Grid Constraints Force Data Center Power Shift: Why Fuel Cells Are a Reliable Solution in 2026

Industry Adoption: From Niche Pilots to Prime Power Projects

Hyperscaler and utility adoption of fuel cells has shifted from small-scale reliability pilots between 2021 and 2024 to multi-megawatt prime power agreements from 2025 onward, directly addressing grid interconnection delays and power deficits created by AI.

- Between 2021 and 2024, adoption centered on technology validation for backup power, such as Microsoft’s successful demonstration of a 1.5 MW hydrogen fuel cell system from Ballard Power Systems and Caterpillar. These projects proved technical viability but were not yet positioned as primary power sources.

- Starting in 2025, the industry witnessed a strategic pivot to fuel cells for prime power at a commercial scale. This change was driven by grid instability and the exponential power needs of AI, exemplified by Equinix’s expansion agreement with Bloom Energy to deploy over 100 MW of Solid Oxide Fuel Cells (SOFCs) across more than 19 data centers.

- The scale of commitment escalated dramatically in late 2025 and early 2026, with landmark announcements like the Brookfield Asset Management and Bloom Energy partnership to deploy up to $5 billion in SOFC technology specifically for AI data centers. This was followed by Fuel Cell Energy’s collaboration with Sustainable Development Capital LLP (SDCL) to explore deploying up to 450 MW of fuel cell systems, cementing their role as a solution to grid constraints.

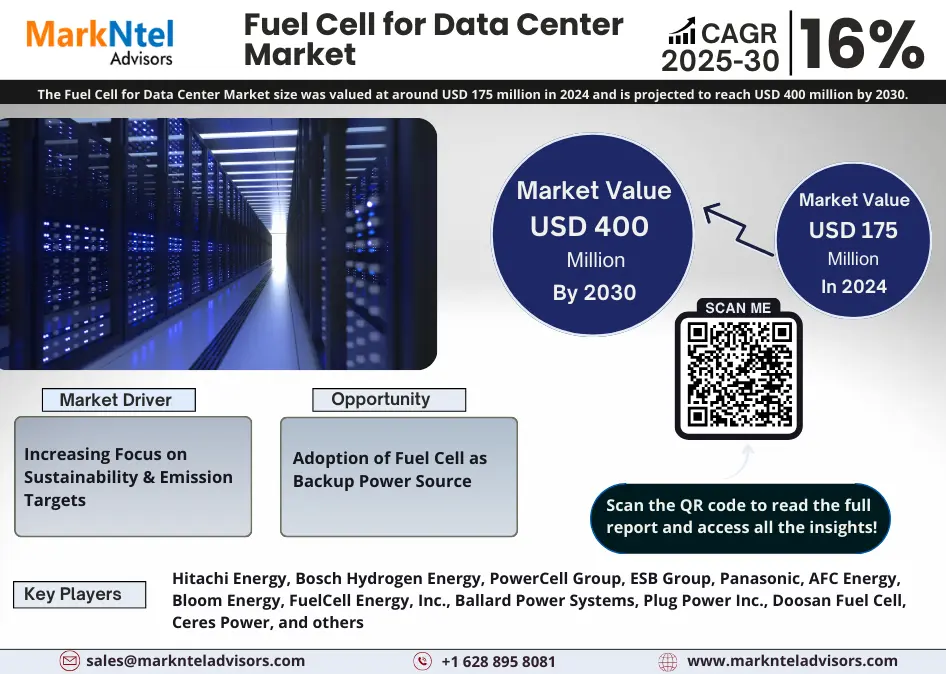

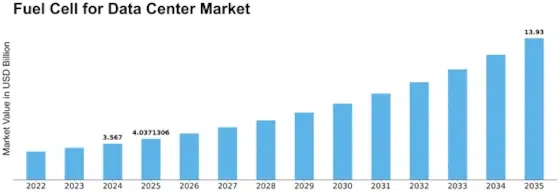

Data Center Fuel Cell Market Grows

This chart projects significant growth for the data center fuel cell market, aligning with the section’s focus on industry adoption moving from pilots to prime power.

(Source: MarkNtel Advisors)

Investment: Strategic Capital Mobilizes for Gigawatt-Scale Fuel Cell Deployments

Strategic capital has accelerated into the data center fuel cell sector, moving beyond project-level financing to large-scale infrastructure funds aimed at deploying gigawatts of on-site power, a clear signal that investors view the technology as a bankable solution to the AI-driven energy shortage.

Fuel Cell Data Center Market Booms

Forecasting the market to reach nearly $14 billion, this chart visualizes the large-scale investment flowing into the sector to fund gigawatt-scale deployments.

(Source: EnkiAI)

- Before 2025, investments were often tied to specific projects or corporate balance sheets, with a focus on proving out the technology’s long-term operational performance.

- The period from 2025 to today is defined by the entrance of major infrastructure investors. The most significant event was the October 2025 announcement of a strategic partnership between Brookfield Asset Management and Bloom Energy, mobilizing up to $5 billion to finance fuel cell deployments for AI data centers. This structure allows data center operators to procure power through service agreements, reducing their upfront capital burden.

- This trend was reinforced in January 2026 when Fuel Cell Energy and Sustainable Development Capital LLP (SDCL) formed a strategic collaboration to jointly market and finance up to 450 MW of fuel cell power systems for data centers globally, indicating a standardized, repeatable financing model is now in place for the industry.

Table: Key Investments in Data Center Fuel Cell Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 20, 2026 | Strategic collaboration to finance and deploy up to 450 MW of fuel cell systems, creating a dedicated capital pool for data center projects and standardizing investment. | Sustainable Development Capital LLP and Fuel Cell Energy … |

| Bloom Energy & Brookfield | Oct 13, 2025 | A landmark strategic partnership valued at up to $5 billion to deploy Bloom Energy’s SOFC technology at AI data centers. This provides a clear financing path for large-scale, on-site prime power. | Brookfield and Bloom Energy Announce $5 Billion … |

| Fuel Cell Energy PPAs | Dec 18, 2025 | Entered into 20-year Power Purchase Agreements (PPAs) with utilities Eversource and United Illuminating, validating the long-term bankability of its fuel cell projects for utility-scale power. | Fuel Cell Energy Ends FY 2025 with Revenue Growth and a … |

Partnership Analysis: Alliances Evolve to Support Fuel Cell Deployments at Scale

Partnerships have matured from technology validation between vendors and single end-users to complex, multi-party alliances involving financiers, utilities, and data center operators to enable gigawatt-scale deployments that bypass traditional grid development timelines.

Partnerships Enable Grid-Independent Data Center Power

This infographic details a multi-party partnership to deliver scalable fuel cell power, illustrating the complex, evolving alliances described in the section.

(Source: FuelCell Energy)

- From 2021 to 2024, collaborations were primarily bilateral, focusing on proving reliability. An example is the long-standing relationship between Equinix and Bloom Energy, which demonstrated the viability of fuel cells in live data center environments over many years.

- Beginning in 2025, partnerships became more complex and financially oriented. The Brookfield and Bloom Energy alliance introduced a critical third party, a major infrastructure investor, to solve the high CAPEX barrier and enable an energy-as-a-service model for data center customers.

- Similarly, the January 2026 collaboration between Fuel Cell Energy and SDCL established a framework to jointly market and co-finance projects, streamlining the path from proposal to deployment. These new partnership structures are designed to deliver power at the speed and scale required by the AI industry, which the grid cannot match.

Table: Evolution of Strategic Partnerships for Data Center Fuel Cells

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 20, 2026 | A strategic collaboration to deploy up to 450 MW of fuel cell power systems, combining technology with dedicated capital to accelerate market penetration in the data center sector. | Sustainable Development Capital LLP and Fuel Cell Energy … |

| Bloom Energy & Brookfield | Oct 13, 2025 | A $5 billion partnership to deploy SOFCs at AI data centers, creating a scalable financing model that decouples data center construction from grid availability. | Brookfield and Bloom Energy Announce $5 Billion … |

| Equinix & Bloom Energy | Aug 14, 2025 | Expansion of a long-term agreement to deploy over 100 MW of SOFCs, validating the technology’s reliability and economic viability for a leading global data center operator. | Equinix Collaborates with Leading Alternative Energy … |

| Microsoft, Ballard, Caterpillar | 2021 – 2024 | A technology validation partnership to demonstrate a 1.5 MW PEM fuel cell system for backup power, proving technical readiness for long-duration backup. | Caterpillar demonstrates Ballard hydrogen fuel cell … |

Geography: North America Becomes the Epicenter for Fuel Cell Data Center Growth

While early fuel cell deployments were globally dispersed, North America has become the definitive epicenter for large-scale data center projects from 2025-2026, driven by a combination of intense AI-driven power demand and significant federal incentives under the Inflation Reduction Act (IRA).

North American Fuel Cell Market Leads Growth

Highlighting steady growth in the North American fuel cell market, this chart supports the section’s claim that the region is the epicenter for new projects.

(Source: Market Data Forecast)

- Between 2021 and 2024, significant projects occurred in multiple regions, including Microsoft’s hydrogen pilot in Dublin, Ireland, and Fuel Cell Energy’s power generation projects in South Korea. These activities established a global footprint for the technology.

- From 2025, the focus of major capital and deployments shifted decisively to the U.S. The $5 billion Brookfield investment fund is primarily targeting the U.S. AI data center market. Likewise, Equinix’s 100 MW expansion with Bloom Energy is concentrated on its U.S. facilities.

- This geographical concentration is reinforced by market projections. While South Korea is forecast to have a high CAGR of 15.3%, the U.S. market, with a 15.2% CAGR on a much larger base, represents the most significant growth opportunity. The U.S. market’s attractiveness is amplified by IRA tax credits like the 48 E ITC and 45 V, which improve project economics.

Technology Maturity: Fuel Cells Are Now a Bankable Prime Power Solution

Fuel cell technology has advanced from a proven backup power solution between 2021 and 2024 to a commercially bankable prime power source for mission-critical loads, a status validated by high-availability metrics and large-scale deployments by hyperscalers in 2025 and 2026.

- In the 2021-2024 timeframe, technical maturity was defined by successful long-duration tests for backup power. Microsoft’s completion of a 48-hour, 1.5 MW test of hydrogen fuel cells was a key validation point, proving the technology was a reliable alternative to diesel generators but not yet positioned for continuous 24/7 prime power.

- From 2025, the technology’s maturity is now measured by its performance as a primary power source. Bloom Energy markets its Solid Oxide Fuel Cell (SOFC) systems with “four nines” or 99.99% availability, a metric that meets or exceeds the requirements for mission-critical data center operations.

- This claim is substantiated by commercial contracts. The decision by Equinix to expand its SOFC deployment to over 100 MW for prime power, combined with Brookfield’s $5 billion commitment, confirms that both operators and financiers now consider the technology reliable and mature enough for continuous, 24/7 data center loads.

SWOT Analysis: Grid Constraints Unlock Fuel Cell Market Opportunity

Fuel cells possess significant strengths in reliability and emissions that are directly aligned with data center needs, but their market expansion remains constrained by high capital costs and natural gas dependency. This strategic tension is now being resolved by a combination of large-scale infrastructure financing, supportive federal policy, and a clear market need driven by grid limitations.

Surging Power Demand Creates Market Opportunity

By forecasting data center power demand to double, this chart visualizes the grid constraints that create a significant market opportunity for on-site fuel cells.

(Source: EnkiAI)

- Strengths like demonstrated high availability and superior efficiency have moved from theoretical benefits to commercially validated attributes, driving major new partnerships.

- Weaknesses, particularly high CAPEX, are being directly addressed through new financing models and significant federal tax credits.

- Opportunities created by the AI-driven power crunch and grid interconnection delays are the primary catalysts for the recent acceleration in market activity.

- Threats from price volatility are now being mitigated by long-term Power Purchase Agreements (PPAs), which offer cost certainty that the grid currently cannot.

Table: SWOT Analysis for Fuel Cells in 24/7 Data Center Operations

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High efficiency and low emissions were key selling points. Reliability was demonstrated in pilot projects (e.g., Microsoft’s backup test). | Demonstrated reliability at scale, with providers like Bloom Energy marketing 99.99% availability. Scalability is proven with deployments over 100 MW. | Reliability shifted from a claim to a bankable attribute, validated by long-term operator contracts (Equinix) and large-scale investor commitments (Brookfield). |

| Weaknesses | High initial CAPEX compared to diesel generators was a major barrier. Dependency on natural gas infrastructure created a fossil fuel linkage. | CAPEX remains high ($10 M/MW), but is now being addressed by infrastructure funds and PPAs. Natural gas dependency persists, but the hydrogen transition path is clearer. | The high CAPEX barrier is being resolved by third-party financing models, shifting the cost from a capital expenditure to a predictable operating expense for the data center operator. |

| Opportunities | Decarbonization goals and the need for backup power were the primary market drivers. Early adopters sought to improve their emissions profiles. | Massive AI power demand and severe grid constraints (interconnection queues, price volatility) are now the dominant drivers. IRA tax credits (48 E ITC, 45 V) dramatically improve project economics. | The market driver shifted from a “nice-to-have” sustainability goal to a “must-have” solution for securing power and avoiding revenue loss from delayed data center deployments. |

| Threats | Cost-competitiveness of traditional grid power and diesel generators. Uncertainty in the hydrogen supply chain. | Extreme grid price volatility (surges past $1, 000/MWh) makes fuel cell PPAs more attractive. Diesel remains a cost-effective backup option, but not for prime power. | Grid unreliability and price shocks have turned a threat into an opportunity, making the stable, predictable cost of fuel cell PPAs a significant competitive advantage. |

Scenario Modelling: On-Site PPAs Will Accelerate to Bypass Grid Delays

If grid interconnection queues and power price volatility persist through 2026, watch for an acceleration in data center operators signing multi-year, multi-megawatt Power Purchase Agreements (PPAs) directly with fuel cell providers, effectively bypassing the utility for prime power.

Stationary Fuel Cell Market Set to Double

This forecast for the stationary fuel cell market illustrates the growth potential of the on-site ‘energy-as-a-service’ model described in the scenario.

(Source: Grand View Research)

- The primary signal is the creation of dedicated infrastructure funds, like the $5 billion Brookfield partnership with Bloom Energy, designed to offer an “energy-as-a-service” model. This removes the CAPEX barrier for data center operators and allows them to secure power on timelines aligned with their business needs, not utility construction schedules.

- A second signal is the increasing use of long-term PPAs, such as those secured by Fuel Cell Energy, to provide cost certainty. With wholesale electricity prices in U.S. data center hubs increasing by as much as 267% in five years, the predictable cost of a fuel cell PPA becomes a critical strategic advantage for managing operational expenses.

- The market is clearly bifurcating. If a data center can secure a timely and affordable grid connection, it will. If not, which is an increasingly common scenario, these on-site power partnerships provide a viable, reliable, and now financially accessible alternative for 24/7 operations.

Frequently Asked Questions

Why are data centers adopting fuel cells for prime power now?

The primary drivers are severe grid constraints, including long interconnection delays and power deficits, which cannot meet the exponential energy demands of AI. As a result, data centers are turning to on-site fuel cells as a reliable way to bypass grid limitations and secure the power needed for 24/7 operations.

What is the main difference between how fuel cells were used before 2025 and how they are being used now?

Before 2025, fuel cells were primarily used in smaller pilot projects for backup power, such as Microsoft’s 1.5 MW demonstration. Starting in 2025, the industry shifted to deploying them for multi-megawatt prime power, as shown by Equinix’s agreement for over 100 MW and Brookfield’s $5 billion investment for AI data centers.

How can data center operators afford the high cost of fuel cells?

The high upfront capital cost is being addressed by new financing models from major infrastructure investors. Partnerships, like the $5 billion alliance between Brookfield and Bloom Energy, allow data center operators to procure power through service agreements or Power Purchase Agreements (PPAs). This converts the cost from a large capital expenditure (CAPEX) to a predictable operating expense (OPEX).

How reliable is fuel cell technology for mission-critical data centers?

Fuel cell technology is now considered a bankable, prime power solution. Providers like Bloom Energy market their systems with 99.99% availability, a metric that meets data center requirements. This reliability has been validated by long-term contracts from major operators like Equinix, who are using fuel cells for their primary power needs.

Which companies are the key players in this data center fuel cell trend?

The key technology providers mentioned are Bloom Energy and Fuel Cell Energy. Major data center operators adopting the technology include Equinix and Microsoft. On the investment side, large infrastructure firms like Brookfield Asset Management and Sustainable Development Capital LLP (SDCL) are providing the capital to enable these gigawatt-scale deployments.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Microsoft's 2025 Fuel Cell Strategy for Data Centers

- Fuel Cells Data Centers: 2025 AI Power Trends Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.