AI Data Center Power Demand: How Grid Constraints Will Reshape Energy Investments in 2026

Grid Saturation and AI Power Demand: The Shift to On-Site Generation

The primary constraint on AI infrastructure expansion is no longer capital or technology, but the inability of public electrical grids to deliver sufficient, reliable power. This operational bottleneck is forcing a strategic pivot across the technology industry, away from sole reliance on grid-supplied electricity and toward direct investment in dedicated, on-site power generation solutions. This shift redefines risk, investment, and the core business model for data center operators.

- Between 2021 and 2024, the industry focused on improving Power Usage Effectiveness (PUE) and securing renewable energy through Power Purchase Agreements (PPAs) to manage what was seen as a future power demand issue. Projections from this era, such as Mc Kinsey’s forecast of U.S. data centers reaching 35 GW by 2030, highlighted a growing but seemingly manageable load.

- Starting in 2025, the risk became immediate and structural. The power density of AI-optimized racks, demanding 30 k W to over 100 k W compared to 5-15 k W for traditional racks, overwhelmed local grid capacity. Reports of wholesale electricity costs rising by 267% near U.S. data centers confirmed that grid supply could not keep pace with the exponential demand from AI workloads.

- This shift validated that grid interconnection delays, which can exceed three years, are now a primary business risk. The industry response evolved from efficiency initiatives to securing power independence through direct partnerships with energy producers and deploying on-site generation, as seen in major deals by Microsoft and Google.

AI Workloads Drive Massive Power Demand Surge

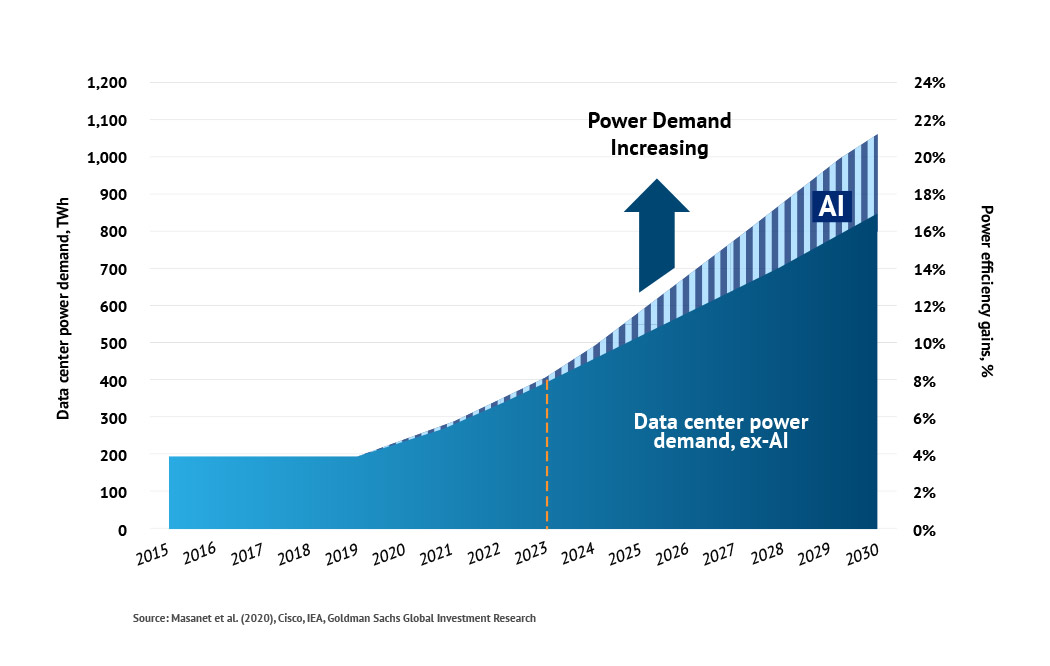

This chart illustrates the core problem of grid saturation by showing how AI-specific workloads are the primary driver of the projected surge in data center power demand through 2030.

(Source: Navitas Semiconductor)

AI Power Infrastructure Investment: A Multi-Trillion Dollar Market Emerges

The immense capital and operational expenditures required to power AI data centers have created a new economic sector focused on energy infrastructure, with trillions of dollars in projected investment through 2030. The scale of spending has shifted from building data centers to building the energy systems needed to run them, reflecting a new reality where power is the most critical and expensive component of AI expansion.

- Capital expenditure forecasts now quantify the massive scale of this new market. Mc Kinsey projects that $6.7 trillion in capital will be deployed for data center infrastructure globally through 2030, while Nvidia estimates a $1 trillion investment in AI-specific data center upgrades alone.

- The AI data center market itself is projected to see explosive growth, with one forecast predicting an expansion from $236.44 billion in 2025 to $933.76 billion by 2030, representing a compound annual growth rate (CAGR) of 31.6%.

- Operational expenditures are dominated by electricity, which accounts for 20-30% of a data center’s total Op Ex. The documented surge in wholesale electricity prices near data center clusters directly translates to higher, more volatile operating costs, reinforcing the economic case for stable, privately-owned power sources.

Table: AI Data Center Market and Infrastructure Investment Projections

| Forecast Provider | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Mc Kinsey | Through 2030 | Projects $6.7 trillion in cumulative capital investment for global data center infrastructure, indicating the massive scale of the build-out required to support AI. | The cost of compute: A $7 trillion race to scale data centers |

| Marketsand Markets | 2025 – 2030 | Forecasts the AI data center market will grow from $236.44 billion to $933.76 billion, a 31.6% CAGR, quantifying the rapid commercial expansion of the sector. | AI Data Center Industry worth $933.76 billion by 2030 |

| Nvidia (Estimate) | Through 2030 | Estimates $1 trillion will be spent on data center upgrades specifically for AI, highlighting the high cost of specialized hardware and supporting infrastructure. | How Much Electricity Does A Data Center Use? 2025 Guide |

| Goldman Sachs | By 2030 | Predicts a 165% increase in data center power demand by the end of the decade, driven primarily by AI workloads, underscoring the energy intensity of the trend. | AI to drive 165% increase in data center power demand by … |

Strategic Alliances for AI Power: How Tech and Energy Leaders are Responding

In response to grid limitations, technology companies are forming deep, strategic partnerships with energy firms to secure the massive, reliable power blocks required for AI. These alliances go beyond conventional PPAs, representing a fundamental integration of energy strategy into technology infrastructure planning and deployment.

- Microsoft’s deal with Brookfield Renewable Partners for 10.5 GW of power and Google’s similar 3 GW agreement with the same company signal a move to secure gigawatt-scale capacity directly from major energy asset owners. These deals are designed to provide the firm, 24/7 power that intermittent renewables alone cannot guarantee.

- The $5 billion strategic partnership between Brookfield and Bloom Energy, announced in October 2025, marks a critical pivot toward financing and deploying on-site power infrastructure. By positioning Bloom Energy’s fuel cells as the preferred “behind-the-meter” solution, this alliance directly addresses grid constraints by co-locating generation with consumption.

- Google’s collaboration with Next Era Energy focuses on developing clean energy solutions to power gigawatt-scale data centers, further demonstrating that hyperscalers are now active participants in energy project development, not just passive consumers.

- Older models of energy procurement are being replaced by more integrated solutions. For example, Fuel Cell Energy’s partnership with Diversified Energy and TESIAC aims to use captured coal mine methane to power fuel cells for data centers, showing a pragmatic approach to securing reliable power while addressing emissions.

Table: Key Strategic Partnerships in AI Data Center Power

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Microsoft and Brookfield Renewable Partners | 2026 | A landmark agreement for 10.5 GW of new renewable energy capacity, securing long-term, large-scale power for Microsoft’s expanding AI data center footprint. | The Best Artificial Intelligence (AI) Data Center Play You’ve … |

| Google and Next Era Energy | December 2025 | A collaboration to build gigawatt-scale data centers powered by clean energy, directly integrating energy development with data center planning to bypass grid limitations. | Google and Next Era Team Up to Build Gigawatt-Scale AI … |

| Brookfield and Bloom Energy | October 2025 | A $5 billion partnership to finance and develop on-site AI infrastructure, with Bloom Energy serving as the preferred provider of solid oxide fuel cells for reliable, “behind-the-meter” power. | Brookfield and Bloom Energy Announce $5 Billion … |

| Fuel Cell Energy, Diversified Energy, and TESIAC | August 2025 | Formation of a development company to use captured methane to power fuel cell systems for data centers, creating a reliable energy source while mitigating emissions. | How Fuel Cells Help Solve the Growing Data Center and … |

Regional Hotspots: Where AI Power Demand is Reshaping Local Grids

The United States has emerged as the primary geography where the collision between AI’s power demand and grid limitations is most acute. While global consumption is rising, hyper-concentrated development in specific U.S. regions is creating unprecedented strain on local and regional power systems, making these areas leading indicators of future infrastructure challenges.

U.S. Data Center Power Demand to Quadruple

Highlighting the U.S. as a regional hotspot, this chart projects its data center power consumption will quadruple by 2030, underscoring the acute strain on local grids.

(Source: Visual Capitalist)

- Between 2021 and 2024, data center growth was significant but more distributed. The U.S. and China were identified as the largest consumers, but the narrative focused on national-level consumption, such as U.S. data centers using 4.4% of the country’s electricity in 2023.

- Since 2025, the focus has shifted to extreme, localized load growth. In Wisconsin, two planned data centers by Microsoft and another company will require a combined 3.9 GW, a demand equivalent to the power consumption of 4.3 million homes. This represents a state-level energy crisis driven by just two projects.

- The U.S. is the clear leader in this trend, with forecasts showing its data center power demand could reach 8-12% of total national electricity consumption by 2030. This national figure is driven by regional hotspots where hyperscalers are building massive campuses.

- Projections from Deloitte specify the acute impact in the U.S., with power demand from AI data centers alone potentially surging from 4 GW in 2025 to 123 GW by 2035. This thirty-fold increase in a single country highlights why the U.S. grid has become the central battleground for powering AI.

Technology Maturity: On-Site Power Moves from Niche to Essential AI Infrastructure

On-site power generation technologies, particularly fuel cells, have rapidly matured from niche, backup applications to commercially essential components for powering AI data centers. The inability of public grids to meet demand has accelerated their adoption, validating them as a primary solution for providing the reliable, scalable, and high-density power that AI workloads require.

AI Servers Fuel Explosive Power Consumption

This chart shows why on-site power is now essential, breaking down consumption to reveal that the dramatic surge is overwhelmingly driven by the growth of power-hungry ‘AI Specialized’ servers.

(Source: dev/sustainability)

- From 2021 to 2024, on-site generation was primarily discussed in the context of grid resilience and backup power. The industry standard for new facilities, PUE, focused on building efficiency rather than power sourcing, with an average of 1.45 for modern data centers.

- Beginning in 2025, the conversation shifted to primary, “behind-the-meter” power. The technology’s maturity was validated by major commercial deals. Bloom Energy’s partnership with Brookfield established its solid oxide fuel cells as a bankable, scalable solution for AI data centers, moving it from a component supplier to a core infrastructure partner.

- The technical specifications of AI hardware directly drive this trend. With modern AI chips consuming up to 1, 200 W each and full racks demanding over 100 k W, on-site solutions are one of the few ways to deliver such high power density without overwhelming grid substations.

- The market now treats on-site power technologies as a commercially ready and necessary element of AI deployment. The formation of a development company by Fuel Cell Energy to specifically target the data center market confirms that these technologies are no longer in a pilot phase but are at the center of a major commercial scale-up.

SWOT Analysis: AI Data Center Power Demand and Grid Constraints

The escalating power demand of AI data centers has created a distinct set of strategic factors defined by the limitations of public grid infrastructure. The analysis reveals that the primary opportunity lies in developing and deploying a new energy paradigm, while the central threat is the physical constraint of an aging grid system unable to support exponential load growth.

Data Centers Emerge as Major Power Consumer

Providing strategic context for a SWOT analysis, this chart shows data centers as a significant driver of global electricity demand growth compared to other major industrial sectors through 2030.

(Source: Scientific American)

- Strengths have shifted from computational power to energy integration, with market leadership now tied to the ability to secure reliable power.

- Weaknesses are centered on the extreme power density and inflexibility of AI workloads, which present a unique and difficult load for grid operators to manage.

- Opportunities are concentrated in the multi-trillion-dollar market for new energy infrastructure, particularly on-site generation and long-term energy partnerships.

- Threats are dominated by grid instability, connection delays, and rising electricity costs, which can stall projects and undermine the economic viability of AI deployments.

Table: SWOT Analysis for AI Data Center Power Consumption

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Focus on computational efficiency and PUE improvements. AI-driven optimization of data center operations was seen as a key strength. | Ability to secure massive, reliable power blocks through strategic partnerships (e.g., Microsoft’s 10.5 GW deal) and deploy on-site generation (e.g., Bloom Energy). | The strategic strength shifted from operational efficiency to energy procurement and independence. Access to power is now the key competitive advantage. |

| Weaknesses | High energy consumption was a known weakness, but it was primarily framed as a cost and sustainability issue managed through renewable PPAs. | Extreme power density (over 100 k W per rack) and massive facility-scale demand (approaching gigawatts) create an inflexible, concentrated load that existing grids cannot support. | The weakness evolved from a manageable operational cost to a hard structural bottleneck. The physical properties of AI workloads were validated as incompatible with legacy grid infrastructure. |

| Opportunities | Opportunities focused on AI-driven efficiency gains and participation in demand-response programs with utilities. | A $6.7 trillion market for new data center and energy infrastructure. Dominance in on-site power solutions like fuel cells and long-term potential for Small Modular Reactors (SMRs). | The opportunity shifted from optimizing within the existing system to building an entirely new, decentralized energy ecosystem for AI. |

| Threats | Threats included rising electricity prices and pressure to decarbonize, which were addressed with long-term renewable contracts. | Grid connection delays of 1-3 years, regional power shortages, and spiraling wholesale electricity costs (up 267%) directly stalling multi-billion dollar projects. | The threat became acute and immediate. Grid instability is no longer a risk to be managed but a primary constraint on growth, validated by real-world project delays and market impacts. |

2026 Scenario: The Race for Power Independence Accelerates

The most critical dynamic for the next 12-24 months is the acceleration of data center operators becoming de facto energy companies. The widening gap between AI’s power demand and the grid’s delivery capacity will force technology companies to move beyond partnerships and into direct ownership and development of power generation assets.

Global Data Center Power Demand to Double

This forecast visually supports the 2026 scenario, showing that worldwide data center electricity use is projected to more than double by that year, accelerating the race for power independence.

(Source: Statista)

- If grid interconnection queues in key markets like the U.S. continue to lengthen and utilities cannot commit to delivery timelines for new hyperscale projects, watch for major technology firms to acquire or fund the development of dedicated power generation facilities. This trend is already signaled by Microsoft’s and Google’s deep partnerships with firms like Brookfield.

- This could be happening as tech companies bypass utilities and directly finance on-site power projects at an unprecedented scale, moving beyond the $5 billion Brookfield–Bloom Energy partnership to larger, more integrated developments. Watch for announcements of direct investments in SMR developers or geothermal projects co-located with planned data center campuses.

- The signal that this trajectory is locked in will be the announcement of a major hyperscale data center campus being built in tandem with its own dedicated, non-grid-reliant power plant. This will mark the final transition from data centers as energy consumers to self-contained energy and computation ecosystems.

Frequently Asked Questions

Why is the public electrical grid struggling to power new AI data centers?

The grid is struggling because AI infrastructure demands power in a way it wasn’t designed for. AI-optimized racks require 30 kW to over 100 kW, far exceeding the 5-15 kW of traditional racks. This extreme power density overwhelms local grid substations. Furthermore, new data center campuses require massive amounts of power (e.g., two projects in Wisconsin needing a combined 3.9 GW), and connecting them to the grid can face delays of over three years, creating a critical structural bottleneck.

What is the main strategy data center operators are using to overcome these grid limitations?

Tech companies are shifting from relying on the public grid to securing their own power sources. The main strategies include investing directly in on-site power generation, such as fuel cells from Bloom Energy, to create power “behind-the-meter.” They are also forming deep strategic partnerships with energy firms, like Microsoft’s 10.5 GW deal with Brookfield Renewable Partners, to develop dedicated, reliable, 24/7 power that bypasses grid constraints.

How large is the investment in building the energy infrastructure for AI?

The investment is massive, creating a new multi-trillion dollar market. Projections through 2030 include McKinsey’s forecast of $6.7 trillion in global capital for data center infrastructure and Nvidia’s estimate of $1 trillion specifically for AI-related data center upgrades. This shows that power has become the most critical and expensive component of AI expansion.

What is the key difference between the industry’s approach to power before 2025 and after?

Before 2025, the industry focused on managing power as a future cost and sustainability issue through efficiency improvements (PUE) and renewable energy contracts (PPAs). Since 2025, power has become an immediate, structural bottleneck. The focus has shifted to securing power independence through on-site generation and direct energy partnerships, as grid delays and instability are now seen as primary business risks that can stall projects.

Which companies are mentioned as key players in this new energy-focused strategy?

The key players include technology hyperscalers like Microsoft and Google, who are securing massive power blocks. On the energy side, firms like Brookfield Renewable Partners are partnering to build new capacity, while technology providers like Bloom Energy are supplying on-site solutions such as solid oxide fuel cells. These collaborations signify a fundamental integration of energy and technology infrastructure planning.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.