Automaker Pivot to Hybrids: Why Manufacturing Investment Shifted in 2026

Manufacturing Realignment: Automaker Pivot from EVs to Hybrids Intensifies

U.S. automakers are executing a significant strategic realignment, shifting capital and manufacturing capacity away from aggressive battery electric vehicle (BEV) mandates toward a flexible, multi-powertrain model that prioritizes profitable gasoline engines and high-demand hybrids. This pivot is a direct response to slowing EV sales growth and staggering financial losses, forcing a de-risking of electrification timelines.

- Between 2021 and 2024, the industry pursued an “all-in” EV strategy, with companies like General Motors and Ford committing billions to dedicated BEV platforms and new battery facilities, signaling a rapid phase-out of internal combustion engine (ICE) technology. This period was defined by ambitious announcements and heavy capital expenditure on a singular, electric-only future.

- Starting in 2025, this strategy was sharply revised. General Motors announced it would reintroduce plug-in hybrids (PHEVs) to North America by 2027 to meet emissions standards. Ford is now planning to offer hybrid options across its entire North American lineup by 2030, while Stellantis committed to a “multi-energy” production strategy capable of building ICE, hybrid, and electric vehicles on the same assembly lines.

- This shift from specialized EV-only plants to flexible manufacturing demonstrates a fundamental change in strategy. It allows automakers to respond dynamically to consumer demand, hedge against policy uncertainty, and leverage existing, profitable manufacturing footprints to fund a more measured, long-term transition to electrification.

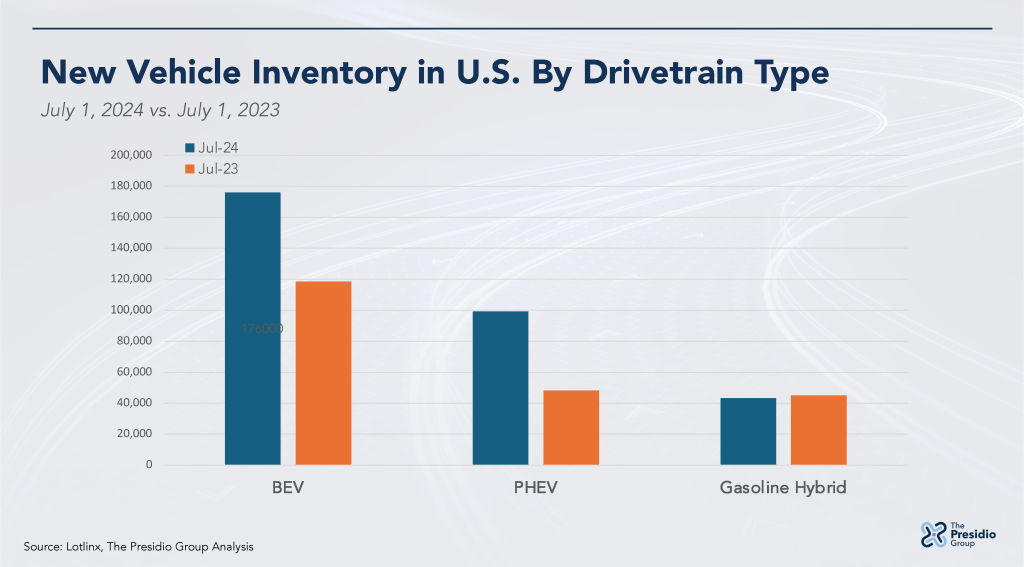

Surging BEV Inventory Spurs Automaker Pivot

This chart shows the dramatic rise in unsold EVs compared to stable hybrid inventory, illustrating the market forces driving the strategic shift to hybrids mentioned in the section.

(Source: The Presidio Group |)

Investment Recalibration: Tracking the Billions Behind the Automotive Pivot to Hybrids

The pivot to hybrids is underscored by a massive financial course correction, involving tens of billions of dollars in writedowns on prior EV investments and the strategic reallocation of capital to expand gasoline and hybrid production capacity. This recalibration is not a retreat from electrification but a pragmatic move to align production with current market profitability and demand.

Ford’s EV Division Posts Billions in Losses

Quantifying the ‘enormous financial losses’ from the premature EV push, this chart shows Ford’s EV division losing $3.7 billion, which directly supports the section’s focus on financial recalibration.

(Source: Seeking Alpha)

- Automakers are absorbing enormous financial losses from the premature EV push, with collective writedowns estimated between $65 billion and $92 billion. Ford Motor Company alone announced a $19.5 billion writedown, including $8.5 billion for canceled EV programs, after its Model e division continued to post significant losses.

- Stellantis is taking a $26 billion charge as part of its strategic shift away from an aggressive EV-only plan. This financial reset is coupled with a new $13 billion investment to expand its U.S. manufacturing footprint and increase overall vehicle production by 50%, with a focus on multi-powertrain flexibility.

- In a clear signal of the pivot, new capital is flowing directly into ICE and hybrid production. General Motors invested $888 million to support V-8 engine production for its profitable trucks and SUVs, while Toyota, a longtime hybrid proponent, is investing $912 million to boost hybrid component and vehicle production across five of its U.S. plants.

Table: Key Automotive Investments and Cancellations (2025-2026)

| Company / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Ford Motor Company | Feb 2026 | Announced a $19.5 billion writedown from canceled EV programs and a terminated joint venture. The move is part of a “refined” EV strategy to push back profitability targets and reduce production of models like the F-150 Lightning. | Capstone Partners |

| Stellantis | Feb 2026 | Taking a $26 billion charge to pivot away from its aggressive EV strategy and refocus on gasoline and hybrid vehicles to revive sales and regain U.S. market share. | The New York Times |

| Toyota | Nov 2025 | Investing $912 million to expand hybrid vehicle and component production capacity at five U.S. plants in West Virginia, Kentucky, Missouri, Tennessee, and Mississippi, creating over 250 new jobs. | Toyota |

| Stellantis | Oct 2025 | Announced a $13 billion investment to expand its U.S. manufacturing footprint and increase annual vehicle production by 50%, supporting its multi-energy vehicle strategy. | Stellantis |

| General Motors | Jun 2025 | Investing $888 million into four plants for production of its next-generation V-8 gasoline engines, reinforcing its commitment to profitable full-size trucks and SUVs. | CBT News |

Strategic Alliances in Powertrain Tech: How Automakers Are Sharing Hybrid Systems

To lower development costs and accelerate the manufacturing pivot, automakers are forming strategic alliances to share hybrid powertrain technology. This collaborative approach marks a significant shift from the proprietary, “walled-garden” development that characterized the early EV race, signaling that hybrid systems are becoming a commoditized, essential technology.

- In a move to mitigate tariff impacts and secure its supply chain, Honda plans to source hybrid vehicle batteries from Toyota’s new U.S. plant. This partnership leverages Toyota’s established hybrid leadership and manufacturing scale, allowing Honda to quickly expand its hybrid offerings without massive upfront capital investment.

- Nissan is reportedly in discussions with both Ford and Stellantis about sharing its hybrid technology. If an agreement is reached, it would represent a major trend toward cross-company collaboration to standardize hybrid systems, reduce R&D costs, and focus resources on other areas like software and next-generation EVs.

- These emerging partnerships stand in contrast to the dissolved collaborations of the EV-centric era, such as a joint venture that Ford ended as part of its $6 billion writedown. The new alliances are pragmatic, cost-driven, and focused on deploying proven, in-demand hybrid technology at scale.

Table: Key Hybrid Technology Partnerships and Collaborations

| Partners | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Nissan, Ford, Stellantis | Oct 2025 | Nissan is in talks to potentially supply its hybrid technology to Ford and Stellantis. This collaboration would enable the Detroit automakers to accelerate their hybrid rollouts and reduce development costs. | Automotive News |

| Honda, Toyota | Mar 2025 | Honda is planning to source hybrid vehicle batteries from Toyota’s new U.S. battery plant. The partnership is a strategic move to de-risk supply chains and avoid potential tariff impacts on imported components. | Automotive Manufacturing Solutions |

U.S. Manufacturing Footprint: Automakers Reinforce Midwest and Southern Production Hubs for Hybrids

The strategic manufacturing pivot is geographically concentrated in the traditional U.S. automotive heartland, with automakers investing billions to retool existing facilities in the Midwest and the growing Southern automotive corridor for multi-powertrain flexibility. This approach prioritizes leveraging established infrastructure and skilled workforces over building new, EV-only greenfield sites.

Toyota and Honda Lead in Supplier Relations

This chart provides context for the partnerships in the table, showing that consistent leaders in working relations, like Toyota and Honda, are well-positioned for successful collaboration.

(Source: Plante Moran)

- From 2021 to 2024, geographic investment focused heavily on new, dedicated EV and battery plants, such as Toyota’s battery facility in North Carolina. The strategy was to build a new manufacturing ecosystem specifically for an electric future.

- Beginning in 2025, the focus shifted to reinforcing existing assets. Toyota is now boosting hybrid production across five established plants in West Virginia, Kentucky, Mississippi, Tennessee, and Missouri. This leverages its deep regional presence to scale hybrid output quickly and cost-effectively.

- Similarly, General Motors is channeling $3.5 billion into its Michigan plants to expand hybrid and PHEV production, while Stellantis is investing over $406 million across three of its Michigan facilities. These investments show a clear strategy to protect and enhance legacy production hubs by adapting them for the renewed importance of hybrid vehicles.

Hybrid Powertrain Maturity: A Proven Technology Finds Renewed Commercial Scale

Hybrid technology, once viewed as a transitional solution, is now being deployed at full commercial scale as a mature, profitable, and strategically vital part of automaker portfolios. The industry pivot validates hybrids as a durable, long-term technology that meets both consumer needs and regulatory requirements, moving it from a bridging solution to a core pillar of manufacturing strategy.

Hybrid Profitability Validates Renewed Strategic Focus

This chart demonstrates the strong profitability of hybrid models, with some generating over $4,000 in profit per vehicle, validating the section’s claim that hybrids are a mature, profitable technology.

(Source: The Presidio Group |)

- In the 2021-2024 period, the industry narrative framed hybrid technology as a legacy system destined for phase-out, with R&D and capital expenditure overwhelmingly directed at next-generation BEV platforms and battery chemistries.

- The market shift in 2025 confirmed the commercial maturity and profitability of hybrids. The technology is now seen as a key enabler for funding the long-term EV transition. Surging sales, with hybrids accounting for 14% of U.S. light vehicle sales in Q 1 2025, provide definitive market validation.

- The maturity of hybrid systems is further confirmed by emerging technology-sharing partnerships. Nissan’s talks to supply its hybrid tech to competitors suggests the systems are becoming a standardized, off-the-shelf component, allowing automakers to deploy them rapidly without extensive proprietary R&D.

SWOT Analysis: U.S. Automaker Pivot to Hybrids and Petrol

The strategic pivot to hybrids allows automakers to capitalize on existing manufacturing strengths and meet immediate consumer demand, but it also creates exposure to regulatory risks and cedes ground in the pure-play EV market. This SWOT analysis examines the core dynamics of this industry-wide recalibration.

US Automakers Cede Ground in Global EV Market

This chart illustrates a key weakness in the SWOT analysis, showing that by pivoting, U.S. automakers risk falling further behind in the global EV market where they already lag significantly.

(Source: LinkedIn)

- Strengths: The pivot allows automakers to generate strong profits from popular hybrid and ICE models, which can fund the costly EV transition.

- Weaknesses: Billions in writedowns from prior EV investments have damaged balance sheets and revealed significant forecasting errors.

- Opportunities: Surging consumer demand for hybrids presents a major revenue opportunity that aligns with existing production capabilities.

- Threats: A renewed focus on hybrids could slow BEV innovation, leaving automakers vulnerable to focused EV competitors and future shifts in policy or consumer preference.

Table: SWOT Analysis for the U.S. Automaker Pivot to Hybrids

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Ambitious EV vision and strong brand marketing around an all-electric future. Capitalizing on early government incentives for EVs. | Leveraging profitable ICE/hybrid segments (trucks, SUVs). Utilizing existing, paid-for manufacturing infrastructure. A diversified powertrain portfolio that hedges market risk. | The strategy shifted from vision-driven to profit-driven. The pivot validated the strength of existing manufacturing assets and the profitability of legacy powertrains. |

| Weaknesses | High R&D costs and unprofitability of dedicated EV divisions. Over-reliance on fragile battery supply chains. | Billions in quantified financial losses from EV writedowns (Ford, Stellantis). High inventory levels for unsold EVs, indicating a mismatch with consumer demand. | The financial unsustainability of the aggressive “all-in” EV strategy was validated by staggering writedowns, forcing the strategic pivot. |

| Opportunities | Capture the early-adopter EV market. Secure government subsidies under the Inflation Reduction Act (IRA). | Meet surging demand for hybrid vehicles (14% market share). Use hybrid profits to fund development of more affordable, next-generation EVs. Form cost-saving technology partnerships (e.g., Nissan, Honda/Toyota). | The primary market opportunity shifted from a single-track EV race to a multi-track approach, with hybrids emerging as a highly profitable growth segment. |

| Threats | Intense competition from EV-native companies like Tesla. Volatility in battery material costs and supply chain disruptions. | Policy uncertainty, including the potential repeal of the $7, 500 IRA tax credit. Ceding long-term EV market leadership. Falling behind Toyota, which perfected a profitable hybrid strategy. | The primary threat evolved from execution risk (building EVs) to market and policy risk (consumer adoption and political instability). |

Forward Outlook: The Hybrid Bridge Strategy and Key Signals for 2026

If consumer demand for hybrids remains strong and EV adoption continues its modest growth trajectory, watch for automakers to further delay capital-intensive, EV-only platform launches and instead prioritize rolling out hybrid options across their most profitable truck and SUV lines. The “hybrid bridge” is no longer a short-term gap-filler but a multi-year strategic pillar.

Ford Hybrid Sales Massively Outpace EV Model

This chart provides the historical data behind the forward outlook, showing surging sales for Ford’s hybrid Maverick vastly outpacing its EV Mach-E, justifying the ‘hybrid bridge’ strategy.

(Source: Seeking Alpha)

Hybrid Urgency Index Shows Dramatic Strategic Shift

Visualizing the change detailed in the SWOT table, this chart’s ‘Urgency Index’ highlights the rapid strategic pivot towards hybrids by major automakers between 2024 and 2025.

(Source: LinkedIn)

- Watch this signal: Ford now projects that hybrids and EVs will constitute approximately 50% of its global sales volume by 2030, a significant increase from 17% in 2025. This forecast confirms a long-term reliance on hybrids to meet both sales targets and emissions goals.

- If this happens: If partnership talks between Nissan and competitors like Ford or Stellantis are finalized, it will validate a major trend toward the commoditization of hybrid systems. This would allow automakers to focus their own R&D on next-generation EVs and software differentiation.

- This could be happening: Automakers may announce more investments in retooling existing ICE plants for hybrid production, following the model of GM’s recent $888 million V-8 engine investment. These announcements would signal a deepening commitment to leveraging legacy assets over building new, high-risk EV facilities.

Frequently Asked Questions

Why are U.S. automakers pivoting from an “all-in” EV strategy to producing more hybrids?

The pivot is a direct response to slowing EV sales growth and staggering financial losses. Automakers are de-risking their electrification timelines and shifting to a flexible, multi-powertrain model to meet current consumer demand for profitable hybrids while funding a more measured, long-term transition to a fully electric future.

How significant are the financial losses associated with the initial push into electric vehicles?

The financial impact has been massive. The article estimates collective industry writedowns are between $65 billion and $92 billion. For example, Ford Motor Company announced a $19.5 billion writedown from canceled EV programs, and Stellantis is taking a $26 billion charge as part of its strategic shift.

Are automakers actually investing new money into gasoline and hybrid production?

Yes, they are making significant new investments. General Motors invested $888 million to support V-8 gasoline engine production, Toyota is investing $912 million to boost hybrid production across five U.S. plants, and Stellantis announced a new $13 billion investment to expand its multi-powertrain manufacturing footprint in the U.S.

How are car companies collaborating to speed up their pivot to hybrids?

To lower costs and accelerate the shift, automakers are forming strategic alliances. For instance, Honda plans to source hybrid vehicle batteries from Toyota’s new U.S. plant. In another potential collaboration, Nissan is in talks to supply its hybrid technology to Ford and Stellantis, which would help them reduce development costs and speed up their hybrid rollouts.

Does this renewed focus on hybrids mean automakers are giving up on an all-electric future?

No, the shift is described as a “hybrid bridge strategy” rather than a complete retreat from electrification. It is a pragmatic move to align with current market demand and profitability. The profits from popular hybrid and ICE models are intended to fund the costly, long-term development of more affordable, next-generation EVs.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.