AFC Energy’s Hydrogen Commercialization 2025: How Strategic Partnerships Drive Market Entry

AFC Energy Commercial Scale Projects Target Diesel Replacement Market 2025

AFC Energy has pivoted from technology demonstrations to structured commercial deployments, using strategic partnerships to penetrate the off-grid power market and directly challenge diesel generators.

- Between 2021 and 2024, the company focused on technology validation through pilot projects with construction firms like Mace and Keltbray, alongside high-profile demonstrations with Extreme E. These early deployments proved the technical viability of its hydrogen power generators in demanding, real-world environments.

- The strategy shifted decisively in 2025 towards commercialization with the establishment of formal joint ventures, including Speedy Hydrogen Solutions with Speedy Hire. This venture created a dedicated rental market for its generators, moving beyond one-off pilots to a scalable, revenue-focused model.

- This transition is further highlighted by the agreement with TAMGO to power the FIA Extreme H World Cup with a high-capacity 200 k W system, demonstrating market acceptance for larger-scale applications. The diverse use cases, from construction sites to global motorsports, confirm the technology’s adaptability for the lucrative diesel replacement market.

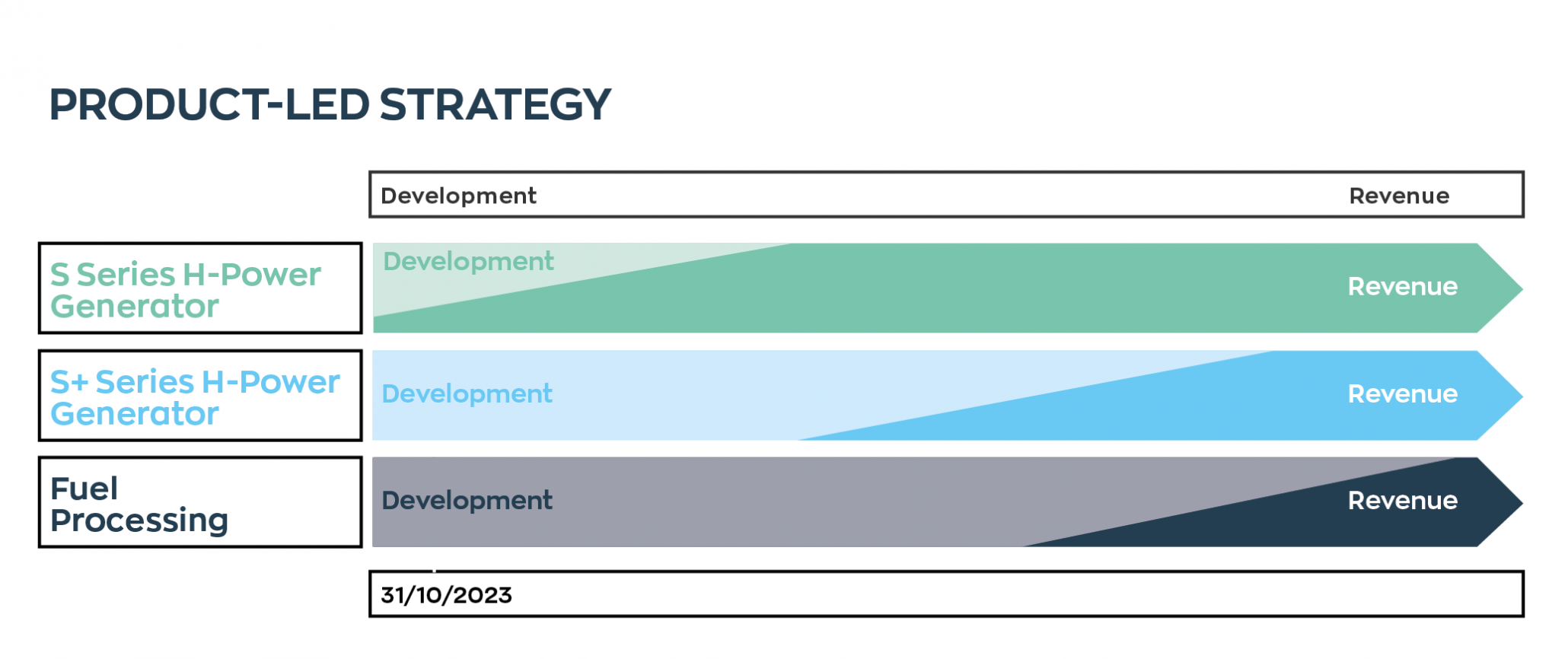

AFC Energy’s Roadmap to Revenue

This chart visually confirms the section’s point about AFC Energy’s strategic pivot from a development phase to a commercial, revenue-generating phase for its core technologies.

(Source: AFC Energy)

Investment Analysis: AFC Energy Secures Funding for Commercial Production

AFC Energy secured critical funding in 2025 to directly finance its transition from a research-focused entity to a commercial producer, marking a clear strategic shift in capital allocation.

- The successful oversubscribed fundraising of £27.5 million in July 2025 was explicitly targeted to commercialize its new low-cost fuel cell generators and the innovative Hy-5 ammonia cracker system.

- This funding provides a crucial runway to scale operations and mitigate the high cash burn associated with pre-commercial companies, which saw the company report a pretax loss of £11.6 million for the first half of 2025.

- The 2025 capital raise builds on earlier strategic investments, such as the one from ABB in 2021, signaling sustained and growing investor confidence in the company’s commercial roadmap and technology.

Table: AFC Energy Key Investment Milestones

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Public Fundraising | July 2025 | Raised £27.5 million (~$35 M) through an oversubscribed placing and subscription to fund the commercialization of fuel cell generators and ammonia crackers. | AFC ENERGY PLC – Investor Update |

| ABB | April 2021 | Received a strategic investment from ABB as part of an expanded partnership to co-develop and integrate fuel cell technology for e Mobility and other high-growth markets. | ABB expands partnership with investment in AFC Energy to … |

Partnership Strategy Analysis: AFC Energy’s Alliances Secure the Value Chain

In 2025, AFC Energy’s partnerships evolved from technology pilots into structured commercial ventures designed to secure manufacturing, establish supply chains, and guarantee market access.

- The company’s strategy matured from demonstration agreements with firms like Mace (2021) and Kier (2022) to legally binding 50:50 joint ventures. These include the Speedy Hydrogen Solutions JV with Speedy Hire for UK rental market access and a JV with Industrial Chemicals Group (ICL) to create an ammonia-to-hydrogen supply chain.

- A critical move in June 2025 was the strategic manufacturing partnership with Volex Plc. This collaboration is essential to delivering on the claimed 85% reduction in generator build costs and enables the global, volume manufacturing required for commercial scale.

- To de-risk technology development, AFC Energy signed a Joint Development Agreement in June 2025 with an unnamed S&P 500 industrial company to co-develop ammonia crackers. This secures external funding and third-party validation for its core fuel processing technology.

Table: AFC Energy Strategic Partnership Milestones

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Industrial Chemicals Group (ICL) | October 2025 | Established a 50:50 joint venture to produce and sell low-cost hydrogen from ammonia, with ICL managing the ammonia supply chain. This vertically integrates the fuel source. | ICL and AFC Energy Announce Joint Venture for Low-Cost … |

| Speedy Hire plc | September 2025 | Formed the Speedy Hydrogen Solutions 50:50 joint venture to exclusively supply and rent fuel cell generators to the UK construction and temporary power market. | ‘Let’s get Cracking’ with Dr. Mike Rendall, CTO of AFC Energy |

| Volex Plc | June 2025 | Announced a strategic manufacturing partnership to validate the 85% cost reduction and enable global, volume manufacturing of fuel cell systems. | AFC Energy (AIM:AFC) Cuts Fuel Cell Costs by 85%, Signs … |

| Unnamed S&P 500 Industrial Company | June 2025 | Signed a Joint Development Agreement to co-develop ammonia crackers, with development costs reimbursed by the partner to de-risk AFC Energy’s investment. | AFC Energy signs joint development agreement for … |

| Zollner Elektronik AG | July 2024 | Signed a multi-year supply agreement to outsource manufacturing of fuel cell systems, intended to accelerate scaling and reduce capital expenditure. | AFC Energy: Hydrogen firm hopes deal with German … |

AFC Energy Regional Growth: Expanding from the UK to Europe and MENA

AFC Energy has strategically expanded its geographic footprint from a UK-centric model to securing commercial entry points in mainland Europe and the Middle East, aligning its expansion with specific market opportunities.

- Between 2021 and 2024, the company’s commercial activities were primarily concentrated in the UK, with deployments and partnerships involving domestic firms like Speedy Hire, Mace, and Keltbray.

- The year 2025 marked a significant international expansion. The partnership with TAMGO to supply the FIA Extreme H World Cup provides a high-visibility entry into the capital-rich MENA market, while a deployment with ACCIONA in Madrid established a presence in Spain.

- This expansion builds on an established operational footprint in mainland Europe, supported by a 2024 manufacturing agreement with Germany’s Zollner and a long-standing hydrogen supply agreement with Air Products at its German test facility.

AFC Energy Technology Maturity: From Pilot Stage to Commercial Viability

AFC Energy’s technology advanced from demonstration-level systems to commercially viable, low-cost generators and a validated ammonia cracking solution, culminating in major milestones in 2025.

Advanced Ammonia Cracker Technology

This diagram illustrates the advanced ammonia cracking technology central to the section, showing how it achieves near-total fuel conversion at lower temperatures compared to conventional methods.

(Source: EnkiAI)

- In the 2021-2024 period, the company focused on proving its technology in field trials, deploying its H-Power Tower systems and advancing its ammonia cracker to achieve 99.99% hydrogen purity by late 2023.

- A fundamental shift occurred in June 2025 when AFC Energy announced an approximate 85% reduction in the build cost of its 30 k W generator. This achievement positions the technology as a commercially competitive alternative to diesel.

- The ammonia cracker technology progressed from a large-scale demonstrator in 2023 to a commercially-backed development program in 2025, validated through a JDA with an S&P 500 partner and a supply JV with ICL. This confirms its maturation from a research project to a key component of the company’s market strategy.

AFC Energy SWOT Analysis: How Partnerships Mitigated Key Risks

AFC Energy’s targeted partnership strategy in 2024–2025 directly addressed critical weaknesses from its earlier development phase, specifically high manufacturing costs and a lack of scalable market channels.

- The SWOT analysis reveals how the company leveraged its core technology (Strengths) to capture a growing market opportunity (Opportunities).

- It also shows how strategic alliances were deployed to mitigate historical weaknesses and counter external threats.

Table: SWOT Analysis for AFC Energy

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Proprietary alkaline fuel cell (AFC) technology proven in multiple demonstrations (e.g., Extreme E, Kier). | Validated low-cost 30 k W generator design (~85% cost reduction); advanced ammonia cracker IP; growing portfolio of commercial partnerships. | The core technology’s commercial viability was validated by the cost reduction and the willingness of major partners like Volex and Speedy Hire to enter binding agreements. |

| Weaknesses | High manufacturing costs, lack of scalable market access, significant cash burn, and reliance on pilot projects for validation. | Remains pre-revenue with ongoing losses (£11.6 M pretax loss in H 1 2025); heavy reliance on partners for manufacturing and distribution. | The Volex and Zollner manufacturing deals directly address high production costs, while the Speedy Hydrogen Solutions JV creates a scalable channel to market. However, profitability remains a future target. |

| Opportunities | Large diesel generator replacement market; growing demand for off-grid EV charging and clean construction power. | Targeting the £20 billion off-grid power market; pioneering the ammonia-to-hydrogen fuel chain via a “Fuel as a Service” model. | The JVs with ICL (supply) and an S&P 500 partner (development) show a clear strategy to capture the entire ammonia fuel chain opportunity, moving beyond just hardware sales. |

| Threats | Hydrogen supply and logistics challenges; competition from incumbent power solutions and other fuel cell technologies. | High execution risk on ambitious 2026 commercialization roadmap; financial runway dependent on achieving revenue targets. | The ammonia strategy directly mitigates hydrogen logistics threats. The primary threat has shifted from technological feasibility to commercial execution risk within the defined financial runway. |

Forward-Looking Insights: Execution of Partnerships is Key to AFC Energy’s 2026 Goal

AFC Energy’s success over the next 18 months hinges entirely on its ability to execute its partnership-led strategy, specifically by scaling low-cost manufacturing and generating material revenue from its commercial ventures.

- The most critical near-term action is converting the engineering achievement of an 85% cost reduction into mass production. The success of the Volex and Zollner manufacturing partnerships in meeting quality, cost, and volume targets for the 2026 delivery goal will be the primary indicator of progress.

- The commercial validation of its business model now rests on the performance of the Speedy Hydrogen Solutions joint venture. This partnership must transition from initial deployments to a steady stream of rental contracts to prove the market’s willingness to adopt hydrogen power over diesel.

- Investors will closely watch for milestones from the ammonia cracker development with the S&P 500 partner and the subsequent supply chain build-out with ICL. Progress here validates the company’s long-term strategy to solve the hydrogen logistics problem and differentiate itself in a competitive market.

Frequently Asked Questions

What was AFC Energy’s main strategic shift in 2025?

In 2025, AFC Energy pivoted from technology demonstrations and pilot projects to a full commercialization strategy. This involved forming structured joint ventures, such as Speedy Hydrogen Solutions, to create a scalable, revenue-focused model targeting the diesel generator replacement market.

How is AFC Energy addressing the high cost of its hydrogen generators?

The company announced an approximate 85% reduction in the build cost of its 30 kW generator in June 2025. To achieve this at scale, it entered a strategic manufacturing partnership with Volex Plc, which is essential for enabling global, volume manufacturing and delivering on the cost reduction.

What is the purpose of the ‘Speedy Hydrogen Solutions’ joint venture?

Speedy Hydrogen Solutions is a 50:50 joint venture with Speedy Hire plc, established to create a dedicated rental market for AFC Energy’s fuel cell generators. It exclusively supplies and rents the generators to the UK construction and temporary power market, moving beyond one-off sales to a scalable rental model.

How does AFC Energy plan to solve the problem of hydrogen fuel supply and logistics?

AFC Energy is developing an ammonia-to-hydrogen solution. This strategy includes co-developing ammonia crackers through a Joint Development Agreement with an S&P 500 company and establishing a joint venture with Industrial Chemicals Group (ICL) to create a vertically integrated supply chain that produces low-cost hydrogen from ammonia.

What was the significance of the £27.5 million fundraising in July 2025?

The £27.5 million fundraising was critical for financing AFC Energy’s transition from a research-focused entity to a commercial producer. The funds were explicitly raised to commercialize its new low-cost fuel cell generators and the innovative ammonia cracker system, providing the financial runway to scale operations.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.