Top 10 Geothermal Projects and Initiatives in China for 2025

China’s geothermal sector in 2024-2025 is unequivocally dominated by large-scale, direct-use urban heating, a strategic choice that eclipses electricity generation. This focus has positioned the nation as the world’s undisputed leader in geothermal direct-use applications, leveraging vast low-to-medium temperature resources to decarbonize its cities. The scale of this commitment is staggering, with direct-use heating capacity soaring past 77 GW, while total geothermal power generation capacity remains under 50 MW. The dominant theme for 2025 is the relentless, state-driven expansion of district heating networks, spearheaded by state-owned giants like Sinopec and enabled by critical international technology partnerships.

The Definitive List of China’s Top Geothermal Endeavors

The following projects, programs, and strategic initiatives represent the core of China’s geothermal ambitions, highlighting a clear prioritization of displacing coal for heating over generating electricity.

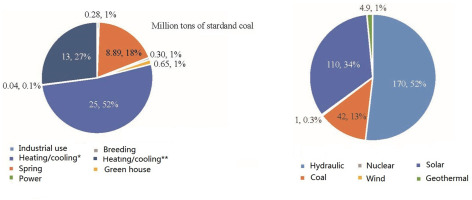

China’s Geothermal Use Dominated by Heating

This chart illustrates the article’s core premise that China prioritizes geothermal for direct heating, which dwarfs its use for power generation.

(Source: ScienceDirect.com)

1. Sinopec’s National Geothermal Heating Program (2025 Expansion)

Company/Operator: Sinopec Green Energy (SGE), a joint venture with Iceland’s Arctic Green Energy

Capacity/Scale: A record heating capacity covering 126 million square meters, serving over 70 municipalities via a network of more than 926 wells.

Application: Large-scale urban district heating.

Source: Sinopec hits record high geothermal heating capacity in …

2. National Direct-Use Capacity Growth Initiative

Company/Operator: National Government/Multiple Project Developers

Capacity/Scale: Cumulative installed capacity for direct-use heating exceeds 77 GW (thermal).

Application: National policy and project framework for geothermal heating and cooling.

Source: China Is Scaling Geothermal District Heating & The World …

3. Unnamed Record-Breaking Deep Well Project (2025)

Company/Operator: Unnamed

Capacity/Scale: A single well designed to provide sustainable heating for approximately 10, 000 homes.

Application: High-capacity district heating from a single deep well.

Source: China breaks geothermal energy records: a new well will …

4. Yuncheng Geothermal Based Space Heating System

Company/Operator: Unnamed (Project 5902)

Capacity/Scale: Specific capacity not detailed, but registered as a verified carbon credit project.

Application: District heating and monetization of emissions reductions via carbon credits.

Source: Australian developer lists GS soil carbon project

5. Lumut Balai Geothermal Power Plant Project (Phase II)

Company/Operator: SEPCOIII (a subsidiary of Power China)

Capacity/Scale: Adds 55 MW of electricity generation capacity in Indonesia.

Application: Geothermal power generation (overseas project).

Source: China-Indonesia Cooperation Shines in Energy Transition

6. China-Iceland Geothermal Technology Cooperation Initiative

Company/Operator: Bilateral government and corporate partnership (e.g., Arctic Green Energy).

Capacity/Scale: Strategic initiative focused on technology transfer, not direct capacity.

Application: Accelerating domestic development through transfer of advanced drilling and reservoir modeling expertise.

Source: China and Iceland deepen cooperation in geothermal energy

7. National Deep Geothermal Resource Development Strategy

Company/Operator: National Government

Capacity/Scale: National strategy to exploit deep resources with high capacity factors (65%-90%).

Application: Strategic policy to improve baseload energy supply.

Source: The Role of Deep Geothermal Resources in China’s …

8. National Geothermal Power Generation Pilot Program

Company/Operator: National Government/Various pilot projects

Capacity/Scale: Total national installed power generation capacity is less than 50 MW.

Application: Pilot-scale geothermal electricity generation.

Source: The Role of Deep Geothermal Resources in China’s …

9. Sinopec Star Petroleum Geothermal Development Program

Company/Operator: Sinopec Star Petroleum

Capacity/Scale: Manages a significant portfolio of heating projects, contributing to Sinopec Group’s overall dominance.

Application: Geothermal resource development and project operation for district heating.

Source: How Indonesia and China Can Get Geothermal Right

10. Geothermal Integration into the 15 th Five-Year Plan

Company/Operator: National and Regional Governments

Capacity/Scale: High-level policy framework driving all project investment and approvals.

Application: Policy alignment with national “dual carbon” strategy.

Source: Under 15 th Five-Year Plan, Multiple Regions Prioritize …

Table: Key Geothermal Projects in China (2024-2025)

| Company/Operator | Capacity/Scale | Application | Source |

|---|---|---|---|

| Sinopec Green Energy (SGE) | 126 million m² heating area | District Heating | Sinopec hits record high geothermal heating capacity in … |

| National Government/Multiple | >77 GW (thermal) | District Heating & Cooling | China Is Scaling Geothermal District Heating & The World … |

| Unnamed | Heating for 10, 000 homes | District Heating | China breaks geothermal energy records: a new well will … |

| SEPCOIII (Power China) | 55 MW (electric) | Power Generation (Indonesia) | China-Indonesia Cooperation Shines in Energy Transition |

From Urban Heating to Carbon Credits: The Expanding Applications of Geothermal

The applications landscape for geothermal energy in China is remarkably uniform: it is a tool for decarbonizing heat. The primary driver is the national goal of replacing coal-fired boilers in urban centers, and projects like Sinopec’s massive heating program are the main vehicle for this transition. This singular focus has created a market that is rapidly scaling, evidenced by an average annual growth rate of 23% in heating and cooling applications. However, new business models are emerging. The Yuncheng Geothermal Based Space Heating System, registered as a carbon credit project, signals a strategic evolution. This move indicates that developers are beginning to monetize the environmental benefits of geothermal heat, creating an additional revenue stream and strengthening the financial case for these projects. This contrasts sharply with the minimal adoption for power generation, which remains confined to a small pilot program.

China’s Centralized Command: How State Policy Drives Geographic Dominance

The geography of geothermal development is a story of Chinese exceptionalism. The country is the undisputed global leader in direct-use geothermal capacity, a status achieved through a powerful combination of top-down state policy and execution by massive state-owned enterprises (SOEs). The inclusion of geothermal in high-level policy like the 15 th Five-Year Plan ensures political backing and capital flow. This centralized strategy is executed on the ground by entities like Sinopec and its subsidiaries, which have rolled out heating networks across more than 70 cities. The success of this rapid scaling was catalyzed by the China-Iceland Geothermal Technology Cooperation Initiative, particularly the joint venture between Sinopec and Arctic Green Energy, which facilitated crucial knowledge transfer. Interestingly, China is also exporting its expertise, with SOEs like Power China developing significant power projects like the 55 MW Lumut Balai plant in Indonesia, demonstrating a capability that is not yet being deployed at scale domestically.

China Leads World in Geothermal Capacity

This chart provides direct evidence for the section’s central claim that China is the ‘undisputed global leader’ in direct-use geothermal capacity, driven by state policy.

(Source: ScienceDirect.com)

A Tale of Two Maturities: Scaled Heating vs. Nascent Power

China’s geothermal sector exhibits a stark duality in technological maturity. Geothermal for district heating is a fully commercial and rapidly scaling technology. The success of Sinopec Green Energy, which has captured over 35% of the domestic market with its network of over 926 wells, proves the technical and economic viability of this application. The technology for tapping low-to-medium temperature resources is well-established. In contrast, geothermal for power generation is in its infancy within China. With a total domestic capacity of less than 50 MW, it remains in the pilot and demonstration phase. The “National Geothermal Power Generation Pilot Program” and the “National Deep Geothermal Resource Development Strategy” show intent, but the sector lacks the strong financial incentives that have propelled wind and solar. However, drilling technology itself is advancing, as shown by the “Unnamed Record-Breaking Deep Well, ” which is critical for accessing hotter, deeper resources needed for both more efficient heating and future power generation.

China’s Geothermal Power Capacity Remains Nascent

Highlighting China’s minimal power capacity, this chart validates the section’s ‘tale of two maturities’ by quantifying how nascent power generation is compared to scaled heating.

(Source: ScienceDirect.com)

The Future is Hot: Deeper Wells, Broader Networks, and the Power Generation Horizon

The trajectory for China’s geothermal sector is clear: the aggressive expansion of district heating will continue to be the primary focus. The market’s future will be defined by the continued build-out of heating networks under the leadership of state champions like Sinopec, driven by the national “dual carbon” strategy. A key emerging trend is the strategic push to exploit deeper geothermal resources. This will not only improve the efficiency of existing heating projects but also expand their potential geographic reach to areas with less favorable shallow geology. While domestic power generation remains a distant priority, the expertise Chinese firms are gaining on overseas projects, such as those in Indonesia, is creating a pool of experienced engineers and project managers. This latent capability could be rapidly deployed to accelerate domestic power projects if, and when, national policy and financial incentives shift to favor stable, baseload geothermal electricity.

Vast Untapped Potential Fuels Geothermal Future

This chart shows the significant gap between China’s geothermal potential and its current use, illustrating the immense room for future growth in broader heating networks.

(Source: ScienceDirect.com)

Frequently Asked Questions

Why is China focusing so heavily on geothermal for heating instead of generating electricity?

China’s strategic priority is to use its vast low-to-medium temperature geothermal resources to decarbonize urban centers by replacing coal-fired boilers. This direct-use application for heating is more suitable for their available resources and provides a direct path to reducing urban pollution. As a result, direct-use heating capacity has soared past 77 GW, while power generation capacity remains under 50 MW.

Who are the main players driving China’s geothermal expansion?

The expansion is primarily led by state-owned enterprises, with Sinopec being the dominant force. Its subsidiary, Sinopec Green Energy (SGE), a joint venture with Iceland’s Arctic Green Energy, operates a heating network covering 126 million square meters. The national government also plays a critical role by setting policy through frameworks like the 15th Five-Year Plan.

What is the significance of the China-Iceland partnership?

The China-Iceland Geothermal Technology Cooperation Initiative, particularly the joint venture between Sinopec and Arctic Green Energy, has been a critical catalyst for China’s success. It facilitated the transfer of advanced technology and expertise in areas like drilling and reservoir modeling, enabling China to rapidly scale its district heating projects and become the world leader in direct-use geothermal applications.

Is China involved in geothermal power generation at all?

Domestically, geothermal power generation is still in a pilot phase, with a total national capacity of less than 50 MW. However, Chinese companies are gaining significant experience abroad. For instance, Power China’s subsidiary is developing the 55 MW Lumut Balai power plant in Indonesia, building technical expertise that could be applied in China if policies shift to favor geothermal electricity.

What are the emerging trends in China’s geothermal sector for 2025?

The primary trend remains the aggressive expansion of district heating networks. A key emerging development is the push to exploit deeper geothermal resources, as shown by projects like the record-breaking deep well designed to heat 10,000 homes. Additionally, new business models are appearing, such as the Yuncheng project which monetizes emissions reductions through carbon credits, adding a new financial incentive for development.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.