Grid Constraints & BTM Power: The Data Center Imperative in 2026

BTM Power Adoption for Data Centers: From Niche to Necessity Amidst Grid Delays

The adoption of Behind-the-Meter (BTM) power by data centers has fundamentally shifted from a strategy for enhancing reliability to a mandatory requirement for timely infrastructure deployment, directly driven by the failure of public utility grids to meet explosive, AI-driven power demand.

- Between 2021 and 2024, BTM strategies were primarily exploratory, focusing on large, innovative but complex projects like the Amazon Web Services (AWS) deal to co-locate with Talen Energy’s nuclear plant. This approach was novel, aiming to secure large-scale clean power, but it also highlighted significant regulatory hurdles, as seen in the later FERC ruling which introduced uncertainty for similar nuclear BTM models. The primary goal was often supplementing grid power to improve reliability or meet sustainability targets.

- From 2025 to today, the dynamic has inverted. Chronic, multi-year delays for grid interconnections have made BTM the primary path to market. Hyperscalers and developers now prioritize speed and energy independence, leading to the creation of self-contained “energy islands.” This is validated by Meta’s plan to add 200 MW of BTM generation at its Ohio AI campus and the strategic alliance between Chevron and GE Vernova to build dedicated natural gas plants for data centers. The conversation is no longer about supplementing the grid but bypassing it altogether to avoid crippling deployment delays.

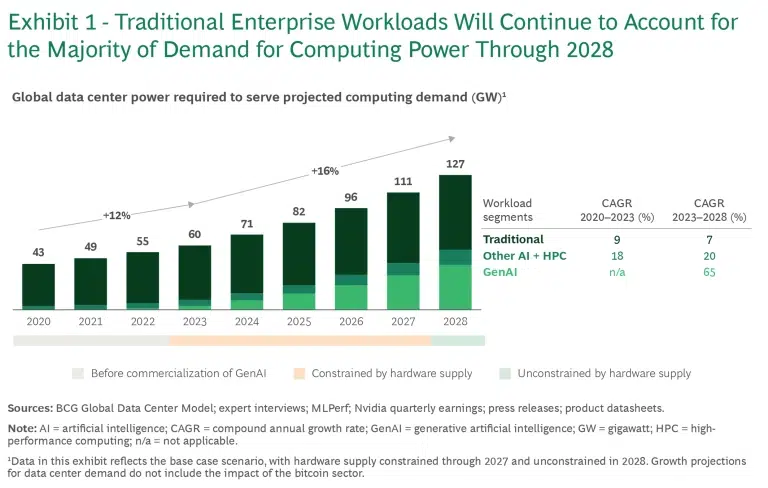

AI Drives Explosive Data Center Power Demand

This chart establishes the core problem driving BTM adoption: the explosive, AI-driven growth in power demand that public grids cannot meet, as stated in the section.

(Source: Boston Consulting Group)

Investment Surge: How Capital is Fueling BTM Data Center Power Solutions

The convergence of data center demand and power generation has been validated as a “generational investment opportunity” by major financial institutions, unlocking billions in dedicated capital to build out BTM infrastructure as a distinct asset class.

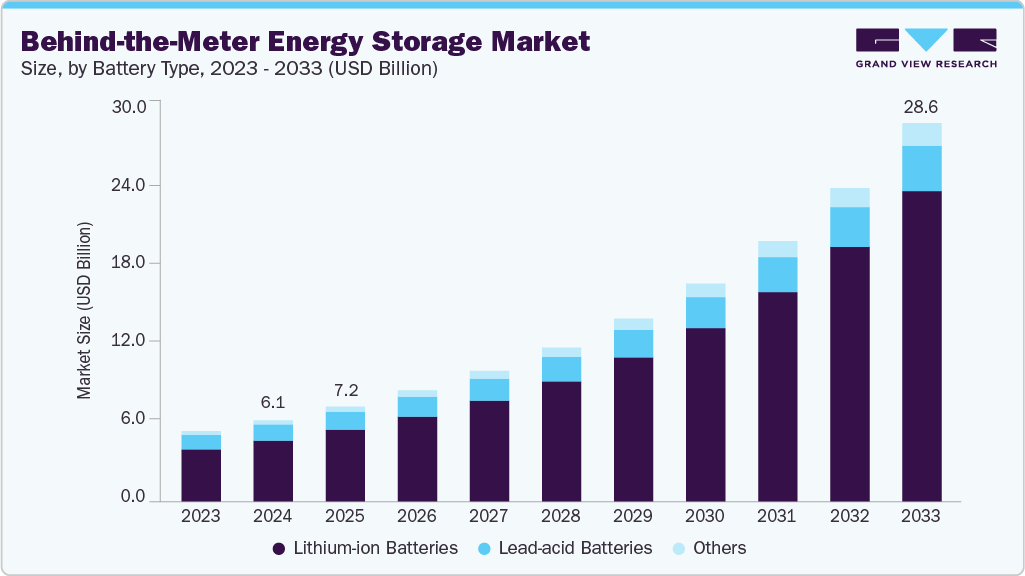

BTM Storage Market Shows Strong Growth

This forecast supports the section’s “Investment Surge” theme by showing the multi-billion dollar market growth for BTM energy storage, validating it as a significant asset class.

(Source: Grand View Research)

- Private equity and infrastructure funds are deploying massive capital pools to address the power bottleneck. In October 2024, KKR and Energy Capital Partners (ECP) announced a $50 billion investment initiative specifically to scale power generation infrastructure for data centers, signaling deep investor confidence in the BTM model.

- Technology-specific investments confirm the maturation of BTM solutions. Bloom Energy secured a $5 billion strategic partnership in October 2025 to power AI data centers with its off-grid fuel cell technology, establishing a commercially viable, cleaner alternative to traditional combustion.

- The scale of the market opportunity is attracting broad financial attention. Blackstone has publicly identified the data center and power convergence as a prime investment theme, while Bain & Company estimates that over $2 trillion in new energy generation resources may be required to meet global data center demand, framing the immense long-term potential.

Table: Key Investments in Behind-the-Meter Data Center Power

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| KKR & Energy Capital Partners (ECP) | October 2024 | Announced a $50 billion investment initiative to accelerate the development of power generation infrastructure for data centers. This move validates BTM as a major asset class. | Private equity giants invest $50 B to help scale data center … |

| Bloom Energy | October 2025 | Signed a $5 billion strategic partnership to power AI data centers with its fuel cells. This deal establishes fuel cells as a large-scale, bankable BTM technology. | Bloom Energy signs $5 bn ‘strategic partnership’ to power … |

| Blackstone | October 2024 | Identified the convergence of data centers and power as a “generational investment opportunity, ” signaling strong interest from one of the world’s largest investment firms. | The Convergence of Data Centers and Power |

Strategic Alliances in BTM Power: The New Ecosystem for Data Center Energy

The technical complexity and capital required for BTM solutions are driving the formation of a new partnership ecosystem, where data center operators, energy producers, and equipment manufacturers collaborate to de-risk and execute projects.

Diagram of On-Site BTM Power Generation

This diagram visually represents the type of technical solution enabled by the strategic alliances mentioned, such as using on-site natural gas to power a data center.

(Source: YouTube)

- Turnkey power solutions are emerging from alliances between energy and technology giants. The collaboration between Chevron, GE Vernova, and Engine No. 1, announced in February 2025, combines natural gas supply, turbine technology, and development expertise to offer data centers a direct path to reliable BTM power.

- Financial and technology partnerships are accelerating the deployment of cleaner BTM options. Fuel Cell Energy and Sustainable Development Capital LLP (SDC) forged a collaboration in January 2026 to deploy up to 450 MW of fuel cell technology, creating a dedicated financing and deployment vehicle for this specific technology.

- Landmark projects demonstrate the ultimate ambition of BTM. Energy Abundance’s “Data City, Texas, ” announced in March 2025, is a planned 5 GW data center hub powered entirely by on-site green energy, showcasing a vision of fully integrated and self-sufficient digital infrastructure.

Table: Key Partnerships Shaping the BTM Data Center Landscape

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDC | January 2026 | Established a strategic collaboration to deploy up to 450 MW of fuel cell technology at data centers, creating a dedicated financing and implementation channel. | Sustainable Development Capital LLP and Fuel Cell Energy … |

| Chevron, GE Vernova, & Engine No. 1 | February 2025 | Formed a joint effort to develop BTM power plants for data centers, combining fuel expertise with turbine technology to bypass grid constraints. | US companies make bold move to power nation’s data … |

| Energy Abundance | March 2025 | Announced “Data City, Texas, ” a planned 5 GW BTM data center hub, illustrating the scale and ambition of new projects designed for complete energy independence. | Energy Abundance Announces Data City, Texas |

| Amazon Web Services (AWS) & Talen Energy | March 2023 | AWS acquired the Cumulus data center campus adjacent to the Susquehanna nuclear plant. This pioneering deal for direct nuclear power sourcing later faced a FERC setback, highlighting regulatory risk. | Existing nuclear power plants are best behind-the-meter … |

Geographic Hotspots: Where Behind-the-Meter Data Centers Are Taking Root

BTM data center development is concentrating in key U.S. states like Texas and Ohio, where abundant energy resources, high data center demand, and significant grid congestion create the ideal conditions for pursuing energy independence.

Geothermal Power Potential Across US Markets

This chart directly aligns with the “Geographic Hotspots” theme by ranking US markets on their behind-the-meter power potential, a key factor for BTM development.

(Source: Rhodium Group)

- Between 2021 and 2024, BTM geography was more opportunistic, often tied to a single, unique power source. The AWS project in Pennsylvania was dictated by its proximity to the Susquehanna nuclear plant, representing a site-specific strategy rather than a broader regional trend.

- Starting in 2025, the geographic focus has become more strategic and concentrated. Texas has emerged as a major hub, exemplified by Energy Abundance’s plan for a 5 GW “Data City.” This location was chosen for its favorable regulatory environment and access to energy resources. Similarly, Meta’s plan to add 200 MW of BTM power to its Ohio campus underscores the state’s attractiveness for large-scale, self-powered developments. These regions are now being selected for their ability to support entire energy ecosystems, not just host individual data centers.

BTM Technology Maturity: A Pragmatic Mix for Data Center Power

The current BTM technology portfolio is defined by pragmatism, with commercially proven natural gas turbines meeting immediate GW-scale demand for speed and reliability, while cleaner technologies like fuel cells and Small Modular Reactors (SMRs) are scaling to provide future baseload power.

Visualizing a BTM Solar and Battery Strategy

This chart illustrates the “pragmatic mix” of BTM technologies by visualizing a 24-hour strategy using on-site solar and battery storage, a specific example mentioned in the text.

(Source: Blue Power Partners)

- In the 2021-2024 period, BTM technology exploration was varied but lacked scalable deployment. Nuclear co-location was a novel concept, and on-site solar with battery storage was pursued for sustainability goals, but neither could provide the fast, multi-megawatt baseload power required by the emerging AI boom.

- From 2025 onward, a clear technology hierarchy has emerged based on deployment speed. Natural gas turbines, supplied by firms like GE Vernova and Mitsubishi Power, are the dominant solution today, offering an 18-24 month path to operation that directly counters multi-year grid delays.

- Concurrently, cleaner technologies are achieving commercial scale. Bloom Energy’s $5 billion deal validates fuel cells as a bankable, low-emission baseload alternative, albeit with higher initial costs. Long-duration battery storage, such as Sumitomo Electric’s flow batteries, is being adopted for grid-independent resilience.

- Future carbon-free baseload power is being pursued through SMRs. While still in an exploratory phase, as seen with Microsoft’s interest, SMRs represent a long-term (5-10+ year) solution for providing 24/7 clean energy, positioning them as the eventual successor to natural gas in a fully decarbonized BTM model.

SWOT Analysis: Behind-the-Meter Power for Data Centers in 2026

BTM power provides a definitive solution to grid-related deployment delays, but its strategic value is mediated by a near-term reliance on fossil fuels, high capital costs, and emerging regulatory threats that challenge the long-term viability of complete grid separation.

Table: SWOT Analysis for Behind-the-Meter Power for Data Centers

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Enhanced reliability; potential for cost savings on transmission charges; meeting ESG goals with on-site renewables. | Speed-to-market by bypassing multi-year grid queues; control over power supply and price stability; enabling GW-scale AI deployments. | The primary strength shifted decisively from cost/reliability optimization to speed. BTM is now the fastest path to deploying new capacity. |

| Weaknesses | High upfront CAPEX; operational complexity of running power plants; permitting challenges for new generation. | Heavy reliance on natural gas as the primary “bridge” fuel; exposure to fuel price volatility; carbon emissions conflict with long-term corporate sustainability goals. | The urgency for rapid deployment amplified the reliance on natural gas, introducing significant ESG and fuel cost risks that were less prominent in earlier, smaller-scale projects. |

| Opportunities | Leveraging PPAs with existing power plants (e.g., AWS-Talen nuclear deal); smaller-scale microgrid deployments. | Massive addressable market for turbine providers (GE, Mitsubishi) and fuel cell makers (Bloom, Fuel Cell Energy); new infrastructure investment class attracting billions (KKR, Blackstone). | The scale of the grid constraint created a multi-billion-dollar market for energy technology and dedicated infrastructure funds, moving BTM from a niche to a core investment theme. |

| Threats | Local permitting hurdles; uncertainty around the economics of on-site generation versus grid power. | Regulatory pushback on grid secession, exemplified by the FERC ruling on the AWS-Talen deal; challenges in securing social license to operate for new fossil fuel plants. | Regulatory risk became a concrete and significant threat. The FERC decision introduced major uncertainty for large-scale BTM projects attempting to fully disconnect from the grid. |

2026 Outlook: BTM as the Default for AI Infrastructure Deployment

The critical path for AI infrastructure growth now runs directly through BTM power; if data center operators cannot secure dedicated, independent power sources, their multi-billion-dollar expansion plans will stall, rendering chip availability and software advancements irrelevant.

AI Power Demand Projected to Surge 31x

This chart provides a powerful, forward-looking visual for the outlook, reinforcing the argument that extreme growth in AI power demand makes BTM solutions essential.

(Source: Deloitte)

- If grid interconnection queues remain at their current multi-year lengths, then watch for an acceleration of large-scale partnerships between hyperscalers and energy majors to build dedicated, on-site gas-powered plants. This is the fastest and most proven path to bringing hundreds of megawatts online.

- The Chevron/GE Vernova joint venture and Meta’s BTM plan for its Ohio campus are the key signals to monitor. These are no longer one-off projects but are becoming the standard template for hyperscale development in power-constrained regions.

- If regulators like FERC continue to challenge models that appear to “secede” from the grid, then watch for the evolution of hybrid BTM agreements. These models would maintain a grid connection for stability or to sell excess power, creating a more symbiotic relationship that may be more palatable to regulators.

- The major deals signed by Bloom Energy and Fuel Cell Energy confirm that cleaner baseload technologies are on a parallel commercialization track. If natural gas prices experience a significant spike or ESG pressures from investors intensify, expect a rapid pivot of capital towards these alternatives, even with their higher initial costs.

Frequently Asked Questions

Why have data centers suddenly shifted to using Behind-the-Meter (BTM) power?

The primary reason for the shift is that public utility grids are failing to meet the explosive, AI-driven demand for power, leading to chronic, multi-year delays for new grid connections. As a result, BTM power has evolved from a strategy for reliability into a mandatory requirement for data centers to achieve speed-to-market and avoid crippling deployment delays.

Are these BTM power solutions environmentally friendly?

The current approach is a mix. For speed and scale, the dominant technology is natural gas turbines, a fossil fuel. This conflicts with long-term sustainability goals. However, significant investments are being made in cleaner alternatives. Fuel cells, from companies like Bloom Energy and Fuel Cell Energy, are being deployed as a commercially viable, low-emission option, while Small Modular Reactors (SMRs) are viewed as a potential long-term, carbon-free solution.

Who is funding this massive build-out of BTM power infrastructure?

Major financial institutions and infrastructure funds are deploying billions of dollars, viewing the convergence of data centers and power as a ‘generational investment opportunity.’ Examples include a $50 billion investment initiative from KKR and Energy Capital Partners, and strong interest from firms like Blackstone. This has established BTM infrastructure as a distinct asset class, attracting massive capital pools to solve the power bottleneck.

What are the biggest risks or challenges for data centers using BTM power?

The main risks are regulatory pushback and a near-term reliance on fossil fuels. As seen with the FERC ruling on the AWS-Talen nuclear deal, regulators can introduce uncertainty for projects that appear to disconnect from the public grid. Additionally, the heavy use of natural gas creates exposure to fuel price volatility and can conflict with corporate carbon emission and sustainability goals.

What kinds of partnerships are emerging to build these BTM solutions?

A new ecosystem of partnerships is forming. This includes alliances between energy and technology giants, like the one between Chevron and GE Vernova to offer turnkey natural gas plants. There are also financial and technology collaborations, such as the one between Fuel Cell Energy and SDC to finance and deploy 450 MW of fuel cell technology, creating dedicated vehicles for specific solutions.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.