Suncor Energy’s Carbon Capture Strategy: A Look at the Top 10 Energy AI Trends for 2025-2026

Suncor Energy is executing a focused decarbonization strategy by concentrating capital on large-scale Carbon Capture, Utilization, and Storage (CCUS) for its core oil sands business. This approach diverges from broader industry trends of diversification into renewable power generation and instead aims to reduce the carbon intensity of its primary revenue source. By leveraging major industry alliances and targeted technology investments, Suncor is positioning itself to address emissions reduction mandates while capitalizing on its existing operational strengths and infrastructure in a carbon-constrained future.

Suncor Energy’s Commercial Scale Carbon Capture Projects 2026

Suncor Energy strategically shifted from broad clean energy exploration to a focused decarbonization strategy centered on large-scale CCUS for its core oil sands operations.

- Between 2021 and 2024, Suncor laid the groundwork for its carbon capture strategy through foundational investments and alliances. Key actions included its participation in a US$100 million funding round for carbon capture firm Svante Inc. in March 2021 and its role as a founding member of the Oil Sands Pathways to Net Zero initiative in June 2021.

- This strategic direction was solidified in 2022 when Suncor sold its renewable energy portfolio of wind and solar assets for $730 million, signaling a deliberate pivot away from power generation to concentrate on abating emissions from its fossil fuel production.

- From 2025 to today, the strategy has moved toward execution and dual-purpose energy supply, allocating $540 million in capital toward its net-zero initiatives, which are dominated by the Pathways Alliance CCUS project. Concurrently, a new $5 billion partnership with Brookfield announced in November 2025 aims to power AI data centers, positioning Suncor to supply energy for the high-growth tech sector while decarbonizing its existing production.

Suncor’s Strong Balance Sheet Supports Future Investments

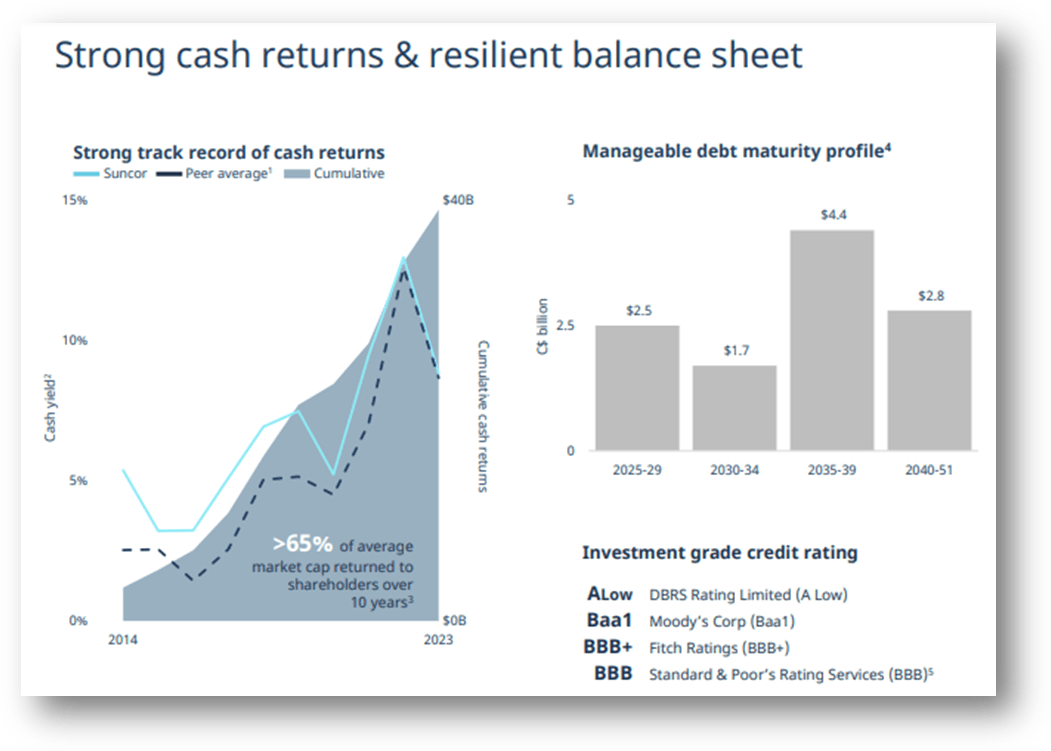

This chart shows Suncor’s strong financial position and manageable debt, providing the capital required to fund the commercial-scale carbon capture projects mentioned in the section.

(Source: Seeking Alpha)

Suncor Energy’s Strategic Investment Analysis

Suncor’s investment pattern reveals a disciplined allocation of capital toward decarbonizing existing assets through CCUS and forming strategic alliances, rather than speculative venture funding in a wide range of renewables.

Strong Operating Cash Flow Funds Investments

The chart highlights Suncor’s significant operating cash flow, which enables the disciplined capital allocation and strategic investments in decarbonization described in the section.

(Source: Seeking Alpha)

Table: Suncor Energy Strategic Investments (2021-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| 2026 Corporate Capital Plan | 2026 | Allocated C$5.7 billion for capital expenditures, primarily for sustaining projects and growth initiatives designed to support production targets of 840, 000-870, 000 bpd while funding decarbonization. | Reuters |

| Brookfield Partnership | November 2025 | Announced a $5 billion strategic partnership to deploy fuel cells to power AI factories, capitalizing on the high energy demand of data centers. | Barchart.com |

| Avatar Innovations Fund | November 2022 | Became a corporate partner in a $3 million fund to collaborate with technology startups on developing and scaling clean energy and decarbonization solutions for the oil sands. | The Logic |

| Astisiy Limited Partnership | September 2021 | Partnered with eight Indigenous communities to acquire a 15% equity interest in the Northern Courier Pipeline for C$1.3 billion, creating a long-term revenue stream for the communities. | Reuters |

| Svante Inc. | March 2021 | Participated in a US$100 million Series D financing round to support the development of a novel solid sorbent technology for point-source carbon capture. | Global News |

Suncor Energy’s Partnership Ecosystem for Decarbonization

Suncor builds its carbon capture and energy transition capabilities through a network of large-scale industry consortiums, targeted technology partnerships, and novel equity agreements with Indigenous communities.

Table: Suncor Energy Technology and Decarbonization Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Focus FS | January 2026 | Funded a project via the Hibernia and Hebron projects to apply AI across offshore assets to reduce risk and downtime, enhancing operational efficiency in its East Coast operations. | Yahoo Finance |

| Alta ML Applied AI Lab | August 2025 | Acted as a founding partner of the Calgary-based lab to develop a local AI talent pipeline, ensuring access to skilled professionals for operational optimization projects. | Klover.ai |

| Pathways Alliance | June 2021 – Present | Co-founded an alliance with five other major Canadian oil sands producers to develop a large-scale CCUS network in northern Alberta, aiming to collectively achieve net-zero emissions by 2050. | Cenovus |

| ATCO | May 2021 | Partnered to explore developing a world-scale clean hydrogen project in Alberta capable of producing over 300, 000 tonnes of hydrogen per year while capturing over 90% of CO 2 emissions. | Bennett Jones |

Suncor Energy’s Geographic Focus on Canadian Assets

Suncor’s carbon capture and energy transition activities are intensely concentrated in Alberta, Canada, leveraging the region’s existing energy infrastructure and aligning with policy support for CCUS.

- Between 2021 and 2024, all of Suncor’s major decarbonization and partnership initiatives were centered in Alberta. This includes the Pathways Alliance CCUS network, the proposed clean hydrogen project with ATCO, the Astisiy LP pipeline deal, and its support for the Calgary-based Avatar Innovations fund.

- From 2025 to today, this geographic focus on Western Canada remains dominant, reinforcing Alberta as the hub of its decarbonization efforts. The funding provided to Co Lab Software and Focus FS through its offshore partnerships in Newfoundland represents a secondary, yet important, regional focus on applying AI and technology to its East Coast assets.

- This concentration in Canada, particularly Alberta, allows Suncor to de-risk projects by operating in a familiar regulatory environment, maximize synergies with its existing asset base, and tap into a skilled local energy workforce.

Suncor Energy’s Technology Moves from Pilot to Commercial Scale

Suncor’s technology strategy prioritizes de-risking and scaling commercially ready carbon capture technologies through large alliances, while its direct operational AI applications have already reached full commercial deployment.

- In the 2021-2024 period, Suncor focused on adopting mature AI technologies for immediate operational gains. This included the full-scale deployment of Autonomous Haulage Systems (AHS) and predictive maintenance AI from partners like AVEVA. In contrast, its CCUS involvement was at the strategic investment and alliance-building stage, demonstrated by the Svante financing and formation of the Pathways Alliance.

- From 2025 onward, the emphasis has shifted toward executing its large-scale decarbonization projects. The Pathways Alliance is now moving from planning to the engineering and development phase, aiming to make a final investment decision on the foundational CCUS project.

- This progression shows a clear technology roadmap: first, implement proven AI to optimize existing cash-generating operations, and second, use that financial strength to fund the development and deployment of capital-intensive clean technologies like CCUS at an industrial scale.

SWOT Analysis of Suncor Energy’s Carbon Capture Strategy

Suncor’s strategy leverages its operational scale and strong cash flow to fund high-cost decarbonization projects, but it remains exposed to project execution risks and external pressures from investors and regulators.

Suncor’s Financial Health Supports Major Projects

This chart illustrates Suncor’s strong financial health and history of cash returns, directly supporting the ‘Strengths’ (strong cash flow) identified in the SWOT analysis.

(Source: Seeking Alpha)

Table: SWOT Analysis for Suncor Energy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Strong operational cash flow from core oil and gas business; established partnerships with Indigenous communities (Astisiy LP). | Record adjusted funds from operations (C$12.8 B in 2025) and record production (909, 000 bpd in Q 4 2025) provide capital for decarbonization. | The company’s financial performance validated its ability to fund large-scale projects like CCUS and the Brookfield partnership without compromising shareholder returns. |

| Weaknesses | Operational safety incidents and a major cybersecurity breach in June 2023 raised concerns about operational integrity and risk management. | High capital intensity of planned CCUS projects (Pathways Alliance estimated at C$16.5 billion) creates significant financial exposure. | The company addressed pressure from activist investor Elliott Management with board changes and a focus on operational excellence, but execution risk for large projects remains. |

| Opportunities | Government incentives for CCUS and hydrogen projects; growing market for low-carbon fuels and energy sources. | Surging electricity demand from AI data centers creates a new, high-growth market for energy, addressed by the Brookfield fuel cell partnership. | The AI boom validated a new business opportunity that aligns with Suncor’s core competency in energy production, diversifying its customer base beyond traditional markets. |

| Threats | Pressure from activist investors (Elliott stake in 2022) to improve performance and shareholder returns; volatility in global oil prices. | Increased scrutiny on the carbon intensity of energy sources for AI; potential delays or regulatory hurdles for the Pathways Alliance project. | Activist investor pressure intensified as Elliott nearly doubled its stake to US$3 billion in 2024, reinforcing the need for disciplined capital allocation and consistent returns. |

Future Outlook: Execution of Carbon Capture Projects Is Critical

For 2026, the primary challenge for Suncor is to translate its strategic carbon capture plans, particularly the C$16.5 billion Pathways Alliance project, into a final investment decision and concrete execution to meet its 2030 emissions reduction targets.

- The company’s success is tied to advancing the Pathways Alliance CCUS network, which is the cornerstone of its net-zero ambitions and its primary tool for mitigating long-term regulatory and market risk for its oil sands assets.

- Investors should monitor progress on key capital projects funded by the C$5.7 billion 2026 budget, as on-time and on-budget delivery will be a key indicator of Suncor’s project execution capabilities under its new operational improvement mandate.

- The evolution of the $5 billion Brookfield partnership to power AI data centers is a critical development to watch, as it represents a strategic move to link Suncor’s energy production to the rapidly growing digital economy.

- Finally, continued discipline in shareholder returns, including the planned $3.3 billion in share buybacks for 2026, will be essential for maintaining investor confidence while funding its capital-intensive decarbonization strategy.

High Oil Production Underscores Decarbonization Need

This chart’s depiction of Suncor’s high oil production volume visually underscores why the successful execution of carbon capture projects is critical for the company’s future.

(Source: Statista)

Frequently Asked Questions

What is Suncor’s main strategy for reducing its carbon emissions?

Suncor’s primary strategy is to focus on large-scale Carbon Capture, Utilization, and Storage (CCUS) for its core oil sands operations. Instead of diversifying into renewable power generation, Suncor sold its wind and solar assets to concentrate capital on reducing the carbon intensity of its main revenue source, which is oil production.

What is the Pathways Alliance, and what is Suncor’s role in it?

The Pathways Alliance is a consortium of six major Canadian oil sands producers, co-founded by Suncor in 2021. Its goal is to achieve net-zero emissions from oil sands operations by 2050, primarily by developing a foundational CCUS network in Alberta estimated to cost C$16.5 billion. This alliance is the cornerstone of Suncor’s decarbonization efforts.

How is Suncor involved with the AI industry?

Suncor is involved with AI in two key ways. First, it is applying AI to optimize its own operations, such as using predictive maintenance and enhancing offshore safety with partners like Alta ML and Focus FS. Second, it has formed a $5 billion partnership with Brookfield to deploy fuel cells to power energy-intensive AI data centers, creating a new market for its energy production.

What are the biggest risks or challenges to Suncor’s strategy?

The main challenges include the high capital cost (C$16.5 billion for the initial Pathways project) and execution risk of its large-scale CCUS plans. The company also faces significant pressure from activist investors to maintain financial discipline and shareholder returns while funding these expensive projects, and potential regulatory hurdles could delay progress.

Besides carbon capture, what other significant partnerships has Suncor made?

Suncor has formed several key partnerships, including a potential collaboration with ATCO to develop a world-scale clean hydrogen project. It also partnered with eight Indigenous communities in the Astisiy Limited Partnership to acquire a 15% stake in the Northern Courier Pipeline, creating a long-term revenue stream for the communities.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.