Grid Constraints Force Data Center Self-Generation: 2026 Power Market Reshaped by AI

Data Center Self-Generation Projects Accelerate as Grid Delays Mount

The adoption of on-site power generation by data centers has shifted from a peripheral strategy before 2025 to a mainstream imperative, driven by the inability of traditional grid infrastructure to meet AI-driven power demand and connection timelines. This “Bring Your Own Power” (BYOP) model is no longer a choice but a necessity for hyperscale developers who require speed-to-market and operational certainty that the public grid cannot provide.

- Before 2025, the primary strategy for securing power involved large-scale power purchase agreements (PPAs) for renewable energy, such as Microsoft’s 10.5 GW deal with Brookfield, or acquiring data centers co-located near existing power plants, like Amazon’s purchase of the Talen Energy campus. These actions supplemented grid reliance rather than replacing it.

- From 2025 onward, the strategy pivoted to direct, on-site power construction to bypass grid connection queues that can stretch for years. An estimated 48 GW of proposed data center capacity, or 33% of all planned projects, now includes behind-the-meter generation, primarily using natural gas for rapid deployment.

- This shift is quantified by the wave of new project announcements in 2025 and early 2026, including Vantage Data Centers’ partnership with Liberty Energy for 1 GW of power solutions and Babcock & Wilcox’s agreement to build 1 GW of gas-fired power for an Applied Digital AI data center.

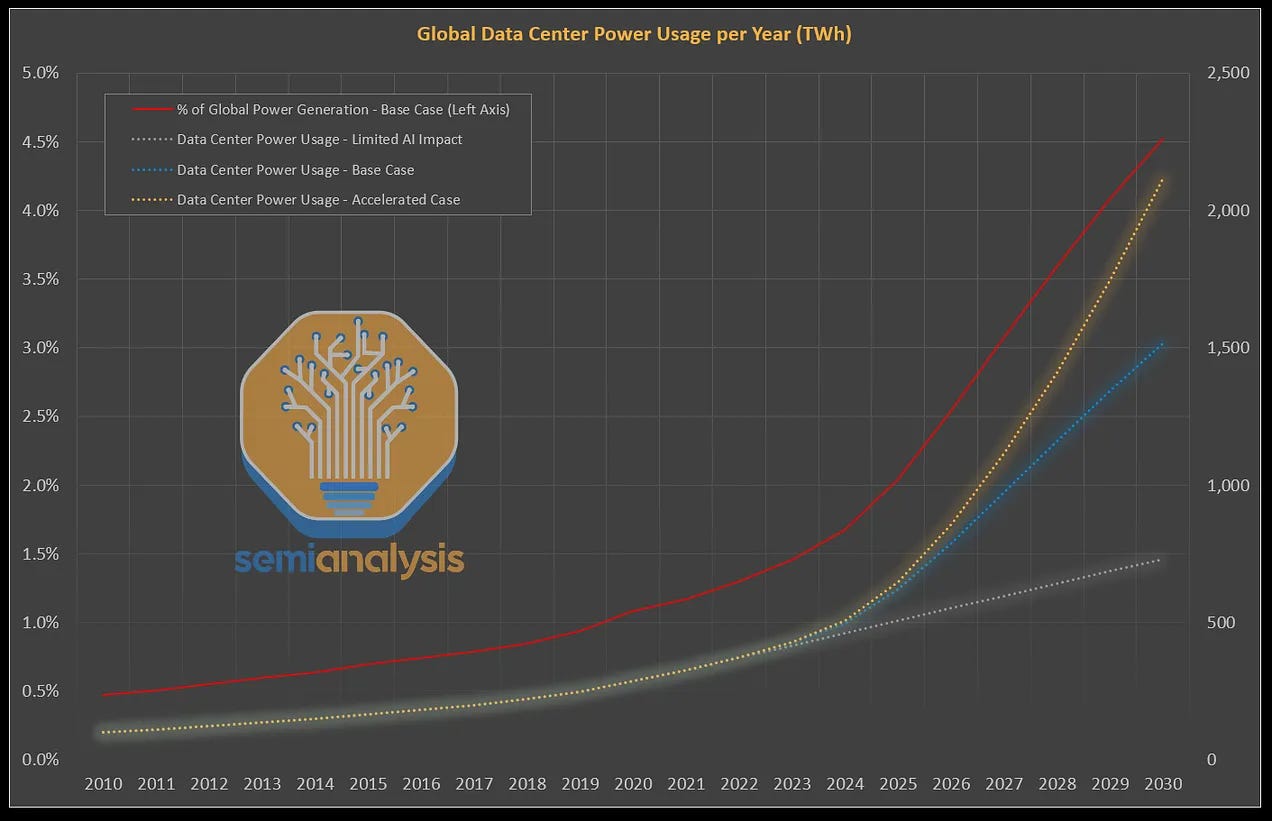

AI to Drive Exponential Data Center Power Use

This chart’s forecast of surging power consumption driven by AI directly supports the section’s core argument that grid infrastructure cannot meet demand, necessitating self-generation.

(Source: Generative Value)

Multi-Billion Dollar Investments Fund Data Center Power Independence

Massive capital inflows, particularly from private equity and infrastructure funds, are underwriting the separation of data centers from traditional grid reliance, validating the commercial viability of dedicated power infrastructure. The scale of investment has moved from funding individual data center assets to financing entire integrated energy and digital ecosystems, signaling a permanent structural change in both markets.

- In July 2025, Energy Capital Partners (ECP) and KKR announced a $50 billion strategic partnership explicitly designed to develop and build co-located power generation and data centers, with an initial project leveraging Calpine natural gas plants.

- Blackstone has identified this convergence as a “generational investment opportunity, ” with a pipeline of over $100 billion for data centers, many of which will require dedicated power. This is exemplified by its July 2025 joint venture with PPL Corporation to construct new gas generation in Pennsylvania specifically for data centers.

- This contrasts with the pre-2025 period, where major transactions were often focused on acquiring data center assets with power advantages, such as Amazon’s $650 million purchase of the Cumulus data center campus adjacent to a nuclear plant in March 2024. The new model focuses on funding the power source itself.

Table: Key Investments in Data Center Power Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Vantage Data Centers, Liberty Energy | Jan 2026 | A strategic partnership to develop and operate 1 GW of power solutions, enabling Vantage to bypass grid constraints for its next-generation data centers. | Vantage Data Centers and Liberty Energy Announce … |

| Exxon Mobil, Next Era Energy | Dec 2025 | A partnership to develop a 1.2 GW natural gas power plant. This directly links an energy major with a power developer to build dedicated generation for a data center initiative. | Exxon Mobil, Next Era Partner on New 1.2-GW Power Plant … |

| Energy Capital Partners (ECP), KKR | Jul 2025 | A $50 billion strategic partnership to build integrated digital and power infrastructure. This creates a massive capital vehicle dedicated to the BYOP trend. | Energy Capital Partners (ECP) and KKR Announce … |

| Microsoft, Brookfield Asset Management | May 2024 | A landmark agreement for Brookfield to develop 10.5 GW of new renewable energy capacity, backed by over $10 billion, to power Microsoft’s data centers. This represents the peak of the PPA-driven model before the shift to on-site generation. | Brookfield, Microsoft Sign Massive 10.5-GW Power … |

Strategic Alliances Reshape the Data Center Power Supply Chain

A new ecosystem is forming as technology companies forge direct, large-scale partnerships with energy producers and equipment manufacturers, bypassing traditional utility intermediaries. Before 2025, tech companies were primarily customers of utilities and energy developers. Now, they are becoming co-development partners, fundamentally changing the structure of energy project finance and development.

Visualizing the Traditional Data Center Power Chain

This diagram illustrates the conventional power grid model that the section describes being bypassed by new strategic alliances between tech companies and energy producers.

(Source: Dgtl Infra)

- The alliance between Google and Next Era Energy in December 2025 to develop data centers with on-site power plants marks a strategic integration where the power infrastructure is designed and built in tandem with the digital infrastructure.

- Energy and industrial giants are now creating offerings specifically for the data center market. The partnership between NRG and GE Vernova in February 2025 to develop 5.4 GW of gas generation shows that equipment and power producers are aligning to directly serve this new class of energy buyer.

- Similarly, Exxon Mobil’s partnership with Next Era in December 2025 to build a 1.2 GW power plant demonstrates that energy majors are moving to directly power data centers, viewing them as a new anchor market for their resources.

- In early 2025, Babcock & Wilcox partnered with Denham Capital to repurpose existing coal plants to power data centers, indicating a strategy to leverage existing infrastructure assets to accelerate power delivery.

Table: Landmark Partnerships for Data Center Self-Generation

| Partners | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Vantage Data Centers, Liberty Energy | Jan 2026 | Partnership to develop 1 GW of power solutions for next-generation data centers, focusing on on-site generation to ensure speed and reliability. | Vantage Data Centers and Liberty Energy Announce … |

| Google, Next Era Energy | Dec 2025 | Alliance to develop data centers with co-located power plants, aiming to build 15 GW of power for data centers by 2030. | Google, Next Era Energy to develop data centers with … |

| Energy Capital Partners (ECP), KKR | Jul 2025 | A $50 billion strategic partnership to deliver integrated digital and power infrastructure, bypassing traditional utility development models. | Energy Capital Partners (ECP) and KKR Announce … |

| Google, Intersect Power, TPG Rise Climate | Dec 2024 | Strategic partnership to co-locate data centers with renewable energy and storage, targeting $20 billion in new energy infrastructure. This was a transitionary model between PPAs and full on-site generation. | Intersect Power Forms Strategic Partnership with Google and … |

U.S. Power Hubs Emerge to Support Data Center On-Site Generation

The buildout of dedicated data center power generation is concentrating in U.S. regions with favorable energy resources and supportive regulatory frameworks. Power availability is now a primary driver of data center location, creating new geographic centers of gravity for digital infrastructure in places like Texas, Pennsylvania, and the U.S. Southeast.

Gas Pipelines Map Route to Data Center Hubs

This map directly visualizes the emergence of new power hubs by showing the geographic link between energy infrastructure and data centers in key regions like the U.S. Southeast.

(Source: Enverus)

- Between 2021-2024, data center growth was concentrated in established hubs like Northern Virginia, which is now facing significant grid constraints that impede further development and drive the need for alternative power solutions.

- Since 2025, Texas has become a focal point for on-site, gas-fired power plant construction, as developers race to avoid grid delays in the state’s deregulated market. It is also a target for future nuclear-powered data centers, such as the project planned by Crusoe and Blue Energy.

- Pennsylvania has emerged as a key location for leveraging nuclear power, demonstrated by Amazon’s acquisition of a campus next to the Susquehanna plant and a new joint venture between PPL Corporation and Blackstone to build gas generation for data centers.

- The U.S. Southeast is another target region, with energy companies noting interest to serve up to 4.5 GW of new gas-fired demand for data centers, and utilities like Entergy Louisiana breaking ground on new gas plants specifically for a Meta data center.

Natural Gas Dominates Near-Term Data Center Power Strategy, Nuclear Gains Traction for Long-Term Scale

Natural gas is the commercially mature, go-to technology for immediate on-site power deployment due to its reliability and speed, while advanced nuclear has transitioned from a conceptual goal to a strategic investment focus for long-term, carbon-free baseload power. This two-track approach allows data centers to solve the immediate power crisis while planning for a decarbonized future.

Future Data Centers to Rely on Gas and Nuclear

This chart aligns with the section’s focus on technology strategy, as its description explicitly mentions the future reliance on a mix of energy sources including natural gas and nuclear power.

(Source: Statista)

- During the 2021-2024 period, the prevailing technology strategy focused on procuring off-site renewable energy through massive PPAs, as seen in Microsoft’s 10.5 GW agreement. Nuclear was a passive opportunity, realized by co-locating near existing plants.

- Beginning in 2025, natural gas became the dominant technology for on-site generation to meet urgent power needs. This is confirmed by numerous gigawatt-scale projects announced by Vantage, Applied Digital, Exxon Mobil, and others, all leveraging gas turbines and engines.

- Concurrently, the 2025-2026 period saw a marked acceleration in commitments to nuclear energy. Meta signed deals with Constellation and Vistra for nuclear power, while companies like Crusoe and Terra Power established partnerships to develop data centers powered by next-generation Small Modular Reactors (SMRs).

SWOT Analysis: Data Center Self-Generation Market Dynamics

The strategic pivot to on-site power generation grants data center operators control over their energy supply, a critical strength for ensuring rapid deployment. However, this move also introduces significant new weaknesses and threats related to capital expenditure and fuel-source dependency, while creating major opportunities to drive the commercialization of next-generation clean energy technologies.

- Strengths in speed-to-market and operational reliability are validated by the 33% of new data center projects now planning to build their own power.

- Weaknesses emerge from the shift to high capital expenditures for power plants and exposure to volatile natural gas prices.

- Opportunities are created to act as anchor customers for advanced technologies like SMRs, de-risking their development.

- Threats include potential carbon lock-in from new gas infrastructure, which conflicts with corporate net-zero targets.

Table: SWOT Analysis for Data Center Self-Generation

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Secured large-scale renewable energy supply through PPAs to meet sustainability goals (e.g., Microsoft’s 10.5 GW deal with Brookfield). | Achieved speed-to-market and operational certainty by bypassing multi-year grid queues (e.g., Texas developers building own gas plants). | The primary strength shifted from energy procurement for sustainability to on-site construction for speed and reliability, validating that grid access is now the main bottleneck. |

| Weakness | Dependence on intermittent renewable sources, requiring grid backup and facing increasing grid congestion. | High capital expenditure for building power plants and direct exposure to volatile natural gas fuel markets and supply chains. | The financial model shifted from operational expenses (buying power) to significant capital expenses (building power), introducing new balance sheet risks. |

| Opportunity | Co-location next to existing, large-scale power sources like nuclear plants (e.g., Amazon’s acquisition of Talen’s Cumulus campus). | Acting as an anchor customer to accelerate the commercialization of advanced clean energy like SMRs (e.g., Meta, Crusoe nuclear partnerships). | Tech companies transformed from passive energy buyers into active enablers of next-generation energy technologies, de-risking first-of-a-kind projects. |

| Threat | Grid connection delays and the rising cost of grid upgrades, which stalled project timelines and increased costs. | Carbon lock-in from building new fossil fuel generation, creating a conflict with corporate net-zero commitments and risking stranded assets. | The primary threat evolved from external grid constraints to the internal, self-inflicted risk of dependency on fossil fuels to solve near-term power needs. |

Forward Outlook: Data Centers as Grid-Interactive Energy Hubs

If the current trajectory of on-site generation continues, the critical signal to watch is the evolution of data center campuses from isolated power islands into sophisticated, grid-interactive energy hubs. This development would position them not just as power consumers, but as potential providers of grid stability services, fundamentally altering the traditional utility business model.

AI Data Centers Demand Province-Sized Power

This chart’s comparison of a single AI data center’s power needs to that of an entire province effectively illustrates the massive scale required for data centers to become the grid-interactive hubs envisioned in the forward outlook.

(Source: Orennia)

- Watch for the first operational SMR at a data center campus. Deals announced by Meta, Crusoe, and Terra Power are leading indicators. A successful deployment will validate the nuclear strategy and trigger a new wave of investment.

- Monitor the integration of large-scale Battery Energy Storage Systems (BESS) at on-site power plants. The forecast from UBS of a BESS “boom cycle” driven by data centers suggests a move toward managing on-site power and potentially selling ancillary services back to the public grid.

- Track the regulatory and commercial response from utilities. As data centers become major power generators, traditional utilities will be forced to adapt, viewing these campuses as either large-scale competitors or a new class of sophisticated grid partner.

Frequently Asked Questions

Why are data centers building their own power plants?

Data centers are building their own power plants because traditional grid infrastructure cannot meet the rapid, large-scale power demand driven by AI. Grid connection queues can last for years, so on-site generation provides the speed-to-market and operational certainty that hyperscale developers need.

What type of energy are these data centers using for on-site power?

For immediate power needs, the primary energy source is natural gas, valued for its reliability and rapid deployment. Concurrently, companies are making strategic investments in advanced nuclear, like Small Modular Reactors (SMRs), as a long-term solution for carbon-free baseload power.

How has the investment strategy for data centers changed since 2025?

Before 2025, investments focused on acquiring data center assets with existing power advantages. Since 2025, the strategy has shifted to directly funding the power source itself. Multi-billion dollar partnerships, like the one between ECP and KKR, are now financing entire integrated ecosystems of co-located power plants and data centers.

What are the major risks for data centers that build their own power?

The main risks include high capital expenditures for constructing power plants and direct exposure to volatile natural gas fuel prices. A significant long-term threat is “carbon lock-in” from building new fossil fuel generation, which conflicts with corporate net-zero commitments and risks creating stranded assets.

Which companies are involved in these large-scale data center power partnerships?

The new ecosystem involves strategic alliances between tech giants, energy producers, and investment firms. Key examples from the text include Vantage Data Centers and Liberty Energy; Energy Capital Partners (ECP) and KKR; Google and Next Era Energy; and Blackstone’s joint venture with PPL Corporation.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.