Tencent’s AI Power Play: Top 10 Infrastructure Projects Driving Energy Demand in 2025 and 2026

Tencent’s artificial intelligence strategy is driving a massive expansion of its energy-intensive data center infrastructure, with capital expenditures for AI soaring and new international facilities being established to support its proprietary Hunyuan large language model (LLM). While its initial approach focused on integrating AI into its vast portfolio of applications, the period from 2025 to 2026 marks a decisive pivot toward building and optimizing the foundational compute power necessary for next-generation AI. This shift has profound implications for regional energy consumption and infrastructure planning, as the company navigates a competitive landscape against rivals like Alibaba and Byte Dance. Energy market participants must monitor this infrastructure build-out to anticipate new demand centers and opportunities in the power sector.

Tencent’s Commercial Scale Projects Signal Shift to AI Infrastructure Dominance

Tencent is shifting its AI strategy from broad ecosystem integration to a targeted focus on building and optimizing the massive data center infrastructure required for large-scale AI model deployment.

- The period from 2021 to 2024 was characterized by integrating AI across more than 180 existing services like We Chat and gaming, supported by broad R&D spending that exceeded $20 billion over three years.

- A strategic change occurred in 2025, with capital expenditure surging 91% year-over-year in Q 1 2025 to RMB 27.5 billion, signaling a pivot to physical infrastructure build-out to support power-hungry models like Hunyuan.

- The adoption of advanced applications like the Yuanbao AI agent, which crossed 50 million daily active users in 2026, and the Hunyuan Video generative video model creates immense computational demand, directly driving the need for more specialized and powerful data centers.

- A reported capital expenditure reversal in late 2025, where spending fell below previous guidance, indicates a maturation of its strategy from raw expansion to capital-efficient optimization and a focus on high-ROI AI infrastructure projects.

Tencent’s Earnings Growth Fuels AI Strategy

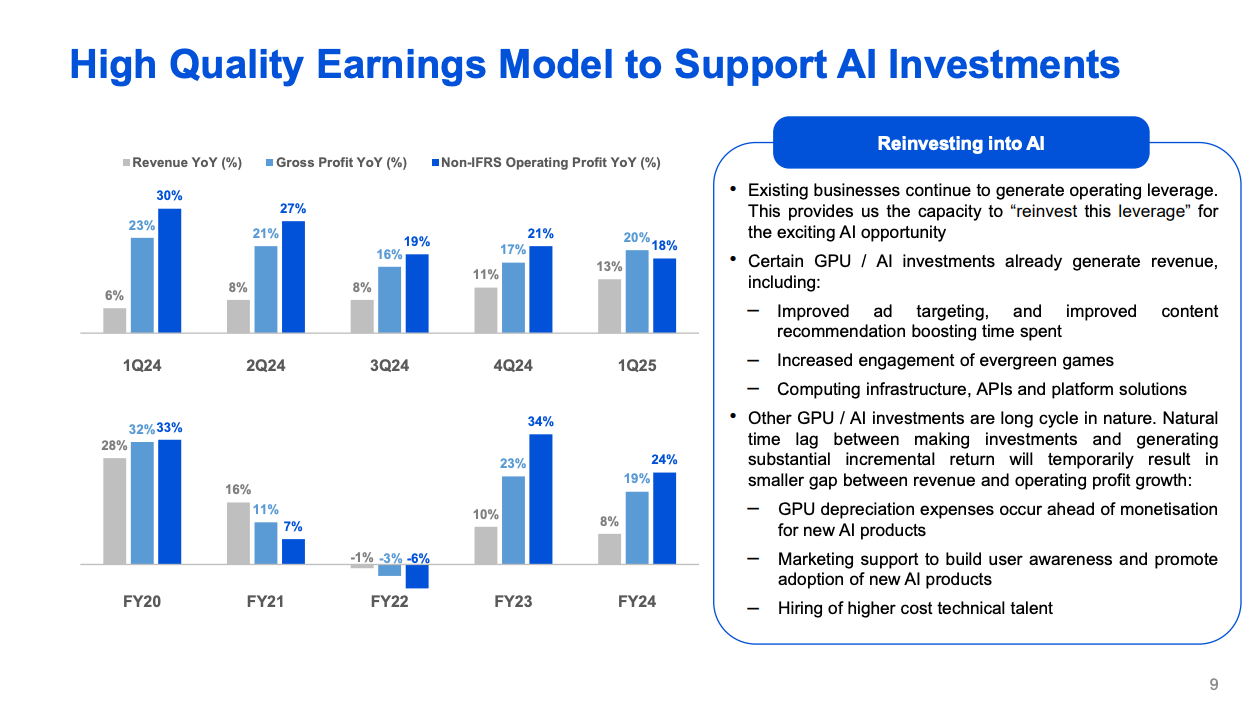

This chart shows the ‘high quality earnings’ growth that enables Tencent’s strategic shift from broad R&D to capital-intensive AI infrastructure. The company’s strong profit growth provides the financial foundation for its surge in AI investment.

(Source: AI Proem – Substack)

Tencent’s AI Investment Analysis Reveals Surge in Infrastructure Spending

Tencent’s capital expenditure on AI infrastructure accelerated dramatically from 2023 to 2025, reflecting the intense computational demands of its foundation models and a strategic race against competitors to secure processing capacity.

- Combined capital spending with rival Alibaba reached $7 billion in the first half of 2024, doubling from the previous year, as both companies rushed to acquire processors for training large language models.

- Beginning in 2025, Tencent announced a multi-year 500 billion yuan ($69.9 billion) investment plan for new infrastructure, with AI and cloud computing as primary targets, underscoring its long-term commitment.

- The company is executing a global expansion, exemplified by its plan to invest $500 million in Indonesian data centers by 2030 and a $150 million commitment for its first data center in the Middle East.

- Quarterly capital expenditure in 2025 showed significant volatility, with a 91% year-over-year increase in Q 1 followed by a sharp contraction, suggesting a strategic pivot toward efficiency and ROI over unrestrained growth.

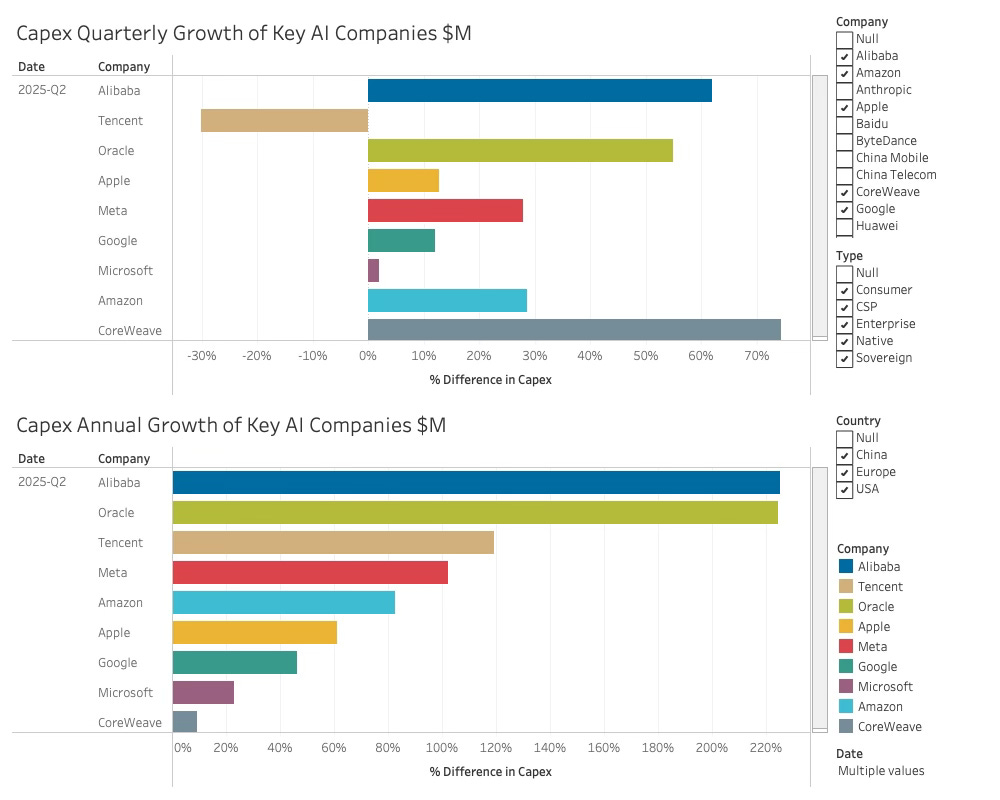

Tencent Capex Growth Among Top Spenders

This chart directly illustrates the section’s point about Tencent’s surging AI infrastructure spending. It quantifies the accelerated capital expenditure and positions Tencent’s annual growth among top spenders like Alibaba, validating the competitive race described in the text.

Table: Tencent’s Key AI Infrastructure Investments (2024-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| New Technology and Infrastructure Investment | 2025-Ongoing | A multi-year plan to invest 500 billion yuan ($69.9 billion) in new infrastructure including cloud, AI, and blockchain to build its foundational technology stack. | AI Business |

| Q 1 2025 Capital Expenditure | Q 1 2025 | Capital expenditure increased 91% Yo Y to RMB 27.5 billion to support the development and deployment of the Hunyuan AI model and associated cloud infrastructure. | Tech in Asia |

| Data Center Development in Indonesia | 2024–2030 | Announced a $500 million investment to build out data center capacity in Indonesia to deliver cloud and AI services, including the construction of a third data center. | Data Center Dynamics |

| Joint Capital Expenditure with Alibaba | H 1 2024 | Combined capital spending doubled to $7 billion from the previous year to acquire processors and infrastructure for training large language models in China. | Financial Times |

Tencent Partnership Analysis: Alliances Secure Global AI Infrastructure Demand

Tencent leverages partnerships to expand its cloud infrastructure reach and secure demand for its AI services, targeting key regional players and technology providers to accelerate its global data center strategy.

- The November 2024 agreement with Go To Group and Alibaba Cloud in Indonesia directly supports Tencent’s data center expansion in the region by creating a local ecosystem of users for its cloud services.

- Partnerships with hardware and device makers like Honor, finalized in December 2024, create downstream demand for its AI models, which in turn justifies further infrastructure investment to handle the computational load.

- Collaborations with regional digital solution providers, such as the November 2024 alliance with Zain TECH in the Middle East, establish a footprint for its AI-powered services that rely on a robust data center backend.

- The partnership with Nokia in June 2024 combines Tencent’s cloud infrastructure with Nokia’s industrial networking solutions, opening up enterprise digitalization markets that require significant compute resources.

Table: Tencent’s Strategic AI Infrastructure Partnerships (2024)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Honor Device Co. | December 2024 | A strategic partnership to integrate Tencent’s AI models and cloud services into Honor’s devices, securing a large-scale user base for its AI infrastructure. | Bloomberg |

| Go To Group & Alibaba Cloud | November 2024 | An agreement to boost cloud infrastructure and digital talent in Indonesia, creating a stable demand base for Tencent’s new data center investments in the country. | Go To |

| Pony.ai | April 2025 | A strategic partnership to develop autonomous driving solutions, leveraging Tencent’s cloud, map data, and security infrastructure to power L 4 robotaxi services. | CNBC |

| Sound Hound AI | April 2025 | A collaboration to integrate advanced in-vehicle voice AI into Tencent’s cloud-based solutions for global automotive brands, driving compute demand in the mobility sector. | Sound Hound AI |

Tencent Regional Growth: Geographic Expansion Targets Global AI Markets

Tencent is expanding its data center footprint from a China-centric model to a targeted global presence, prioritizing high-growth markets in Southeast Asia and the Middle East to support its international AI ambitions.

- Between 2021 and 2024, major infrastructure investments were concentrated in China, highlighted by a combined $7 billion in capital expenditure in H 1 2024 with Alibaba focused on domestic LLM training needs.

- Starting in late 2024 and into 2025, the strategy visibly shifted to include significant international commitments, such as the $500 million investment plan for Indonesia and a $150 million project for its first Middle East data center.

- The partnership with Go To Group in Indonesia (November 2024) and a collaboration with Tourism Malaysia (January 2026) validate Tencent’s focus on establishing a strong commercial and infrastructure presence in Southeast Asia.

- This geographical diversification of its data center assets mitigates geopolitical risks associated with a single-country concentration and positions Tencent to serve a global customer base for its energy-intensive cloud and AI services.

China’s AI Industry Concentrated in Key Hubs

This chart provides context for Tencent’s geographic expansion by visualizing the highly concentrated domestic AI landscape it is growing from. The data illustrates the ‘China-centric model’ that the company is now expanding beyond to target global markets.

(Source: Glass.AI – Medium)

Tencent Technology Status: AI Infrastructure Matures to Commercial Scale

Tencent’s data center technology strategy has matured from foundational capacity building to deploying specialized, high-efficiency infrastructure at a commercial scale to support advanced AI applications.

- In the 2021-2024 period, the focus was on acquiring general compute and building foundational cloud infrastructure, which supported the initial development of the Hunyuan model and its integration into existing products.

- The period from 2025 to today demonstrates a shift to commercial-scale deployment, evidenced by the 91% Yo Y increase in Cap Ex in Q 1 2025 specifically to support the public-facing Hunyuan model and its associated cloud services.

- The launch of an Agent Development Platform (ADP) in early 2026 signals the need for persistent, high-availability infrastructure capable of running complex, multi-step AI tasks, moving beyond simple model training and inference.

- The successful rollout of data-intensive services like its global palm scanning technology (September 2024) and the Hunyuan Video model (December 2024) confirms that the underlying data center infrastructure is robust enough to support diverse, real-world AI products at scale.

PyTorch, TensorFlow Lead AI Development Tools

As Tencent’s infrastructure matures to a commercial scale, this chart shows the popular software tools developers use to build advanced AI models. It provides technological context for the kind of development happening on Tencent’s high-efficiency infrastructure.

(Source: Orca Security)

Tencent SWOT Analysis: Infrastructure Strategy Balances Strengths with Market Threats

Tencent’s primary strength is its vast ecosystem for AI deployment, but its AI infrastructure strategy faces intense competition and capital allocation pressures, creating both opportunities for global expansion and threats from market volatility.

- Key strengths are validated by the rapid user acquisition of AI apps like Yuanbao, which leverages the We Chat ecosystem to build a massive user base that justifies continued infrastructure investment.

- Weaknesses have appeared in market perception, with a reported $173 billion stock value decline from its peak attributed to a “conservative” AI strategy and volatile capital expenditure, creating investor uncertainty.

- Clear opportunities exist in global expansion, confirmed by partnerships in Indonesia (Go To Group), the Middle East (Zain TECH), and Brazil (Treeal) that establish new markets for its cloud services.

- Threats include intense domestic competition from Alibaba and Byte Dance and a market rotation to “pure-play” AI startups, which forces Tencent into reactive pricing and investment strategies that could impact profitability.

Cloud Revenue Growth Shows Intense Competition

This chart validates the ‘intense competition’ and ‘market threats’ mentioned in the SWOT analysis. It visualizes Tencent’s position in the competitive cloud market, where it vies for revenue growth against dominant global players.

Table: SWOT Analysis for Tencent’s AI Infrastructure Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Massive user base (We Chat) and broad R&D investment ($20 B+ over three years) provided a foundation for AI development. | Leveraged ecosystem to scale AI app Yuanbao to over 50 M DAUs. AI-driven ad targeting fueled 15% Yo Y revenue growth in Q 3 2025. | The ability to monetize AI through existing revenue streams (advertising, gaming) was validated, justifying the high cost of infrastructure. |

| Weaknesses | Perceived as a laggard in the generative AI race, with a less aggressive initial strategy compared to competitors. | A $173 B stock rout from its peak was fueled by investor concerns over a “conservative” AI approach and a sharp, unexpected reversal in Cap Ex in late 2025. | The company’s cautious, ROI-focused approach, while potentially profitable long-term, creates short-term market uncertainty and exposes it to criticism of being slow. |

| Opportunities | Early partnerships and cloud infrastructure presence in select international markets. Began investing in emerging AI startups. | Accelerated global expansion with major data center investments in Indonesia and the Middle East, plus new partnerships in Latin America (Treeal) and Singapore (RYDE). | The strategy to become the infrastructure provider for global and regional enterprises is validated by partnerships with Toyota, Orange, and Zain TECH. |

| Threats | Intense domestic competition from Alibaba and Baidu in the foundational model space. Early signs of a price war. | A “zero-margin inference” price war intensifies, forcing reactive price cuts. Investors rotate to “pure-play” AI startups like Zhipu AI, reducing capital flow to diversified tech giants. | The threat of commoditization is real, forcing Tencent to differentiate its AI offerings through deep ecosystem integration rather than competing on price alone. |

Future Outlook: Tencent’s 2026 Focus Shifts to AI Infrastructure Monetization

For the remainder of 2026, Tencent’s success will be defined by its ability to convert its massive infrastructure investments into profitable, high-efficiency AI services, moving beyond user acquisition to clear monetization.

- The key indicator to watch is the profitability of AI-enhanced services, as Tencent aims to achieve superior model performance at lower operational costs to avoid a “zero-margin inference” price war, a concern raised in late 2025.

- The race to develop sophisticated AI agents, highlighted by its Agent Development Platform (ADP) launched in January 2026, will test the efficiency and scalability of its data center infrastructure against competitors.

- The expansion into physical and spatial AI with “world models” and the Tairos robotics platform, announced in late 2025, will create new and even greater energy and compute demands, shaping future data center design and investment.

- Continued strategic investments in “pure-play” AI firms like Moonshot AI will signal whether Tencent is choosing to acquire specialized capabilities to optimize its energy and compute costs rather than building all technology in-house.

Tencent AI Capex Reverses After 2024 Peak

This chart supports the future outlook by visualizing a ‘strategic reversal’ in capital expenditure. The spending decline aligns with the 2026 shift from infrastructure build-out to a focus on monetization and operational efficiency.

(Source: Hello China Tech)

Frequently Asked Questions

What is the main change in Tencent’s AI strategy for 2025-2026?

For 2025-2026, Tencent has pivoted its AI strategy from integrating AI into its existing portfolio of applications to a focused build-out of massive, energy-intensive data center infrastructure. This shift is driven by the need to support the immense computational demands of its proprietary Hunyuan large language model and its advanced applications.

How much is Tencent investing in its AI infrastructure expansion?

Tencent is making substantial investments. It announced a multi-year 500 billion yuan ($69.9 billion) plan for new infrastructure, with AI as a primary target. Its capital expenditure surged 91% year-over-year in Q1 2025 to RMB 27.5 billion, and it has committed to specific international projects, including a $500 million investment in Indonesian data centers by 2030.

Which specific projects are driving Tencent’s need for more data centers and energy?

The primary drivers are projects that create huge computational loads. These include the development and deployment of the Hunyuan LLM, the scaling of the Yuanbao AI agent (which crossed 50 million daily users), and the rollout of generative models like Hunyuan Video. Furthermore, partnerships with Pony.ai for autonomous driving and SoundHound AI for in-vehicle voice AI also contribute significantly to infrastructure demand.

Why is Tencent expanding its data centers globally, particularly in Southeast Asia and the Middle East?

Tencent is expanding its data center footprint globally to support its international AI ambitions, serve a global customer base for its cloud services, and mitigate the geopolitical risks of being concentrated in a single country. High-growth markets like Southeast Asia and the Middle East are prioritized to establish a commercial presence and support regional partners, as seen in its alliances with Indonesia’s Go To Group and the Middle East’s Zain TECH.

What are the biggest challenges or threats to Tencent’s AI infrastructure strategy?

The main threats identified are intense domestic competition from rivals like Alibaba and ByteDance, which has led to a ‘zero-margin inference’ price war, and a market trend where investors are rotating capital to ‘pure-play’ AI startups. This puts pressure on Tencent’s profitability and forces it to differentiate its offerings through deep ecosystem integration rather than competing on price alone.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- IMO Decarbonization & Net Zero 2025: Policy Collapse

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.