Solid Oxide Fuel Cell Fuels 2026: Why Fuel Flexibility is the Ultimate Growth Catalyst

SOFC Fuel Flexibility in Commercial Projects: From Natural Gas Bridge to Ammonia Future

Commercial adoption of Solid Oxide Fuel Cells (SOFCs) has strategically shifted from primarily leveraging existing natural gas infrastructure for stationary power to actively developing systems for emerging carbon-free fuels like ammonia, validating the technology’s role as a versatile energy transition tool.

- Between 2021-2024, deployments were dominated by natural gas applications, with companies like WATT Fuel Cell developing residential systems and a Blue Gen SOFC demonstrating 89% CHP efficiency at NETL in November 2024. This established a commercial foothold using existing infrastructure.

- The period from January 2025 to today shows a diversification into off-grid and backup power, exemplified by WATT Fuel Cell’s partnership with Hope Gas to launch a residential propane-fueled backup power program.

- A significant pivot toward future fuels is now evident. While Bloom Energy marketed “hydrogen-ready” systems in the earlier period, the focus has sharpened on ammonia for maritime use, with companies like Hitachi Zosen and Samsung Heavy Industries now associated with ammonia-SOFC development for shipping.

- Research and pilot projects are also expanding into more complex fuels. While the 2021-2024 period saw work on syngas and methanol, the 2025-today timeframe highlights ARPA-E projects for ethanol-powered vehicle APUs and research into heavy-duty diesel, signaling a push into logistics and transportation sectors.

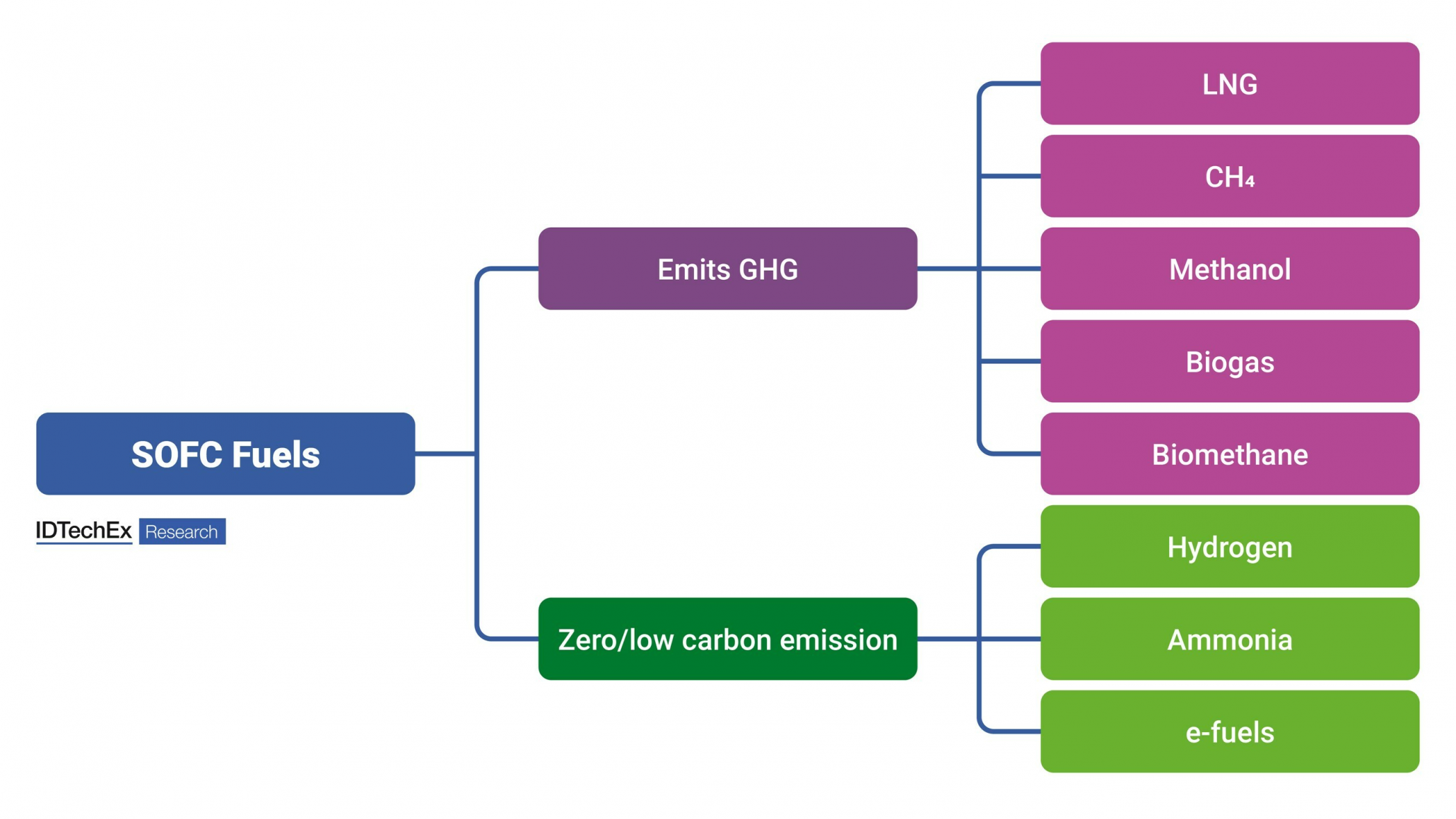

SOFC Fuel Options by Carbon Profile

This chart visually separates carbon-emitting fuels like natural gas from zero-carbon options like ammonia, directly supporting the section’s theme of a strategic transition between these two fuel types.

(Source: Hydrogen Central)

Strategic SOFC Alliances: How Fuel-Focused Partnerships Are Shaping Deployment

Strategic partnerships in the SOFC sector are increasingly focused on matching specific fuel pathways to end-market applications, shifting from broad technology validation to targeted commercial rollout in residential, industrial, and maritime sectors.

Table: Key SOFC Fuel-Related Partnerships

| Partnership | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Hope Gas and WATT Fuel Cell | 2025 | Launched a residential leasing program in West Virginia for propane- and natural gas-fueled backup power units. This partnership establishes a commercial channel for off-grid and grid-resiliency applications using readily available fuels. | Hope Gas and WATT Fuel Cell Launch… |

| Fuel Cell Energy and SDCL | 2025-2026 | Connected on a 450 MW fuel cell power plan. Fuel Cell Energy’s systems can operate on biogas, natural gas, and hydrogen blends, enabling large-scale projects that leverage diverse fuel inputs for clean power generation. | Fuel Cell Energy, SDCL Connect… |

| Samsung Heavy Industries (with MOL) | 2025 | Partnership focused on developing ammonia-fueled SOFCs for maritime applications. This reflects a strategic commitment to use SOFCs to decarbonize the shipping industry, leveraging ammonia as a carbon-free hydrogen carrier. | Review of the Application of Metal-Supported… |

Global SOFC Adoption: North America Leads with Natural Gas, Europe and Asia Pivot to Ammonia

North America continues to dominate commercial SOFC deployment by leveraging its extensive natural gas infrastructure, while Europe and Asia are accelerating development focused on ammonia as a primary fuel for maritime and industrial decarbonization.

- Between 2021-2024, the United States was a clear leader in commercial applications, driven by DOE funding and companies like Bloom Energy and WATT Fuel Cell focusing on stationary power and residential systems using natural gas. The NETL demonstration of a Blue Gen SOFC in West Virginia underscored this regional focus.

- Since January 2025, the U.S. has expanded this lead into new commercial models, such as the WATT Fuel Cell and Hope Gas leasing program in West Virginia, which uses propane to address grid resiliency. This reinforces a market strategy built on existing fuel supply chains.

- In contrast, European and Asian activities show a strong pivot towards future fuels. The Ship FC project in Europe, active during the 2021-2024 period, laid the groundwork for using ammonia in shipping. This has intensified, with companies like Norway’s Alma Clean Power and South Korea’s Samsung Heavy Industries now at the forefront of ammonia-SOFC development.

- Brazil has emerged as a region of interest for bio-ethanol applications, with a 2025 FAPESP-supported project exploring technology for ethanol-powered electric cars using SOFCs. This highlights a regional strategy to utilize local biofuel resources.

SOFC Fuel Technology Maturity: From Commercial Natural Gas Systems to Pilot-Stage Ammonia Solutions

SOFC technology has reached full commercial maturity for natural gas and propane applications, while systems for carbon-free fuels like ammonia and hydrogen have advanced from laboratory research to validated pilot-scale demonstrations, confirming their near-term commercial viability.

- In the 2021-2024 period, technology readiness for natural gas was proven at scale, with electrical efficiencies reaching up to 60% and CHP efficiencies near 90% in commercial and demonstration units from Bosch and Blue Gen.

- The major shift since January 2025 is the demonstrated maturity of ammonia-fueled SOFCs. Alma Clean Power’s successful tests and DNV approval in 2023 moved ammonia from a theoretical fuel to a practical one. In 2025, its ability to achieve 61-67% electrical efficiency is a key validation point for the maritime sector.

- Hydrogen-fueled SOFCs have also been validated at high efficiency, with Bloom Energy announcing a system with 60% electrical efficiency in August 2024. The company’s strategy of designing “hydrogen-ready” systems that operate on natural gas today confirms the technology’s readiness to transition as hydrogen infrastructure develops.

- Fuels like ethanol and heavy hydrocarbons remain at an earlier stage. ARPA-E’s funding for a metal-supported SOFC for vehicles using bio-ethanol (2025) and ongoing research into diesel-fed SOFCs represent a pipeline of technologies moving from R&D towards specialized pilot applications.

- Direct Carbon Fuel Cells (DCFCs), which use solid fuels like coal or biomass, remain at the lowest technology readiness level. While research between 2021 and 2025 showed feasibility with waste products, they are still in the research stage and not yet at pilot scale.

SOFC Fuel Strategy SWOT: Analyzing Strengths, Weaknesses, Opportunities, and Threats

The primary strength of SOFC technology is its unparalleled fuel flexibility, which creates significant opportunities to bridge current and future energy systems, though this versatility also introduces complexity in fuel processing and exposes the technology to competition from fuel-specific solutions.

SOFC Technology’s Core Advantages Highlighted

This infographic reinforces the section’s main point by illustrating that fuel flexibility is a primary strength and key technological advantage of SOFC systems.

- The SWOT analysis reveals that SOFC’s core strength, fuel flexibility, is now a proven commercial asset, not just a theoretical advantage.

- Opportunities are expanding from stationary power into challenging sectors like maritime and transportation, driven by progress in ammonia and ethanol utilization.

- A key threat remains the need for fuel processing, particularly desulfurization for fossil fuels and cracking for ammonia, which adds system complexity compared to direct-hydrogen PEM cells.

Table: SWOT Analysis for SOFC Fuel Versatility

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High electrical efficiency (up to 60% on natural gas). Ability to use existing natural gas infrastructure. High-quality heat for CHP applications. | Demonstrated high efficiency (61-67%) with carbon-free ammonia. Proven commercial models for propane backup power (WATT Fuel Cell). “Hydrogen-ready” systems (Bloom Energy) provide future-proofing. | Fuel flexibility has been validated as a commercial strength beyond natural gas. High efficiency is now proven for ammonia, confirming SOFCs’ role in hard-to-abate sectors. |

| Weaknesses | High operating temperatures (600-1000°C) lead to longer start-up times. Sensitivity to sulfur in fossil fuels requires reformers and cleanup systems. | Challenges in complete NOx-free cracking of ammonia. Carbon deposition (coking) risk with liquid hydrocarbons like ethanol. Higher system complexity vs. direct-H 2 PEM cells. | The core weaknesses persist, but are now better defined for specific fuel pathways. The challenge has shifted from general operation to optimizing performance and mitigating side-reactions for emerging fuels. |

| Opportunities | Leverage natural gas grid for distributed generation. Use of biogas from waste sources (ULTIMATE project). Potential use of coal-derived syngas (DOE program). | Decarbonize maritime shipping with ammonia (Samsung Heavy Industries, Hitachi Zosen). Provide off-grid/backup power with propane. Develop vehicle APUs with ethanol (ARPA-E project). | The addressable market has expanded significantly. The focus has moved from stationary power to high-value applications in shipping and transportation that other fuel cell types cannot easily address. |

| Threats | Competition from lower-cost renewable energy sources (solar, wind) + storage. Price volatility of natural gas. Slow development of a pure hydrogen economy for hydrogen-only cells to compete. | Rapid advancements in PEM fuel cells for hydrogen applications could dominate green H 2 markets. Availability and cost of green ammonia. Public and regulatory perception of using fossil fuels. | The threat landscape has matured. The primary threat is no longer if a hydrogen economy will arrive, but that PEM cells will capture the pure H 2 market, confining SOFCs to markets requiring multi-fuel capability. |

2026 Outlook for SOFC Fuel Pathways: Monitoring Ammonia Adoption and Natural Gas Expansion

If SOFC manufacturers successfully scale maritime and industrial projects using ammonia in the next 18 months, watch for major capital investments in dedicated SOFC-ammonia production lines; this will confirm that the technology has secured a critical, long-term role beyond its current natural gas-based market.

- Gaining Traction: Ammonia is rapidly moving from pilot to commercial-intent. Watch for announcements of first full-scale ship installations or large industrial orders from partners like Samsung Heavy Industries. The reported 61-67% efficiency is a strong signal that the technology is ready.

- Gaining Traction: The residential and commercial backup power market using propane and natural gas is a growing, near-term revenue stream. The WATT Fuel Cell and Hope Gas leasing model is a key signal of a scalable business strategy. Expect similar partnerships in other regions with grid reliability issues.

- Losing Steam (Relatively): While important, direct use of complex hydrocarbons like diesel remains in the research phase. Without a significant breakthrough in sulfur removal and coking prevention, this application will likely lag behind ammonia and cleaner hydrocarbons for at least the next few years.

- Steady Progress: Use of hydrogen and biogas continues to be a core part of the value proposition. The “hydrogen-ready” tag from companies like Bloom Energy and Fuel Cell Energy’s demonstrated capability with biogas are essential for marketing but are now baseline expectations, not forward-looking differentiators.

Frequently Asked Questions

Why is fuel flexibility considered a major advantage for SOFCs?

Fuel flexibility is a key advantage because it allows SOFCs to operate on a wide range of fuels. They can use existing infrastructure like natural gas and propane for immediate commercial use, while also being ready to adopt future carbon-free fuels like ammonia and hydrogen. This versatility makes them a critical transition technology for various sectors, from residential power to maritime shipping.

What fuels can SOFCs use commercially right now?

SOFC technology is fully mature and commercially deployed for natural gas and propane. The article highlights residential backup power programs by WATT Fuel Cell using propane and high-efficiency demonstrations on natural gas, proving their readiness with currently available fuels.

Which future fuel is gaining the most traction for SOFCs and in what industry?

Ammonia is rapidly gaining traction as a primary future fuel, especially for decarbonizing the maritime shipping industry. Companies like Samsung Heavy Industries and Alma Clean Power are leading the development of ammonia-fueled SOFCs, with pilot systems demonstrating high electrical efficiencies (61-67%), confirming their near-term viability for ships.

How does SOFC adoption differ between North America and regions like Europe and Asia?

North America leads commercial deployment by leveraging its extensive natural gas infrastructure for stationary and backup power. In contrast, Europe and Asia are focusing more on future fuels, accelerating the development of ammonia-fueled SOFCs to meet decarbonization goals in the maritime and industrial sectors.

What are the main technical challenges or weaknesses of SOFCs?

The primary weaknesses of SOFCs include their high operating temperatures (600-1000°C), which result in longer start-up times. They are also sensitive to fuel impurities like sulfur, which requires additional processing systems. For newer fuels like ammonia and hydrocarbons, challenges include ensuring complete NOx-free cracking and preventing carbon deposition (coking).

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.