US Grid Congestion Hotspots 2026: Why PJM’s Data Center Crisis Defines the New Bottleneck

Commercial Impact of Grid Congestion: Data Center Demand Shifts Hotspot Focus to PJM

The primary driver of acute grid congestion has shifted from geographically dispersed renewable integration challenges, which drove costs in MISO and ERCOT through 2024, to a concentrated demand shock from data centers in PJM’s Northern Virginia corridor, creating a more immediate economic and reliability bottleneck in 2025 and 2026.

- Between 2021 and 2024, the most severe congestion was defined by cost, with MISO experiencing a cost explosion to $5.2 billion in 2022. This was driven by a structural mismatch between remote renewable generation and distant load centers, leading to high curtailment rates for wind power and price spikes during extreme weather like Winter Storm Elliot.

- From 2025 onward, the most critical congestion issue became the unprecedented velocity and geographic concentration of new demand in PJM Interconnection. The surge in electricity consumption from AI data centers in Northern Virginia, the world’s largest data center market, began overwhelming existing transmission capacity and creating multi-year backlogs for new connections.

- This represents a fundamental change in the nature of grid constraint. The problem in MISO and ERCOT was primarily about the difficulty of moving low-cost supply across vast territories. The crisis in PJM is about an overwhelming surge in localized demand that aging infrastructure cannot serve, directly threatening economic development and grid reliability in a core load center.

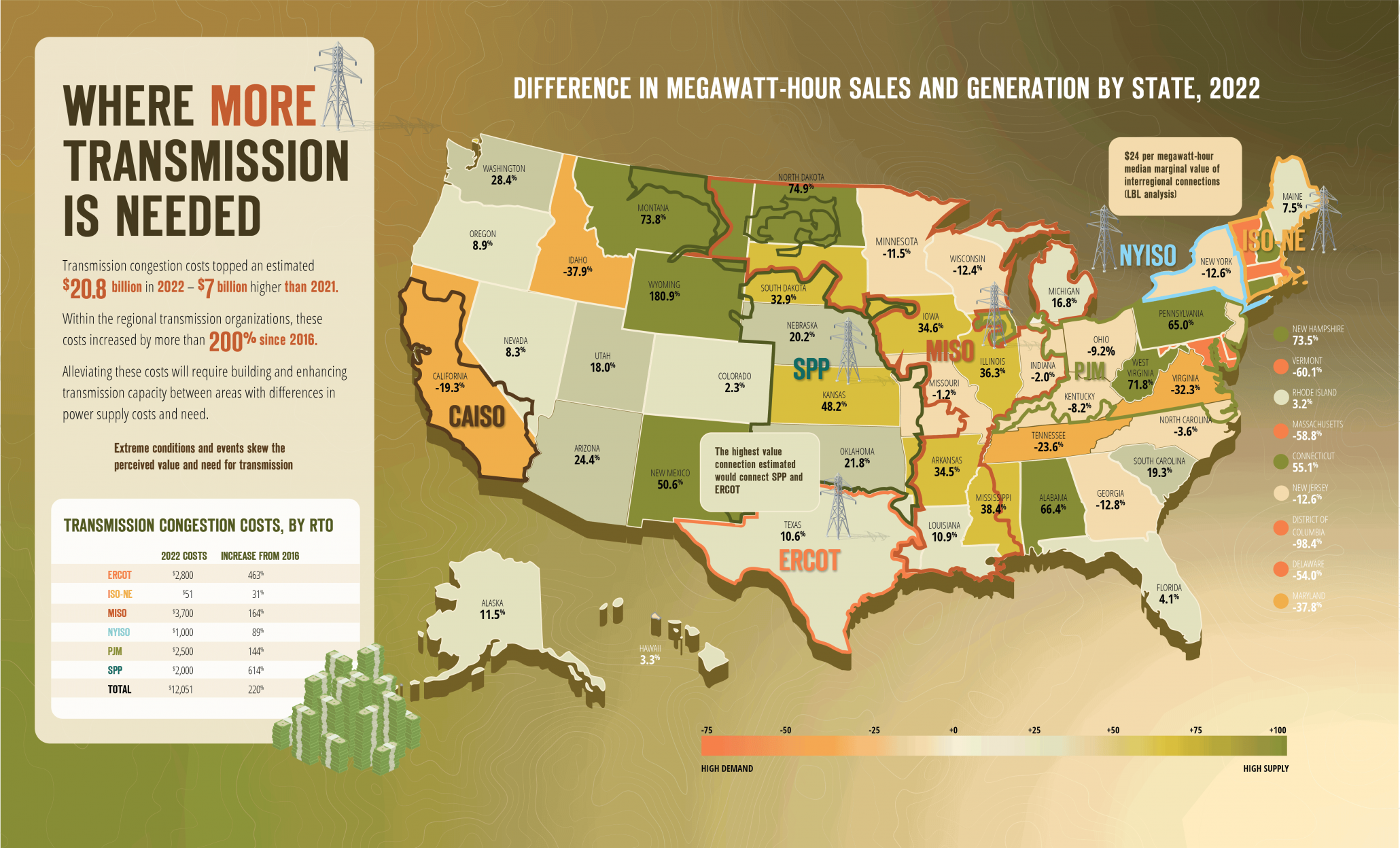

Grid Congestion Costs Exceeded $20B in 2022

This chart quantifies the commercial impact of congestion, highlighting the multi-billion dollar costs in MISO mentioned in the text for the 2022-2024 period.

(Source: American Public Power Association)

Grid Investment Response: Multi-Billion Dollar Plans Target PJM and SPP Congestion

In response to escalating congestion, grid operators initiated major, multi-billion-dollar transmission investment plans in late 2024 and 2025, shifting from reactive cost management to proactive capacity building, with PJM’s plan directly targeting the new data center load crisis.

MISO and West Lead in Planned Transmission

This chart shows the scale of planned transmission projects, directly illustrating the multi-billion dollar grid investment response described in the section for SPP and other regions.

(Source: S&P Global)

- PJM Interconnection approved its largest-ever regional plan in February 2025, a $6.7 billion initiative to build a new 765-k V transmission backbone. This project is a direct response to the demand shock in Northern Virginia and is designed to alleviate critical bottlenecks that delay data centers and offshore wind projects.

- In October 2024, the Southwest Power Pool (SPP) board approved a $7.7 billion transmission expansion plan. This investment targets the “generational challenges” of integrating its vast wind resources, aiming to reduce the high levels of curtailment and congestion that have historically plagued the region.

- These actions follow the model of ERCOT’s historical $6.9 billion Competitive Renewable Energy Zones (CREZ) initiative, which successfully addressed wind-related congestion by adding 3, 600 miles of high-voltage lines. However, the new wave of investment is driven by a more complex mix of renewable integration and extreme load growth.

Table: Major Grid Transmission Investment Plans (2024-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| PJM Regional Transmission Plan | Feb 2025 | A $6.7 billion plan featuring a new 765-k V backbone to relieve severe congestion caused by data center load growth in Northern Virginia and enable new generation connections. | Out of Sync: The Infrastructure Misalignment Undermining … |

| SPP Transmission Expansion | Oct 2024 | A $7.7 billion expansion approved to address systemic congestion from high wind penetration and improve grid resilience against extreme weather events. | SPP OKs $7.7 B transmission plan targeting ‘generational … |

| ERCOT CREZ Initiative | Completed Pre-2025 | A $6.9 billion historical project that added 3, 600 miles of transmission to connect remote wind generation in West Texas to major load centers, serving as a model for large-scale infrastructure response. | Congestion isn’t good for anyone, especially the electric grid |

Geographical Hotspots: PJM Overtakes MISO as the Epicenter of US Grid Congestion

The geography of critical grid congestion has concentrated from the broad plains of MISO and SPP to the Mid-Atlantic, specifically PJM’s Northern Virginia load pocket, representing a shift from a rural generation-based problem to an urban demand-driven one.

Map Delineates Key US Grid Regions

This map provides essential geographical context by showing the boundaries of PJM, MISO, and SPP, helping the reader visualize the geographical hotspots discussed.

(Source: EPA)

- Between 2021 and 2024, the most congested areas were vast geographical regions like MISO and SPP, along with West Texas in ERCOT. The challenge was transmitting power from areas with high concentrations of wind and solar generation across hundreds of miles to population centers, resulting in high costs and curtailment.

- Beginning in 2025, the epicenter of the congestion crisis shifted decisively to PJM Interconnection. The problem is now hyper-localized in the Northern Virginia suburbs, the world’s largest data center market, where extreme demand growth is overwhelming the regional grid infrastructure.

- This geographical shift changes the strategic challenge. The MISO/SPP problem required building long-haul transmission lines to move supply. The PJM problem requires reinforcing and rebuilding the regional grid to handle a level of concentrated demand it was never designed for, creating a critical bottleneck for one of the nation’s most important economic zones.

Grid Modernization Maturity: From Legacy Lines to GETs and Advanced Backbones

The approach to mitigating grid congestion is evolving from a near-exclusive reliance on long-lead-time transmission builds to a dual strategy that incorporates rapidly deployable Grid-Enhancing Technologies (GETs) to maximize existing asset capacity while major new infrastructure projects are developed.

Map Visualizes Grid Congestion and Upgrade Needs

This chart’s focus on required capacity upgrades visually supports the section’s discussion on grid modernization and the technologies needed to alleviate congestion.

(Source: Nature)

- The core technology for solving congestion, new high-voltage transmission lines, is mature but faces a critical deployment bottleneck, with permitting and construction often taking over a decade. This is validated by the fact that the U.S. built only 55 miles of new high-voltage capacity in 2023 while thousands of generation projects were stuck in queues.

- In the period from 2025 onward, Grid-Enhancing Technologies (GETs) have emerged as a commercially proven, near-term solution. Pilot projects and early deployments demonstrated significant impact, such as Alliant Energy reducing congestion by 49% and delivering $24 million in savings, proving GETs can unlock capacity on existing wires in months, not years.

- The long-term strategy, confirmed by PJM’s plan for a new 765-k V backbone, remains large-scale infrastructure builds. The industry now recognizes a two-pronged approach is necessary: using GETs for immediate relief and high-return optimization, while simultaneously undertaking the multi-year process of building new, high-capacity transmission corridors.

SWOT Analysis: Navigating US Grid Congestion Risks and Opportunities

The strategic landscape for grid infrastructure has pivoted from managing the economic fallout of renewable curtailment to confronting an acute, localized demand shock in PJM, creating new urgency and opportunities for both targeted infrastructure investment and grid modernization technologies.

Summer Power Grid Risk Areas Identified

This map shows grid regions at risk, directly aligning with the ‘Risks and Opportunities’ theme of the section’s SWOT analysis.

(Source: Yahoo)

- The primary threat has shifted from managing intermittent supply to accommodating explosive, concentrated demand.

- This shift has validated the business case for a dual-track approach: rapidly deploying Grid-Enhancing Technologies (GETs) for near-term relief while initiating long-lead-time, multi-billion-dollar transmission projects.

- Federal funding through programs like the $10.5 billion GRIP Program provides a powerful tailwind for both technology classes.

Table: SWOT Analysis for US Grid Congestion

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Abundant, low-cost renewable resources in MISO, SPP, and ERCOT. Established market mechanisms to price and manage congestion. | Proven ability to finance and approve large-scale transmission projects (PJM’s $6.7 B plan, SPP’s $7.7 B plan). Growing political and regulatory will to address the crisis. | The scale of the problem is now met with concrete, large-scale investment commitments, moving from analysis to action. |

| Weaknesses | Aging infrastructure and slow transmission build-out (only 55 miles of HV lines in 2023). Growing renewable curtailment, especially for wind in MISO and SPP. | Severe interconnection queue backlogs (PJM paused new requests). Extreme demand forecasts from data centers continuously outpace planning. Long lead times for critical components like transformers. | The weakness shifted from a general infrastructure deficit to an acute inability to respond to the velocity of demand growth in specific economic zones, exposing the limitations of current planning cycles. |

| Opportunities | Deploying battery storage to absorb excess renewables. Early-stage pilots of Grid-Enhancing Technologies (GETs). | Massive commercial market for GETs as a rapid, cost-effective solution (e.g., Alliant Energy’s 49% congestion reduction). A projected $1.4 trillion utility spending cycle from 2025-2030. Federal funding from the DOE’s $10.5 B GRIP Program. | The business case for GETs was validated, moving from niche pilots to a mainstream solution for near-term capacity gains. The scale of projected investment creates a “super-cycle” for grid suppliers. |

| Threats | Extreme weather events (Winter Storm Elliot) causing massive cost spikes. Economic losses from being unable to deliver low-cost power. | Unprecedented demand shock from AI and data centers overwhelming grid operators, particularly in PJM. Delays in new infrastructure risk stalling economic development. Grid reliability failures in critical load centers. | The primary threat is no longer just high costs; it is now the physical inability of the grid to support economic growth and maintain reliability in the face of a demand profile that did not exist a few years ago. |

2026 Outlook: PJM’s Data Center Demand Test and the Rise of GETs

If the velocity of data center demand in PJM continues to outpace planned transmission upgrades, watch for increased use of emergency grid actions and a significant acceleration in the regulatory approval and commercial deployment of Grid-Enhancing Technologies (GETs) as a critical stopgap measure.

- The most critical signal to monitor is PJM’s quarterly load forecast updates for Northern Virginia. If these forecasts continue to be revised upwards at a rapid pace, it confirms that even the newly approved $6.7 billion transmission plan may be insufficient or too slow, increasing pressure for faster solutions.

- Watch the commercial adoption of GETs by utilities within PJM and MISO. An increase in large-scale deployments beyond pilots, driven by state-level regulatory incentives and proven savings like those reported by Alliant Energy, will signal a market-wide strategic shift toward maximizing existing assets.

- Monitor progress on interconnection queue reform within PJM. Any breakthrough that expedites the connection of new generation, particularly offshore wind and solar-plus-storage projects, will be a key indicator of whether the supply side can be scaled to meet the demand shock without creating new downstream congestion.

Frequently Asked Questions

Why is PJM suddenly considered the main grid congestion hotspot?

PJM, specifically its Northern Virginia corridor, has become the epicenter of grid congestion due to an unprecedented and geographically concentrated demand shock from AI data centers. Unlike previous issues in MISO and ERCOT driven by integrating remote renewable energy, PJM’s problem is that this massive, localized surge in electricity consumption is overwhelming the existing infrastructure’s ability to serve a core economic zone.

What is being done to fix the grid congestion in PJM and other areas?

Grid operators are launching major, multi-billion-dollar transmission investment plans. In February 2025, PJM approved a $6.7 billion plan to build a new high-voltage backbone specifically to address the data center load. Similarly, in October 2024, SPP approved a $7.7 billion expansion to better integrate its wind resources and improve resilience.

The article mentions ‘Grid-Enhancing Technologies’ (GETs). What are they and why are they important?

Grid-Enhancing Technologies (GETs) are modern solutions that help maximize the capacity of existing power lines. They are important because they can be deployed in months, not the decade-plus it takes to build new transmission lines. As highlighted by Alliant Energy’s success in reducing congestion by 49%, GETs offer a rapid, cost-effective way to provide immediate relief while larger infrastructure projects are being developed.

How is the congestion problem in PJM different from the issues previously seen in Texas (ERCOT) and the Midwest (MISO)?

The nature of the problem has fundamentally changed. In MISO and ERCOT, the challenge was primarily a supply-side issue: how to move low-cost wind and solar power from remote, rural areas to distant cities. The new crisis in PJM is a demand-side issue, driven by an overwhelming surge in power consumption in a concentrated urban and suburban area that the existing grid was never designed to handle.

What is the biggest risk for the U.S. grid in 2026 according to the analysis?

The biggest risk for 2026 is that the speed of data center demand growth in PJM’s Northern Virginia area will continue to outpace the construction of planned transmission upgrades. If this happens, it could lead to emergency grid actions to maintain reliability and will likely force a rapid acceleration in the adoption of Grid-Enhancing Technologies (GETs) as a necessary stopgap measure.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.