France’s 2026 Renewable Rollback: A Warning Signal for European Energy Planning Risk

Systemic Risk Uncovered: How France’s Target Revisions Expose European Renewable Planning Flaws

France’s decision to scale back its 10-year targets for solar and wind energy is a critical course correction that exposes a systemic weakness in Europe’s energy transition strategy: a dangerous gap between ambitious supply-side generation goals and the lagging reality of grid infrastructure and market design. This pivot from pure capacity targets to a more constrained, pragmatic approach is not a French anomaly but a harbinger of challenges facing the entire EU, revealing that the era of “build at all costs” is over.

- Between 2021 and 2024, EU policy was defined by aggressive, supply-focused target setting, including the REPower EU plan and the revised Renewable Energy Directive (RED III), which aims for a 42.5% renewable share by 2030. The primary focus was on accelerating gigawatt-scale deployment to meet climate goals and achieve energy independence.

- The period from 2025 to today marks a painful reckoning. France’s draft PPE 3 plan slashes the 2035 solar target from a high of 100 GW to 65 GW and cuts the onshore wind goal from 45 GW to a range of 35-40 GW. This recalibration is a direct response to the consequences of the earlier strategy: grid congestion, market saturation, and slowing electricity demand.

- The problem is pan-European. While wind and solar generated more power than fossil fuels for the first time in the EU in 2025, this success created price cannibalization, with a record number of negative price hours recorded in 2024. Simultaneously, an estimated 80 GW of wind projects remain stuck in permitting queues across Europe, a clear signal that infrastructure cannot keep pace with generation ambition.

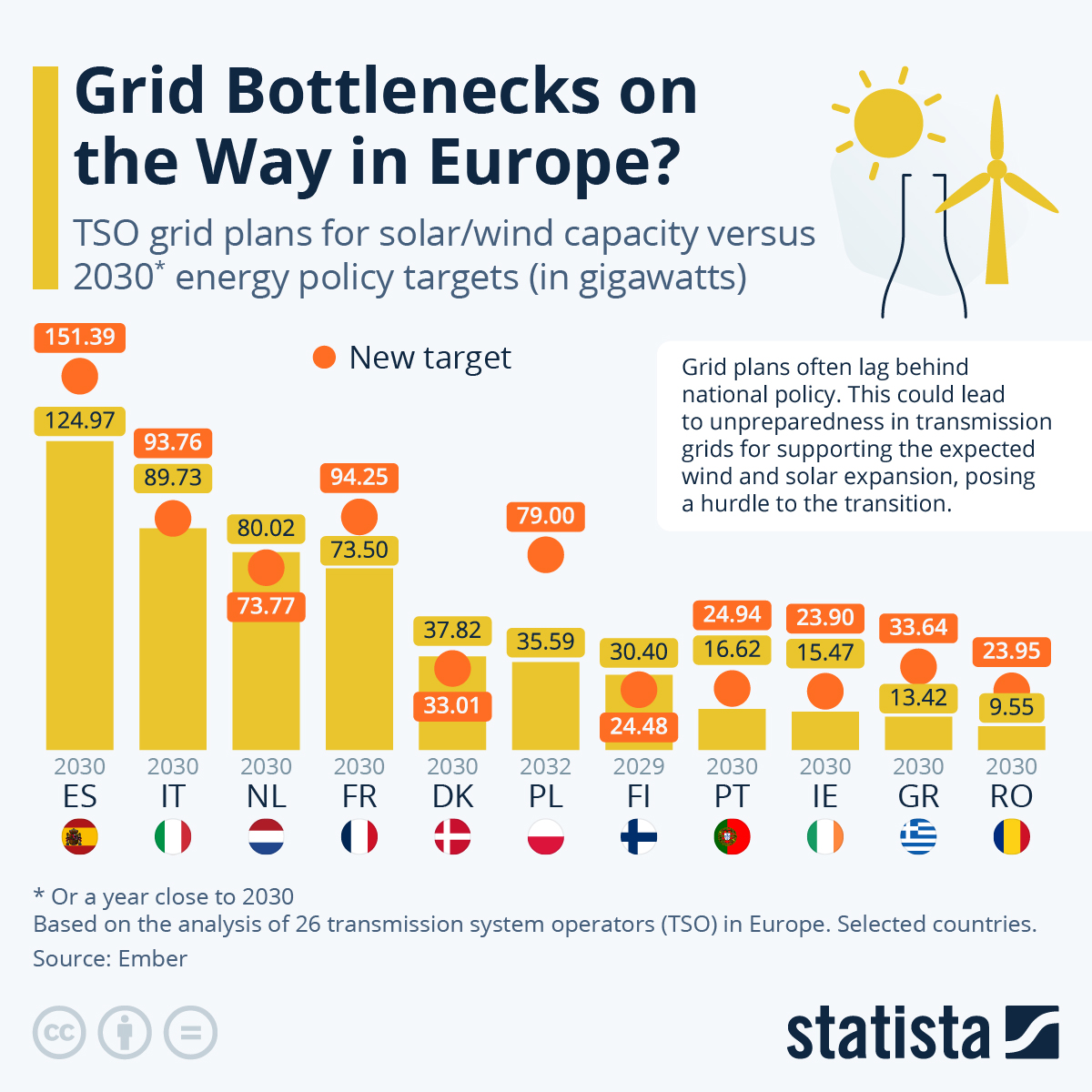

Grid Plans Lag Europe’s Renewable Targets

This chart perfectly illustrates the section’s central thesis about a ‘systemic weakness’ by showing the significant gap between France’s national renewable targets and the insufficient capacity planned by its grid operator.

(Source: Statista)

Investment Headwinds: Why Capital is Slowing for European Renewables in 2026

Policy volatility, exemplified by France’s sudden target changes, combined with market saturation and rising capital costs, is creating significant investment headwinds that threaten to derail the EU’s long-term goals. The previous assumption of stable, ever-expanding policy support has been broken, increasing perceived risk and causing investors to slow the pace of capital deployment needed to meet 2030 targets.

- The investment climate has soured significantly since early 2025. European utilities are now cutting investments due to market uncertainty, a stark reversal from the growth period of 2021-2024. A September 2025 report from S&P Global confirmed that utilities are reducing investments as the pace of the energy transition slows.

- Spending growth from the top 10 EU renewable developers is also decelerating. An August 2025 analysis by Wood Mackenzie projected that aggregate spending growth would slow to just 14% over the next two years, a rate insufficient to meet ambitious EU-wide targets.

- France’s policy reversal directly impacts the cost of capital. A KPMG analysis in September 2025 highlighted how policy risk perception in markets like Germany is already affecting the Weighted Average Cost of Capital (WACC) for major offshore wind projects, a dynamic now amplified by France’s actions.

- This slowdown confirms that the market has shifted from a supply-push model to one constrained by systemic realities. A February 2025 analysis from CEPS called for EU renewable policy to pivot from aggressive supply support to stimulating industrial demand, acknowledging that the current model is creating unsustainable market imbalances.

Table: European Renewable Investment and Policy Headwinds

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| European Utilities | Sep 2025 | Major utilities began cutting investments, citing market uncertainty and a slowing pace of transition. This signals a direct private sector response to policy volatility and market saturation, reducing capital available for new projects. | S&P Global |

| Top 10 EU P&R Developers | Aug 2025 | Aggregate spending growth was forecast to slow to only 14% over the next two years. This represents a significant deceleration from prior years and indicates that major developers are pulling back on new commitments due to market headwinds. | Wood Mackenzie |

| EU Energy Market | Oct 2025 | A Mc Kinsey report identified an untapped €8 billion opportunity in energy flexibility (e.g., storage, demand response). This highlights a critical investment gap: the solutions needed to solve grid saturation are not being deployed at the required scale. | Mc Kinsey |

| EU Policy Analysis (CEPS) | Feb 2025 | A policy recommendation urged the EU to shift focus from subsidizing renewable supply to stimulating industrial demand. This validates the view that the supply-only approach has reached its limit and is causing market distortion. | CEPS |

Geographic Divergence: How France’s Policy Shift Highlights Pan-European Planning Disconnect

While EU-level bodies in Brussels push for unified targets, France’s national-level recalibration demonstrates a growing and dangerous divergence in strategy across the continent. National realities, such as France’s inflexible nuclear baseload and slowing domestic demand, are now taking precedence over top-down EU ambition, exposing a fragmented approach to a supposedly integrated energy market.

Germany Leads European Solar; France Trails

This chart directly visualizes the ‘geographic divergence’ and ‘pan-European planning disconnect’ by comparing France’s solar output to Germany’s, highlighting the different national realities discussed in the text.

(Source: AleaSoft)

- The strategic contrast between EU member states is sharpening. During the 2021-2024 period, a unified narrative prevailed. Now, Germany continues to pursue an aggressive 80% renewable electricity target for 2030, while France’s draft NECP targets a more modest 41.3% renewable share of gross final energy, driven by lower demand forecasts and a renewed commitment to nuclear power.

- France’s situation is amplified by its large, inflexible nuclear fleet, which provides low-carbon baseload power but directly competes with variable renewables for limited grid capacity and demand. This “crowding out” effect is a planning risk for any nation considering a nuclear expansion, including the UK, Poland, and the Netherlands.

- This is not just a French problem but a systemic EU implementation failure. As of July 2025, 26 member states were facing legal action for failing to transpose the RED III directive into national law. This widespread non-compliance underscores a deep disconnect between Brussels’ directives and national execution capabilities.

- Grid development deficits confirm this pan-European issue. Grid plans in France, Spain, and Poland all fall significantly short of their national renewable capacity targets for 2030, revealing a systemic bottleneck where infrastructure readiness lags far behind policy ambition.

Technology vs. System Maturity: Why Solar and Wind Success Now Exposes Grid and Market Weakness

Renewable generation technologies like solar PV and wind are commercially mature and have scaled successfully, but the European energy system designed to absorb them is not. The current crisis is not a failure of renewable technology but a failure of system integration, where the very success of rapid deployment has exposed the profound immaturity of Europe’s grids, markets, and flexibility mechanisms.

French Renewables Hit Record Share in 2024

This chart supports the section’s argument about the ‘success’ of renewable technology by showing that French renewables hit a record high in Q2 2024, providing a concrete example of the generation success that exposes grid weakness.

(Source: Review Energy)

- The narrative from 2021 to 2024 centered on the remarkable success of solar and wind, marked by falling costs and rapid deployment. This period validated the technologies as commercially ready and scalable.

- The period from 2025 to today reveals the consequence of this success: system-level failure. A CERRE report from May 2025 noted that flexibility requirements in European energy systems are set to double by 2030. Yet, deployment of solutions like battery energy storage systems (BESS) in France is only now gaining ground, far too slow to match generation growth.

- The symptom of this immaturity is price cannibalization. The massive build-out of solar, in particular, led to a glut of power during midday hours and a record number of hours with negative electricity prices in 2024. This destroys the business case for new, unsubsidized projects, directly threatening future investment.

- The core issue is that Europe prioritized subsidizing generation capacity without concurrently engineering the market and infrastructure to handle it. The result is a system that wastes clean energy through curtailment and punishes generators for producing power when it is most abundant.

SWOT Analysis: Deconstructing the Systemic Risks in European Renewable Planning

The European renewable strategy’s historical strengths in policy ambition and rapid technology deployment are now being directly undermined by foundational weaknesses in grid infrastructure and market design. This has created acute threats of investment flight and target failure, while the primary opportunity lies in a necessary and urgent pivot toward integrated system planning that values flexibility and demand creation.

- Strengths in rapid deployment have become a stressor on an unprepared system.

- Weaknesses in grid planning and market design, once latent, are now forcing painful policy reversals.

- Opportunities have shifted from pure generation to grid flexibility, storage, and demand-side solutions.

- Threats from policy volatility and market saturation are now actively deterring the investment needed for the transition.

Table: SWOT Analysis for European Renewable Planning Risk

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Ambitious, unified EU targets (RED III, REPower EU); rapid cost declines and deployment of solar and wind; strong policy support for generation. | Renewables became the largest source of EU electricity in 2025, validating their technical maturity and ability to scale. France’s renewable output hit record highs in Q 2 2024. | The success in deploying generation capacity has been validated, but this strength has in turn exposed deep systemic weaknesses. The focus on supply-side scaling was successful on its own terms. |

| Weaknesses | Known but unaddressed issues of slow permitting (80 GW of wind stuck in 2023), inadequate grid infrastructure, and nascent flexibility markets. | Downward revisions of demand forecasts, acute grid congestion, price cannibalization (record negative prices in 2024), and competition from inflexible baseload (France’s nuclear fleet). | Latent weaknesses in grid planning and market design have become acute constraints. The system’s inability to absorb new capacity is now forcing policy to change, as seen in France’s PPE 3 revision. |

| Opportunities | Focus on electrification of transport and heat; development of national energy and climate plans (NECPs). | Urgent need for grid modernization and flexibility solutions, creating an €8 billion market (Mc Kinsey); pivot to stimulating industrial demand (CEPS); scaling green hydrogen as a flexible load. | The problem of oversupply has created clear, urgent market opportunities in flexibility, storage, and demand-side management. The focus of innovation and investment is shifting from generation to system integration. |

| Threats | Rising interest rates and supply chain inflation began to emerge as headwinds for high-CAPEX renewable projects. | Acute policy volatility (France’s target rollback), investment slowdown (S&P Global, Wood Mackenzie), and systemic non-compliance with EU directives (26 states facing legal action over RED III). | Economic and policy risks have been validated and are now actively deterring investment. The threat of a disorderly, fragmented energy transition with missed targets is now a primary concern for investors. |

2026 Forward Outlook: Pivoting from Supply Targets to System Integration

If European policymakers continue to focus on generation-only targets without mandating concurrent investment in grid flexibility, storage, and demand creation, expect more countries to follow France’s lead in scaling back ambitions, leading to a fragmented and stalled energy transition. The critical action for the year ahead is to shift policy and investment focus from simple gigawatt targets to building an integrated, flexible, and resilient energy system.

France’s Energy Roadmap Details Renewable Targets

This table quantifies the exact ‘supply targets’ that the section argues policymakers must pivot away from. It provides the necessary context for the recommended ‘forward outlook’ shift toward system integration.

(Source: Financial Post)

- If this happens: Other EU nations with significant grid constraints or slowing demand will announce downward revisions to their National Energy and Climate Plans (NECPs) over the next 18 months. Watch this: The investment announcements from major utilities and developers for signs of a capital shift away from pure generation and toward grid services, interconnectors, and large-scale energy storage.

- These could be happening: A bifurcation in renewable project development emerges. Projects co-located with storage or those securing corporate PPAs with flexible offtake will attract capital, while standalone, intermittent generation projects in saturated markets will struggle to find financing.

- The increasing frequency of negative power prices is a key signal to monitor. A sustained increase in their duration and depth across more European markets will confirm that system saturation is worsening, making policy revisions like France’s more likely elsewhere.

- The EU’s enforcement actions against the 26 member states failing to transpose RED III will be a critical indicator. Strict enforcement would signal a commitment to integrated planning, while leniency would validate the trend toward national fragmentation.

Frequently Asked Questions

Why is France reducing its renewable energy targets for 2035?

France is scaling back its targets as a direct response to several systemic issues. The rapid build-out of renewables has led to grid congestion, market saturation (causing a record number of negative price hours), and slowing electricity demand. Additionally, France’s large, inflexible nuclear power fleet competes with renewables for limited grid capacity, making it difficult to absorb more variable solar and wind power.

Is this slowdown in renewable energy adoption only a French problem?

No, the article argues this is a pan-European issue. It points to an estimated 80 GW of wind projects stuck in permitting queues across Europe, widespread non-compliance with EU directives (26 member states face legal action over RED III), and grid development plans in countries like Spain and Poland that fall short of renewable targets. France’s decision is presented as a harbinger of challenges facing the entire EU.

What does the article mean by ‘price cannibalization’ and why is it a threat?

Price cannibalization refers to a situation where the success of renewables, particularly solar, creates a glut of power during certain times (like midday). This oversupply drives electricity prices down, sometimes to negative levels. This is a major threat because it destroys the profitability and business case for new renewable projects, especially those without subsidies, which in turn slows down the investment needed to meet long-term energy goals.

How are these policy changes and market issues affecting investment in European renewables?

The investment climate has soured significantly. Policy volatility, exemplified by France’s sudden target changes, increases perceived risk for investors. As a result, major European utilities are cutting investments, and spending growth from top developers is decelerating. This slowdown in capital deployment directly threatens the EU’s ability to meet its 2030 renewable energy targets.

According to the analysis, what is the key solution to Europe’s energy planning problems?

The proposed solution is a major strategic pivot. Instead of focusing only on supply-side generation targets (i.e., building more wind and solar farms), policymakers must prioritize system integration. This means investing heavily in grid modernization, energy storage (like batteries), demand-side response, and other flexibility solutions that allow the system to absorb and manage variable renewable energy effectively.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.