Fuel Cell Cost Per Megawatt in 2026: Why Policy and Data Centers Are Unlocking Commercial Scale

From Pilots to Power Plants: Fuel Cell Adoption Reaches Megawatt-Scale

Commercial adoption of fuel cells has decisively shifted from broad, research-led pilots to targeted, megawatt-scale deployments driven by specific high-value markets, particularly data centers. This transition marks a critical move from chasing theoretical cost targets to executing commercially viable projects where the technology’s unique attributes, supported by policy, justify its current cost structure.

- Between 2021 and 2024, market analysis focused on general growth projections, such as the stationary fuel cell market reaching $9.0 billion by 2031, and cost reduction targets set by organizations like the DOE aiming for $650/k W. This period was characterized by technology development and a diverse but fragmented application landscape.

- Starting in 2025, the focus pivoted to concrete commercial agreements for large-scale power generation. Landmark announcements include Fuel Cell Energy and Sustainable Development Capital’s letter of intent for up to 450 MW for data centers and American Electric Power’s agreement to purchase up to 1 GW of fuel cells from Bloom Energy, signaling a new phase of industrial-scale demand.

- The range of applications has consolidated around use cases where reliability and clean power are paramount. While earlier periods saw development across many sectors, the 2025-2026 data shows a clear focus on data center power, utility grid support, and industrial combined heat and power (CHP), as seen in the 7.4 MW Hartford grid project and the 9.6 MW Bridgeport CHP project.

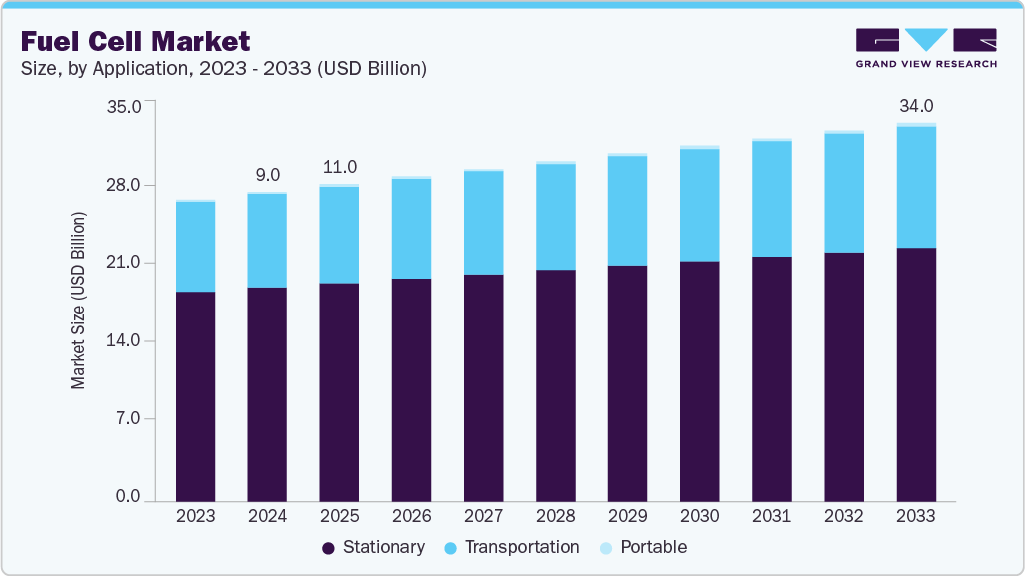

Fuel Cell Market Forecasted to Reach $34B

This chart illustrates the projected market growth, with the stationary segment’s dominance supporting the article’s point about a shift to megawatt-scale power plant deployments.

(Source: Grand View Research)

Investment Shifts from R&D Funding to Firm Offtake Contracts

Capital is now being deployed to underwrite large-scale commercial offtake agreements rather than funding speculative technology development, a clear signal that investors require revenue certainty to de-risk manufacturing investments. This shift from venture-style funding to project finance and corporate procurement validates the technology’s bankability in specific, policy-supported applications.

- In January 2025, Fuel Cell Energy secured a $160 million contract for a 7.4 MW baseload power plant in Hartford, Connecticut. This project-specific financing, tied to a direct grid need, represents a move toward mature asset development.

- The agreement between AEP and Bloom Energy in November 2024 for up to 1 GW of fuel cells to power data centers is a defining moment. This large-scale procurement commitment provides the demand visibility needed to justify investments in expanded manufacturing capacity.

- In 2021, Daroga Power closed a $230 M fund to deploy 32.85 MW of Bloom Energy systems, an earlier example of financing a portfolio of smaller distributed projects. The newer, larger deals of 2025-2026 indicate a significant increase in the scale and concentration of capital deployment.

Table: Key Financial Commitments and Fuel Cell Project Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy / Sustainable Development Capital (SDCL) | Jan 2026 | A non-binding LOI for up to 450 MW of deployments. This represents a pipeline of projects targeting the high-growth AI data center market, signaling massive potential investment if converted to firm orders. | Fuel Cell Energy, SDCL plan up to 450 MW data center power |

| Fuel Cell Energy / Hartford, CT Grid Support | Jan 2025 | A $160 million contract to build a 7.4 MW plant. This is a direct investment in grid infrastructure, validating the technology for reliable, Class 1 renewable baseload power. | Fuel Cell Energy Announces $160 Million Contract to Support … |

| AEP / Bloom Energy | Nov 2024 | An offtake agreement for up to 1 GW of fuel cells. This long-term utility procurement de-risks manufacturing scale-up for Bloom Energy and provides a clear path to market for data center power solutions. | AEP, Bloom Energy 1-GW fuel cell deal to power data … |

| Daroga Power / Bloom Energy | Aug 2021 | A $230 M fund to deploy 32.85 MW of SOFC systems. This represents an earlier financing model focused on deploying a distributed fleet of assets, contrasting with the larger, centralized projects seen more recently. | Daroga Power closes $230 M fund, will deploy 32.85 MW … |

Partnerships Target High-Value Niches, Driving Fuel Cell Cost Viability

Strategic alliances have evolved from general technology advancement to targeting specific, high-margin end markets where fuel cells offer a distinct advantage. Collaborations now focus on solving immediate customer problems, such as rapidly deploying power for AI data centers or capturing industrial carbon emissions, thereby creating a commercial pull that justifies the current fuel cell cost per megawatt.

- The July 2025 collaboration between Oracle and Bloom Energy aims to deliver onsite power to data centers with a 90-day deployment target. This partnership directly addresses the critical constraint of long grid connection lead times for the rapidly expanding AI sector.

- Fuel Cell Energy’s ongoing joint development agreement with Exxon Mobil, updated in May 2025, is focused on using carbonate fuel cells for carbon capture. This positions the technology as a dual-purpose industrial solution, generating power while reducing emissions, creating an additional value stream.

- These targeted partnerships contrast with the broader market-building activities of the 2021-2024 period. The current collaborations are designed to secure anchor customers in nascent, high-growth segments, establishing a foothold that can be expanded as costs decline.

Table: Strategic Fuel Cell Partnerships and Alliances

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 2026 | Partnership to develop up to 450 MW of projects for AI data centers. This alliance combines technology provision with specialized project financing to unlock a massive target market. | Fuel Cell Energy Data Center Push: What the 450 MW Plan … |

| Oracle & Bloom Energy | Jul 2025 | Collaboration to provide rapidly deployable onsite power for Oracle’s AI data centers. The strategic purpose is to circumvent grid delays and provide reliable, clean power at the speed required by AI infrastructure growth. | Oracle and Bloom Energy Collaborate to Deliver Power … |

| Exxon Mobil & Fuel Cell Energy | May 2025 | Joint development agreement to advance carbonate fuel cell technology for industrial carbon capture. This partnership seeks to create a new market for fuel cells as an integrated emissions reduction and power generation technology. | Reducing emissions with carbon capture and storage |

United States Emerges as the Epicenter for Fuel Cell Growth and Cost Reduction

The United States, particularly due to the Inflation Reduction Act (IRA), has become the primary geography for megawatt-scale fuel cell deployment, creating a concentrated market where projects can achieve financial viability despite a high underlying cost per megawatt. This policy-driven momentum is attracting capital and driving a localized surge in demand that is not yet replicated globally.

- Between 2021 and 2024, market reports described North America as a significant but broadly growing market, with a projected 8.1% CAGR. The focus was on general market size rather than specific project hotspots.

- From 2025 onward, the data reveals a concentration of major projects in the U.S. The 7.4 MW project in Hartford, Connecticut, and the 9.6 MW project in Bridgeport, Connecticut, are direct beneficiaries of a favorable state and federal policy environment.

- The IRA’s Investment Tax Credit (ITC), which can reduce a project’s capital cost by 30% or more, is the key enabler. For a project with a CAPEX of $7 million per MW, this incentive provides a $2.1 million per MW reduction, fundamentally altering the investment case and making the U.S. the most attractive market for near-term deployment.

Technology Maturity: Validated for Niche Markets, Not Mass-Market Cost Parity

Fuel cell technology has achieved commercial maturity for specific high-value applications, a shift from its earlier status as a technology chasing long-term, mass-market cost targets. The recent wave of deployments validates that fuel cells are technically and commercially ready for niches where policy support and unique value propositions, like grid-independent power, outweigh the high unsubsidized capital cost.

- In the 2021-2024 period, the focus was on achieving future cost goals, such as the DOE’s target of $650/k W for PEM systems at massive scale. The technology’s maturity was measured against these forward-looking, high-volume manufacturing scenarios.

- The 2025-2026 data demonstrates a different kind of maturity: commercial readiness at current costs. Projects are proceeding with a reported CAPEX of $6, 639 – $7, 224 per kilowatt because incentives like the IRA’s 30% ITC make the economics viable for customers like data centers and utilities.

- This validation in premium markets is a critical step. It allows manufacturers to generate revenue, scale production, and progress down the cost curve through real-world deployment experience, rather than relying solely on R&D and theoretical models. The success of these initial large-scale projects is the true test of the technology’s commercial maturity.

SWOT Analysis: Fuel Cell Market Dynamics and Cost Trajectory

The strategic position of fuel cells has fundamentally improved, as powerful external opportunities like the U.S. Inflation Reduction Act and soaring data center power demand are now directly mitigating the technology’s primary weakness of high capital cost. This shift enables companies to leverage their strengths in providing reliable, clean power to capture immediate commercial traction, validating the technology long before it achieves unsubsidized cost parity with conventional generation.

- Strengths in clean, reliable, and rapidly deployable power are being monetized in high-value niches.

- Weaknesses related to high CAPEX are being directly addressed by government incentives, making projects bankable.

- Opportunities in data center power demand and decarbonization policy are creating unprecedented market pull.

- Threats remain centered on the long-term cost of hydrogen and the potential for policy changes.

Table: SWOT Analysis for Fuel cell cost per megawatt

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High efficiency and low emissions were recognized but lacked a strong commercial pull. Value proposition was largely theoretical for large-scale applications. | Clean, baseload power is now a key selling point for grid support (Hartford 7.4 MW project) and data centers (Oracle/Bloom Energy collaboration). Rapid deployment capability is a critical advantage. | The value of reliable, grid-independent power has been validated by the massive, urgent demand from the AI data center sector, turning a technical feature into a decisive commercial advantage. |

| Weaknesses | High CAPEX (e.g., $6, 996-$7, 603/k W EIA estimate) and a high LCOE ($288-$875/MWh) were primary barriers to adoption. The industry was focused on R&D to solve this internally. | High CAPEX ($6, 639-$7, 224/k W) persists but is being directly mitigated by the U.S. IRA’s 30% Investment Tax Credit, making projects financially viable. | The problem of high cost has been temporarily resolved by external policy intervention. This shifts the immediate challenge from pure cost reduction to successful project execution and securing subsidies. |

| Opportunities | Market growth was projected based on general decarbonization trends and hydrogen economy development, with CAGRs forecast between 13% and 21%. | The explosive growth of AI-driven data centers created a massive, urgent need for power, perfectly aligning with fuel cell strengths. The Fuel Cell Energy/SDCL 450 MW LOI is a direct result. | A specific, urgent, and well-funded market (AI data centers) emerged, providing a powerful demand signal that was absent in earlier, more generalized forecasts. |

| Threats | The high cost of green hydrogen ($4.5-$6.5/kg) and competition from cheaper technologies like natural gas turbines were significant commercial hurdles. | The high LCOE remains a threat, but it is now competitive in the peaker plant market ($150-$300/MWh). The primary threat is now policy risk, i.e., the potential sunset of the IRA subsidies that make projects viable. | The key risk has shifted from being uncompetitive to being dependent. Near-term viability is tied to the continuation of the IRA, while long-term success depends on unsubsidized hydrogen costs falling. |

Scenario Outlook: IRA as a Bridge to Unsubsidized Competitiveness

The most critical factor for near-term growth is the industry’s ability to successfully execute the current pipeline of large-scale, policy-supported projects, using the revenue and operational experience to accelerate the path toward an unsubsidized fuel cell cost per megawatt that is competitive with alternatives. If these initial megawatt-scale deployments demonstrate reliability and achieve their expected financial returns, it will validate the technology for a much broader set of investors and customers, creating a virtuous cycle of demand and cost reduction. Conversely, any significant project delays, failures, or a premature rollback of incentives would stall this momentum.

Comparing the Cost of Energy Generation Sources

This chart ranks energy sources by cost, visually defining the competitive landscape that fuel cells must enter to achieve the ‘unsubsidized competitiveness’ described in the scenario outlook.

(Source: Solar Power Guide)

- If this happens: The first wave of large-scale projects, such as Fuel Cell Energy’s Hartford plant and the initial deployments under the AEP/Bloom Energy agreement, are completed on time and on budget.

- Watch this: The conversion of large, non-binding agreements like the 450 MW LOI between Fuel Cell Energy and SDCL into firm, financed contracts. This will be the strongest signal that the data center market is a sustainable driver of demand.

- These could be happening: Manufacturing capacity expansion announcements from major players, funded by the revenue from these initial projects. Simultaneously, watch for any movement in the unsubsidized levelized cost of green hydrogen, as this remains the key variable for long-term, policy-independent growth.

Frequently Asked Questions

What is the estimated cost of a fuel cell power plant in 2026?

Based on the data provided for 2025-2026, the unsubsidized capital expenditure (CAPEX) for a fuel cell project is between $6,639 and $7,224 per kilowatt. This translates to approximately $6.6 million to $7.2 million per megawatt before any incentives are applied.

Why are data centers suddenly a major market for fuel cells?

Data centers, particularly those for AI, have an urgent and massive need for reliable, continuous power that the traditional grid often cannot supply quickly enough. Fuel cells offer a key advantage with rapid deployment (as fast as 90 days in some cases) and provide grid-independent, clean, and reliable baseload power, directly addressing the data center industry’s critical constraints of long grid connection times and power quality.

How is government policy making expensive fuel cells commercially viable?

The U.S. Inflation Reduction Act (IRA) is the key policy driver. It provides an Investment Tax Credit (ITC) that can cover 30% or more of a project’s capital cost. For a project costing $7 million per megawatt, this incentive provides a reduction of $2.1 million per megawatt, which fundamentally changes the financial viability and makes these projects bankable for investors and customers.

What is the biggest change in fuel cell investment between 2021 and 2026?

The primary change is a shift from speculative, research-focused funding to large-scale project finance backed by firm customer contracts. Instead of funding R&D to lower future costs, capital is now being used to underwrite massive offtake agreements, such as the 1 GW deal between AEP and Bloom Energy. This signifies that the technology is now considered bankable for specific, policy-supported applications.

Are fuel cells fully competitive with traditional power sources now?

No, not on an unsubsidized cost basis. Their high capital cost remains a primary weakness. However, in niche markets where their unique strengths—like reliability, rapid deployment, and clean power—are highly valued, and with the help of significant government incentives like the IRA, they have become commercially viable and competitive. Their success is currently dependent on this combination of policy support and specific market demand, rather than unsubsidized cost parity with conventional generation.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.