Tencent Holdings AI Infrastructure Strategy 2026: A Shift From Capex to Ecosystem Dominance

Tencent AI Commercial Scale Projects Signal Shift to Application and Monetization in 2026

Tencent Holdings has pivoted its AI strategy from internal, foundational technology development between 2021 and 2024 to a model focused on aggressive commercial productization and deep ecosystem integration in 2025 and 2026.

- During the 2021-2024 period, the company focused on building core assets, launching its proprietary Zixiao AI inference chip in November 2021 and its foundational Hunyuan large language model in September 2023, which were primarily used for internal efficiency gains like its AI Coding Assistant.

- Starting in 2025, the strategy shifted to external deployment and monetization, evidenced by a 21% year-over-year surge in advertising revenue in Q 3 2025 directly attributed to AI-powered targeting.

- By 2026, Tencent was heavily promoting consumer-facing products with a 1 billion yuan (~$140 million) campaign for its Yuanbao AI chatbot and integrating its services into partner ecosystems, such as the February 2026 partnership to embed We Chat location data into Tesla vehicles in China.

- The company also began offering its technology as a commercial product for developers, releasing the Hunyuan 2.0 LLM and the Hunyuan 3 D Engine in late 2025 to lower the barrier for third-party application creation.

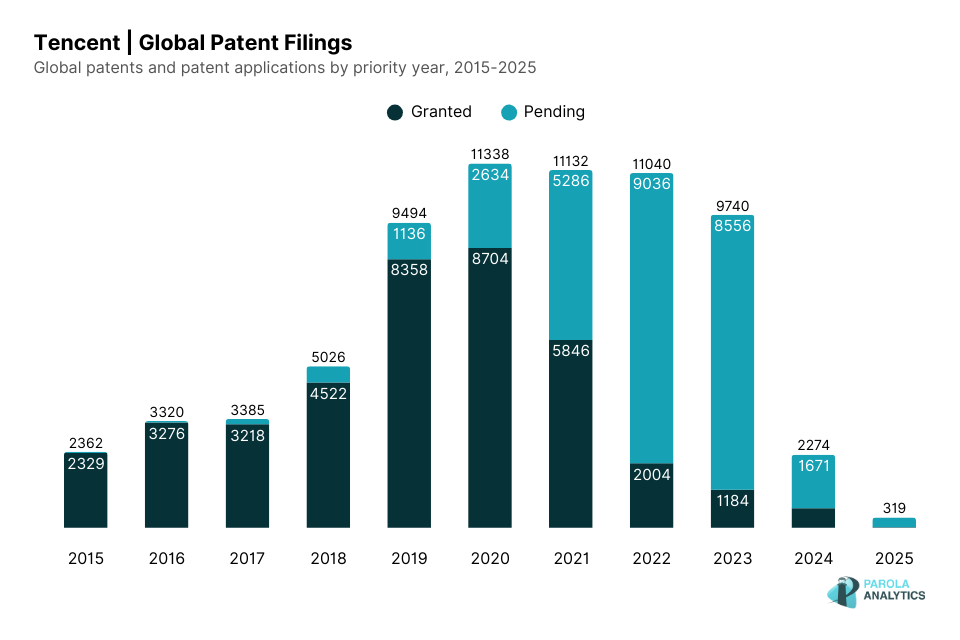

Tencent’s R&D Focus Shifted After 2022

Tencent’s patent applications peaked between 2020-2022, visually marking the end of its foundational R&D phase before its strategic pivot to commercialization.

(Source: Parola Analytics)

Tencent AI Investment Analysis: A Pivot to Ecosystem and Strategic Infrastructure

Tencent‘s investment patterns reveal a strategic shift from broad capital expenditure toward a dual focus on targeted international infrastructure projects and significant equity investments in a portfolio of leading AI startups, insulating it from single-model risk.

- In the earlier period (2021-2024), Tencent‘s investments targeted the foundational hardware layer, such as its leading role in a $279 million Series C round for AI chip designer Enflame Technology in January 2021.

- A significant capital expenditure increase occurred in Q 1 2025, reaching RMB 27.5 Billion (a 91% Yo Y increase) for GPU acquisition, before becoming more measured; this was complemented by a $150 million commitment for its first data center in the Middle East.

- Post-2024, Tencent began aggressively investing in China’s top AI startups, participating in a $300+ million round for Moonshot AI (August 2024), a $688 million round for Baichuan AI (July 2024), and a $342 million round for Zhipu AI (October 2023).

- This “picks and shovels” strategy ensures Tencent profits from the AI boom by providing the essential cloud infrastructure to its portfolio companies while holding a direct stake in their success.

Tencent Slashed Capex to Fund AI Pivot

A dramatic reduction in capital expenditure after Q4 2024 visually confirms the company’s strategic pivot from broad spending to targeted AI investments.

(Source: Hello China Tech)

Table: Tencent Holdings’ Key AI Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Yuanbao AI Chatbot Promotion | 2026-02-03 | Invested 1 Billion Yuan (~$140 M) in a digital red envelope campaign to drive mass adoption of its AI assistant by integrating it into the We Chat Pay ecosystem. | Simply Wall St |

| First Middle East Data Center | 2025-09-16 | Announced a $150 Million investment to build its first data center in the Middle East, expanding its global cloud and AI services footprint into a high-growth region. | Tencent |

| Investment in Moonshot AI | 2024-08-05 | Participated in a $300 M+ financing round for the generative AI startup, valuing it at $3.3 billion and securing a stake in a leading Chinese AI model developer. | Bloomberg |

| Investment in Baichuan AI | 2024-07-25 | Joined Alibaba and Xiaomi in a US$688 million funding round for the prominent AI startup, diversifying its investment across China’s top AI contenders. | SCMP |

| Investment in Zhipu AI | 2023-10-23 | Invested alongside Alibaba in a $342 million round for Zhipu AI, another of China’s leading generative AI companies. | Data Center Knowledge |

| Investment in Enflame Technology | 2021-01-07 | Acted as a lead investor in a $279 M Series C round for the Shanghai-based AI chip designer, signaling an early focus on controlling the AI hardware stack. | AI Business |

Tencent Partnership Strategy: Building a Global AI-Powered Ecosystem

Tencent‘s partnerships have evolved from hardware-centric collaborations to a broad, international ecosystem strategy designed to embed its AI into high-growth industries like automotive, fintech, and 3 D content creation.

- Between 2021 and 2024, partnerships were foundational, focusing on the infrastructure layer through an alliance with Broadcom (2022) for energy-efficient co-packaged optics and the automotive sector with Nio (2022) and Toyota (2024).

- Post-2025, the strategy expanded to create a global ecosystem, highlighted by the high-profile Tesla partnership in February 2026 to integrate its We Chat platform directly into vehicles.

- The company pursued industry-specific integrations, partnering with Thailand’s digital asset exchange Bitkub (December 2025) for fintech, 3 D printer manufacturer Creality (August 2025) for AI modeling, and Sound Hound AI (April 2025) for in-car conversational AI.

- These alliances demonstrate a clear model: leverage Tencent Cloud as the infrastructure backbone while using its AI models and dominant social platforms as the value-added service layer.

Tencent’s AI Ecosystem Spans Infrastructure to Applications

This diagram illustrates the full-stack ecosystem Tencent is building through partnerships, with its foundational model supporting platforms for consumer, business, and robotics applications.

(Source: AI Proem – Substack)

Table: Tencent Holdings’ Key Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Tesla | 2026-02-11 | Technology integration to provide We Chat-linked in-car features for the Chinese market, leveraging Tencent Cloud to enhance the intelligent cabin experience. | Reuters |

| Bitkub | 2025-12-17 | Strategic partnership to provide Thailand’s digital asset exchange with a suite of Tencent Cloud technologies, including AI, to create a secure, high-performance platform. | Tencent Cloud |

| Creality | 2025-08-27 | AI partnership to integrate Tencent‘s Hunyuan LLM into Creality‘s AI modeling platform, leveraging AI for advanced 3 D modeling and creation. | 3 D Printing Industry |

| Pony.ai | 2025-04-25 | Collaboration to advance autonomous driving technology and robotaxi deployment, leveraging Tencent‘s cloud, AI, and mapping services. | Pony.ai |

| Toyota Motor Corp. | 2024-04-26 | Business alliance to integrate Tencent‘s AI, cloud, and big data services into Toyota vehicles for the Chinese market. | Kyodo News |

| Broadcom | 2022-08-22 | Strategic partnership to accelerate the adoption of high-bandwidth co-packaged optics network switches for cloud AI clusters, aiming to improve performance and power efficiency. | Broadcom |

Tencent Holdings’ Geographic Expansion: From Domestic Dominance to Global AI Infrastructure Provider

Tencent Holdings is leveraging its AI and cloud capabilities to transition from a domestically-focused tech giant to a global infrastructure provider, with targeted expansion into Southeast Asia, the Middle East, and Latin America since 2025.

- Before 2025, Tencent‘s primary focus was building a massive domestic infrastructure, which included over 2, 300 cache nodes in Mainland China as of 2022, supporting its core services like We Chat and gaming.

- A clear global push began with the announcement of a $500 million investment in Indonesia’s cloud infrastructure through 2030, a plan to boost investment in the Middle East to provide AI computing power, and a $150 million investment in its first regional data center there.

- The expansion is executed through partnerships, as seen in the February 2026 collaboration with Treeal to launch AI services in Brazil and the December 2025 agreement with Bitkub in Thailand, establishing a presence in key emerging markets.

Tencent Holdings’ Technology Status: From Foundational Models to Commercial-Grade AI Platforms

Tencent Holdings’ AI technology stack has rapidly matured from internally-focused foundational R&D in the 2021-2024 period to a suite of commercially deployed, specialized AI platforms and consumer-facing applications by 2026.

- The early phase was defined by the creation of core IP, including the Hunyuan foundation model (2023) and the proprietary Zixiao AI inference chip (2021). These technologies were primarily validated through internal applications, such as an AI coding assistant that improved programmer productivity by 40%.

- Since 2025, the focus has shifted to commercialization and specialization. The launch of Hunyuan 2.0 with a Mixture-of-Experts architecture, the global release of the Hunyuan 3 D Engine, and the AI Agent Development Platform 3.0 all provide enterprise-grade tools for external developers.

- The company’s ability to secure access to Nvidia‘s latest H 200 AI chips in January 2026 provides a critical hardware advantage for training next-generation models, signaling its readiness for large-scale, high-performance AI deployment.

Proprietary Zixiao Chip Powers Tencent’s AI Platform

The technical diagram shows how Tencent’s proprietary Zixiao AI chip is a core component of its inference platform, demonstrating its matured, in-house technology stack.

(Source: Anyscale)

Tencent Holdings SWOT Analysis: Ecosystem Strengths Mitigate Cloud Market Weakness

Tencent Holdings‘ AI strategy leverages its dominant ecosystem to overcome its persistent weakness in cloud market share, enabling it to capitalize on partnership opportunities while navigating competitive and geopolitical threats.

Tencent Trails Competitors in AI Cloud Market

With just 7% of the AI cloud market, this chart highlights the “cloud market weakness” mentioned in the SWOT analysis, trailing far behind market leaders.

(Source: eu.36kr.com)

Table: SWOT Analysis for Tencent Holdings’ AI Infrastructure Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Massive, engaged user base in We Chat and gaming ecosystems providing a proprietary data advantage for model training. | Demonstrated ability to monetize the ecosystem with AI, reflected in a 21% Yo Y growth in advertising revenue in Q 3 2025. | The strategic value of its ecosystem was validated as a direct monetization engine for AI-enhanced services, not just a data source. |

| Weaknesses | Persistently low cloud infrastructure market share in China, trailing competitors like Alibaba Cloud and Huawei Cloud. | Cloud market share remains low at 9-10% in 2025, constraining its ability to capture enterprise AI spend directly. | The weakness in direct cloud sales persists, reinforcing the strategic necessity of its partnership-led, ecosystem-first approach to embed AI. |

| Opportunities | Began strategically investing in promising Chinese AI startups like Zhipu AI to gain a foothold in the emerging market. | Secured government approval in January 2026 to purchase high-performance Nvidia H 200 AI chips and is in talks for a potential partnership with Apple in China. | The company elevated its strategy from financial investment to securing access to critical, state-of-the-art technology and high-value distribution partnerships. |

| Threats | Geopolitical tensions and US-led restrictions on advanced semiconductor access posed a significant risk to its hardware supply chain. | Intense competition from more agile, specialized AI startups (some of which it has invested in) and regulatory scrutiny over mass data collection for AI training. | The threat landscape diversified from primarily geopolitical supply chain issues to include fierce domestic market competition and regulatory challenges. |

Forward-Looking Insights: Tencent’s 2026 Focus on AI Monetization and Ecosystem Integration

The primary strategic imperative for Tencent Holdings in the coming year is to translate its massive investments in AI user acquisition and advanced hardware into demonstrable and sustainable revenue streams that deepen its competitive moat.

- The key metric to watch is the monetization and user retention of the Yuanbao AI assistant following its 1 billion yuan promotional campaign, which will determine if it can become an integral, revenue-generating part of the We Chat ecosystem.

- The integration of Nvidia H 200 chips, approved in January 2026, is expected to produce more powerful Hunyuan models. The market will look for a direct impact on the performance of high-margin businesses like advertising and gaming in the second half of 2026.

- Progress on the $150 million Middle East data center will be a critical indicator of Tencent‘s ability to execute its global expansion and compete for enterprise AI clients against established international cloud providers.

- Financial results in upcoming quarters must show a clear return on the significant AI-related capital expenditures from 2025, validating its integrated strategy through improved operating leverage and growth in AI-enhanced businesses.

Frequently Asked Questions

What was the main change in Tencent’s AI strategy between the 2021-2024 period and the 2025-2026 period?

Tencent’s AI strategy pivoted from an internal focus on building foundational technology (like its Hunyuan LLM and Zixiao chip) between 2021 and 2024 to a model centered on aggressive commercial productization and deep ecosystem integration in 2025 and 2026. This is shown by the launch of consumer-facing products like the Yuanbao chatbot and partnerships to embed its services in external products like Tesla vehicles.

How is Tencent investing in AI besides building its own models?

Tencent has adopted a “picks and shovels” strategy by making significant equity investments in a portfolio of leading Chinese AI startups, including Moonshot AI, Baichuan AI, and Zhipu AI. This approach diversifies its risk beyond its own Hunyuan model and allows it to profit by providing essential cloud infrastructure to these portfolio companies.

What is a key weakness in Tencent’s AI strategy, and how is the company trying to overcome it?

A persistent weakness for Tencent is its relatively low cloud infrastructure market share in China compared to competitors like Alibaba Cloud. To mitigate this, Tencent leverages its core strength: its massive user ecosystem. The company is pursuing a partnership-led, ecosystem-first strategy to embed its AI services into high-growth industries like automotive (Tesla, Toyota) and fintech (Bitkub), thereby driving demand for its cloud and AI platforms.

What are some specific examples of Tencent monetizing its AI technology?

Tencent has successfully started monetizing its AI capabilities, as evidenced by a 21% year-over-year surge in advertising revenue in Q3 2025, which was directly attributed to AI-powered targeting. Additionally, it is driving mass adoption of its Yuanbao AI chatbot with a 1 billion yuan (~$140 million) promotional campaign to integrate it into the WeChat Pay ecosystem, paving the way for future monetization.

How is Tencent ensuring it has the necessary hardware for its AI ambitions?

Tencent is securing its hardware supply chain through multiple approaches. Initially, it invested in AI chip designers like Enflame Technology and developed its own proprietary Zixiao inference chip. More recently, in January 2026, the company secured government approval to purchase Nvidia’s high-performance H200 AI chips, giving it a critical advantage for training more powerful, next-generation AI models.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.