partnership for AI … |

| Google & Planet | Dec 2025 | Collaboration on Project Suncatcher, Google‘s initiative to explore solar-powered satellite constellations for AI workloads. This shows a hyperscaler building its own capabilities. | Planet bets on orbital data centers in partnership with Google |

| NVIDIA & Starcloud | Dec 2025 | Starcloud, a startup in the NVIDIA Inception program, used an NVIDIA H 100 processor for the first AI model training in space. This establishes NVIDIA as the key hardware supplier. | Nvidia-backed Starcloud trains first AI model in space … |

| Space X & x AI | 2025-Today | An internal partnership where Space X will leverage its launch capabilities and Starlink network to build and operate orbital data centers for x AI‘s compute needs. This creates a powerful, vertically integrated competitor. | Musk’s Next Ambition: Building a Space-Based AI Data … |

Geographic Winners and Losers: How Space Data Centers Reshape Strategic Advantage

The rise of orbital compute infrastructure redefines geographic advantage, shifting focus from regions with favorable terrestrial conditions like cheap land and power to nations with sovereign launch capabilities and robust space industries. This transition will create a new set of winners while posing a long-term risk to economies built around the current data center model.

- Between 2021 and 2024, the primary geographic winners were states like Texas and Georgia, which attracted massive terrestrial data center investments due to available land and power.

- From 2025 onward, the United States is positioned as the dominant leader due to its combination of private aerospace innovators like Space X and Blue Origin and technology giants like Google and NVIDIA. China is the other major power with the national will and technical ability to compete directly.

- Nations lacking sovereign launch capabilities face a strategic disadvantage. They risk becoming dependent on a few foreign providers for critical AI infrastructure, a vulnerability that initiatives like the Canadian Sovereign AI Compute Strategy may need to address by incorporating orbital components.

- Regions that currently benefit from terrestrial data center construction and tax revenue could see this growth slow. A project on the scale of Stargate (reportedly $500 billion) may represent a peak for terrestrial-only builds if the next generation of hyperscale AI training moves to orbit.

Technology Maturity: From Component Validation to System-Level Proof of Concept

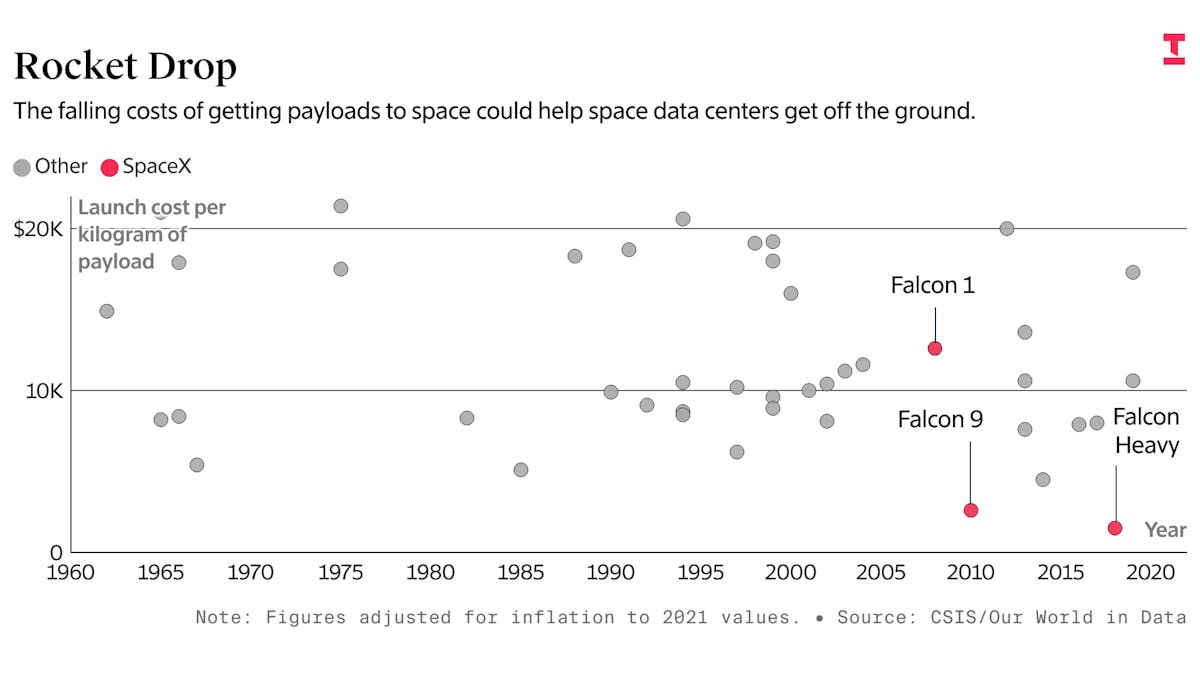

The technology for space-based AI data centers has advanced from the R&D stage of component validation to the initial pilot stage of system-level demonstration. However, achieving commercial scale is entirely dependent on achieving radical reductions in launch costs, a barrier that makes the technology’s maturity inseparable from the operational success of next-generation rockets.

Falling Launch Costs Enable Orbital Compute

This chart illustrates the historical reduction in launch costs, which the section identifies as the critical dependency for achieving commercial-scale technology maturity.

(Source: The Information)

- The 2021-2024 period was defined by reducing perceived technical risk. HPE‘s work on the ISS proved that commercial off-the-shelf electronics could function in the space environment, a key step in lowering hardware costs.

- The period from 2025 to today is marked by the first integrated system-level success. Starcloud‘s demonstration of training an AI model in orbit using an NVIDIA GPU proves that the core function is technically possible.

- The primary constraint remains economic, not technical. Current launch costs of $1, 500-$3, 000 per kilogram are prohibitive for large-scale deployment. Analyses from both Starcloud (requiring $500/kg) and Google (requiring $200/kg) confirm that economic viability is only achieved with an order-of-magnitude cost reduction.

- Therefore, the technology’s readiness for widespread adoption is directly tied to the performance of Space X’s Starship. Without it achieving its targeted cost-per-flight goals, orbital data centers will remain a niche, high-cost solution.

SWOT Analysis: Evaluating the Strategic Outlook for Orbital AI Data Centers

The strategic outlook for space-based AI data centers is defined by a powerful value proposition of limitless power and cooling, which is currently negated by the extreme cost of launch. Recent progress has validated the core technical premise, but the entire model’s success hinges on resolving the economic weakness of launch costs, which presents both a massive opportunity for integrated players and a significant threat to the terrestrial status quo.

Table: SWOT Analysis for the Shift to Space-Based AI Data Centers

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Theoretical advantages of unlimited solar power and a perfect vacuum for cooling were the primary talking points. | Starcloud‘s pilot projects begin to provide empirical data on the energy cost advantage, estimated to be 10 x lower than terrestrial centers. | The core strength of superior operational economics (power and cooling) has moved from a theoretical claim to an early, validated data point. |

| Weaknesses | Extremely high launch costs and unproven reliability of commercial hardware in space were the main barriers. | Launch costs remain the single biggest weakness, with targets of $200-$500/kg cited as necessary for viability, compared to today’s $1, 500-$3, 000/kg. Latency is a known but secondary concern for training workloads. | The launch cost barrier has been quantified, making it the definitive metric to watch. Hardware reliability concerns have been partially eased by tests like HPE’s Spaceborne Computer-2. |

| Opportunities | The growing energy consumption of AI was recognized as a problem, creating a market pull for alternative solutions. | The insatiable demand for AI is now quantified, with projections of data centers consuming up to 12% of U.S. electricity and hyperscalers planning $400 billion in CAPEX for 2026. This defines a massive market to disrupt. | The size of the market opportunity is now much clearer and larger than previously anticipated, strengthening the business case for finding a disruptive solution. |

| Threats | The concept was seen as a distant, long-term risk to terrestrial data center REITs and utilities. | The threat is now more concrete, with specific companies (Space X, Google) and timelines (2027 pilots) emerging. This creates strategic risk for non-integrated cloud providers and long-term demand risk for power utilities. | The threat has moved from a general concept to a specific competitive dynamic led by vertically integrated companies, posing a direct challenge to the business models of terrestrial incumbents. |

Scenario Modeling: Watch Launch Costs to Predict the Future of AI Infrastructure

The critical signal to monitor over the next 12-24 months is the demonstrated, all-in operational cost-per-kilogram of Space X’s Starship. If this metric falls below the $500/kg threshold cited by market participants, expect a rapid acceleration of investment and strategic realignment across the technology and energy sectors.

- If Starship achieves routine, low-cost flights, watch for major cloud providers without integrated launch capabilities, such as Amazon Web Services and Microsoft Azure, to announce significant partnerships with launch companies or accelerate their own orbital compute programs to avoid strategic dependency on competitors.

- A successful, low-cost Starship would trigger a surge in venture capital funding for the entire space-based compute ecosystem, including startups focused on in-orbit servicing, radiation-hardened components, and high-bandwidth laser communications.

- In this scenario, stock valuations for terrestrial data center REITs and developers could face pressure as investors begin to price in a long-term reduction in the growth rate for new, large-scale AI training facilities on Earth.

- Conversely, if Starship faces significant delays or fails to meet its cost targets, the timeline for orbital data centers will extend into the mid-2030 s as predicted by Google‘s more conservative analysis, maintaining the status quo for terrestrial infrastructure for the remainder of this decade.

Frequently Asked Questions

Why are companies exploring putting AI data centers in space?

Companies are exploring space-based AI data centers primarily to circumvent terrestrial constraints on energy and land. The space environment offers significant potential advantages, including access to unlimited solar power and a perfect vacuum for passive cooling, which could make operational energy costs up to 10 times lower than on Earth.

What is the biggest obstacle preventing the large-scale deployment of orbital data centers?

The single biggest obstacle is economic, not technical: the extremely high cost of launching mass into orbit. While current launch costs are around $1,500-$3,000 per kilogram, the article states that a cost of $200-$500 per kilogram is necessary for commercial viability. Therefore, the entire market’s future depends on next-generation rockets, like SpaceX’s Starship, achieving radical reductions in launch costs.

Has anyone actually proven that AI processing can be done in space?

Yes. The article highlights that a critical proof of concept was achieved since 2025. Starcloud, a startup backed by NVIDIA, successfully trained an AI model in orbit using an NVIDIA H100 processor. This event marked a shift from theoretical research to a tangible, system-level demonstration of in-space AI processing.

Who are the key companies leading this new market?

The key players include vertically integrated companies like SpaceX, which plans to launch data centers for its own AI company, xAI. There are also crucial partnerships forming an end-to-end ecosystem, such as the one between Starcloud (in-orbit compute) and Crusoe (cloud operator). Hyperscalers like Google are also involved through initiatives like Project Suncatcher, and NVIDIA is positioned as the essential hardware enabler for the entire sector.

What is the single most important signal for an investor to watch in this sector?

The most critical signal to monitor over the next 12-24 months is the demonstrated, all-in operational cost-per-kilogram of SpaceX’s Starship. If this metric falls below the $500/kg threshold cited by market participants, it is expected to trigger a rapid acceleration of investment and strategic realignment across the technology and energy sectors, signaling that the market is ready for commercial scaling.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.