US Energy Infrastructure Boom 2026: Why Market Demand Now Outweighs Policy Risk

Grid Modernization Projects Surge as Demand Overwhelms Policy Uncertainty

The primary driver for US energy infrastructure investment has fundamentally shifted from a reliance on policy incentives between 2021 and 2024 to an urgent response to non-negotiable market demand in 2025 and 2026. This new cycle is defined by the exponential power requirements of artificial intelligence and data centers, creating a durable, policy-agnostic foundation for growth that was absent in prior years.

- In the 2021-2024 period, major investment decisions were tightly coupled with policy signals. For example, Siemens Gamesa’s 2023 plan for an offshore wind nacelle factory in New York was directly contingent on the incentives and long-term clarity provided by the Inflation Reduction Act (IRA).

- The current period from 2025 to today is defined by a structural demand shock. Big tech firms are projected to spend approximately $600 billion on AI infrastructure in 2026 alone, a catalyst that has rendered previous energy forecasts obsolete and forced investment in grid capacity.

- This shift is confirmed by Siemens Energy’s record-breaking performance in Q 1 FY 2026, where order intake reached nearly €18 billion. The company explicitly linked this growth to “enormous” demand from data centers, which accounted for orders in the “high triple-digit-million-euro volume” in the US.

- This commercial activity validates that the need for reliable grid components, like transformers and switchgear, and dispatchable power from gas turbines is now a baseline economic requirement. This makes investment less sensitive to which energy source is politically favored.

Strategic Capital Allocation: Onshoring Manufacturing for AI-Driven Power Demand

Capital investments in US energy manufacturing have pivoted from being primarily induced by the Inflation Reduction Act to being strategically directed at resolving critical supply chain bottlenecks for components demanded by the AI boom. The focus has moved from capturing tax credits to securing market share in a supply-constrained environment, with recent commitments aimed at building domestic capacity for foundational grid hardware.

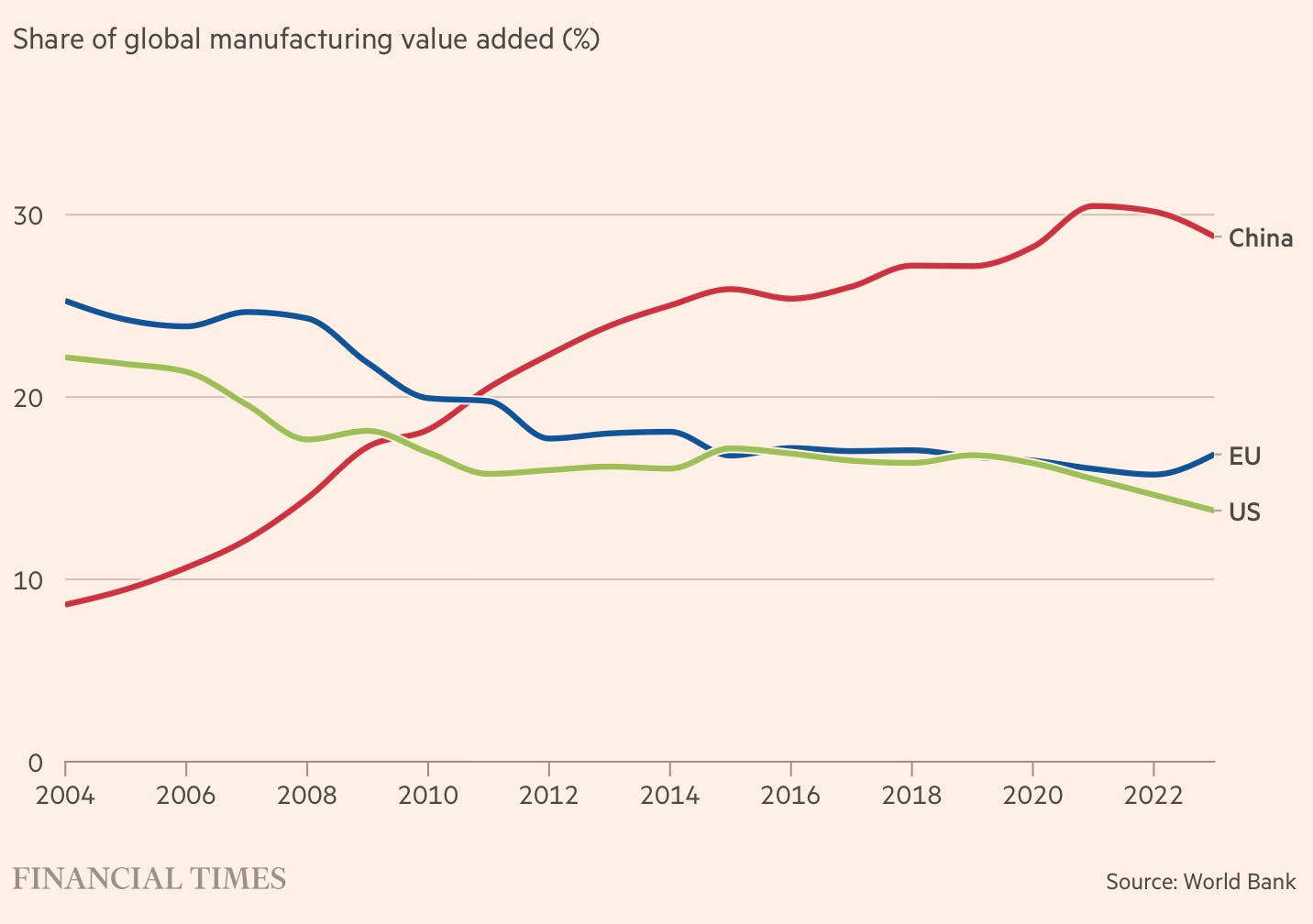

US Onshoring Push Counters Global Manufacturing Decline

This chart provides critical context for the section’s focus on onshoring, illustrating the long-term decline in the US share of global manufacturing that these new investments aim to counter.

(Source: Urbanomics – Substack)

- The contrast is evident in investment motives. Siemens AG’s 2023 decision to build a solar inverter plant in Wisconsin was explicitly credited to IRA incentives. By 2026, Siemens Energy’s $1 billion investment is a direct response to the AI-driven power crunch and chronic shortages of equipment like large power transformers.

- The $1 billion expansion announced in 2026 is targeted at increasing domestic production of gas turbines, power transformers, and switchgear. This onshoring strategy aims to shorten supply chains and ensure availability for US utilities and data center developers facing long lead times for critical equipment.

- This capital is not a single-point investment but a broad-based manufacturing expansion. It includes up to $300 million for a new factory in Mississippi, $421 million across North Carolina facilities, and significant upgrades in New York, Alabama, and Texas, creating over 1, 500 jobs.

Table: Key U.S. Manufacturing Investments by Siemens

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Siemens Energy | Feb 2026 | Announced a $1 billion investment to expand US manufacturing for power grid infrastructure and gas turbines across several states, including Mississippi and North Carolina, to meet AI-driven demand. | Reuters |

| Siemens Energy | Feb 2024 | Committed $150 million to build a new factory in Charlotte, North Carolina, for manufacturing large power transformers, directly addressing a nationwide shortage and grid modernization needs. | Reuters |

| Siemens AG | Nov 2023 | Announced a $150 million high-tech plant in Fort Worth, Texas, to produce electrical equipment specifically for data centers and other critical infrastructure, creating over 700 jobs. | Fort Worth EDP |

| Siemens Mobility | Aug 2023 | Broke ground on a $220 million expansion of its passenger rail manufacturing facility in Lexington, North Carolina, to support US infrastructure projects. | Siemens Mobility |

| Siemens AG | Aug 2023 | Opened a new facility in Kenosha, Wisconsin, to manufacture solar string inverters, a move directly spurred by manufacturing incentives within the Inflation Reduction Act. | Reuters |

| Siemens Gamesa | Feb 2023 | Announced its intention to build an offshore wind turbine nacelle manufacturing facility in New York State, contingent on securing customer orders for renewable energy projects. | Siemens Gamesa |

US Sun Belt Emerges as Hub for New Energy Manufacturing and Investment

The geographic center of gravity for new US energy manufacturing investment has shifted decisively toward the Southeast and Texas. This concentration is driven by a combination of state-level support, established industrial ecosystems, and strategic proximity to the nation’s fastest-growing regions for data center construction and electricity demand.

- Between 2021 and 2024, investment locations were often tied to specific state-level clean energy goals or policies. Projects like the planned New York offshore wind facility and the IRA-driven Wisconsin solar inverter plant reflect this dynamic.

- The investment map from 2025 onward shows a clear consolidation in the Sun Belt. Siemens Energy’s $1 billion plan is anchored by major facilities in North Carolina ($421 million), Mississippi ($300 million), Alabama ($15 million), and Texas ($23 million).

- This geographic focus aligns manufacturing capacity directly with burgeoning demand centers. The Southeast is experiencing a data center building boom, making local production of transformers and switchgear a significant competitive advantage in reducing logistics costs and delivery times.

- Texas remains a critical hub due to its dual role in serving the legacy energy sector and new power-hungry industries. Siemens AG’s $150 million plant in Fort Worth and Siemens Energy’s Houston expansions are positioned to supply both markets.

From Renewables to Reliability: Grid Tech and Gas Turbines Reach Commercial Primacy

The technology focus for large-scale capital investment has matured from emerging renewable components to proven, commercially essential technologies that guarantee grid reliability. In the face of exponential demand growth, the market priority has shifted to hardware that ensures system stability and 24/7 power availability, such as advanced gas turbines and power transformers.

- In the 2021-2024 period, significant investment was directed at scaling up manufacturing for technologies directly incentivized by the IRA. This included solar inverters and offshore wind nacelles, which faced both developmental challenges and supply chain vulnerabilities.

- From 2025 to today, the market has forced a pivot to mature, indispensable hardware. The national shortage of large power transformers elevated this established technology to a top investment priority, validated by Siemens Energy’s $150 million Charlotte factory commitment.

- Advanced, hydrogen-capable gas turbines have shifted from a “transition fuel” technology to a “critical for reliability” asset class. This is driven by data centers’ non-negotiable requirement for uninterruptible power, which intermittent renewables cannot yet provide alone, and is confirmed by Siemens Energy’s record turbine orders.

- This trend affirms that grid modernization and reliable power generation are the immediate, bankable priorities. Their enabling technologies are now the most commercially mature and in-demand asset class, providing a foundational layer upon which further renewable integration can be built.

SWOT Analysis: Navigating US Energy Market Drivers and Policy Headwinds

The US energy infrastructure market offers unprecedented strength through AI-driven demand but faces significant threats from policy volatility, creating a complex risk-reward profile for major manufacturers. While market fundamentals have become the primary investment driver, political uncertainty remains the key variable impacting long-term profitability and the pace of future domestic manufacturing expansion.

- The market’s core Strength has evolved from policy alignment under the IRA to overwhelming, durable market demand from data centers, making the US Siemens Energy’s largest single market.

- A primary Weakness is the persistent domestic supply chain bottleneck for critical grid components, a vulnerability that the new wave of manufacturing investment aims to resolve over the next several years.

- The dominant Opportunity is to become a key “picks and shovels” supplier for the AI revolution, capturing a significant share of the spending on power generation and grid infrastructure required to support it.

- The most acute Threat is policy instability, specifically the potential repeal of IRA manufacturing credits or the imposition of new tariffs, which would disrupt the financial models underpinning these long-term capital investments.

Table: SWOT Analysis for U.S. Energy Infrastructure Manufacturing

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strength | Investment driven by policy certainty from the Inflation Reduction Act (IRA). Strong government backing for domestic clean energy manufacturing. | Investment driven by massive, non-negotiable demand from AI and data centers. The US is confirmed as Siemens Energy’s “largest single market.” | The primary driver shifted from policy push to market pull. Demand became so strong it created a policy-agnostic investment case, validated by record orders in Q 1 FY 2026. |

| Weakness | Reliance on foreign supply chains for critical components like power transformers. Long lead times for key equipment. | Domestic manufacturing capacity is still insufficient to meet the demand surge, causing ongoing shortages and long lead times for transformers and switchgear. | The weakness was validated and intensified. The AI boom exposed the severity of the supply chain deficit, making it the central problem that new investments like the $1 B expansion are trying to solve. |

| Opportunity | Capture market share in the US renewable energy build-out (offshore wind, solar) by leveraging IRA incentives for domestic production. | Become an indispensable supplier of grid infrastructure and reliable power (gas turbines) for the AI boom, a market projected at $600 B in 2026. | The opportunity scaled exponentially. It shifted from a focus on the energy transition to a much larger, more urgent need to power the technology revolution. |

| Threat | General political uncertainty and the risk of future policy changes that could weaken the IRA’s long-term effectiveness. | Specific, articulated risk of a second Trump administration repealing IRA incentives and introducing tariff instability, as voiced by Siemens Energy’s CEO. | The threat became more concrete and personified. It moved from a general political risk to a specific concern about the actions of a named incoming administration, creating a direct call for “policy stability.” |

Forward Outlook: Tracking Policy Stability as the Key Variable for Investment Acceleration

If the next US administration provides policy stability, particularly by maintaining IRA manufacturing credits and avoiding disruptive tariffs, watch for an acceleration of domestic energy infrastructure investment. If not, expect a slowdown in new long-term commitments as companies re-evaluate political risk against the high capital costs of building domestic factories.

- The most critical signal to watch is any formal action or statement from the Trump administration regarding the Inflation Reduction Act. Siemens Energy’s public call for stability makes the future of IRA manufacturing credits the central variable for de-risking future investments.

- A secondary signal is trade policy. The imposition of new tariffs on energy components or raw materials would introduce significant friction into supply chains, increasing costs and uncertainty for projects already underway.

- A positive signal would be statements from the new administration that frame domestic manufacturing of energy equipment as a national security imperative, regardless of the energy source. This would provide the “stability” that companies are seeking.

- While the demand for power is now a certainty, the profitability of manufacturing components domestically remains linked to stable policy. The market is currently proceeding as if the demand justifies the risk, but this calculus could change quickly based on policy signals in 2026.

Frequently Asked Questions

What is the main reason for the recent surge in US energy infrastructure investment?

The primary driver has shifted from policy incentives to the massive and urgent market demand for electricity, fueled by the exponential power requirements of artificial intelligence (AI) and data centers. This demand is so strong that it has created a non-negotiable, policy-agnostic need for new grid capacity and reliable power generation.

How has the focus of investment changed since the Inflation Reduction Act (IRA) was passed?

Initially (2021-2024), investments were tightly linked to IRA incentives, focusing on renewable energy components like solar inverters and offshore wind parts. Since 2025, the focus has pivoted to foundational grid hardware—such as large power transformers, switchgear, and gas turbines—to solve supply chain shortages and provide the reliable, 24/7 power required by the AI boom.

Why is the Sun Belt (Southeast and Texas) becoming a major hub for new energy manufacturing?

The Sun Belt is attracting significant investment due to a combination of supportive state policies, established industrial bases, and its strategic proximity to the nation’s fastest-growing regions for data center construction. Building factories there gives manufacturers a competitive advantage by reducing logistics costs and delivery times for critical equipment.

If market demand is so strong, why is policy stability still considered a major risk?

While demand currently compels investment despite the risks, policy instability remains the most significant threat to the long-term profitability of these projects. The article notes that the potential repeal of IRA manufacturing credits or the imposition of new tariffs could disrupt the financial models for these large-scale capital investments, potentially slowing down future commitments.

What specific types of energy equipment are most in demand right now?

The highest demand is for technologies that guarantee grid reliability and 24/7 power. This includes foundational hardware like large power transformers and switchgear, which are experiencing nationwide shortages, as well as advanced, hydrogen-capable gas turbines needed to provide the uninterruptible power required by data centers.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.