Singapore’s 2026 Cross-Border Energy Strategy: A New Blueprint for Land-Constrained Solar Markets

Singapore’s Cross-Border Energy Imports: Shifting from Concept to Commercial-Scale Projects in 2026

Singapore is operationalizing a cross-border energy import strategy to overcome domestic land constraints, a tactical shift from early-stage bilateral agreements between 2021 and 2024 to concrete project approvals and large-scale corporate offtake agreements beginning in 2025.

- Between 2021 and 2024, Singapore’s external energy strategy was characterized by foundational agreements, such as the March 2023 MOU with Indonesia to explore developing up to 1.2 GW of solar for export. By contrast, the period from 2025 has seen these concepts mature into actionable policy, with Singapore’s government raising its low-carbon electricity import target to 6 GW by 2035.

- The most significant validation of this strategy occurred in October 2024, when the Sun Cable project, known as the Australia-Asia Power Link (AAPower Link), received conditional approval from Singapore. This marked a critical transition from ambition to a commercially viable project intended to supply up to 15% of the nation’s electricity via a 4, 300 km undersea cable.

- Corporate demand now underpins the bankability of these large-scale energy plans. While earlier periods saw public sector tenders like Solar Nova driving domestic growth, the August 2024 PPA between Microsoft and EDP Renewables for the entire output of the Solar Nova 8 project demonstrates the scale of private sector offtake needed to secure financing for both domestic and future import projects.

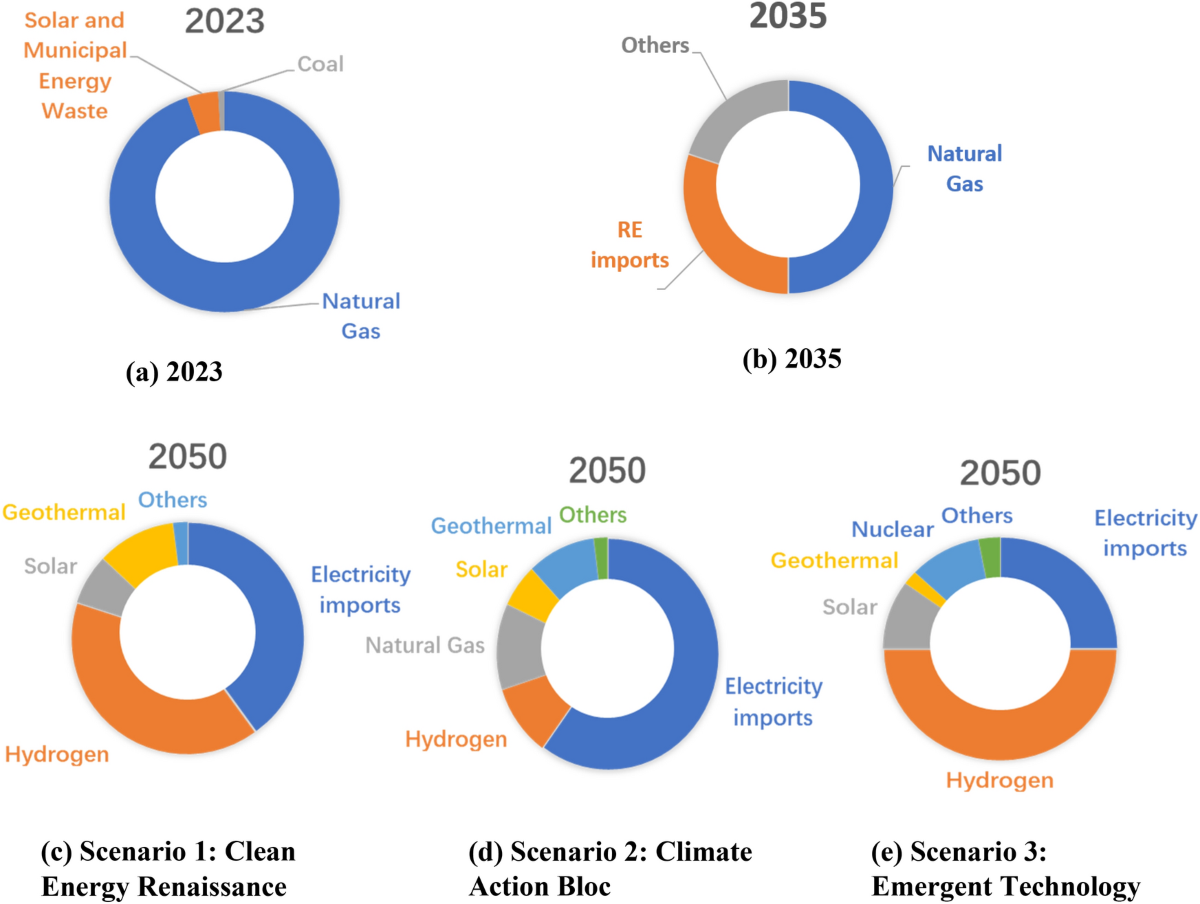

Imports to Dominate Singapore’s Future Energy Mix

This chart perfectly illustrates the section’s core theme: the strategic shift to cross-border energy. It visualizes how imports will become a major component of Singapore’s energy supply, substantiating the move from concept to large-scale projects.

(Source: Nature)

Financing the Grid Beyond Borders: Key Investments in Singapore’s Regional Energy Hub Strategy

Investment patterns have shifted from solely funding domestic solar assets to financing the specialized vehicles and regional project development pipelines required to execute Singapore’s cross-border energy import strategy.

- The Green Investment Partnership (GIP), part of Singapore’s broader FAST-P framework, exemplifies this shift by attracting foreign capital for regional deployment. The US$60 million commitment from British International Investment (BII) in October 2025 is designed to scale climate finance across Southeast Asia, creating the ecosystem needed to build export-oriented projects.

- Direct investment into regional project developers is accelerating, as shown by the US$80 million financing facility secured by ib vogt Singapore in March 2025. This capital, provided by Pentagreen Capital and BII, is explicitly targeted at developing new greenfield solar and battery storage projects across Southeast Asia, which can feed into Singapore’s import market.

- The growing complexity of financing cross-border assets has created a market for specialized fintech solutions. The December 2025 investment by ADB Ventures and Beacon VC into Quantified Energy, a startup focused on de-risking solar asset financing, highlights the need to build a sophisticated financial technology layer to support the physical infrastructure.

Table: Key Regional Energy Investments Supporting Singapore’s Strategy (2025-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Green Investment Partnership (GIP) | Oct 2025 | BII committed US$60 million to the US$510 million fund to scale regional climate finance, enabling projects that can export power to Singapore under the FAST-P framework. | ESG News |

| ib vogt Singapore | Mar 2025 | Secured an US$80 million financing facility from Pentagreen Capital and BII to develop a pipeline of solar and storage projects across Southeast Asia. | ib vogt |

| Quantified Energy | Dec 2025 | Secured investment from ADB Ventures and Beacon VC to scale its data-driven platform, which de-risks financing for solar assets in the region. | Quantified Energy |

Forging a Regional Power Grid: How Strategic Partnerships Underpin Singapore’s Solar Import Ambitions

Singapore is constructing a complex web of bilateral and multi-party partnerships to secure its future energy supply, transitioning from high-level government agreements between 2021 and 2024 to specific, developer-led consortia and corporate offtake deals from 2025 onwards.

Mapping the Drivers of Singapore’s Solar Strategy

This conceptual diagram aligns with the section’s focus on the “complex web of bilateral and multi-party partnerships.” It visually represents the interconnected relationships between government policy, producers, and constraints that underpin the strategy.

(Source: ScienceDirect.com)

- The partnership model has matured from exploratory government-to-government MOUs to concrete infrastructure projects. The AAPower Link project, a partnership involving the governments of Singapore and Australia, advanced from a long-term concept to a project with conditional approval in October 2024, representing the most ambitious cross-border energy partnership in the region.

- Multi-national development consortiums are now forming specifically to supply the Singaporean market. The March 2023 agreement to develop up to 1.2 GW of solar in Indonesia for export involves a powerful consortium of state-owned and private entities, including Abu Dhabi’s Masdar, France’s EDF Renewables, Singapore’s Tuas Power, and Indonesia Power.

- Corporate power purchase agreements have become a critical lynchpin for these partnerships. Microsoft’s 20-year PPA with EDP Renewables for the Solar Nova 8 project, signed in August 2024, provides the revenue certainty that underpins large-scale project financing and serves as a model for future cross-border offtake agreements.

Table: Key Partnerships Driving Singapore’s Cross-Border Solar Strategy

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Sun Cable (AAPower Link) | Oct 2024 | A partnership between Australian and Singaporean entities, receiving conditional approval to build a 4, 300 km subsea cable to import solar power from Australia. | Reuters |

| Microsoft & EDP Renewables | Aug 2024 | Microsoft signed a 20-year PPA for up to 200 MWp from the Solar Nova 8 project, demonstrating the corporate demand that makes large projects bankable. | Carbon Credits |

| Indonesia Export Consortium | Mar 2023 | An MOU between Masdar, Tuas Power, EDF Renewables, and Indonesia Power to develop up to 1.2 GW of solar capacity in Indonesia for export to Singapore. | EDB Singapore |

Expanding the Grid: Singapore’s Solar Strategy Redraws the Energy Map of Southeast Asia

Singapore’s energy geography is actively expanding beyond its physical borders, establishing Australia and Indonesia as key external power generation zones to meet its domestic decarbonization targets, a marked evolution from its internally focused strategy pre-2025.

- Between 2021 and 2024, Singapore’s strategy was almost exclusively focused on maximizing domestic surfaces. This was defined by scaling the Solar Nova program across public housing rooftops and pioneering large-scale floating solar with the 60 MWp Sembcorp Tengeh Floating Solar Farm.

- From 2025, the strategic geography has fundamentally shifted outward. While domestic deployment continues with an increased national target of 3 GWp by 2030, the primary mechanism for large-scale capacity growth is now through securing supply from neighboring countries with abundant land.

- Australia and Indonesia have emerged as the first two pillars of this external strategy. The AAPower Link project aims to connect Singapore to Australia’s vast solar resources, while multiple MOUs signed in 2023 position Indonesia’s Riau Islands as a dedicated “solar farm” for the Singaporean grid.

From Rooftops to Subsea Cables: Singapore’s Solar Technology Mix Matures Towards Grid Integration

While Singapore’s domestic solar growth is built on mature rooftop and floating PV technologies, its ambitious cross-border strategy introduces a new dependency on the successful commercial deployment of complex, large-scale transmission infrastructure like high-voltage direct current (HVDC) subsea cables.

Domestic Solar Technologies Fuel Growth

This infographic directly supports the section’s discussion on technology mix by highlighting the key domestic technologies, like floating and building-integrated PV, that defined Singapore’s solar growth before the pivot to subsea cables.

(Source: Solar Edition)

- The 2021-2024 period was defined by the industrial-scale deployment of proven generation technologies. The Solar Nova program successfully aggregated demand for standard rooftop PV, while the Tengeh Reservoir project validated floating solar (FPV) as a viable solution for land-constrained markets.

- The period from 2025 onwards is characterized by a major technological pivot towards transmission. The viability of Singapore’s entire 6 GW import strategy, particularly the AAPower Link project, hinges on the successful execution of the world’s longest planned HVDC subsea cable, a significant technical and financial undertaking.

- In parallel, Singapore continues to invest in next-generation PV to maximize future domestic yield, with researchers achieving over 30% efficiency for perovskite-silicon tandem cells in December 2025. However, the immediate path to meeting its aggressive 2030 and 2035 targets is now inextricably linked to the successful maturation of cross-border transmission technology.

SWOT Analysis: Singapore’s Cross-Border Solar Import Strategy in 2026

The core strength of Singapore’s import-led solar strategy is its ability to bypass physical land constraints, but this pivot introduces significant new threats related to geopolitical dependencies and the execution risk of mega-projects.

Strategy Promises Drastic Emissions Reduction by 2050

This chart illustrates a primary strength and goal of the strategy detailed in the SWOT analysis. The dramatic forecasted drop in emissions provides the ultimate justification for undertaking the risks associated with the cross-border import plan.

(Source: Nature)

- Strengths are rooted in clear, long-term policy and the ability to leverage its financial hub status to attract capital for regional energy development.

- Weaknesses are shifting from a simple lack of land to the inherent complexities of relying on external partners and unproven, large-scale transmission infrastructure.

- Opportunities lie in cementing its role as a regional green energy and finance hub, creating economic value from its energy transition.

- Threats are now concentrated in the geopolitical and execution risks of massive projects like the AAPower Link, along with the challenge of ensuring domestic grid stability with high intermittent import penetration.

Table: SWOT Analysis for Singapore’s Cross-Border Solar Import Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Strong policy leadership (Green Plan 2030) and demand aggregation via Solar Nova program. | Increased solar target to 3 GWp by 2030 and a firm import target of 6 GW by 2035, providing greater market certainty. | Policy has evolved from domestic focus to an integrated domestic-plus-import strategy, validating the government’s long-term commitment. |

| Weakness | Severe physical land constraints limiting utility-scale solar deployment. | Dependence on technologically complex projects (HVDC cables) and the political stability of partner nations (Australia, Indonesia). | The core weakness shifted from a domestic resource problem to a foreign policy and project execution challenge. |

| Opportunity | Leveraging financial hub status to fund domestic projects and FPV leadership (Tengeh Reservoir). | Mobilizing international capital (BII, ADB Ventures) for regional export-oriented projects, positioning Singapore as a green energy trading hub. | The opportunity expanded from being a user of innovative tech to becoming a financer and orchestrator of a regional energy ecosystem. |

| Threat | Grid stability challenges from integrating intermittent domestic solar. | Geopolitical risks and massive project execution risk, particularly for the multi-billion dollar AAPower Link project. | The primary threat is now external, focused on the successful delivery and long-term reliability of cross-border supply chains. |

2027 Outlook: Will Singapore’s Energy Import Strategy Validate or Falter?

If Singapore’s key import projects, particularly the AAPower Link, move from conditional approval to a final investment decision and secure full financing within the next 18 months, it will validate a new, replicable model for energy security and decarbonization in land-constrained nations.

Solar Capacity Projected to Triple by 2035

This long-term forecast provides the perfect visual context for the 2027 outlook. It quantifies the ambition of the import strategy, illustrating what “validation” looks like and setting the stage for the discussion of near-term project milestones.

(Source: Yahoo Finance)

Renewable Capacity Forecast to Double by 2031

This forecast provides quantitative support for the “Strength” category in the SWOT table. It shows the strategy’s projected success by highlighting a strong compound annual growth rate in renewable capacity, validating the policy’s effectiveness.

(Source: Mordor Intelligence)

- The primary signal to watch is the Sun Cable project. A failure to reach a Final Investment Decision (FID) would represent a major setback for the entire cross-border strategy, while success would signal to global markets that such ambitious projects are bankable.

- Watch for the Indonesia-to-Singapore projects to evolve from MOUs to firm, large-scale Power Purchase Agreements signed by corporate or utility offtakers. This will be the key indicator that these projects are commercially viable and not just politically expedient.

- Monitor announcements from Singapore’s Energy Market Authority (EMA) regarding grid infrastructure upgrades. The strategy’s success depends on the grid’s ability to absorb large, intermittent power imports, requiring significant investment in storage and smart grid management systems.

Frequently Asked Questions

What is the main goal of Singapore’s cross-border energy strategy?

The primary goal is to overcome the country’s severe physical land constraints, which limit large-scale domestic solar deployment. By importing up to 6 GW of low-carbon electricity by 2035, Singapore aims to meet its national decarbonization targets and enhance its energy security.

What is the most significant project in this new strategy?

The most significant project is the Sun Cable project, also known as the Australia-Asia Power Link (AAPower Link). Having received conditional approval in October 2024, it aims to supply up to 15% of Singapore’s electricity by importing solar power from Australia via a record-breaking 4,300 km subsea HVDC cable.

How are these massive cross-border energy projects being financed?

The financing model has evolved to support regional development. It relies on a combination of attracting foreign capital through funds like the Green Investment Partnership (GIP), direct investment into regional project developers like ib vogt Singapore, and leveraging corporate demand through large Power Purchase Agreements (PPAs), as seen with Microsoft’s deal for the Solar Nova 8 project.

Besides Australia, which other countries are key partners for Singapore’s solar imports?

Indonesia is a key partner, positioned to become a dedicated ‘solar farm’ for Singapore. A March 2023 agreement involves a consortium of major energy players (Masdar, EDF Renewables, Tuas Power, and Indonesia Power) to develop up to 1.2 GW of solar capacity in Indonesia for export to the city-state.

What are the main risks associated with Singapore’s import-led energy plan?

The strategy’s primary risks have shifted from a domestic lack of land to external dependencies. Key threats now include geopolitical risks in partner nations, the massive execution and technological risk of mega-projects like the AAPower Link’s subsea cable, and the domestic challenge of ensuring grid stability while integrating large volumes of intermittent imported power.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.