Fuel Cell Deployment Speed 2026: Why On-Site Power is Now a 90-Day Reality

From Years to Months: How AI Demand Redefined Fuel Cell Deployment Projects

The defining characteristic of fuel cell adoption has shifted from gradual, infrastructure-paced commercialization to rapid, at-scale deployment driven by the acute power demands of artificial intelligence. Before 2025, progress was measured by moving technologies through readiness levels and initial fleet deployments, often constrained by the slow build-out of hydrogen infrastructure. Since 2025, the inability of conventional power grids to meet data center energy needs has created a market where deployment speed is the primary value proposition, compressing project timelines from multiple years to a few months.

- Prior to 2025, the fuel cell sector focused on a diverse set of applications, including advancing heavy-duty transport to a commercial readiness level of TRL 8-9 and deploying pilot projects in sectors like marine. These efforts, while critical, were often gated by multi-year infrastructure development programs, such as partnerships to build networks of hydrogen refueling stations.

- The market dynamic shifted in 2025 with the emergence of the “AI power demand shock.” A landmark collaboration between Bloom Energy and Oracle in July 2025 established a new industry benchmark, committing to deliver on-site power for AI data centers within an unprecedented 90-day timeframe.

- This capability is not limited to small-scale projects. Fuel cell providers now assert the ability to deliver 100 MW of power in as little as 90 days and scale projects to 500 MW in six months or less, a radical acceleration compared to conventional energy infrastructure.

- This speed directly contrasts with the timelines for traditional power solutions. Utilities like American Electric Power project 5-to-7-year development cycles for major grid upgrades, while new nuclear plants require over a decade to bring online, making them incompatible with the exponential growth of AI.

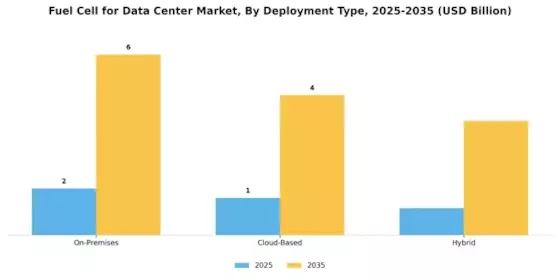

Data Center Fuel Cell Market Booms

This chart visualizes the rapid growth in the on-premises data center fuel cell market, directly supporting the section’s focus on AI demand as the key driver for deployment.

(Source: Market Research Future)

Strategic Capital Inflow: Analyzing the Billions Funding Rapid Fuel Cell Deployment

Massive, targeted capital injections since 2025 are the primary accelerant for rapid fuel cell deployment, creating dedicated financing platforms that de-risk large-scale projects and enable manufacturing to meet urgent demand. This strategic capital, distinct from earlier venture funding, is structured specifically for asset deployment to solve the immediate power-for-AI bottleneck. This shift validates the economic viability of fuel cells as a rapid infrastructure solution, moving the technology from a policy-supported niche to a market-driven necessity.

Market Value Reflects Capital Inflow

This forecast, projecting the market to reach over $35 billion, illustrates the massive scale of capital investment and market validation discussed in the section.

(Source: Market.us)

- The most significant financial signal was the October 2025 strategic partnership between Brookfield Asset Management and Bloom Energy. Brookfield committed up to $5 billion to finance and deploy Bloom’s fuel cell technology, creating a dedicated global platform for “AI power factories.”

- This investment vehicle is designed to bypass traditional project financing hurdles, providing the upfront capital needed for rapid manufacturing and deployment at the scale required by data center customers. It directly addresses the market failure where power demand outpaces the grid’s ability to supply it.

- Broader market interest is confirmed by a January 2026 letter of intent between Fuel Cell Energy and Sustainable Development Capital (SDCL) to develop and finance up to 450 MW of on-site fuel cell projects for data centers, indicating that the model of dedicated financial partnerships is expanding across the industry.

Table: Key Strategic Investments in Fuel Cell Deployment

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 20, 2026 | Non-binding letter of intent to develop and finance up to 450 MW of on-site fuel cell projects for AI-driven data centers globally. | Fuel Cell Energy, SDCL plan up to 450 MW data center power |

| Bloom Energy & Brookfield | Oct 13, 2025 | Strategic partnership with up to $5 billion committed to create a global platform for financing and deploying Bloom’s SOFC technology at AI data centers. | Brookfield and Bloom Energy Announce $5 Billion … |

| Amogy & Kinetics | Dec 2, 2025 | Strategic partnership and investment to accelerate the development of ammonia-based clean energy solutions for floating infrastructure, including data centers. | Kinetics Invests in and Partners with Amogy to Advance … |

Hyperscaler Alliances: How Strategic Partnerships Validate Fuel Cell Deployment Speed

Direct collaborations between fuel cell manufacturers and power-constrained hyperscalers since 2025 provide the clearest market validation for rapid deployment as a core competitive advantage. These partnerships have shifted from focusing on long-term infrastructure planning, which characterized the 2021-2024 period, to executing immediate, large-scale power delivery agreements. This trend demonstrates that data center operators now view on-site fuel cells as a critical, time-sensitive solution to bypass grid interconnection delays and sustain their growth.

Stationary Power Dominates Market Growth

This chart validates the section’s focus on hyperscaler partnerships by showing that ‘Stationary’ applications, such as data centers, constitute the largest and most valuable market segment.

(Source: Grand View Research)

- The July 2025 collaboration between Bloom Energy and Oracle was a foundational moment, explicitly centered on the need to deliver power to Oracle Cloud Infrastructure’s AI data centers at a speed matching AI’s growth, with a stated 90-day deployment window.

- This was not an isolated event. In August 2025, data center giant Equinix announced an agreement to utilize Bloom Energy’s fuel cells as a key component of its clean energy strategy for new AI-ready facilities, confirming an industry-wide trend.

- The market is not reliant on a single provider. A January 2026 letter of intent between Fuel Cell Energy and SDCL to deploy up to 450 MW for data center clients further signals that hyperscalers are actively seeking multiple fuel cell partners to secure their power supply chains.

- These recent alliances contrast sharply with pre-2025 partnerships, such as those between Nikola and Voltera, which focused on the multi-year challenge of building out hydrogen refueling networks for trucking rather than immediate, multi-megawatt power delivery.

Table: Major Strategic Partnerships Accelerating Fuel Cell Deployment

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 20, 2026 | Planned collaboration to develop and finance up to 450 MW of fuel cell systems for global AI data centers. | Fuel Cell Energy, SDCL plan up to 450 MW data center power |

| Bloom Energy & Brookfield | Oct 13, 2025 | A $5 billion partnership to finance and deploy SOFC technology as a dedicated power source for AI data centers. | Brookfield and Bloom Energy Announce $5 Billion … |

| Equinix & Bloom Energy | Aug 15, 2025 | Agreement to use Bloom’s fuel cells to provide clean, on-site power for Equinix’s expanding portfolio of AI-ready data centers. | Equinix Strikes Clean Energy Partnerships for AI-Ready … |

| Bloom Energy & Oracle | Jul 24, 2025 | Collaboration to provide on-site power to Oracle’s AI data centers with a deployment timeline of 90 days to meet urgent demand. | Oracle and Bloom Energy Collaborate to Deliver Power … |

Geographic Focus: Why North America Dominates Rapid Fuel Cell Deployment for Data Centers

While global interest in fuel cells remains strong, the center of gravity for rapid, large-scale deployment has decisively shifted to North America since 2025. This concentration is a direct result of the convergence of the region’s dominant AI industry, severe grid capacity limitations, and a supportive policy environment. The urgent need for data center power in the U.S. has made it the primary theater for validating the speed of fuel cell deployment.

North America Leads in Fuel Cell Growth

This chart directly supports the section’s thesis by providing a specific forecast for the North American market, quantifying its dominant position in fuel cell deployment.

(Source: Market Data Forecast)

- Between 2021 and 2024, significant fuel cell activity was geographically diverse. Europe saw major manufacturing investments like Symbio’s gigafactory in France, while Canada pursued pilot programs for hydrogen-powered trucking.

- The dynamic changed in 2025 as the AI-driven power shortage became most acute in the U.S., home to the world’s largest hyperscalers. Major partnerships with companies like Oracle and Equinix, both headquartered in the U.S., anchored this regional shift.

- The U.S. policy framework, established earlier by the Inflation Reduction Act and reinforced by Department of Energy funding in April 2024, created the foundation for this growth. The funding aims to build out 14 GW of annual domestic fuel cell manufacturing capacity, ensuring a local supply chain to support rapid deployment.

- Consequently, the landmark deals driving the narrative of speed, including the $5 billion Brookfield partnership and the Oracle and Equinix agreements, are all centered on the North American market, solidifying its leadership in this specific application.

Technology Readiness: How Modularity and Power Density Enable Commercial Scale Deployment Speed

The rapid deployment timelines for fuel cells are enabled by the technology’s intrinsic design characteristics, which have matured from prototype-level validation to commercially scalable solutions. Specifically, the modular architecture and high power density of modern solid oxide fuel cell (SOFC) systems are the key technical enablers of their speed advantage. This represents a shift from the 2021-2024 focus on advancing Technology Readiness Levels (TRLs) to the current focus on leveraging mature technology to solve logistical and timeline challenges.

Fuel Cells Boost On-Site Power Capacity

This chart illustrates the section’s point about technology readiness by showing how modular fuel cells can dramatically increase a facility’s power output, enabling rapid commercial scaling.

(Source: FuelCell Energy)

- The modular design of fuel cell systems allows for precise scalability and parallelized installation, avoiding the monolithic, sequential construction process of traditional power plants. This enables customers to start with a specific power block and expand capacity as needed, which is a core requirement for fast-growing data centers.

- The high power density of the technology is a critical advantage in land-constrained areas where data centers are often located. Bloom Energy’s technology can deliver 30 MW per acre, and this can be increased to 100 MW per acre through vertical stacking, dramatically simplifying siting and reducing project preparation time.

- In response to the demand surge, manufacturers are proactively scaling production. Bloom Energy announced plans to double its manufacturing capacity to 2 GW by 2026, demonstrating that the supply side is gearing up to maintain the speed advantage promised to customers.

- Furthermore, the non-combustion nature of fuel cells results in ultra-low emissions, which can lead to a more streamlined and predictable permitting process compared to combustion-based power generation, removing a common source of delay in energy projects.

SWOT Analysis: Strategic Outlook for Fuel Cell Deployment Velocity in 2026

A strategic analysis of fuel cell deployment speed reveals a technology whose primary strength, rapid installation, has found a critical market opportunity in the AI-driven power crisis. However, its current reliance on natural gas infrastructure creates a significant vulnerability, while competition from other on-site power solutions remains a long-term threat. The key change since 2024 is that speed-to-power has become the single most important differentiator, elevating fuel cells from an alternative energy source to a strategic enabler of digital economic growth.

Market to Quadruple by 2030

This rapid growth forecast quantifies the massive market opportunity identified in the SWOT analysis, driven by the urgent need for speed-to-power that has become the key differentiator.

(Source: MarketsandMarkets)

- Strengths: Unparalleled deployment speed is the technology’s core advantage, now proven at a multi-megawatt scale.

- Weaknesses: Dependence on the natural gas grid for fuel introduces emissions concerns and exposure to fuel price volatility.

- Opportunities: Severe and persistent grid interconnection delays create a captive market among power-constrained data centers.

- Threats: While slower to deploy, alternative technologies like small modular reactors are being developed as long-term on-site power solutions.

Table: SWOT Analysis for Fuel Cell Deployment Speed

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Unit-level speed was a known advantage, with stationary systems deployable in months and vehicles refuelable in minutes. | Demonstrated ability to deploy large-scale, multi-megawatt (100 MW to 500 MW) power solutions for data centers in 3-6 months, as committed in deals with Oracle. | The scale of rapid deployment was validated, moving from a theoretical benefit to a commercially contracted reality for mission-critical infrastructure. |

| Weaknesses | System-wide deployment was constrained by the slow development of hydrogen production and refueling infrastructure. | The current wave of rapid deployments for data centers relies heavily on existing natural gas infrastructure, linking them to fossil fuels and their emissions profile. | The primary weakness shifted from the availability of hydrogen fuel for mobility to the carbon intensity of the fuel source for large-scale stationary power. |

| Opportunities | Policy incentives like the Inflation Reduction Act’s $3.00/kg hydrogen production tax credit created strong economic tailwinds. | The “AI power demand shock, ” with utilities like AEP forecasting 24 GW of new data center load, created an urgent, multi-billion-dollar market for solutions that bypass multi-year grid queues. | The market opportunity became acute and time-sensitive, shifting from a policy-driven push to a crisis-driven pull from hyperscalers. |

| Threats | Competition from other clean technologies, particularly battery electric vehicles in the transport sector. | Long-term competition from other on-site power solutions like small modular reactors, although they lack the near-term speed advantage (10+ year timelines). The $5 billion Brookfield investment was noted as beating out such alternatives. | The competitive landscape for on-site power intensified, but fuel cells’ speed advantage became the decisive factor for capturing immediate market share. |

2026 Forward Outlook: Monitoring Signals for Sustained Deployment Acceleration

If the extreme power demand from the AI sector continues to outstrip the development capacity of the traditional grid, watch for the replication of large-scale financing and manufacturing commitments as the definitive signal of sustained, rapid fuel cell deployment. The central question for 2026 is whether the precedent set in 2025 becomes the new industry standard. The following signals will confirm this trajectory.

Long-Term Growth Projected Through 2034

This long-range forecast provides a visual representation of the sustained deployment acceleration discussed in the forward outlook, projecting growth to over $37 billion.

(Source: Polaris Market Research)

- If this happens: Another major asset manager announces a multi-billion dollar financing vehicle for fuel cell deployment, mirroring the Brookfield and Bloom Energy partnership. Watch this: It would confirm that dedicated “AI power factory” financing is a repeatable template, not a one-off event, unlocking a new class of capital for the sector.

- If this happens: Competitors to Bloom Energy, such as Fuel Cell Energy, announce firm plans to build new gigawatt-scale manufacturing facilities. Watch this: This would indicate the supply side of the market is responding competitively to the demand surge, preventing bottlenecks and ensuring deployment speed can be maintained across the industry. The 450 MW LOI with SDCL is a leading indicator.

- If this happens: One of the other major hyperscalers (e.g., Amazon, Google, Microsoft) announces a large-scale, rapid-deployment power agreement with a fuel cell provider. Watch this: This would validate the use case beyond the initial movers like Oracle and Equinix, confirming it as an industry-wide strategy for mitigating power constraints.

Frequently Asked Questions

Why are fuel cells suddenly being deployed so quickly for data centers?

The rapid deployment is driven by the ‘AI power demand shock’ that began in 2025. Conventional power grids cannot keep up with the urgent and massive energy needs of AI data centers, with grid upgrades taking 5-7 years. This has created a market where fuel cells, which can be deployed in as little as 90 days, provide a critical solution to bypass these delays.

How fast can a large-scale fuel cell power project be completed?

According to the article, fuel cell providers can now deliver 100 MW of power in as little as 90 days and can scale projects to 500 MW in six months or less. This new benchmark for speed was established in a July 2025 collaboration between Bloom Energy and Oracle.

What is enabling this rapid, large-scale deployment financially?

Massive, targeted capital injections are the primary financial driver. A key example is the October 2025 partnership where Brookfield Asset Management committed up to $5 billion to finance Bloom Energy’s projects. These dedicated financial vehicles provide the upfront capital for manufacturing and deployment, de-risking the projects for data center customers.

Which companies are leading this trend?

Key players include fuel cell manufacturers like Bloom Energy and Fuel Cell Energy. They are forming strategic partnerships with hyperscalers and data center operators like Oracle and Equinix, as well as with major financial firms like Brookfield Asset Management and Sustainable Development Capital (SDCL) who provide the funding.

What is the main weakness or risk associated with this new wave of fuel cell deployments?

The primary weakness identified is the current dependence on the natural gas grid for fuel. While this enables rapid deployment by using existing infrastructure, it links the solution to a fossil fuel, raising concerns about emissions and exposure to fuel price volatility.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.