UK Solar Policy in 2026: How Record Subsidy Contracts Shape Future Growth and Constraints

UK Solar Projects: How Policy Shifts from Volatility to Unprecedented Commercial Scale

The UK solar market has transitioned from a period of intermittent, policy-sensitive growth to one of systematic, large-scale deployment, driven by a deliberate strengthening of the Contracts for Difference (Cf D) scheme that has de-risked investment and established a clear path to commercial scale.

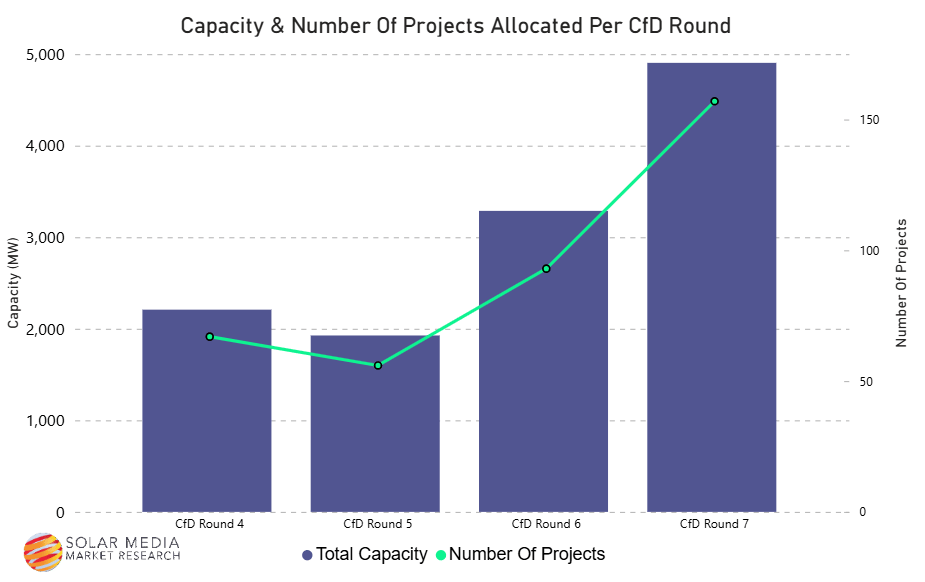

- Between 2021 and 2024, the Cf D scheme delivered inconsistent results, such as the approximately 1.9 GW of solar capacity awarded in Allocation Round 5 (AR 5) in 2023, which was a step down from the 2.2 GW secured in 2022. This period demonstrated the market’s sensitivity to auction parameters and budget fluctuations, even as over 1 GW of subsidy-free projects emerged, proving solar’s growing standalone economic viability.

- From 2025 onwards, policy has become the primary accelerator, with the landmark Allocation Round 7 a (AR 7 a) auction in 2026 securing a record-breaking 4.9 GW of solar capacity across 157 new projects. This represents a 50% increase over the previous round and solidifies utility-scale solar as a core component of national energy strategy, moving it beyond niche adoption into a mainstream power source.

- The key market risk has shifted from securing financing to project execution and delivery. With a massive pipeline of awarded projects now needing to come online by 2029, the industry’s primary constraints are local planning approvals and grid connection availability, challenges the government aims to address with a new £46 million investment to improve local planning capabilities.

Solar Capacity Soars in Recent CfD Auctions

This chart directly illustrates the section’s focus on the Contracts for Difference (CfD) scheme, showing the dip in Allocation Round 5 and the subsequent unprecedented growth, which aligns with the theme of moving from policy volatility to large commercial scale.

(Source: Solar Power Portal)

UK Solar Investment Analysis: State-Backed Funds and Cf D Certainty Drive Capital Inflow

A combination of direct government funding initiatives and the de-risked revenue model of the Contracts for Difference (Cf D) scheme has created a highly attractive environment for both public and private capital investment in the UK solar sector, signaling strong financial backing for the nation’s energy transition.

- The establishment of Great British Energy (GBE) in 2025 marks a new public-private investment model, with its Local Power Plan committing up to £1 billion to support locally-owned clean energy projects and initiating its activity with a £200 million investment in rooftop solar for schools and hospitals.

- The Cf D scheme’s revenue certainty remains the primary driver for private capital, demonstrated by the successful bids in the AR 7 a auction from major European utilities like Germany’s RWE (290 MW) and Denmark’s European Energy (116 MWp), who have committed capital based on guaranteed strike prices.

- Government commitment extends beyond utility-scale to distributed generation through the ambitious £15 billion Warm Homes Plan. This long-term program is designed to finance the installation of solar panels and batteries for millions of households by 2030, stimulating the residential market and creating a new demand-side growth channel.

Table: Key Financial Commitments and Investments in UK Solar

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Warm Homes Plan | 2026 – 2030 | A £15 billion government plan to subsidize solar panels, batteries, and insulation for households. This initiative aims to drive growth in the residential and distributed generation market segments. | GOV.UK |

| Great British Energy (GBE) | 2026 | Launch of a £1 billion Local Power Plan to fund locally-owned clean energy projects. Its first major investment is a £200 million initiative for rooftop solar on schools and hospitals, signaling a focus on community and public sector assets. | The Co-operative News |

| AR 7 a Auction Winners | 2026 | Major European utilities including RWE (290 MW), European Energy (116 MWp), and BELECTRIC (210 MWp) secured Cf D contracts. This represents significant private capital commitment underpinned by the government’s guaranteed revenue scheme. | RWE |

| Solar Roadmap Funding | 2025 | A £46 million government investment allocated to improve local planning capabilities. The strategic purpose is to accelerate project approvals and address a key bottleneck in deploying the growing solar pipeline. | GOV.UK |

Strategic Alliances in UK Solar: Corporate PPAs and Institutional Capital Reshape the Market

The UK solar market is maturing beyond a singular reliance on government subsidies, as corporate power purchase agreements (PPAs) and institutional asset acquisitions have become critical mechanisms for financing and de-risking large-scale projects, diversifying the routes to market.

- During the 2021-2024 period, corporate PPAs emerged as a viable alternative financing path, exemplified by Quinbrook Infrastructure Partners securing long-term offtake agreements with Tesco and Shell for its 363 MW Cleve Hill Solar Park. This transaction validated strong commercial demand for subsidy-free solar power.

- The market for operational solar assets has attracted significant institutional capital, demonstrated by Lightsource bp‘s sale of the UK’s largest completed solar farm to specialist renewable investment manager Schroders Greencoat. This confirms that utility-scale solar is viewed as a mature, bankable asset class.

- Construction-focused partnerships are accelerating the deployment of the Cf D project pipeline. The agreement between Ameresco and Sunel to construct a 300 MW solar portfolio for independent power producer Sonnedix shows how developers are executing on capacity awarded under the government’s subsidy scheme.

Table: Notable Partnerships and Offtake Agreements

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Lightsource bp & Schroders Greencoat | August 2024 | Lightsource bp completed and sold its largest UK solar farm, co-located with battery storage, to Schroders Greencoat. The deal validates the asset class for institutional investors and establishes a clear path for developer asset rotation. | Lightsource bp |

| Quinbrook Infrastructure Partners, Tesco & Shell | October 2024 | Quinbrook secured corporate PPA offtake agreements with Tesco and Shell for its 363 MW Cleve Hill Solar Park. This provides a long-term, subsidy-free revenue stream and demonstrates the viability of corporate partnerships for financing major projects. | Solar Power Portal |

| Ameresco, Sunel & Sonnedix | December 2023 | Ameresco and Sunel began construction on a 300 MW portfolio of solar projects for Sonnedix. The capacity is fully contracted under the Cf D scheme, highlighting partnerships focused on building out the government-backed project pipeline. | Ameresco |

UK Solar Geographic Focus: National Strategy Drives Widespread UK Project Deployment

While solar development is concentrated within the United Kingdom, the success of its national policy framework is attracting significant investment from major international energy firms, making the UK a primary European market for large-scale solar deployment.

UK Solar Capacity Surges After Policy-Driven Slowdown

This chart visualizes the “widespread UK project deployment” described in the section, showing the sharp acceleration in total installed capacity after 2021 as a direct result of the successful national strategy.

(Source: Carbon Brief)

- Between 2021 and 2024, solar development was geographically dispersed across the UK, with project viability driven by securing suitable land and grid connections. This led to landmark projects like the 363 MW Cleve Hill Solar Park in Kent, which became the nation’s largest consented solar project.

- The 2025-2026 period shows a continuation of this national-level focus, with the AR 7 a auction awarding contracts to 157 projects across the country. Specific examples of this geographic spread include European Energy‘s successful bids for new solar farms in Nottinghamshire, Oxfordshire, and Leicestershire.

- The UK’s predictable policy environment has made it a magnet for international capital and expertise. The AR 7 a auction saw German utility RWE securing 290 MW and German specialist BELECTRIC securing nearly 210 MWp, confirming the UK’s status as a leading destination for European energy investment.

Technology Maturity: Utility-Scale Solar Hits Commercial Stride, Co-located Storage Becomes Standard

Utility-scale solar PV has reached full commercial maturity in the UK, with the new frontier of development now focused on the standardized integration of Battery Energy Storage Systems (BESS) to manage intermittency, provide grid services, and maximize project revenue.

- In the 2021-2024 period, the economic case for co-locating battery storage with solar farms became firmly established, with developers like Lightsource bp completing and selling projects that fully integrated both technologies. This shift was driven by the need to capture additional revenue streams and provide essential grid balancing services.

- The 2025-2026 period solidifies this trend as standard practice, with analysis showing that over 900 MW of new battery capacity co-located with Cf D-backed wind and solar projects is expected to come online by the end of 2025. Co-location is no longer a niche innovation but a core component of a bankable project design.

- While ground-mount solar PV and BESS are commercially mature, the UK government is also funding innovation in nascent technologies to secure future energy options. A £4.3 million government investment in Space-Based Solar Power (SBSP) in 2023 indicates a long-term strategy to explore disruptive energy sources, although this remains in the early research and development phase.

SWOT Analysis: UK Solar Market Opportunities and Evolving Constraints

The UK solar market’s primary strength lies in its robust and enhanced policy framework, but this rapid, state-sponsored growth creates new threats and weaknesses related to grid capacity, planning bottlenecks, and supply chain execution risk.

CfD Subsidy Payments Reveal Market Price Volatility

This chart supports the SWOT analysis by visualizing the financial volatility of the CfD scheme—a key market dynamic. The negative payments in 2022 reflect the high market prices that represent both an opportunity for generators and a complex risk factor.

(Source: University of Bath Blogs)

- The market’s core strength has evolved from a functioning Cf D scheme to one with enhanced investor certainty, thanks to longer contract terms and record-breaking auction budgets.

- The main weakness has shifted from policy volatility, such as the failed offshore wind auction in 2023, to physical infrastructure constraints like grid connection queues and slow planning approvals.

- Opportunities have diversified from a reliance on corporate PPAs to a multi-channel approach that now includes significant public funding through Great British Energy and a major push into the residential market via the Warm Homes Plan.

Table: SWOT Analysis for UK Solar Subsidy Contracts and Market Growth

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | The Contracts for Difference (Cf D) scheme provided a bankable revenue model, attracting investment for projects like the 2.2 GW of solar in AR 4. | Cf D scheme enhanced with 20-year contract extensions and a record budget, leading to 4.9 GW of solar awarded in AR 7 a. | The government validated its commitment to solar by strengthening the core policy mechanism, significantly boosting investor confidence and project pipelines. |

| Weakness | Policy volatility was a key risk, highlighted by the failure of offshore wind to secure any bids in the AR 5 auction of 2023. | Physical infrastructure constraints, including long grid connection queues and local planning delays, are now the primary bottleneck for new projects. | The key constraint shifted from policy uncertainty to the practical challenges of deploying a massive project pipeline onto the existing grid and navigating local approvals. |

| Opportunity | The rise of subsidy-free projects financed via corporate PPAs, such as the Tesco and Shell agreements for the Cleve Hill Solar Park. | Diversified funding channels emerge with the £1 billion Local Power Plan from Great British Energy and the £15 billion Warm Homes Plan for residential solar. | The market expanded beyond a dual-track of Cf D and corporate PPAs to include major public and residential funding initiatives, opening new growth fronts. |

| Threat | Macroeconomic headwinds, including inflation and supply chain costs, impacted project economics and contributed to the low strike prices in AR 5. | Execution risk and supply chain strain to deliver the unprecedented 4.9 GW project pipeline from AR 7 a by the 2029 deadline. | The threat evolved from managing financial viability in a high-cost environment to the logistical challenge of sourcing materials and labor for a historic construction boom. |

2026 Forward Outlook: Will Grid Constraints Stall the UK’s Record Solar Pipeline?

The successful delivery of the 4.9 GW of solar capacity awarded in the latest Cf D auction hinges on the government’s ability to rapidly resolve grid connection and planning permission bottlenecks; failure to do so will stall the UK’s energy transition momentum and leave gigawatts of clean power capacity stuck in development.

Grid Surplus Risk Grows With Solar Capacity

This chart directly addresses the section’s forward outlook on grid constraints by modeling how increasing solar capacity leads to more hours of surplus generation. This visualizes the core challenge the UK must resolve to deliver its record solar pipeline.

(Source: Cloud Wisdom – Substack)

- If the £46 million allocated to improve local planning capabilities successfully accelerates project approvals, watch for a significant increase in projects reaching “ready-to-build” status in late 2026 and 2027. This would be the first signal that this critical administrative pipeline is clearing.

- If grid connection queues remain the primary obstacle to deployment, watch for developers increasingly prioritizing projects with pre-existing grid agreements or those co-located with large-scale battery storage to manage interconnection challenges. This could lead to a consolidation of the market around players with advanced grid expertise and portfolios.

- The success of Great British Energy‘s Local Power Plan could decentralize growth away from utility-scale farms. Watch for the first wave of funding awards from its £1 billion pot, which would validate a new growth front in community and commercial-scale solar and diversify the overall market structure.

Frequently Asked Questions

What is the main government policy driving the recent boom in UK solar projects?

The primary driver is the strengthened Contracts for Difference (CfD) scheme. The landmark Allocation Round 7a (AR 7a) in 2026 secured a record-breaking 4.9 GW of solar capacity, a 50% increase over the previous round. The government enhanced the scheme with longer contract terms and a record budget, which de-risked investment and established solar as a mainstream power source.

What are the biggest challenges facing the UK solar industry in 2026?

The main challenges have shifted from policy or financing risk to project execution and delivery. The primary constraints are now physical infrastructure issues, specifically long grid connection queues and delays in securing local planning approvals. The government is attempting to address the planning bottleneck with a £46 million investment to improve local capabilities.

How is the UK government supporting smaller-scale solar projects, like on homes and in communities?

The government has launched two major initiatives. The first is the £15 billion ‘Warm Homes Plan’ (2026-2030), which will subsidize the installation of solar panels and batteries for millions of households. The second is the ‘Local Power Plan’ from the newly established Great British Energy (GBE), which has committed £1 billion to fund locally-owned clean energy, starting with a £200 million investment in rooftop solar for schools and hospitals.

Are all large-scale solar farms dependent on government subsidies like the CfD scheme?

No. While the CfD scheme is a major driver, corporate Power Purchase Agreements (PPAs) are a viable, subsidy-free alternative. The article highlights the 363 MW Cleve Hill Solar Park, which was financed through long-term offtake agreements with corporate buyers like Tesco and Shell, demonstrating strong commercial demand for solar power without direct government subsidies.

How important is battery storage for new UK solar projects?

Co-locating Battery Energy Storage Systems (BESS) with solar farms has become a standard and essential practice. It is no longer a niche innovation but a core component of a bankable project. This is because batteries help manage the intermittency of solar power, provide valuable grid-balancing services, and create additional revenue streams for the project owner.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.