AI Power Demand 2026: How Utility Prioritization of Large Loads Will Reshape Grid Investment

The Shift to Strategic Partnership: How Utilities Are Prioritizing AI Data Center Loads

Utilities are abandoning a reactive “duty to serve” model and implementing strategic frameworks to prioritize large AI loads, a fundamental operational shift driven by unprecedented electricity demand. The previous approach of accommodating all new load requests is no longer viable due to capital constraints, grid stability risks, and the sheer velocity of connection queues. Instead, utilities are now prioritizing AI data center projects that function as strategic partners, offering grid-supportive flexibility, co-investment in new infrastructure, and alignment with clean energy goals.

- Between 2021 and 2024, utilities primarily focused on quantifying the surging demand from AI, with load growth forecasts being revised upwards for the first time in decades. The approach was largely reactive, centered on understanding the scale of the problem as data center power requests began to overwhelm traditional planning cycles.

- Starting in 2025, the focus shifted from passive analysis to active prioritization and risk mitigation. This change was marked by direct government intervention, such as Ontario’s new measures in July 2025 to prioritize data centers creating high-value jobs, and the formation of industry consortia like the EPRI and NVIDIA Open Power AI Consortium to develop new grid management tools.

- The new prioritization model evaluates AI loads not just as consumers of power but as potential grid assets. Utilities now grant preferential queue access and grid resources to data centers that offer flexible load management, contribute capital for generation or transmission build-outs, or serve as anchor tenants for new clean power projects.

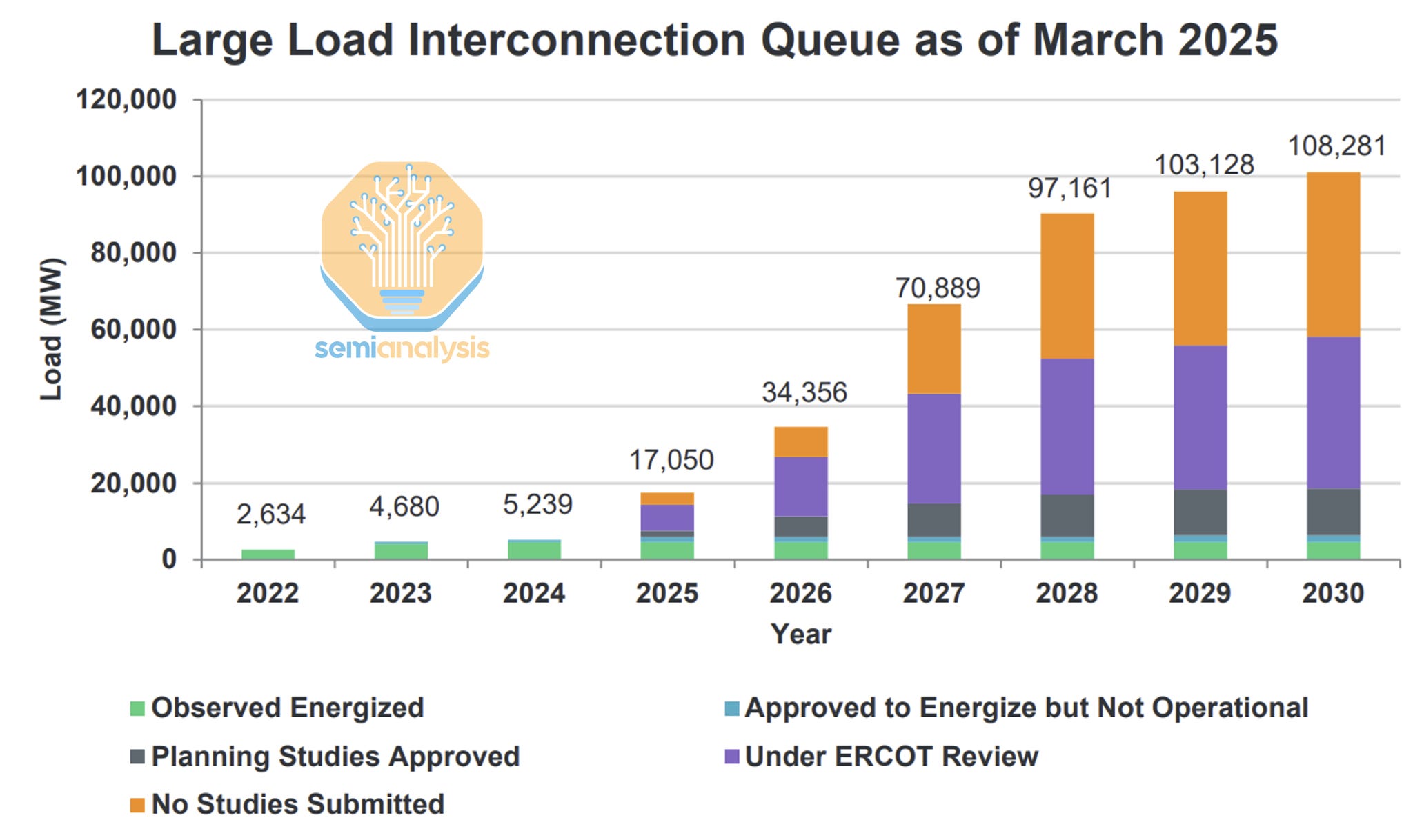

Grid Interconnection Queue Explodes

This chart illustrates the exploding interconnection queue mentioned in the text, which is the primary driver for utilities shifting to strategic prioritization of new loads.

(Source: SemiAnalysis)

Utility CAPEX Surge: Why Investment Prioritization Follows AI Co-Development

Record-level capital expenditure forecasts are forcing utilities to be highly selective in their infrastructure investments, prioritizing projects that are de-risked through financial partnerships with the large AI loads they will serve. With U.S. utilities planning to spend nearly $200 billion annually on CAPEX through 2027, capital is being allocated to grid upgrades and new generation that come with commitments from credit-worthy data center partners, rather than speculative build-outs.

Data Centers Swell Utility Revenue Needs

This chart shows the projected increase in utility revenue requirements driven by data center growth, contextualizing the need for massive CAPEX and investment prioritization.

(Source: Bain & Company)

- Massive capital requirements, estimated at over $2 trillion globally for new generation to serve data centers, make it impossible for utilities to fund the expansion alone without significant rate increases for all customers. This financial pressure is the primary driver behind the shift to co-investment models.

- Data from 2025 shows a clear trend toward joint development. The partnership between Chevron and GE Vernova to build up to four gigawatts of gas-fired generation is a direct response to data center demand, creating dedicated capacity that would not have been financed on a speculative basis.

- Utilities are increasingly requiring AI customers to contribute directly to the cost of infrastructure. This can include funding for new substations, transmission lines, or acting as the anchor offtaker for a new power plant, ensuring the utility’s investment has a guaranteed revenue stream from day one.

Table: Projected Capital Expenditures Driven by AI and Grid Modernization

| Source Entity | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| S&P Global | 2025-2027 | Aggregate U.S. utility CAPEX is forecast to hit $192 billion in 2025 and rise to $197 billion by 2027. This spending is driven by grid modernization and accommodating new, large industrial loads, primarily data centers. | Energy utility capex plans on track to all-time highs from … |

| Bain & Company | Next Decade | Over $2 trillion in new investment is estimated to be required for energy generation resources globally to satisfy the power demand from the data center boom. | Utilities Must Reinvent Themselves to Harness the AI … |

| Deloitte | Next Decade | Total U.S. utility CAPEX could reach between $1.5 trillion and $1.8 trillion over the next decade. This reflects a sustained growth rate of 5% to 8%, fueled by the energy transition and significant new load from data centers. | Electric companies’ cost dilemma | Deloitte Insights |

| Goldman Sachs | Unspecified | Approximately $50 billion in new generation capacity investment may be required in the U.S. specifically to support data center load growth, separate from transmission and distribution costs. | AI is poised to drive 160% increase in data center power … |

Partnership Analysis: How Co-Development Models Accelerate AI Grid Connection

Strategic partnerships between energy companies, technology firms, and utilities have become the primary mechanism for prioritizing and accelerating grid connections for AI data centers. These collaborations move beyond a simple customer-supplier relationship to a model of co-development, where risks and investments are shared to build dedicated or “near-the-meter” power solutions, allowing data centers to bypass congested interconnection queues.

AI Cluster Supports Grid in Partnership

This chart provides a concrete example of a strategic partnership, showing an AI data center acting as a grid asset by reducing its load during peak demand.

(Source: NVIDIA Blog)

- In November 2025, Babcock & Wilcox and Applied Digital signed a Limited Notice to Proceed to develop one gigawatt of on-site power for AI data centers using natural gas. This behind-the-meter approach gives the data center operator control over its power supply and reduces the immediate burden on the public grid.

- The collaboration between Chevron and GE Vernova, announced in November 2025, to develop up to four gigawatts of gas-powered generation is explicitly aimed at serving the data center market. This utility-scale project, backed by two major energy players, provides the firm, 24/7 power that AI workloads require and that intermittent renewables alone cannot guarantee.

- Industry-wide collaboration is also taking shape, as seen with the launch of the Open Power AI Consortium by EPRI and NVIDIA in March 2025. This initiative brings utilities and tech leaders together to build open AI models for grid optimization, transforming data center loads from a problem into a manageable resource.

Table: Key Partnerships for AI Data Center Power Solutions

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Babcock & Wilcox / Applied Digital | November 2025 | Signed an agreement to design and install 1 GW of on-site electric power using natural gas. This behind-the-meter solution is designed to bypass grid constraints and provide reliable power directly to AI data centers. | Babcock & Wilcox Announces AI Data Center Power … |

| Chevron / GE Vernova | November 2025 | Announced a collaboration to develop up to 4 GW of natural gas-fired generation. The initiative aims to provide reliable, dispatchable power to support the burgeoning data center industry and other industrial loads. | Top Energy Companies for AI Data Centers: Power Guide |

| EPRI / NVIDIA | March 2025 | Launched the Open Power AI Consortium, a global collaboration to create open-source AI models for the power sector. The goal is to enhance grid operations, from generation to transmission and use, enabling better integration of large, variable loads. | EPRI, NVIDIA and Collaborators Launch Open Power AI … |

| National Grid Partners | March 2025 | Committed $100 million to invest in AI startups focused on the energy sector. This signals a utility’s strategic intent to leverage AI internally for grid modernization and to partner with innovators to manage new demand. | National Grid Partners commits $100 million to invest in AI … |

Geographic Focus: How Regional Policies Shape AI Load Prioritization

The implementation of formal prioritization frameworks is geographically concentrated in regions where grid capacity is most constrained, forcing governments and utilities to actively manage burgeoning interconnection queues. While data center construction was previously driven by factors like tax incentives and fiber connectivity, site selection is now increasingly dictated by the existence of clear, predictable policies for allocating power.

Electricity Demand Surges in Key Regions

Highlighting the geographic concentration of demand growth in the Southeast and Mid-Atlantic, this chart explains why regional policies for load prioritization are becoming critical.

(Source: Utility Dive)

- Between 2021 and 2024, data center development was concentrated in established hubs like Northern Virginia, where proximity to network infrastructure was paramount. Utilities in these areas were the first to signal alarms about overwhelming load growth.

- Beginning in 2025, a new pattern emerged where regions with proactive energy policies became more attractive. In July 2025, Ontario’s government introduced measures to prioritize electricity access for data centers that create high-value jobs, creating a formal framework for triage.

- Canadian provinces like Québec, Alberta, and British Columbia are now developing similar frameworks to manage large load connections based on economic and environmental criteria. This policy leadership provides a clear signal to developers about which projects are likely to be approved, shifting investment toward regions with transparent prioritization rules.

- In the U.S., states with high concentrations of data centers are seeing utilities revise load growth forecasts upward by nearly double, from 2.6% to 4.7% over five years, forcing a re-evaluation of how to allocate scarce grid capacity among competing industrial, commercial, and AI loads.

Technology Maturity: Commercialization of On-Site Power and Flexible Load Management

The technologies enabling utilities to prioritize AI loads, namely on-site generation and flexible load management, have matured from pilot concepts to commercially essential solutions. Instead of waiting years for traditional grid expansion, data centers are deploying commercially available behind-the-meter technologies to secure power, while utilities are requiring demand response capabilities as a condition for grid connection.

Flexible Data Centers Unlock Grid Capacity

This chart quantifies the grid capacity that can be unlocked by flexible load management, demonstrating the commercial viability and impact of this mature technology.

(Source: Deloitte)

- From 2021 to 2024, on-site generation for data centers was primarily for backup power, and flexible load management was a concept championed by a few hyperscalers like Google. It was not a widespread requirement for interconnection.

- In 2025, this changed significantly. On-site power solutions from companies like Bloom Energy, offering 99.9% uptime with fuel cells, are now being marketed as primary, baseload power sources for mission-critical AI workloads, not just as backup.

- The partnership between Babcock & Wilcox and Applied Digital to deploy one gigawatt of dedicated gas power validates the commercial model of building power generation as an integral part of the data center campus.

- Simultaneously, flexible load management has become a contractual requirement. Utilities are now structuring agreements that allow for periodic demand curtailment, turning data centers into dispatchable grid resources. This is enabled by AI-powered tools that can shift non-urgent computing tasks to off-peak hours, a capability that has moved from internal hyperscaler projects to an industry standard.

SWOT Analysis: Strategic Outlook for Utility Prioritization of AI Loads

The strategic prioritization of AI loads presents utilities with a generational opportunity for growth, but it is accompanied by significant operational risks and competitive threats. Success hinges on a utility’s ability to transition from a traditional regulated monopoly to an agile infrastructure partner, capable of integrating a diverse portfolio of energy assets it may not own or control.

AI Load Growth Follows Hype Cycle

This chart models the strategic outlook for AI load growth using a technology hype cycle, mirroring a SWOT analysis by outlining periods of opportunity and future challenges.

(Source: Energy and Environmental Economics, Inc.)

- This analysis shows that the primary opportunity for utilities is to secure long-term, high-margin revenue from credit-worthy AI customers while using their flexible loads to improve overall grid stability.

- The main threat is disintermediation. If utilities fail to provide timely and reliable grid connections, data center operators will increasingly choose to build and operate their own on-site power infrastructure, bypassing the public grid entirely.

Table: SWOT Analysis for Utility Prioritization of AI Loads

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Established infrastructure and regulatory position as sole energy provider. Predictable revenue from regulated rates. | Ability to attract massive, credit-worthy AI customers. New revenue from innovative tariffs and “premium power zone” services. Flexible loads are leveraged as grid assets. | The scale of AI demand validated utilities as critical enablers, shifting their role from a simple provider to a strategic partner capable of offering value-added services. |

| Weaknesses | Slow, multi-year planning and permitting cycles. A reactive “duty to serve” mindset unable to cope with gigawatt-scale load requests. | Inability to build transmission and generation fast enough. High capital intensity for grid expansion strains balance sheets and puts upward pressure on rates for all customers. | The speed of AI growth confirmed that traditional utility planning cycles are obsolete. The weakness is now an acute bottleneck, forcing a move to partnership models. |

| Opportunities | Potential for new load growth after nearly two decades of flat demand. Early discussions on demand response programs with large customers. | Co-investment partnerships with tech companies to de-risk CAPEX. Integrating and orchestrating behind-the-meter (BTM) generation (e.g., fuel cells, microgrids). Using AI internally for grid modernization. | Partnerships like Babcock & Wilcox/Applied Digital and consortia like EPRI/NVIDIA validated the shift from a utility-centric model to a collaborative ecosystem. The opportunity is to become an integrator, not just a generator. |

| Threats | Risk of customer dissatisfaction due to long interconnection queues. Early signs of large customers exploring on-site generation alternatives. | Disintermediation, as data centers build their own on-site power (e.g., Bloom Energy fuel cells, gas turbines) to bypass the grid entirely. Becoming a bottleneck to economic growth, inviting regulatory intervention. | The threat of being bypassed became a commercial reality in 2025. Data centers are no longer just exploring BTM solutions; they are actively deploying them at scale to ensure reliability and speed-to-market. |

Scenario Modeling: The Future of AI Load Integration in 2026

The critical factor determining the success of AI load integration in 2026 is the scalability of the partnership-first model, which hinges on aligning utility, regulatory, and technology company interests. If this alignment succeeds, utilities will evolve into orchestrators of complex energy ecosystems; if it fails, the energy landscape will fragment as large customers build their own independent power islands.

AI Load Threatens to Exceed Grid Capacity

This chart illustrates the core challenge for future scenarios by showing how a large, inflexible AI load can exceed grid capacity, which would necessitate load curtailment.

(Source: SemiAnalysis)

- If this happens: Utilities and AI firms successfully execute co-development agreements for on-site and near-the-meter generation, and regulators approve new tariff structures that reward load flexibility.

- Watch this: An increase in announcements of “premium power zones” or “compute-ready supply corridors” where utilities guarantee power availability in exchange for co-investment and demand flexibility. Also watch for the first standardized contracts for demand curtailment from data centers being filed with public utility commissions.

- This could be happening: Leading utilities will report that a significant portion of new data center load is being served by assets they do not own but help integrate. Interconnection queues in regions with clear prioritization policies will shorten, attracting further investment and creating a virtuous cycle. The success of the EPRI/NVIDIA consortium’s open models will become evident as smaller utilities adopt AI-powered load forecasting and dispatch.

Frequently Asked Questions

Why can’t utilities simply build more power plants and lines to meet the demand from AI?

The primary reasons are speed, cost, and risk. The article notes that traditional utility planning and permitting cycles take multiple years, which is too slow for the rapid growth of AI. Furthermore, the capital required is enormous—estimated at over $2 trillion globally for new generation alone. Utilities cannot fund this expansion by themselves without significant rate increases for all customers. To manage this financial risk, they are now requiring AI data centers to co-invest in the new infrastructure they need.

What does it mean for a data center to act as a ‘strategic partner’ instead of just a customer?

A strategic partner, as described in the article, actively helps support the grid in exchange for priority access to power. This partnership can take three main forms: 1) Offering flexible load management, where the data center agrees to reduce power consumption during peak times to help stabilize the grid. 2) Co-investing capital to help fund the construction of new power plants or transmission lines. 3) Serving as an ‘anchor tenant’ by guaranteeing the purchase of power from a new clean energy project, which makes the project financially viable for the utility.

What are ‘behind-the-meter’ power solutions and why are they becoming more common for data centers?

Behind-the-meter (BTM) or on-site solutions are power generation systems, like natural gas plants or fuel cells, that are built directly on the data center’s property. According to the article, they are becoming common because they allow data centers to bypass long, congested grid interconnection queues and gain access to reliable power much faster. For example, the partnership between Babcock & Wilcox and Applied Digital to build one gigawatt of on-site power is a direct response to this need for speed and reliability.

How are government policies affecting where new data centers are located?

Policies are becoming a decisive factor in site selection. The article explains that regions with constrained grids are implementing formal prioritization frameworks. For instance, in July 2025, Ontario, Canada, began prioritizing electricity access for data centers that create high-value jobs. This provides clarity and predictability for developers, attracting investment to regions with transparent rules and away from those with uncertain, first-come-first-served connection queues.

What is the biggest threat utilities face from the AI-driven power demand boom?

The biggest threat identified in the article’s SWOT analysis is ‘disintermediation.’ This is the risk that if utilities are too slow or unable to provide power, large data center operators will choose to build their own independent power infrastructure (like on-site gas plants) and bypass the public grid entirely. This would result in utilities losing out on a massive new source of revenue and becoming a bottleneck to economic growth, potentially leading to negative regulatory action.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.