Canada’s 2026 Auto Strategy: How Policy Reversal Creates EV Market Volatility and Investment Risk

Canada’s EV Market Adoption: Policy Shift from Mandates to Incentives Creates Significant Demand Risk

Canada’s 2026 strategic pivot from a mandatory EV sales standard to a less stringent emissions goal has replaced regulatory compliance risk for automakers with significant market demand risk, threatening the utilization of newly built manufacturing capacity.

- Between 2021 and 2024, the federal government established a clear trajectory with its Electric Vehicle Availability Standard, mandating 100% zero-emission vehicle (ZEV) sales by 2035 and attracting over C$37.4 billion in related investments based on this predictable demand signal.

- The 2026 repeal of this mandate and its replacement with an aspirational 75% goal by 2035 introduces profound uncertainty, a risk validated by the 41% collapse in EV sales in 2025 after previous federal subsidies were removed, which demonstrated the market’s extreme dependency on policy stability.

- The new five-year, C$2.3 billion “EV Affordability Program” is a temporary measure that creates a “subsidy cliff” risk at the end of 2030, potentially destabilizing demand just as new factories like Honda’s C$15 billion Ontario facility are scheduled to be fully operational.

- The shift to a fleet-wide greenhouse gas (GHG) standard provides automakers with operational flexibility but obscures the direct path to EV adoption, making it difficult for investors and supply chain partners to accurately forecast demand for EV-specific components and raw materials.

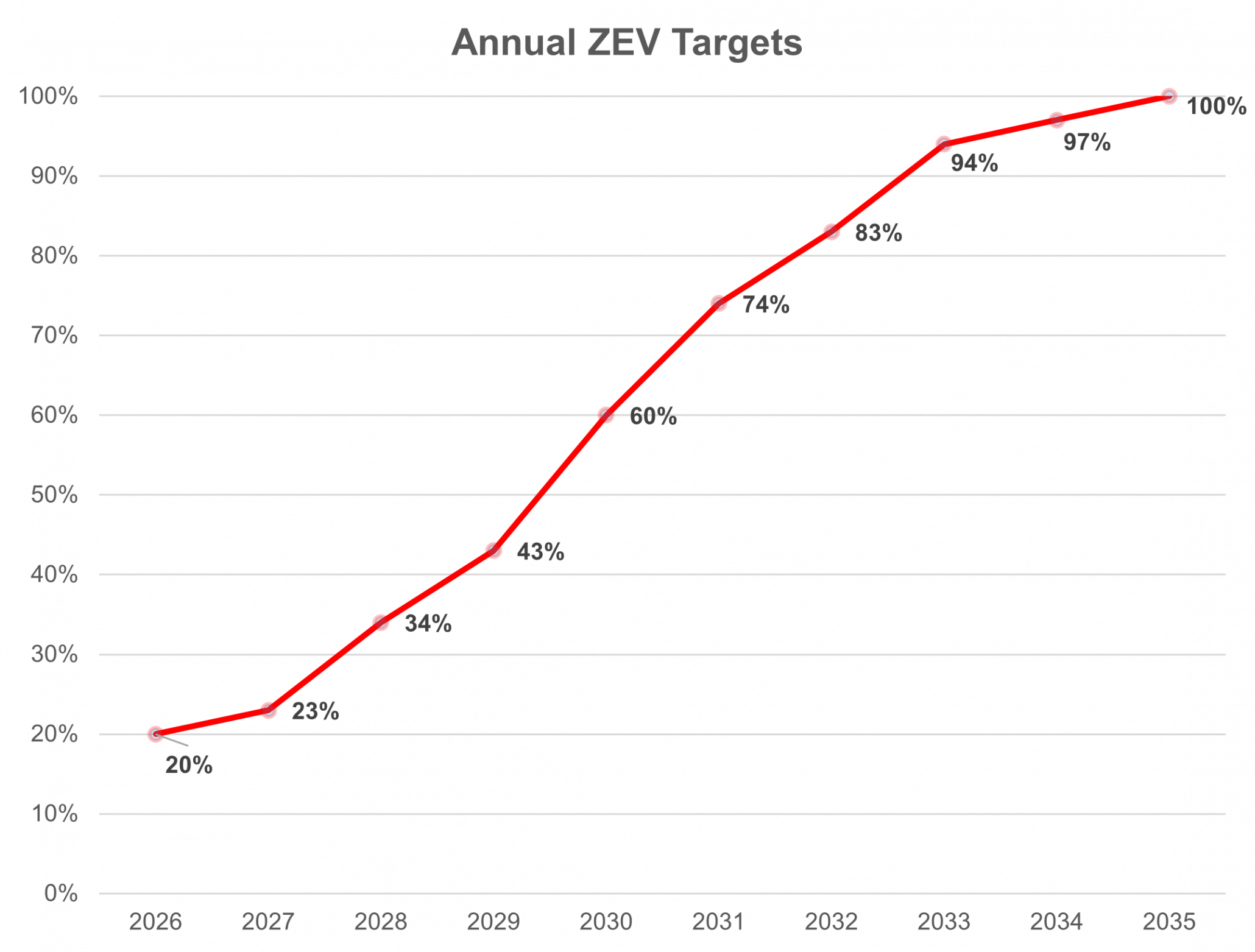

Canada’s Original ZEV Mandate Trajectory

This chart illustrates the original Electric Vehicle Availability Standard mentioned in the section, which mandated a clear ramp-up to 100% ZEV sales by 2035.

(Source: Canada.ca)

EV Manufacturing Investments: How Canada’s Policy Reversal Impacts Billions in Capital Projects

While Canada successfully secured over C$37 billion in electric vehicle and battery manufacturing investments between 2021 and 2024 under a mandate-driven policy, the 2026 strategy shift introduces significant risk to the long-term profitability and return on that invested capital.

- The initial investment wave was a direct competitive response to the U.S. Inflation Reduction Act, with companies committing to massive projects based on the guaranteed domestic market created by Canada’s ZEV mandate.

- The 2026 policy reversal means these facilities, which were backed by tens of billions in public subsidies such as the up to C$15 billion in production support for the Stellantis-LG venture, now face an uncertain domestic market driven by less predictable consumer incentives and emissions rules.

- The new 30% Clean Technology Manufacturing Investment Tax Credit remains a powerful supply-side incentive for capital investment, but its effectiveness is directly tied to the strength of end-market demand, which is now less certain without a sales mandate.

- The financial risk profile for these large-scale projects has shifted from regulatory compliance to market execution, introducing the potential for underutilization or stranded assets if EV adoption falters.

Table: Major EV Manufacturing Investments Secured in Canada (Pre-Policy Shift)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Honda | Apr 2024 | Announced a C$15 billion investment for a comprehensive EV value chain in Ontario, including a 240, 000 vehicle/year assembly plant and integrated battery production, supported by up to C$5 billion in government funding. | Honda |

| Northvolt | Sep 2023 | Committed C$7 billion to build a gigafactory near Montreal for battery cells, cathode active materials, and recycling, backed by C$2.7 billion in joint government funding. | CBC News |

| Volkswagen (Power Co SE) | Apr 2023 | Began a C$7 billion project for an EV battery cell plant in St. Thomas, Ontario, secured with up to C$13.2 billion in federal production subsidies designed to match U.S. IRA incentives. | PBO-DPB |

| Stellantis / LG Energy Solution (Next Star Energy) | Mar 2022 | Launched a C$5 billion joint venture for an EV battery plant in Windsor, Ontario, supported by up to C$15 billion in production subsidies to ensure competitiveness with U.S. facilities. | Al Jazeera |

Strategic Partnerships in Canada’s EV Supply Chain: From Mandate-Driven Alliances to New Geopolitical Realities

Strategic partnerships formed between 2021 and 2024 were centered on building a secure North American supply chain to meet mandated EV targets, while the 2026 policy introduces new, riskier alliances to manage affordability and market transition.

- The 2022 Stellantis-LG Energy Solution joint venture and the 2024 Honda collaborations with POSCO Future M and Asahi Kasei were structured to vertically integrate the supply chain in response to predictable, mandated demand for North American-built EVs.

- The 2026 strategy introduces a new partnership model by agreeing to allow a quota of up to 50, 000 Chinese-made EVs annually into Canada, a decision aimed at increasing affordable vehicle options but which also injects new geopolitical and competitive risks into the market.

- This policy change indicates a strategic shift from focusing solely on building a domestic supply chain to also managing consumer-side price barriers through imports, a move that could place new domestic production from facilities like Ford’s Oakville plant in direct competition with lower-cost vehicles.

Table: Key Automotive and Supply Chain Partnerships in Canada

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Government of Canada / Chinese OEMs | Feb 2026 | Canada agreed to a partnership allowing a limited import quota of fewer than 50, 000 Chinese-made EVs in the first year, subject to a 6.1% tariff, to address vehicle affordability. | Collision Repair Mag |

| Honda / POSCO Future M / Asahi Kasei | Apr 2024 | As part of its C$15 billion investment, Honda formed partnerships to establish local production of key battery components, including cathode active materials and separators, to create a self-contained supply chain. | Honda |

| Stellantis / LG Energy Solution | Mar 2022 | Established the Next Star Energy joint venture to build and operate a C$5 billion battery manufacturing plant in Windsor, Ontario, to supply Stellantis’s North American EV production. | Al Jazeera |

Geographic Concentration: How Canada’s Automotive Strategy Cements Ontario and Quebec as High-Risk EV Hubs

Canada’s automotive strategy has concentrated nearly all major EV investments in Ontario and Quebec, creating a high-stakes industrial cluster whose economic success is now directly exposed to the market volatility introduced by the 2026 policy reversal.

Quebec and BC Lead Provincial EV Readiness

This chart provides provincial context for the section’s focus on Ontario and Quebec, showing Quebec’s established leadership in ZEV adoption which attracted major investment.

(Source: Electrical Industry News Week)

- Between 2021 and 2024, Ontario secured foundational investments from Honda (Alliston, C$15 billion), Volkswagen (St. Thomas, C$7 billion), and Stellantis (Windsor, C$5 billion), establishing the province as the primary center of Canada’s EV assembly and battery manufacturing.

- During the same period, Quebec attracted Northvolt’s C$7 billion battery and CAM gigafactory, positioning itself as a critical upstream node in the battery materials supply chain by leveraging its clean energy grid and mineral resources.

- The 2025-2026 policy shift does not alter this geographic concentration but significantly elevates the economic risk for these two provinces, as their industrial fortunes are now tied to the success of less certain incentive programs rather than a predictable regulatory schedule.

- The lack of significant investment outside this central Canadian corridor highlights a potential regional economic imbalance and creates a concentrated point of failure should the national EV market falter in the absence of a sales mandate.

Policy Maturity Analysis: Canada’s Shift from Proven Mandates to Untested Incentive-Based Frameworks

The 2026 automotive strategy represents a regression in policy maturity, moving from the globally validated model of ZEV sales mandates, which provide clear signals for commercial-scale investment, to a less predictable incentive and emissions-credit system with unproven market outcomes.

Canada’s Proposed Mandate vs. Provincial Leaders

This chart visualizes the ‘globally validated model of ZEV sales mandates’ that the section describes, comparing the federal plan to successful policies in Quebec and BC.

(Source: Clean Energy Canada)

- From 2021 to 2024, Canada was on a path to adopt the ZEV mandate, a mature policy tool used successfully in jurisdictions like California and Quebec to de-risk investment and guarantee a market for commercial-scale production, which directly led to gigafactory commitments from Volkswagen, Northvolt, and Stellantis.

- The post-2025 framework reverts to a combination of consumer rebates and complex fleet-wide emissions standards, a model whose effectiveness is unproven at the required scale, as shown by the market’s sharp decline when incentives previously lapsed in 2025.

- The policy mechanism has shifted from a direct “stick” (mandate) to a complex “carrot” (incentives and ITCs); while the 30% Clean Technology Manufacturing ITC is a strong capital incentive, its value is diminished if the end market for the manufactured goods is volatile or shrinks.

- A critical mismatch has been created where manufacturing technology commitments have reached commercial scale, but the demand-side policy intended to support them has been reverted to a less mature, more experimental state.

SWOT Analysis: Canada’s Evolving Automotive Strategy and its Impact on EV Manufacturing

The strategic shift in Canada’s auto policy has fundamentally altered its risk and opportunity profile, transforming its primary strength of regulatory certainty into a significant weakness of market volatility, which now threatens the viability of prior investments.

ZEV Adoption Lags Behind Federal Targets

This chart visualizes the ‘market volatility’ risk introduced in the SWOT analysis by showing the gap between historical ZEV adoption and the aggressive mandated targets.

(Source: TD Economics – TD Bank)

Table: SWOT Analysis for Canada’s Automotive Strategy and EV Manufacturing Policy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | A clear ZEV sales mandate provided market certainty and a predictable demand curve for investors. | Strong supply-side incentives (30% CTM ITC) and vast critical mineral reserves remain attractive for manufacturers. | The core strength shifted from guaranteed demand-side offtake to a supply-side cost advantage for capital investment. |

| Weakness | High fiscal cost of production subsidies (e.g., up to C$15 B for Stellantis) required to compete with the U.S. IRA. | Extreme market dependence on consumer subsidies (validated by a 41% sales drop in 2025) and a lack of affordable EV models under C$50, 000. | The primary weakness moved from fiscal exposure on the supply side to systemic market instability on the demand side. |

| Opportunity | To build a fully vertically integrated “mines-to-mobility” EV supply chain, leveraging domestic mineral wealth. | Attract further manufacturing with powerful ITCs; leverage Chinese OEM partnerships to lower vehicle costs and stimulate the market. | The opportunity now includes managing vehicle affordability through imports, not just relying on domestic production to drive adoption. |

| Threat | The U.S. Inflation Reduction Act pulling capital investment away from Canada. | A “subsidy cliff” in 2030 when the new rebate program expires; new geopolitical risk with the China partnership; potential for U.S. trade friction. | The primary threat shifted from direct U.S. competition for capital to the risk of internal market failure and new international trade complexities. |

Forward Outlook: Key Signals for Canada’s EV Market Stability and Investment Viability in 2026

The most critical factor for Canada’s automotive sector in the year ahead is whether the new consumer incentive program can generate sufficient and stable demand to justify the massive manufacturing capacity currently under construction.

Canadian EV Sales Slump as Incentives End

This chart directly depicts the sales slump mentioned in the forward outlook, showing the sharp decline from a late-2024 peak that new policies must address.

(Source: Claims Journal)

- If this happens: The EV adoption rate under the new C$2.3 billion rebate program fails to consistently exceed the pre-slump high of nearly 18%, it will signal that the incentive is insufficient to counter the loss of the ZEV mandate’s powerful market-forcing effect.

- Watch this: The specific stringency of the forthcoming 2027 model year GHG emissions standards. If the regulations are not aggressive enough to force a significant mix of EV sales, it will confirm the policy pivot prioritizes automaker flexibility over guaranteed EV adoption, increasing risk for the supply chain.

- These could be happening: Automakers may announce delays or scope reductions for their Canadian investment plans, particularly in downstream component manufacturing, citing market uncertainty. Conversely, a surge in sales of sub-C$50, 000 EVs, including those from the new Chinese partnership, would be an early signal that the affordability-focused strategy is gaining traction.

Frequently Asked Questions

What was the main change in Canada’s EV policy in 2026?

In 2026, Canada repealed its mandatory Electric Vehicle Availability Standard, which mandated 100% zero-emission vehicle (ZEV) sales by 2035. This was replaced with a less stringent, aspirational goal of 75% ZEV sales by 2035, supported by a new consumer incentive program and a fleet-wide emissions standard.

Why are the C$37.4 billion in recent EV investments now considered at risk?

These investments were made between 2021 and 2024 based on the predictable market demand guaranteed by the sales mandate. With the mandate’s removal, the domestic market is no longer certain. The new factories, backed by billions in public subsidies, now face significant demand risk, which could lead to underutilization or the facilities becoming stranded assets if consumer adoption falters.

What is the ‘subsidy cliff’ and why is it a threat?

The ‘subsidy cliff’ refers to the potential for a sharp drop in EV demand around 2030 when the new five-year, C$2.3 billion ‘EV Affordability Program’ is set to expire. This creates a major risk for automakers, as it could destabilize the market just as new factories, like Honda’s C$15 billion Ontario facility, become fully operational.

Why did Canada agree to allow a quota of Chinese-made EVs into the country?

According to the text, the Canadian government agreed to a partnership allowing a limited import quota of Chinese-made EVs to address vehicle affordability for consumers. This move is intended to increase the availability of lower-cost EV options in the market, but it also introduces new geopolitical and competitive risks for domestic manufacturers.

How did the policy shift impact the risk profile for Ontario and Quebec?

Ontario and Quebec are home to nearly all of the major EV and battery manufacturing investments. The 2026 policy shift significantly elevates the economic risk for these provinces because their industrial success is no longer tied to a predictable sales mandate. Instead, it is now dependent on the success of less certain, temporary consumer incentive programs, creating a concentrated point of failure if the national EV market does not perform as hoped.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- IMO Decarbonization & Net Zero 2025: Policy Collapse

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.