Top 10 2025 Fuel Cell Projects for AI Data Centers

SOFCs Emerge as Primary Power for AI Data Centers

Solid Oxide Fuel Cells (SOFCs) have decisively shifted from a niche backup power source to a primary, on-site generation asset for the U.S. data center industry. This transformation is a direct response to the dual pressures of artificial intelligence’s exponential energy demand and the severe, multi-year delays plaguing grid interconnection. Key deployments in 2025 and early 2026 underscore this trend, including the landmark $5 billion partnership between Bloom Energy and Brookfield Asset Management for AI data centers and American Electric Power’s agreement to procure up to 1 GW of SOFCs. These capital-intensive, large-scale projects highlight the year’s dominant theme: the strategic necessity of “behind-the-meter” power to enable rapid, gigawatt-scale data center build-outs, bypassing an increasingly inadequate national grid.

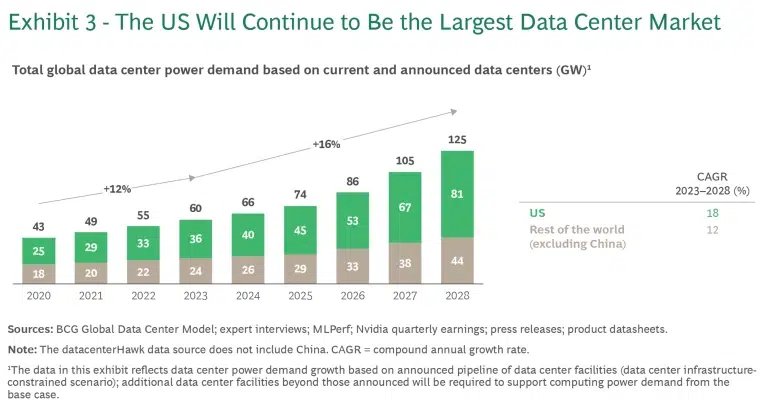

AI Drives US Data Center Power Demand

This chart illustrates the exponential growth in U.S. data center power demand, which is the primary driver for the shift to on-site SOFCs discussed in the section.

(Source: Boston Consulting Group)

Key Fuel Cell Deployments in the U.S. Data Center Market

The following installations represent the most significant capital commitments, large-scale deployments, and strategic technology demonstrations announced in 2025 and early 2026, illustrating the industry’s pivot to on-site power generation.

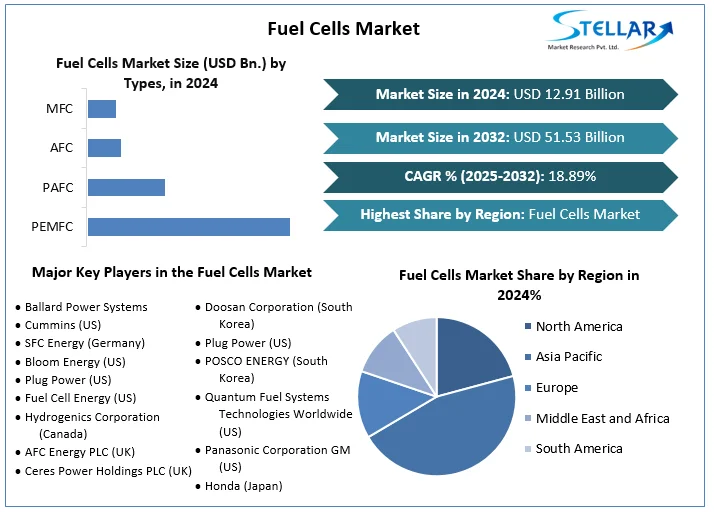

Fuel Cell Market Growth Led by Key Players

This chart provides market context by forecasting significant growth and identifying major players like Bloom Energy and Fuel Cell Energy, who are detailed in the following list of deployments.

(Source: Stellar Market Research)

1. Fuel Cell Energy & SDCL Global Data Center Power Collaboration

Company: Fuel Cell Energy & SDCL

Installation Capacity: Up to 450 MW

Applications: Primary power for data centers using carbonate and solid oxide platforms, with potential for CHP and carbon capture.

Source: Fuel Cell Energy & SDCL Global Data Center Power Collaboration

2. Bloom Energy & Brookfield Asset Management AI Infrastructure Partnership

Company: Bloom Energy & Brookfield Asset Management

Installation Capacity: A $5 billion framework to fund acquisition and deployment.

Applications: On-site, grid-independent SOFC power for AI data centers, deployable in scalable blocks of 10 MW to 100 MW.

Source: Bloom Energy & Brookfield Asset Management AI Infrastructure Partnership

3. American Electric Power (AEP) & Bloom Energy Utility Supply Agreement

Company: American Electric Power (AEP) & Bloom Energy

Installation Capacity: Up to 1 GW, with an initial order of 100 MW.

Applications: Behind-the-meter SOFC power for data centers and other large utility customers facing grid connection delays.

Source: American Electric Power (AEP) & Bloom Energy Utility Supply Agreement

4. Diversified Energy, Fuel Cell Energy & TESIAC Off-Grid Data Center Collaboration

Company: Diversified Energy, Fuel Cell Energy & TESIAC

Installation Capacity: Not specified, focused on forming a development company.

Applications: Powering off-grid data centers by converting coal mine methane and natural gas into electricity.

Source: Diversified Energy, Fuel Cell Energy & TESIAC Off-Grid Data Center Collaboration

5. Equinix & Bloom Energy Multi-Site Expansion

Company: Equinix & Bloom Energy

Installation Capacity: Surpassing 100 MW across 19 data centers.

Applications: Clean, on-site primary power for International Business Exchange (IBX) data centers supporting AI.

Source: Equinix & Bloom Energy Multi-Site Expansion

6. Core Weave AI Cloud Data Center Installation

Company: Core Weave & Bloom Energy

Installation Capacity: 14 MW

Applications: Rapid deployment of primary power for a specialized, high-performance computing AI data center.

Source: Core Weave AI Cloud Data Center Installation

7. Core Site Hybrid Utility and Fuel Cell Systems

Company: Core Site

Installation Capacity: Not specified.

Applications: Hybrid power system combining grid utility with on-site SOFCs for enhanced resilience at SV 9 (Silicon Valley) and BO 1 (Boston) facilities.

Source: Core Site Hybrid Utility and Fuel Cell Systems

8. Dispatch Energy Baseload Fuel Cell Plant

Company: Dispatch Energy

Installation Capacity: 4 MW

Applications: High-reliability baseload power plant in an urban environment, serving as a model for supporting critical infrastructure.

Source: Dispatch Energy Baseload Fuel Cell Plant

9. Microsoft, Caterpillar & Ballard Backup Power Demonstration

Company: Microsoft, Caterpillar & Ballard Power Systems

Installation Capacity: 1.5 MW microgrid

Applications: Demonstration of a hydrogen-powered PEM fuel cell as a clean replacement for diesel backup generators.

Source: Microsoft, Caterpillar & Ballard Backup Power Demonstration

10. Power Cell & U.S. Data Center Leader Hydrogen Pilot

Company: Power Cell & an unnamed U.S. data center leader

Installation Capacity: Pilot scale, specific capacity not disclosed.

Applications: Pilot project to validate the use of next-generation hydrogen fuel cells for resilient, zero-emission data center power.

Source: Power Cell & U.S. Data Center Leader Hydrogen Pilot

Table: 2025-2026 U.S. Data Center Fuel Cell Deployments

| Company / Partnership | Installation Capacity | Applications | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Up to 450 MW | Primary power for data centers | Fuel Cell Energy & SDCL |

| Bloom Energy & Brookfield | $5 billion framework | On-site, grid-independent AI data center power | Bloom Energy & Brookfield |

| AEP & Bloom Energy | Up to 1 GW | Behind-the-meter power for utility customers | AEP & Bloom Energy |

| Diversified Energy, Fuel Cell Energy & TESIAC | Development Company | Off-grid power from coal mine methane | Diversified, Fuel Cell & TESIAC |

| Equinix & Bloom Energy | Over 100 MW | Primary power for 19 IBX data centers | Equinix & Bloom Energy |

| Core Weave & Bloom Energy | 14 MW | Rapid power deployment for AI cloud infrastructure | Core Weave & Bloom Energy |

| Core Site | Not specified | Hybrid utility and SOFC systems | Core Site |

| Dispatch Energy | 4 MW | Baseload distributed generation plant | Dispatch Energy |

| Microsoft, Caterpillar & Ballard | 1.5 MW | Demonstration of PEM fuel cell for backup power | Microsoft, Cat & Ballard |

| Power Cell & Data Center Leader | Pilot scale | Pilot of hydrogen fuel cells for primary power | Power Cell |

From Grid Backup to Grid Bypass: SOFCs Go Mainstream

The diversity of these projects signals that SOFCs have transcended their historical role as backup power and are now a central pillar of data center energy strategy. The applications range from massive, forward-looking utility supply agreements like AEP’s 1 GW procurement to immediate, tactical deployments like Core Weave’s 14 MW installation, which enabled the AI cloud provider to bring new capacity online in under 90 days. This speed is a critical competitive differentiator. Further, established colocation providers like Equinix and Core Site are integrating SOFCs as a primary or hybrid power source to guarantee uptime and power quality for high-density AI workloads. This wide adoption across different segments—utility, hyperscale AI, and colocation—demonstrates that SOFCs are viewed as a mature, reliable, and commercially viable solution to the industry’s systemic power bottleneck.

SOFCs to Dominate Stationary Power Market

The chart reinforces the section’s theme of SOFCs going mainstream by projecting they will become the dominant technology in the stationary power market, which includes data centers.

(Source: Grand View Research)

U.S. Power Infrastructure: A Geographic Realignment

These deployments are concentrated in the United States, indicating the country is the epicenter of the AI-driven power crunch. While projects are located in traditional tech hubs like Silicon Valley and Boston (Core Site), the most strategic trend is the emergence of new power-centric development models. The AEP and Bloom Energy deal is not tied to one location but represents a regional strategy across AEP’s service territory, allowing the utility to attract data center investment by offering a turnkey power solution that circumvents grid delays. Similarly, the partnership between Diversified Energy and Fuel Cell Energy to use coal mine methane suggests a future where data centers could be co-located with unconventional fuel sources, completely detaching their geography from the constraints of the existing grid. This marks a fundamental realignment where power availability, rather than just fiber connectivity, dictates data center location.

Map Shows US Data Center and Grid Locations

This map directly visualizes the section’s topic of geographic realignment by showing the locations of U.S. data centers in relation to the existing power grid.

(Source: Reddit)

Commercial Scale vs. Future Frontiers: A Tale of Two Fuel Cells

The 2025 project landscape reveals a clear distinction in technological maturity. Solid Oxide Fuel Cells, overwhelmingly supplied by market leader Bloom Energy, are being deployed at commercial gigawatt scale. The deals with Brookfield, AEP, and Equinix are not pilot programs; they are multi-billion-dollar commitments to a proven technology for primary, mission-critical power. In contrast, next-generation technologies are still in the demonstration phase. The Microsoft, Caterpillar, and Ballard project uses a Proton-Exchange Membrane (PEM) fuel cell to prove its viability as a *backup* power replacement. Likewise, the Power Cell agreement is a *pilot* to validate hydrogen as a future fuel source. This delineates the market clearly: SOFCs, fueled primarily by natural gas, are the immediate, scalable solution for the current power crisis, while hydrogen-powered PEM systems represent the next technological frontier for achieving zero-carbon operations.

The Future Trajectory: Gas to Green Hydrogen, Financed as a Service

These installations signal a profound and permanent shift in how data centers are powered. The singular catalyst of AI demand has made on-site, behind-the-meter generation not just an option but a prerequisite for growth. The dominant market position of Bloom Energy shows the value of having a mature, scalable SOFC technology ready to meet this unprecedented demand. Looking ahead, the trajectory is clear. The industry will continue to leverage innovative financing like the Energy-as-a-Service (Eaa S) model pioneered by the Brookfield deal, which removes the upfront capital barrier for deploying hundreds of megawatts. The fuel source itself will evolve; the fuel-flexible nature of SOFCs provides a pragmatic pathway from natural gas today to renewable natural gas (RNG) and, ultimately, to green hydrogen as production and infrastructure scale, aligning urgent power needs with long-term decarbonization goals.

Data Center Fuel Cell Market Nears $14B

This forecast quantifies the future trajectory discussed in the article’s conclusion, showing the massive market growth expected for fuel cells in data centers by 2035.

(Source: Market Research Future)

Frequently Asked Questions

Why are data centers adopting SOFCs for primary power instead of just using the grid?

Data centers are turning to on-site Solid Oxide Fuel Cells (SOFCs) in response to two critical issues: the massive, exponential energy demand driven by AI and the severe, multi-year delays in getting new connections to an increasingly inadequate national power grid. SOFCs allow them to bypass these grid constraints and rapidly deploy the gigawatt-scale power needed for modern AI infrastructure.

What is the difference between the SOFC projects and the hydrogen PEM projects mentioned in the article?

The article shows a clear difference in market maturity. SOFCs, primarily fueled by natural gas, are being deployed at commercial gigawatt scale for primary, mission-critical power right now. In contrast, hydrogen-powered Proton-Exchange Membrane (PEM) fuel cells are in the pilot or demonstration phase, being tested as a future clean replacement for backup diesel generators, not yet for primary power.

Who is the leading company providing SOFCs for data centers, according to the article?

The article identifies Bloom Energy as the definitive market leader. Bloom is involved in the largest and most strategic deployments announced, including the $5 billion partnership with Brookfield, the 1 GW supply agreement with American Electric Power (AEP), and the 100+ MW expansion with Equinix.

What fuel do these SOFCs use, and what is the long-term plan for sustainability?

Currently, the SOFCs are primarily fueled by natural gas. However, the technology is fuel-flexible, which provides a clear pathway to greater sustainability. The long-term strategy outlined is to transition from natural gas to renewable natural gas (RNG) and, ultimately, to green hydrogen as production scales and infrastructure becomes available, aligning urgent power needs with decarbonization goals.

How are companies financing these large, multi-billion dollar fuel cell deployments?

The article highlights innovative financing like the Energy-as-a-Service (EaaS) model, pioneered by the $5 billion Bloom Energy and Brookfield partnership. This model removes the large upfront capital investment for data center operators, allowing them to pay for the on-site power as a predictable operating expense, which makes deploying hundreds of megawatts financially feasible.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.