Fuel Cell Market in 2026: Why Biogas Dominates Stationary Power While Hydrogen Targets Mobility

Fuel Cell Commercial Projects in 2026: Biogas and Hydrogen Fuel Distinct Market Segments

The fuel cell market is not monolithic; it has bifurcated into two distinct, application-specific pathways. High-temperature fuel cells using biogas are scaling rapidly for stationary power, while lower-temperature fuel cells using pure hydrogen continue to be optimized for the transportation sector. This divergence, which became pronounced after 2024, is driven by separate economic models and infrastructure requirements for each fuel.

- Between 2021 and 2024, projects like the Fuel Cell Energy/Toyota Tri-gen system at the Port of Long Beach demonstrated the technical feasibility of using biogas to produce electricity (2.3 MW), hydrogen (1, 200 kg/day), and water. This period was characterized by integrated pilots that proved the technology’s versatility.

- From 2025 to today, the market shifted from versatile pilots to specialized, large-scale commercial deployments. Massive capital commitments are now directed at using fuel-flexible Solid Oxide Fuel Cells (SOFCs) and Molten Carbonate Fuel Cells (MCFCs) for baseload stationary power, particularly for data centers.

- Concurrently, the transportation sector, led by companies like Toyota with its 3 rd Gen FC System, remains focused on perfecting Polymer Electrolyte Membrane (PEM) fuel cells that run exclusively on high-purity hydrogen, prioritizing on-board storage and fast refueling over fuel flexibility.

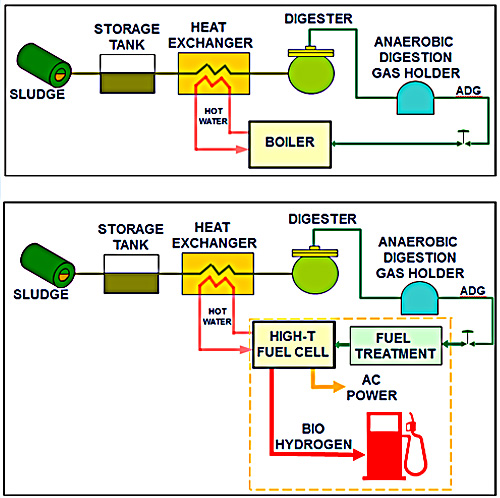

Biogas Can Fuel Both Power and Transport

This process shows how biogas from waste can fuel a high-temperature fuel cell to produce both stationary AC power and bio-hydrogen for transport, illustrating the market’s two distinct pathways.

(Source: Advanced Power and Energy Program (APEP), UC Irvine)

Fuel Cell Investment Analysis: Multi-Billion Dollar Deals Validate Biogas for Stationary Power

Major financial commitments since 2025 confirm that sophisticated institutional capital views biogas-fueled stationary power as a bankable, large-scale infrastructure play. These investments validate a business case built on low-cost waste feedstocks and high system efficiencies, contrasting with the more policy-dependent economics of pure hydrogen.

- The most significant signal is the October 2025 partnership between Brookfield Asset Management and Bloom Energy, which allocates up to $5 billion to deploy fuel-flexible SOFCs for on-site power at AI-driven data centers. This represents a strategic move by an asset manager to finance energy infrastructure that solves grid constraints.

- This trend was reinforced by the partnership between Fuel Cell Energy and investment firm Sustainable Development Capital (SDC) to deploy up to 450 MW of MCFC capacity for data centers globally, further solidifying fuel cells as a preferred solution for behind-the-meter power.

- The business model for biogas was strengthened in November 2025 when Frontier, a carbon removal fund backed by major tech companies, committed to purchasing 96, 000 tons of carbon removal from German startup Reverion. This adds a valuable revenue stream to biogas-to-electricity plants that capture CO₂.

Table: Key Fuel Cell Investments and Financial Commitments (2025-Present)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Reverion & Frontier | Nov 2025 | Purchase of 96, 000 tons of carbon removal, validating the economic model of carbon-negative power generation from biogas using reversible SOFCs. | Frontier, Reverion: Biogas Carbon Removal Pathway |

| Bloom Energy & Brookfield | Oct 2025 | Up to $5 billion investment to deploy fuel-flexible SOFCs to provide reliable, on-site power for AI data centers, bypassing grid constraints. | Brookfield and Bloom Energy Announce $5 Billion … |

| Fuel Cell Energy & SDC | Recent (2026) | Partnership to deploy up to 450 MW of MCFC power for data centers, targeting grid strain with behind-the-meter generation using biogas or natural gas. | Fuel Cell Energy partners with SDC to deploy up to 450 MW … |

Strategic Fuel Cell Partnerships: Data Centers and Biogas Drive 2026 Alliances

Strategic alliances formed since 2025 have coalesced around a central theme: deploying fuel-flexible, high-temperature fuel cells to provide reliable power for energy-intensive data centers. These partnerships match technology providers with large-scale capital and end-users, creating a robust ecosystem for deploying biogas and natural gas-fueled systems.

Fuel Cells Double Power on Same Emissions Budget

This chart demonstrates why data centers partner on fuel cell projects: they can more than double on-site power capacity while remaining under a fixed emissions cap.

(Source: FuelCell Energy)

- The Brookfield and Bloom Energy alliance is a finance-driven deployment model, where a major asset manager directly funds the energy infrastructure needed to support the growth of its other investments in the digital economy.

- Similarly, the Fuel Cell Energy and SDC partnership unites a technology provider with an investment firm specializing in sustainable and decentralized energy, explicitly targeting the global data center market’s reliability and grid-dependency challenges.

- In Asia, the June 2025 joint development agreement between Doosan Fuel Cell and Korea Western Power illustrates a government- and utility-driven strategy to develop fuel cell models specifically designed to run on biogas, aligning with national decarbonization goals.

Table: Major Corporate Partnerships in the Fuel Cell Sector (2025-Present)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Reverion & Frontier | Nov 2025 | A technology-forward alliance where Reverion’s biogas power plants generate carbon removal credits purchased by Frontier’s corporate members, creating a new revenue model. | Frontier, Reverion: Biogas Carbon Removal Pathway |

| Bloom Energy & Brookfield Asset Management | Oct 2025 | A capital-intensive partnership to deploy SOFC technology at scale, providing on-site, fuel-flexible power to meet the immense energy needs of AI data centers. | Brookfield and Bloom Energy Announce $5 Billion … |

| Doosan Fuel Cell & Korea Western Power | Jun 2025 | A joint development project to create a hydrogen fuel cell model specifically adapted for biogas feedstock, supporting South Korea’s Hydrogen Economy Roadmap. | Media Center – News |

| Fuel Cell Energy & Sustainable Development Capital (SDC) | Recent (2026) | A global deployment partnership aiming to provide up to 450 MW of behind-the-meter power for data centers, utilizing fuel-flexible MCFC technology. | Fuel Cell Energy partners with SDC to deploy up to 450 MW … |

Global Fuel Cell Growth: North America Leads in Biogas Deployments, Asia Pursues Hydrogen

While fuel cell development is global, North America has decisively emerged as the center for large-scale commercial deployment of biogas-fueled systems since 2025. This is driven by strong private capital and mature waste-to-energy markets. In contrast, Asia is pursuing a dual-track strategy with strong government support for both biogas and hydrogen initiatives.

Power Generation Is the Top Use for Biogas

Supporting the trend of North American biogas deployments, this chart shows that generating power is the dominant end use for biogas, far surpassing other applications.

(Source: Advanced BioFuels USA)

- Between 2021-2024, notable projects were geographically dispersed, including the landmark Tri-gen project in California and smaller-scale combined-heat-and-power (CHP) demonstrations like Convion’s SOFC project at an Estonian farm.

- Since 2025, North America has become the dominant market for stationary power deployments. The multi-billion dollar Brookfield/Bloom Energy and large-scale SDC/Fuel Cell Energy partnerships are concentrated in the U.S. to serve the data center industry.

- South Korea has established itself as a key region in Asia, with policy-driven projects like the Doosan Fuel Cell/Korea Western Power collaboration designed to integrate biogas into the national hydrogen strategy.

- Europe continues to demonstrate technological leadership. German startup Reverion’s record-efficiency SOFC and its carbon removal partnership with Frontier showcase innovation in both technology and business models, even if deployment scale lags North America.

Fuel Cell Technology Maturity: High-Temp SOFCs and MCFCs Reach Commercial Scale for Biogas Power

High-temperature fuel cells, specifically SOFCs and MCFCs, have successfully transitioned from the pilot stage to commercially bankable assets for stationary power generation using biogas. This maturation, validated by large-scale investments post-2024, confirms their readiness for deployment as reliable, decentralized energy infrastructure. Meanwhile, PEMFC technology continues its own mature path of refinement for hydrogen-based mobility.

How Waste Becomes Clean, Green Electricity

This diagram illustrates the mature technology of using a Solid Oxide Fuel Cell (SOFC) to convert biogas from agricultural waste into green electricity, as described in the section.

(Source: Elcogen)

- The 2021–2024 period served as the final validation phase. Fuel Cell Energy’s Tri-gen project proved that MCFCs could operate at the megawatt scale on renewable biogas, and Convion’s projects demonstrated SOFC reliability in real-world agricultural settings.

- The market signal shifted from technical proof to financial validation in 2025. The $5 billion Brookfield commitment to deploy Bloom Energy’s SOFCs confirms the technology is now treated as a scalable infrastructure asset class, not a speculative venture.

- A key technical milestone was achieved in September 2025 when Reverion announced a world-record electrical efficiency of 74.2% for its biogas-fueled SOFC system. This unequivocally positions high-temperature fuel cells as more efficient than traditional combustion engines for waste-to-energy applications.

- Simultaneously, PEMFC technology for transportation, represented by Toyota’s 3 rd Gen FC System, has matured along a different axis. Its development focuses on achieving the durability of diesel engines and reducing production costs for mass-market adoption, not on expanding fuel sources.

SWOT Analysis: Fuel Cell Market Dynamics for Biogas and Hydrogen

The fuel cell market’s core strength is its proven fuel flexibility, but the divergent economics of hydrogen and biogas are creating distinct opportunities and threats. The high cost of hydrogen infrastructure remains a systemic weakness, while the urgent need for reliable, grid-independent power for data centers has become a powerful opportunity for on-site biogas systems.

Fuel Cells Offer a Near-Zero Emissions Profile

Illustrating a key strength from the SWOT analysis, this chart shows that fuel cells produce virtually no criteria pollutants compared to other power generation technologies.

(Source: OHR Energy)

Table: SWOT Analysis for Fuel Cell Feedstock Versatility

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High electrical efficiency (~60%) of SOFC/MCFCs was demonstrated in pilots. Fuel flexibility was a known technical capability. | World-record efficiency (74.2%) was achieved by Reverion’s SOFC on biogas. Fuel-agnostic systems from Bloom Energy and Fuel Cell Energy are now central to major commercial deals. | The theoretical strength of high efficiency and fuel flexibility has been validated at commercial scale and at record-breaking performance levels. |

| Weaknesses | The high cost of green hydrogen ($5-12/kg) and the need for biogas cleanup were recognized barriers to adoption for each respective pathway. | Hydrogen cost remains a primary constraint, though IRA tax credits ($3/kg) help. The biogas pathway now has proprietary cleanup processes (e.g., from Fuel Cell Energy) and an economic model that bypasses hydrogen infrastructure costs. | The weakness of high hydrogen cost was not resolved but was strategically bypassed by the biogas-for-stationary-power market, which has now scaled independently. |

| Opportunities | Monetizing waste streams (biogas) and providing decentralized power were identified as key market opportunities. | Explosive energy demand from AI data centers created an urgent need for reliable, on-site power. Carbon-negative operation was validated as a new revenue stream via Frontier’s purchase from Reverion. | The abstract opportunity for decentralized power became a concrete, multi-billion dollar market driven by the data center boom. The carbon-negative potential was monetized. |

| Threats | High capital expenditure for hydrogen production and refueling infrastructure was a major threat to the hydrogen mobility vision. Grid instability was a known issue. | Grid instability has intensified, transforming from a background threat into a primary driver for behind-the-meter fuel cell adoption by corporations like Microsoft and data center operators. | A systemic threat (grid strain) has become the primary market driver for fuel cell adoption in the stationary power sector. |

2026 Fuel Cell Outlook: Watch for Biogas-to-Power Scaling in Data Centers

The most critical strategic trend for 2026 is the accelerated deployment of on-site, fuel-flexible fuel cells powered by biogas or natural gas to meet the baseload energy demand of data centers. This trend is gaining momentum as it provides a direct solution to grid constraints and high energy costs, decoupling data center growth from the limitations of public utility infrastructure.

The Biogas-to-Electricity Conversion Pathway

This diagram clearly explains the core trend highlighted in the outlook: various waste streams are converted to biogas, which then powers a fuel cell to generate electricity.

(Source: ScienceDirect.com)

- If the voracious energy demand from AI continues to cause grid congestion and project delays, then watch for an increase in direct, large-scale power purchase agreements between data center operators and fuel cell providers. The $5 billion Brookfield/Bloom Energy deal is the blueprint for this financing and deployment model.

- If regulatory and financial incentives for carbon capture and methane abatement strengthen, then watch for more projects that integrate biogas-fed fuel cells with carbon capture technology. Reverion’s success in securing a carbon removal contract from Frontier validates this as a bankable business model that others will seek to replicate.

- In this scenario, growth in the hydrogen mobility sector will continue to be gated by the slow, capital-intensive build-out of green hydrogen production and refueling infrastructure. The key signals for that market remain the number of new refueling stations opened and the delivered cost of hydrogen, not just new vehicle announcements.

Frequently Asked Questions

Why is the fuel cell market splitting into two separate paths for power and transportation?

The market has bifurcated due to different economic and infrastructure requirements. Stationary power, particularly for data centers, is driven by the need for reliable, grid-independent baseload power, which is effectively met by high-temperature fuel cells (SOFCs, MCFCs) using readily available biogas or natural gas. In contrast, the transportation sector requires compact onboard storage and fast refueling, making lower-temperature PEM fuel cells running on high-purity hydrogen the more suitable technology.

What is the main reason for the recent multi-billion dollar investments in biogas fuel cells?

The primary driver is the explosive energy demand from AI-driven data centers, which are facing significant grid constraints and delays. Major financial firms like Brookfield Asset Management are now treating on-site, biogas-fueled fuel cells as a bankable infrastructure asset that provides reliable power and bypasses public utility limitations, as seen in the $5 billion partnership with Bloom Energy.

Which fuel cell technologies are dominating the stationary power sector and why?

High-temperature fuel cells, specifically Solid Oxide Fuel Cells (SOFCs) and Molten Carbonate Fuel Cells (MCFCs), are dominating. Their key advantages are fuel flexibility (they can use biogas or natural gas directly) and extremely high electrical efficiency. For example, Reverion achieved a world-record 74.2% efficiency with its SOFC, making them a more efficient and commercially viable option than traditional combustion for waste-to-energy applications.

How are companies making biogas-to-power projects even more profitable?

Companies are adding new revenue streams by capturing the carbon dioxide (CO₂) produced during the process. The article highlights the November 2025 deal where Frontier, a carbon removal fund, committed to purchasing 96,000 tons of carbon removal from Reverion. This validates a business model for carbon-negative power generation, making the economics of biogas fuel cells more attractive.

While biogas is scaling for stationary power, what is holding back hydrogen for mobility?

The growth of the hydrogen mobility sector continues to be limited by the high cost of green hydrogen and the slow, capital-intensive build-out of a widespread production and refueling infrastructure. The article notes that the economics of pure hydrogen remain more policy-dependent, and its success is gated by factors like the number of new refueling stations and the delivered cost of fuel.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.