AI Infrastructure Growth Hits the Power Wall: Grid Availability Constraints in 2026

Industry Shifts: How Power Scarcity Redefined AI Infrastructure Adoption from 2025 to 2026

The AI industry’s core strategy has fundamentally pivoted from a singular focus on computational power to a power-first approach, where securing electricity is now the primary enabler of infrastructure expansion. This shift acknowledges that physical grid limitations, not just silicon performance, dictate the pace and location of AI development.

- Between 2021 and 2024, the industry prioritized scaling compute, with power treated as a standard operational expense. The focus was on deploying increasingly powerful hardware, but the underlying assumption was that the grid could accommodate this growth.

- Starting in 2025, this assumption proved incorrect, with corporate leaders like Meta’s Mark Zuckerberg publicly identifying energy availability as the single largest bottleneck for new AI data center construction. This confirmed broader industry analyses, including Gartner’s prediction that 40% of AI data centers would be operationally constrained by power shortages by 2027.

- The primary risk to AI projects transformed from computational capacity to physical grid access. Interconnection queues for new power projects now extend from 4 to 8 years in key markets, a timeline completely misaligned with the 18-24 month development cycle for a new data center.

- In response, the industry’s adoption of energy sources broadened significantly. The earlier ideal of using 100% renewable energy gave way to a pragmatic “all of the above” strategy that includes natural gas and nuclear power to guarantee the 24/7 reliability required for intensive AI workloads, as reported by Reuters in late 2025.

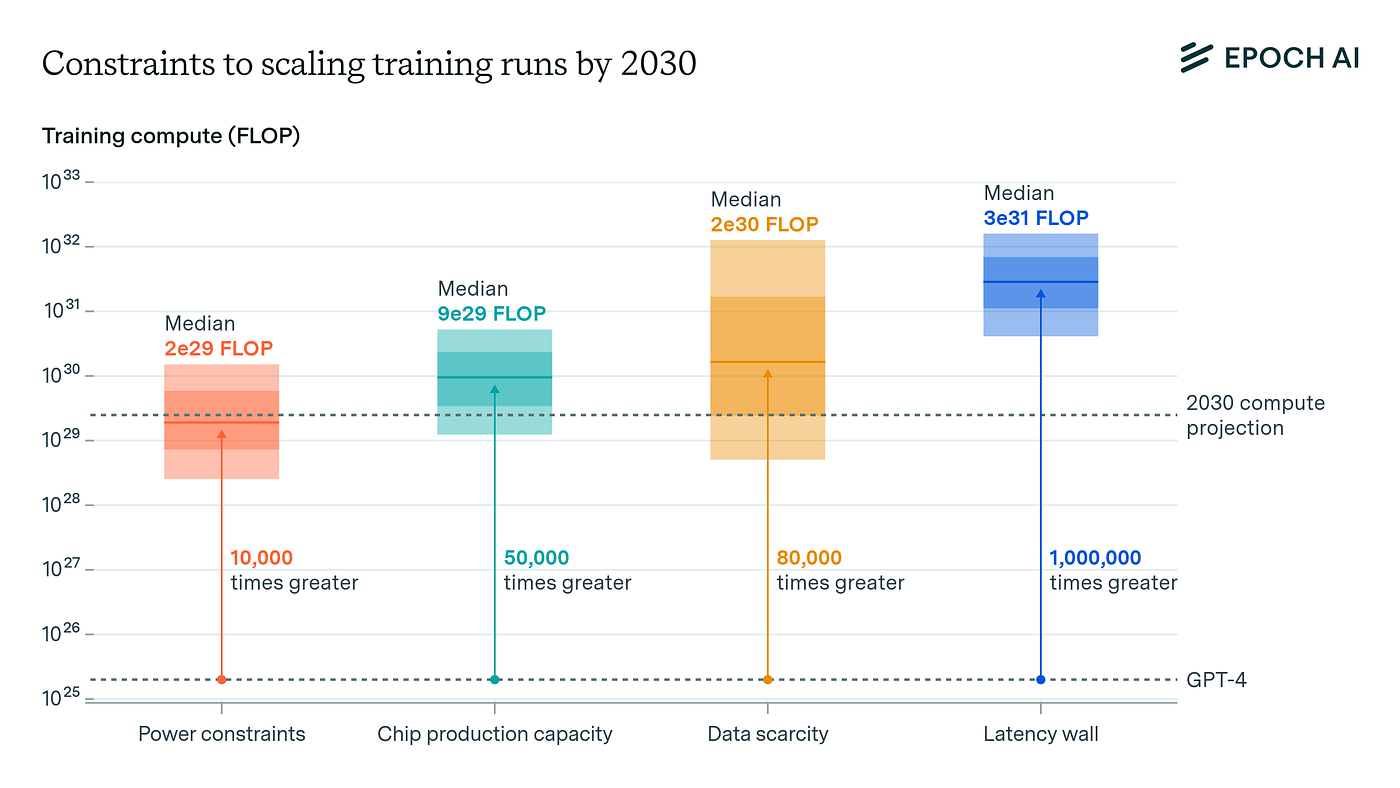

Power Constraints Identified as Key AI Bottleneck

This chart quantifies why the industry is shifting to a power-first strategy, showing that power constraints become a significant bottleneck sooner than other factors like chip production.

(Source: EnkiAI)

AI Power Investments: Trillion-Dollar Capital Flows into Energy Infrastructure to Fuel Growth

Unprecedented capital is now flowing from the technology and finance sectors directly into energy infrastructure to underwrite AI’s enormous power demand. Investment strategies have expanded from data center hardware alone to encompass the entire energy value chain, from generation to on-site delivery.

Power & Data Center Construction Spending Explodes

This chart visualizes the massive capital flows described in the section, showing an exponential increase in construction spending on power and data center infrastructure.

(Source: EnkiAI)

- Market analysis from Mc Kinsey projects that $6.7 trillion in worldwide investment will be required by 2030 to support the demand for compute power, with an increasingly large share of this capital dedicated to securing energy.

- Hyperscalers are making direct, massive investments in their infrastructure platforms. Google alone is expected to spend $75 billion on AI infrastructure in 2025, a figure that increasingly accounts for the associated power sourcing and delivery systems.

- The scale of this trend was solidified by the landmark partnership announced in September 2024 between Black Rock, Microsoft, and MGX, which created a vehicle for a potential $100 billion investment in both data centers and the supporting power infrastructure.

- A critical shift is the direct investment into specific energy technologies designed to bypass grid constraints. The $5 billion strategic partnership between infrastructure investor Brookfield and Bloom Energy, announced in October 2025, is structured to deploy on-site fuel cells as a primary power source for data centers.

Table: Key Investments in AI-Related Energy Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Brookfield / Bloom Energy | October 2025 | A $5 billion strategic partnership to make Bloom Energy the preferred provider of on-site power for Brookfield’s data center developments. This deal is designed to secure reliable power by bypassing grid interconnection delays. | Brookfield and Bloom Energy Announce $5 Billion … |

| Black Rock / Microsoft / MGX | September 2024 | A partnership with a potential investment value of $100 billion to build out data centers and the supporting power infrastructure. This vertically integrated approach signals that future AI growth requires owning the energy supply. | Black Rock, Global Infrastructure Partners, Microsoft, and MGX … |

| Google Renewable Initiative | December 2024 | A $20 billion renewable energy initiative aimed at securing clean power to fuel the company’s AI ambitions, reinforcing the direct link between clean energy investment and AI infrastructure expansion. | Google Launches $20 Billion Renewable Energy Initiative … |

Strategic Alliances: How Tech Giants Partner with Energy Firms to Overcome Power Constraints

Technology companies are no longer passive customers of utilities but are forming deep, strategic alliances with energy producers and technology providers. These partnerships are designed to secure dedicated, large-scale power and develop solutions that circumvent public grid limitations.

- From 2021 to 2024, partnerships were dominated by standard renewable Power Purchase Agreements (PPAs) focused on meeting corporate sustainability targets. These deals, while large, did not typically address the 24/7 reliability challenge.

- A major strategic shift occurred in 2025 with a focus on securing baseload, carbon-free power. This was validated by Amazon Web Services (AWS) signing a PPA with Talen Energy in June 2025 to procure up to 1, 920 MW of electricity from a nuclear power plant, ensuring constant power supply.

- To directly bypass grid congestion, partnerships for on-site generation have become a primary strategy. The alliance between Core Weave and Bloom Energy in July 2024 to deploy fuel cells directly at high-performance computing sites exemplifies this trend.

- Tech firms are now forming future-facing alliances to commercialize next-generation power sources. Google and Amazon began pursuing PPAs with Small Modular Reactor (SMR) developers in early 2025, and Meta issued a formal Request for Proposals (RFP) for nuclear partners in December 2024, signaling market confidence in these emerging technologies.

Table: Major Corporate Energy Partnerships for AI Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Meta / Nuclear Developers | December 2024 | Meta issued a formal RFP to identify and partner with nuclear energy developers, including SMRs, to provide dedicated, carbon-free power for its future AI data centers. This move aims to secure a long-term, scalable power source. | Accelerating the Next Wave of Nuclear to Power AI Innovation |

| Amazon (AWS) / Talen Energy | June 2025 | AWS signed a landmark PPA to purchase up to 1, 920 MW of nuclear power from Talen Energy’s Susquehanna plant. This provides the 24/7 carbon-free power needed for constant AI workloads. | Talen Energy Expands Nuclear Energy Relationship with … |

| Meta / AES Corporation | May 2025 | A PPA for 650 MW of solar energy to power data centers in Texas and Kansas. While a renewable deal, its large scale underscores the massive power volumes required. | Meta Invests in 650 MW of Solar Energy to Power AI and … |

| Google & Amazon / SMR Developers | February 2025 | Both companies began actively pursuing long-term PPAs with various SMR developers to secure future access to reliable, carbon-free baseload power that can be co-located with data center campuses. | Data centers drive surge in clean energy procurement … |

Geographic Power Plays: How Grid Availability Dictates AI Data Center Locations

The geographic strategy for new AI infrastructure is now primarily dictated by regional power availability and grid capacity, forcing a migration away from historically dominant but power-constrained data center hubs.

- Between 2021 and 2024, data center clusters were concentrated in areas like Northern Virginia, selected for their rich fiber connectivity and proximity to population centers. Power availability was a secondary, though growing, concern.

- From 2025 onward, acute power constraints have made these traditional hubs prohibitively difficult for new, large-scale developments. The PJM Interconnection, which serves Virginia, forecasts data center load to reach 31 GW by 2030, nearly matching the 28.7 GW of all planned new generation and creating a severe supply-demand imbalance.

- This power deficit is forcing developers to seek new frontiers. Analysis from the Financial Times suggests that new power capacity coming online in the U.S. in the next three years can only support about 25 GW of data center demand, far short of projections and compelling a search for regions with more robust grid infrastructure.

- This dynamic is creating a new global map of technological influence. Access to stable and abundant power is becoming a key determinant of a nation’s ability to host next-generation AI infrastructure, attracting trillions in investment and shaping economic competitiveness.

Power Generation Tech for AI: From Renewables to Nuclear at Commercial Scale

The technology mix for powering AI has rapidly matured from a primary reliance on grid-scale renewables to a commercially viable portfolio that includes baseload nuclear power and on-site fuel cells to meet stringent 24/7 operational demands.

- In the 2021-2024 period, the primary mature power solution for tech companies was large-scale renewable PPAs for wind and solar. While effective for meeting carbon goals, their intermittency posed a growing operational risk for constant AI workloads.

- Starting in 2025, the definition of a “mature” technology expanded to include 24/7 power sources. Amazon’s 1, 920 MW nuclear PPA with Talen Energy confirmed that existing nuclear power is a commercially ready and bankable solution for hyperscale AI.

- On-site generation has moved from pilot projects to commercial-scale deployment. The $5 billion partnership between Brookfield and Bloom Energy validates that solid oxide fuel cells are now a credible technology for providing primary, grid-independent power to data centers.

- Emerging technologies like SMRs are shifting from research and development to validated pre-commercial assets. Active PPA pursuits by Google and Amazon, along with Meta’s formal RFP, signal strong market confidence that SMRs are on a clear path to commercial viability within the next decade.

SWOT Analysis: Grid Availability and AI Infrastructure Growth

The AI industry’s strength in capital and innovation is being directly challenged by the external threat of an aging, slow-to-adapt power grid. This is forcing a strategic pivot towards energy self-sufficiency, which in turn presents new opportunities for growth, differentiation, and market leadership.

US Energy Supply Struggles to Meet Rising Demand

This chart perfectly illustrates the ‘Threat’ aspect of the SWOT analysis, showing a growing gap between electricity demand and available supply, which is the core challenge facing the AI industry.

(Source: Deloitte)

- Strengths: Hyperscalers possess immense capital reserves and borrowing power, enabling them to directly fund multi-billion-dollar energy projects and vertically integrate their power supply.

- Weaknesses: The industry remains critically dependent on an external factor it does not control: public grid infrastructure, which suffers from long lead times and regulatory hurdles.

- Opportunities: The power constraint creates powerful incentives for innovation and investment in new energy technologies like SMRs, advanced geothermal, and on-site fuel cells, accelerating the energy transition.

- Threats: The primary threat is gridlock. Projected demand, such as the 123 GW needed for U.S. AI data centers by 2035, is far outpacing grid expansion, which could stall AI development in key economic regions.

Table: SWOT Analysis for AI Infrastructure Power Availability

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Massive capital reserves were primarily allocated to R&D, talent acquisition, and scaling compute hardware like GPUs. | Capital deployment shifted to include massive, direct investments in energy generation, exemplified by potential funds like the $100 billion Black Rock/Microsoft vehicle. | The industry validated it could leverage its financial strength not just to buy compute, but to build the power infrastructure needed to run it. |

| Weakness | Rising electricity consumption was viewed as a growing operational cost (OPEX) and a challenge for sustainability reporting. | Power availability became a fundamental strategic bottleneck, publicly confirmed by tech CEOs and evidenced by 4-8 year grid interconnection queues. | The problem evolved from a manageable financial line item to a critical, project-killing physical constraint that dictates corporate strategy. |

| Opportunity | Opportunities focused on signing renewable PPAs to achieve corporate ESG goals and secure long-term price certainty for electricity. | The opportunity shifted to active energy development, including direct investment in baseload nuclear (Amazon’s 1, 920 MW PPA) and on-site generation (Brookfield/Bloom partnership). | Tech companies moved from being passive energy consumers to active energy infrastructure developers, creating new markets for advanced power technologies. |

| Threat | The main threat was considered to be volatile and rising electricity prices, impacting the total cost of ownership for data centers. | The threat became the physical inability to connect to the grid at all in desired locations, regardless of price, due to maxed-out transmission capacity and backlogged queues. | The core threat shifted from a financial risk (cost of power) to an existential one (access to power), which could fragment the global AI market based on regional energy capacity. |

2026 Forward Outlook: Will On-Site Power and Nuclear Unlock AI’s Next Growth Phase?

The critical variable for AI infrastructure growth in 2026 and beyond is the execution speed of on-site and dedicated power strategies designed to bypass the public grid bottleneck. Success in this domain will determine which companies can continue their exponential scaling trajectory.

AI Training Power Demand Grows Exponentially

This chart reinforces the forward outlook by illustrating the exponential growth in power required for AI, underscoring the urgency for the new on-site power strategies discussed in the section.

(Source: LinkedIn)

- If this happens: If hyperscalers successfully deploy their first wave of dedicated nuclear-powered data centers and large-scale on-site fuel cell projects by 2026-2027, it will validate a new infrastructure paradigm.

- Watch this: Monitor for announcements of data center campuses co-located with SMRs or other dedicated power plants. Also, track the megawatt capacity of on-site fuel cell deployments to see if they scale beyond the initial projects announced in 2024-2025.

- These could be happening: A successful pivot would signal a decoupling of AI growth from public grid constraints, creating “power islands” of immense computational capacity. This would accelerate investment into the SMR and fuel cell supply chains and likely spur a new wave of data center development in geographically diverse regions previously considered unviable due to weak grid infrastructure. The “all of the above” energy strategy, including natural gas, will almost certainly continue as a critical bridging solution due to the long development and regulatory timelines for new nuclear projects.