Gridlock 2026: Why Data Centers Now Bypass the Grid for Power

From Grid-Tied to Grid-Independent: How Data Centers Are Redefining Power Sourcing in 2026

The data center industry has executed a strategic pivot from a passive “build-then-connect” model to an active “energy-first” development strategy, driven by untenable multi-year delays for traditional grid interconnection. Faced with a systemic mismatch between exponential digital growth and linear grid development, operators are now aggressively deploying on-site generation and forging direct energy partnerships to secure power and maintain growth trajectories.

- Between 2021 and 2024, the industry focused on quantifying the problem, confirming that interconnection queues had swelled to create average wait times of five years, with extreme cases in constrained markets like Northern Virginia exceeding seven years.

- Starting in 2025, the response shifted from passive waiting to proactive mitigation, marked by a surge in partnerships aimed at bypassing the grid entirely. This transition reflects a recognition that grid-supplied power is no longer a reliable or timely prerequisite for new projects.

- The adoption of on-site generation has reached commercial scale, exemplified by the October 2025 partnership between INNIO and Volta Grid to develop 2.3 GW of power, primarily using natural gas, to directly supply data center campuses and circumvent public utility timelines.

- This trend is reinforced by infrastructure-level collaborations, such as the June 2025 agreement between Eaton and Siemens Energy to create standardized, modular, and grid-independent power solutions, signaling a move toward pre-packaged energy systems that decouple data center deployment from grid availability.

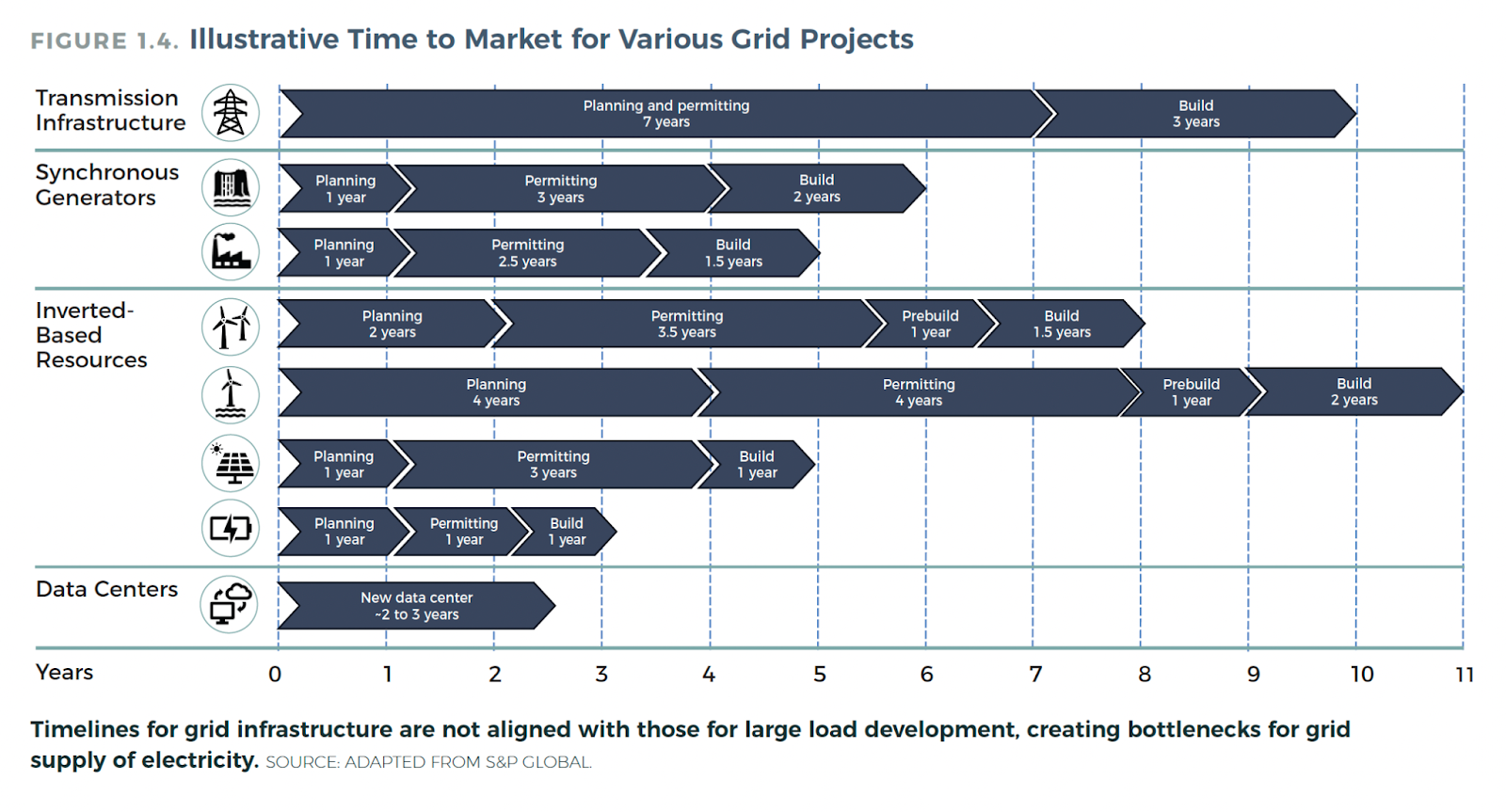

Data Center vs. Grid Build Timelines

This chart perfectly illustrates the section’s core topic of a ‘systemic mismatch’ by comparing the rapid 2-3 year data center construction timeline against the 10-year timeline for new transmission.

(Source: Camus Energy)

Strategic Alliances Powering Data Centers Past the Grid Interconnection Bottleneck

A wave of strategic partnerships in 2025 and early 2026 confirms a decisive industry pivot towards securing dedicated power through direct generation agreements, rendering traditional grid interconnection a secondary and often non-viable option for time-sensitive projects. These alliances are forming across the value chain, uniting data center operators with energy producers and technology providers to create self-sufficient energy ecosystems.

- Large-scale power purchase agreements are becoming standard practice for securing capacity outside of the public grid queue. The January 2026 partnership between Vantage Data Centers and Liberty Energy aims to deliver up to 1 GW in power agreements, enabling Vantage to offer clients predictable power access independent of local utility constraints.

- The focus on on-site generation as a primary power source is now a validated strategy. The INNIO and Volta Grid collaboration to build out 2.3 GW of dedicated power capacity underscores the scale at which operators are willing to invest to achieve energy independence and operational certainty.

- This trend is global, with European operators facing similar grid saturation issues. In June 2025, Cyrus One and E.ON formed a strategic partnership explicitly designed to overcome grid capacity constraints for customers in Europe, indicating that grid bypass is a worldwide response, not a localized one.

- In the United Kingdom, a September 2025 trial between National Grid and Emerald AI demonstrates a parallel effort to make data centers flexible grid assets. However, this strategy aims to optimize existing connections rather than bypass the initial, multi-year wait for one, positioning it as a complementary, longer-term solution.

Table: Key Partnerships Formed to Overcome Grid Connection Delays

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Vantage Data Centers, Liberty Energy | Jan 5, 2026 | Partnership to deliver up to 1 GW of power agreements for Vantage’s end-users, securing large-scale power capacity independent of traditional utility interconnection queues. | Vantage Data Centers and Liberty Energy Announce … |

| INNIO, Volta Grid | Oct 27, 2025 | Collaboration on a 2.3 GW data center power project using on-site generation to provide reliable power and circumvent grid connection delays. | INNIO, Volta Grid Partner on 2.3-GW Data Center Project |

| National Grid, Emerald AI | Sep 15, 2025 | A UK-based demonstration project to test how AI data centers can provide grid flexibility, aiming to optimize power usage once connected rather than bypassing the initial connection. | National Grid and Emerald AI announce strategic … |

| Eaton, Siemens Energy | Jun 3, 2025 | Technology collaboration to accelerate data center deployment with grid-independent energy supplies and standardized modular infrastructure, creating an off-the-shelf bypass solution. | Eaton and Siemens Energy join forces to provide power … |

| Cyrus One, E.ON | Jun 2, 2025 | Strategic partnership to overcome grid capacity constraints for data center customers in Europe, tackling power availability as a primary business challenge. | Cyrus One and E.ON Announce Strategic Partnership to … |

Regional Power Scarcity: How Grid Delays Are Reshaping Global Data Center Locations

Grid connection availability has superseded traditional factors like fiber connectivity and tax incentives as the primary driver of data center site selection, creating a clear geographic divergence. Markets with streamlined grid access are attracting investment, while historically dominant hubs with saturated power infrastructure are experiencing stalled growth and forcing developers to pursue costly bypass strategies.

US Data Center Power Concentrated Geographically

This chart directly supports the section’s focus on ‘geographic divergence’ by showing how data center power capacity is highly concentrated in a few dominant states like Virginia and Texas.

(Source: Bismarck Brief)

- In the U.S., major interconnection zones have become critical bottlenecks. The PJM Interconnection, the nation’s largest grid operator, forecasts data center load to reach 31 GW by 2030 and was forced to pause the review of new connection requests until 2026, effectively freezing development for those reliant on the public grid.

- Northern Virginia, the world’s largest data center market, exemplifies this constraint, with developers facing grid connection wait times exceeding seven years. This has made on-site power generation a baseline requirement for new projects in the region.

- A June 2025 analysis of the European market by Ember highlights a direct correlation between grid connection speed and market growth. Norway, with its faster queues, is experiencing stronger data center investment, while markets like Ireland and the Netherlands, which have placed restrictions on new data centers due to grid strain, are seeing growth stagnate.

- The cost of interconnection is also a regional differentiator. A study of the PJM grid revealed that $4.3 billion in transmission upgrade costs for data centers were passed on to local electricity customers, creating regulatory and social friction that further complicates development in congested areas.

Commercial Scale Bypass: On-Site Generation Becomes the Mature Solution to Grid Connection Failure

The technological response to grid delays has rapidly matured from conceptual studies to commercially deployed, large-scale on-site power generation, establishing it as the primary immediate solution for new data center projects. While grid-supportive technologies are in development, they do not solve the fundamental challenge of securing an initial connection in a timely manner.

On-Site Generation Bridges the Power Gap

This chart visualizes the section’s main point, showing how data centers use supplemental ‘Offgrid Power’—a synonym for on-site generation—to meet peak demand and bypass grid limitations.

(Source: Camus Energy)

- The period between 2021 and 2024 was characterized by industry efforts to diagnose the problem and explore early-stage solutions like load flexibility, which remained largely in pilot phases.

- From 2025 onward, the market validated on-site power, particularly natural gas generation, as a bankable, commercial-scale solution to bypass grid queues. Multi-gigawatt commitments from companies like Vantage, INNIO, and Liberty Energy confirm this shift from a backup power source to a prime power strategy.

- This contrasts with the maturity of load flexibility initiatives like those pursued by Google. While valuable for grid stability, these capabilities require an existing grid connection and do not address the 5-to-10-year delay in obtaining one, positioning them as a post-connection optimization rather than a pre-connection solution.

- The rapid adoption of on-site gas generation, however, introduces a new strategic conflict. It provides speed and reliability but often runs counter to the corporate sustainability goals of hyperscalers and their customers, creating a tension that may accelerate future investment in alternative on-site sources like advanced nuclear or geothermal.

SWOT Analysis: Navigating the Data Center Power Crisis and Grid Connection Challenges

The data center industry’s core strength is its capacity for rapid innovation to engineer around infrastructure constraints, but this agility is directly threatened by the systemic weakness of an aging, slow-to-evolve power grid. The primary opportunity lies in transforming data centers into grid-supportive assets, though the immediate threat is that power scarcity will become the ultimate ceiling on digital economic growth.

- The industry’s key strength has shifted from efficient data center construction to the rapid deployment of sophisticated grid-bypass strategies, including on-site generation and direct power partnerships.

- A significant weakness of this new model is the increased reliance on fossil fuels, particularly natural gas, which can conflict with decarbonization targets and create regulatory risk.

- The most tangible opportunity is for data center operators to form direct partnerships with energy producers, as seen with Vantage and Liberty Energy, to co-develop energy and digital infrastructure, creating a more resilient and predictable model.

- The overriding threat is that the protracted timelines for transmission development, averaging seven to thirteen years, and fragmented regulatory frameworks will remain unresolved, making power availability the definitive bottleneck for the entire AI sector.

Table: SWOT Analysis for Data Center Grid Connection Strategies

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strengths | Recognized and quantified the scale of interconnection delays (5+ year waits). | Rapidly deploying commercial-scale bypass solutions like on-site generation and direct power agreements (Vantage, INNIO). | The industry validated its ability to pivot from grid reliance to an “energy-first” model when faced with untenable delays. |

| Weaknesses | Dependence on slow-moving utility interconnection queues and aging grid infrastructure. | Reliance on natural gas for on-site prime power, creating a conflict with sustainability goals; long lead times for grid equipment (4-8 years for transformers). | The solution to one bottleneck (grid queues) created another (reliance on fossil fuels and exposure to volatile commodity prices). |

| Opportunities | Exploration of data center load flexibility and early-stage grid services. | Formation of large-scale, direct power partnerships (Vantage/Liberty’s 1 GW deal) and co-location with generation. | The market confirmed that creating self-sufficient energy-digital hubs is a bankable, high-growth business model that bypasses public infrastructure limits. |

| Threats | Growing backlog in interconnection queues (reaching 2, 600 GW in the U.S.). | Systemic grid capacity failure in key markets; prohibitive grid upgrade costs (over $240/k W); and fragmented, slow regulatory reform. | The threat evolved from a procedural delay (queue backlog) to a fundamental physical and financial crisis, with power availability becoming the primary constraint on AI growth. |

Forward Outlook: An Energy-First Mandate for Data Center Growth in 2026 and Beyond

If grid modernization and regulatory reform continue at their current linear pace, the “energy-first” model of data center development will become permanently entrenched. This will lead to a fragmented power landscape where digital infrastructure growth is dictated not by public grid availability, but by access to private, dedicated generation, fundamentally altering the economics and geography of the digital economy.

New Grid Transmission Construction Plummets

This chart provides the context for the forward outlook by showing the dramatic decline in grid expansion, illustrating the ‘current linear pace’ that will entrench the ‘energy-first’ data center model.

(Source: Camus Energy)

- If this happens, watch this: Expect an acceleration of projects that co-locate data centers with power generation, moving beyond renewables to include natural gas plants and, in the longer term, advanced nuclear reactors. The success of these initial partnerships will set the template for all major future developments.

- These signals are gaining traction: The recent trend of utility operators like PJM proposing rules to fast-track projects that bring their own generation confirms that the system is beginning to formally favor grid-independent models. This regulatory shift will further incentivize the bypass strategy.

- These signals are losing steam: The notion that data centers can simply wait in interconnection queues for a grid connection is no longer a viable business strategy. Companies without a clear and immediate plan for securing off-grid or dedicated power will be unable to compete on deployment speed.

- This could be happening: The critical bottleneck for AI’s expansion is no longer the availability of specialized silicon but the raw availability of power. This represents a structural shift that will reward energy companies and infrastructure investors who can deliver reliable, large-scale power on timelines that match the speed of digital innovation.

Frequently Asked Questions

Why are data centers no longer just waiting to connect to the power grid?

Data centers are bypassing the grid because traditional interconnection queues have become too long, with average wait times of five years and over seven years in constrained markets like Northern Virginia. The blog post states that this ‘systemic mismatch’ between rapid digital growth and slow grid development makes waiting for a connection commercially non-viable for new, time-sensitive projects.

What are the main strategies data centers are using to secure power independently?

The two primary strategies mentioned are deploying large-scale on-site power generation and forming direct energy partnerships. For example, the INNIO and Volta Grid partnership aims to build 2.3 GW of on-site power, primarily using natural gas. Similarly, Vantage Data Centers partnered with Liberty Energy to secure up to 1 GW in power agreements, bypassing public utility timelines.

Is this grid connection problem specific to the United States?

No, the article highlights this as a global issue. It notes that European operators face similar grid saturation problems, citing a partnership between Cyrus One and E.ON designed to overcome capacity constraints in Europe. Furthermore, it contrasts markets like Norway, which have faster grid access and are attracting investment, with markets like Ireland and the Netherlands, where grid strain is slowing data center growth.

What are the downsides of this new ‘energy-first’ approach?

A significant weakness identified in the SWOT analysis is the increased reliance on fossil fuels, particularly natural gas, for on-site power. This creates a conflict with the corporate sustainability and decarbonization goals of data center operators and their customers. It essentially solves the grid-delay bottleneck by creating a new challenge related to environmental impact and regulatory risk.

What is the difference between ‘on-site generation’ and ‘load flexibility’ strategies?

On-site generation is a strategy to bypass the initial grid connection entirely by producing power directly at the data center campus, as seen with the INNIO/Volta Grid project. It solves the multi-year wait time. Load flexibility, as demonstrated by the National Grid and Emerald AI trial, is a strategy to optimize power usage once a data center is already connected to the grid. It is described as a ‘post-connection optimization’ that does not address the fundamental problem of obtaining the initial connection.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.