Grid Interconnection Delays 2026: Why a 2, 600 GW Backlog Threatens U.S. Energy and Economic Growth

Project Risks Escalate as Grid Interconnection Delays Become the Primary Barrier to Deployment

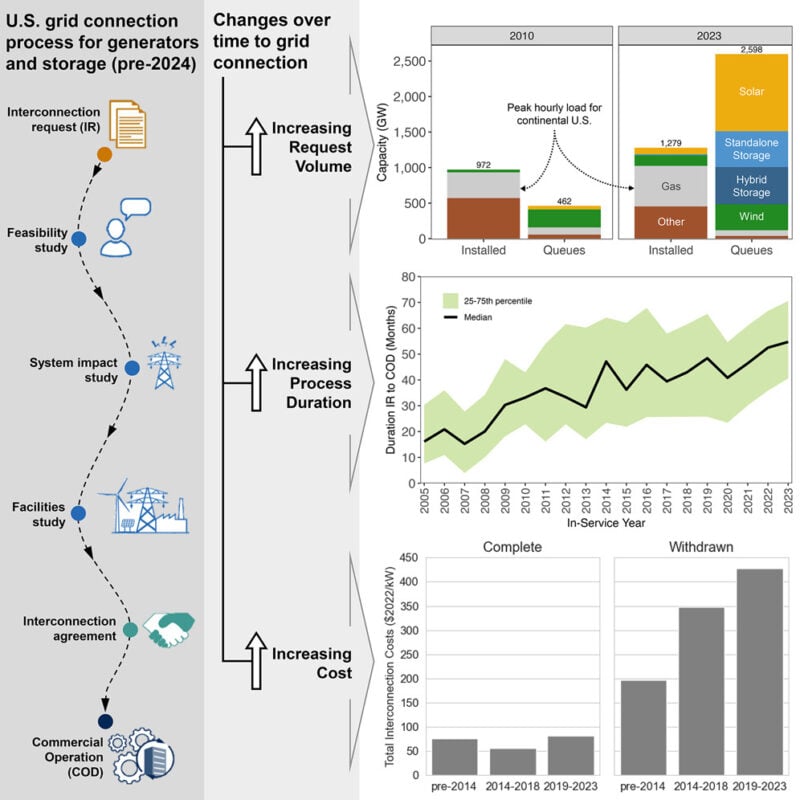

Grid interconnection delay has transitioned from a manageable project risk into the single greatest structural impediment to deploying new energy and data center capacity in the United States. The shift between 2021 and today is stark: what was a growing administrative backlog has become a multi-year, gigawatt-scale market failure, defined by soaring wait times and unsustainable project attrition rates that threaten national energy and economic goals.

- Between 2021 and 2024, the U.S. interconnection queue ballooned from 1, 400 GW to over 2, 000 GW, with average wait times extending to four years. This period established the scale of the problem as demand from solar, wind, and storage projects overwhelmed legacy “first-come, first-served” study processes.

- From 2025 to today, the crisis has intensified, with the queue swelling to 2, 600 GW and the median time to commercial operation approaching five years. The problem’s scope now explicitly includes high-growth sectors, with companies like Google reporting potential transmission grid connection delays of up to 12 years for new data centers.

- Project viability has deteriorated significantly, with withdrawal rates reaching nearly 80% for projects entering the queue in the current environment. This contrasts with a historical completion rate of 20% for projects entering between 2000 and 2018, signaling that the queue is no longer a functioning process but a primary driver of project failure.

US Grid Delays, Costs, and Queues Explode

This infographic quantifies the escalating crisis described in the section, showing the stark increase in project wait times, queue volume, and costs that define the current market failure.

(Source: PV Tech)

Project Cancellations and Financial Strain Driven by Soaring Interconnection Costs and Uncertainty

The dysfunctional interconnection process directly causes high rates of project cancellation by imposing unpredictable, multi-year delays and assigning prohibitive upgrade costs that destroy project economics. This financial strain has moved beyond developer balance sheets to inflict billions of dollars in direct costs on consumers and represents a massive loss of economic benefits from delayed infrastructure investment.

Grid Project Withdrawals Spike Amidst Persistent Backlogs

This chart directly illustrates the section’s focus on high project cancellation rates by showing the significant recent increase in withdrawn generation capacity due to delays and costs.

(Source: Wood Mackenzie)

Table: Economic Impact and Financial Strain from U.S. Grid Interconnection Delays (2025)

| Impact Area | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Consumer Cost Increases | 2025 | In the PJM market, the failure to connect new, cheaper generation resources cost consumers an estimated $7 Billion in a single capacity auction, demonstrating the direct financial penalty of the backlog. | Faulty Interconnection Processes Costing PJM Consumers … |

| Project Withdrawal Rates | 2025 | Nearly 80% of new generation projects withdraw from the queue before completion. This attrition rate is driven by interconnection costs that can represent 30-37% of total project costs for withdrawn projects, compared to 6-8% for completed ones. | 80% of energy projects withdraw from “inefficient” US grid … |

| Investment Inefficiency | 2025 | For every $1 billion in transmission investments that is delayed, consumers lose between $150 million and $370 million in net benefits per year of delay. This quantifies the opportunity cost of failing to build new transmission capacity. | Transmission Delays Mean Higher Costs for Customers … |

| Data Center Expansion Risk | 2025 | The International Energy Agency (IEA) estimates that 20% of planned data center projects globally are at risk of significant delays due to grid congestion, highlighting the threat to digital infrastructure growth. | Report: Global grid congestion risks 20% of data center … |

Regulatory and Industry Alliances Form to Overhaul Failed Interconnection Processes

The severity of the interconnection bottleneck has forced collaborations between federal regulators, grid operators, and industry stakeholders to reform outdated queue management systems. These partnerships have shifted from theoretical discussions prior to 2024 to the mandated implementation of new processes and technologies starting in 2025, signaling a systemic, albeit overdue, response to the crisis.

Table: Key Partnerships and Reforms Targeting Grid Interconnection Delays

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| FERC and PJM | July 2025 | The Federal Energy Regulatory Commission (FERC) ordered PJM to incorporate the evaluation of Grid-Enhancing Technologies (GETs) in its interconnection studies. This collaboration forces the grid operator to consider solutions that maximize existing infrastructure capacity before requiring costly upgrades. | FERC orders changes to PJM’s grid interconnection … |

| PJM Interconnection | August 2025 | PJM transitioned its interconnection process from a serial, “first-come, first-served” model to a “first-ready, first-served” cluster study approach. This reform aims to process ready-to-build projects in groups, with a goal of reducing new agreement timelines to one to two years. | PJM Announces Application Deadline for First Cycle … |

| CAISO | August 2025 | The California ISO (CAISO) launched its 2025 Interconnection Prioritization Process. This initiative aims to streamline its queue by prioritizing projects that are most advanced in their development, a strategic shift to clear its own significant backlog. | CAISO’s Interconnection Prioritization Process 2025 |

| U.S. Department of Energy (DOE) | January 2025 | The DOE released its Distributed Energy Resource Interconnection Roadmap through the i 2 X initiative. This sets aggressive targets, such as processing large systems (>5 MW) in less than 140 days, creating a federal benchmark for performance. | DOE Distributed Energy Resource Interconnection Roadmap |

Geographic Spread of Grid Interconnection Delays Reveals a Global Infrastructure Deficit

The grid interconnection crisis, once perceived as a regional issue confined to specific U.S. grid operators, is now understood as a global structural deficit in transmission capacity. While U.S. backlogs were the primary focus between 2021-2024, data from 2025 confirms that similar bottlenecks are stalling gigawatts of projects across Europe and other developed economies, indicating a worldwide failure to align grid infrastructure investment with decarbonization and electrification goals.

US Grid Queues Overwhelmed by Renewable Gigawatts

This chart visualizes the national scale of the problem across major U.S. grid operators, supporting the section’s argument about the issue’s broad geographic spread beyond a single region.

(Source: Reuters)

- In the U.S., the crisis is concentrated within organized markets, with operators like PJM and CAISO facing the largest backlogs and implementing the most aggressive reforms. The total U.S. queue of 2, 600 GW in 2025 remains the largest and most well-documented example of the global problem.

- Europe’s situation is now recognized as equally severe, with a reported 1, 700 GW of renewable energy projects delayed in grid connection processes as of 2025. This demonstrates that the issue is not unique to the U.S. regulatory model but is a widespread consequence of insufficient transmission planning.

- Globally, over 3, 000 GW of renewable energy projects are estimated to be stuck in interconnection queues. This figure validates that inadequate grid capacity is a worldwide constraint on the energy transition, not a series of isolated national problems.

Solutions to Grid Interconnection Delays Mature from Process Tweaks to Mandated Technologies

The approach to solving grid interconnection delays has matured from incremental process adjustments to the mandated adoption of new planning methodologies and advanced technologies. The period from 2021-2024 was characterized by analysis of the problem, whereas the period from 2025 onward is defined by regulatory action to deploy scalable solutions, including cluster studies and Grid-Enhancing Technologies (GETs), as a commercial necessity.

Flexible Interconnection Model Bypasses Grid Delays

This diagram presents a clear technological solution, matching the section’s theme of maturing solutions that move beyond simple process tweaks to include new mandated technologies.

(Source: Camus Energy)

- From 2021 to 2024, solutions focused on analyzing the flaws of the “first-come, first-served” serial study process and the potential benefits of GETs. These technologies and methods remained largely in pilot or discussion stages, not yet adopted as standard practice by grid operators.

- Beginning in 2025, solutions have achieved commercial-scale implementation driven by regulatory mandate. Both PJM and CAISO have formally abandoned serial studies in favor of cluster-based “first-ready, first-served” models, representing a fundamental shift in processing methodology.

- FERC’s 2025 order requiring PJM to evaluate GETs marks a critical validation point for technology-based solutions. This compels operators to use software and hardware to optimize the existing grid, a faster and cheaper alternative to relying solely on new construction, with companies like Grid Unity providing AI platforms to accelerate the underlying studies.

- Alternative strategies are also gaining commercial traction as a direct response to queue dysfunction. These include behind-the-meter (BTM) generation to bypass the grid entirely and flexible interconnection agreements that allow faster connection in exchange for operational constraints.

SWOT Analysis of Grid Interconnection Dynamics

The interconnection landscape is defined by the tension between overwhelming demand and inadequate infrastructure, with recent reforms offering a path forward but facing immense execution risk. The core challenge has shifted from managing a queue to rebuilding an entire paradigm for transmission planning and investment.

Table: SWOT Analysis for Grid Interconnection Delay

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | A massive pipeline of renewable and storage projects (1, 400+ GW) indicated strong developer interest and a healthy market for new generation. | Unprecedented demand from both clean energy (2, 600 GW queue) and high-growth sectors like data centers validates the critical need for massive grid expansion. | The strength of the project pipeline has now become a stress test that has broken the existing system, making the case for urgent, large-scale transmission investment undeniable. |

| Weaknesses | Inefficient “first-come, first-served” serial study processes, aging grid infrastructure, and speculative projects clogging the queues. | A systemic failure defined by a 2, 600 GW backlog, 5-12 year wait times, and a nearly 80% project withdrawal rate. Inadequate transmission capacity is the core weakness. | The weakness has been validated as the primary structural barrier to the energy transition. The problem is no longer just procedural but a fundamental lack of physical grid capacity. |

| Opportunities | Proposals for regulatory reform (leading to FERC Order No. 2023) and initial discussions around using Grid-Enhancing Technologies (GETs). | Mandated queue reforms (cluster studies at PJM, CAISO), regulatory orders to evaluate GETs, and the deployment of AI-powered study software are now active. | The opportunity has moved from discussion to implementation. Reforms and new technologies are no longer theoretical options but are being actively deployed to address the crisis. |

| Threats | Rising interconnection costs, project delays, and the risk of hindering clean energy goals. | Direct economic damage, including billions in consumer costs ($7 B in PJM), jeopardized climate targets, and a direct threat to the digital economy (Google warning). | The threats have fully materialized. The interconnection bottleneck is now causing measurable financial harm to consumers and actively stifling economic growth in key sectors. |

Scenario Modeling: Proactive Transmission Build-Out vs. Incremental Reform

If federal and state policymakers fail to enable a proactive, large-scale transmission build-out that anticipates future demand, then the current process reforms at grid operators will prove insufficient to clear the backlog. This will stall the U.S. energy transition and constrain digital economic growth. The signals to watch are not just reformed queue timelines but the actual pace of new high-voltage transmission construction.

Solar and Storage Dominate 2024 Grid Additions

This forward-looking chart shows the projected near-term build-out, providing a data-driven baseline for the section’s scenario modeling of what happens with or without a proactive transmission build-out.

(Source: Clean Power Research)

- Watch this: The execution of the new “first-ready, first-served” cluster studies at PJM and CAISO. A key signal will be whether these new processes can issue Interconnection Service Agreements (ISAs) within the one-to-two-year target and successfully reduce project withdrawal rates.

- Watch this: The deployment of Grid-Enhancing Technologies (GETs) and AI-powered study platforms. Traction is confirmed if these technologies are shown to reduce the scope and cost of physical network upgrades for projects in the initial study clusters, accelerating their path to construction.

- These could be happening: Despite process reforms, the total queue capacity continues to grow as new demand from data centers and electrification outpaces the rate of project completion. Wait times for projects requiring significant transmission upgrades, particularly those cited by companies like Google, remain in the 5-10 year range, indicating that process fixes cannot solve a physical capacity deficit.

- These could be happening: The primary bottleneck shifts from the study process to permitting and supply chains for physical infrastructure like high-voltage transformers. Even with faster study approvals, projects remain stalled, validating the analyst view that a national commitment to building a larger grid, not just managing its queue, is the only long-term solution.

Frequently Asked Questions

How large is the U.S. grid interconnection backlog in 2026 and how long are the delays?

As of 2026, the U.S. interconnection queue has swelled to a 2,600 GW backlog. The median wait time for a project to reach commercial operation is approaching five years, with some sectors like data centers facing potential delays of up to 12 years.

Why are so many energy projects withdrawing from the queue?

Nearly 80% of new projects withdraw primarily due to unpredictable, multi-year delays and prohibitively high grid upgrade costs. For withdrawn projects, these interconnection costs can account for 30-37% of the total project budget, destroying their financial viability.

How do these grid delays directly impact consumers?

The delays have significant financial consequences for consumers. For example, the failure to connect new, cheaper generation resources in the PJM market cost consumers an estimated $7 billion in a single capacity auction. Delays in transmission investment also translate to lost net benefits of $150 million to $370 million per year for every $1 billion of delayed investment.

What are the key reforms being implemented to address the interconnection crisis?

Grid operators like PJM and CAISO are replacing the old “first-come, first-served” system with a “first-ready, first-served” cluster study approach to process projects in groups. Additionally, federal regulators (FERC) are now mandating that grid operators evaluate Grid-Enhancing Technologies (GETs) to maximize the capacity of existing infrastructure before requiring costly new construction.

Is the grid interconnection backlog just a U.S. problem?

No, this is a global infrastructure deficit. While the U.S. queue is 2,600 GW, Europe has a reported 1,700 GW of renewable projects delayed. Globally, it’s estimated that over 3,000 GW of projects are stuck in similar queues, highlighting a worldwide failure to align grid investment with energy and economic goals.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.