Grid Constraints Fuel SOFC Growth: Why Natural Gas is Powering 2026 Data Centers

SOFC Commercial Projects Pivot to Data Centers to Bypass Grid Lock

Commercial adoption of natural gas-fueled Solid Oxide Fuel Cells (SOFCs) has pivoted from broad, exploratory pilots to targeted, large-scale deployments, a shift driven by the acute power and infrastructure constraints facing the data center industry. This strategic focus capitalizes on the technology’s core ability to use existing natural gas pipelines for rapid, reliable, and high-efficiency on-site power generation, bypassing grid connection delays that can span years.

- From 2021 to 2024, SOFC deployments were characterized by market-seeding activities across various sectors, including utility microgrids with partners like So Cal Gas, residential backup power pilots with WATT Fuel Cell and Hope Gas, and institutional projects like the one at the University of Connecticut. These projects validated the technology’s performance and reliability on natural gas in diverse, smaller-scale applications.

- The period from 2025 to today marks a decisive commercial escalation. The market is now defined by multi-megawatt projects directly targeting the power-intensive AI sector. The $5 billion partnership between Bloom Energy and Brookfield, announced in October 2025 to deploy SOFCs at AI data centers, confirms this pivot from validation to gigawatt-scale commercialization where grid availability is the primary growth inhibitor.

- Application diversity continues, but at a much larger scale, reinforcing the technology’s industrial readiness. In maritime, MOL and Samsung Heavy Industries are integrating a 300 k W SOFC system fueled by Liquefied Natural Gas (LNG) onto a carrier. Simultaneously, MODEC is scaling a multi-megawatt system for offshore platforms, demonstrating that natural gas-based SOFCs are a practical solution for decarbonizing heavy industries that lack access to robust electrical infrastructure.

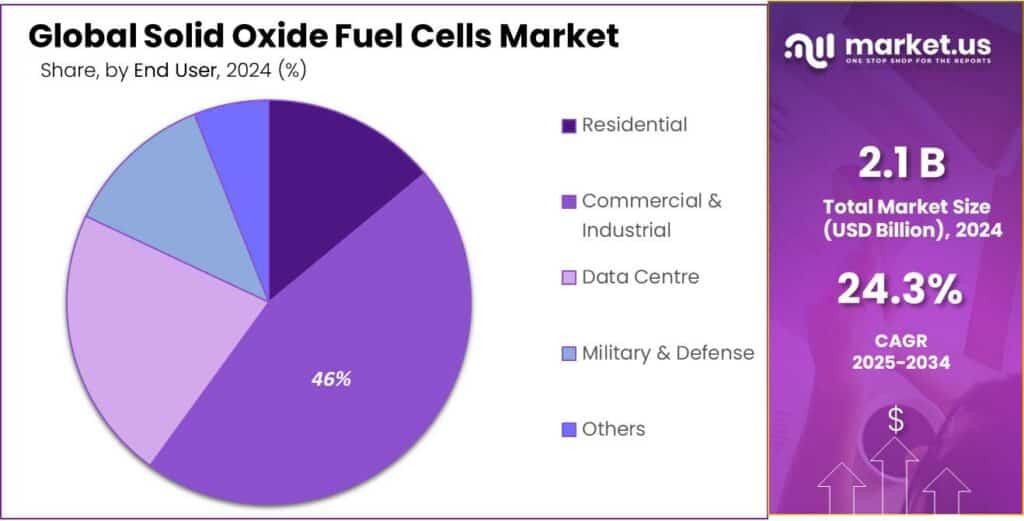

Data Centers Emerge as Key SOFC Segment

This chart visually confirms the article’s pivot to data centers by showing ‘Data Centre’ as an explicit, significant end-user segment for SOFC technology in 2024.

(Source: Market.us)

Investment Scales to Billions as Data Center Power Demand Creates Bankable Opportunities

Investment in natural gas SOFCs has scaled dramatically, moving from project-specific funding to multi-billion-dollar strategic capital allocations aimed at capturing the data center market. The surge in AI-driven power demand has transformed SOFCs from an alternative energy technology into a critical infrastructure solution, making their high capital cost justifiable when weighed against the extreme opportunity cost of waiting for grid upgrades.

SOFC Market to See Explosive Billion-Dollar Growth

This forecast illustrates the massive market expansion justifying the multi-billion-dollar investments discussed. The projected growth to over $37 billion validates SOFCs as a bankable opportunity driven by data center demand.

(Source: Straits Research)

- The $5 billion financing partnership between Bloom Energy and Brookfield in October 2025 is the defining investment signal. This transaction reframes SOFCs as a bankable asset class for infrastructure investors, with a clear focus on deploying at-scale power solutions for AI data centers that cannot afford to wait for utility service.

- This massive capital allocation contrasts sharply with the investment environment of 2021-2024, which was characterized by corporate R&D, venture funding, and smaller project finance for pilot installations. The new scale of investment indicates the market has moved past technology risk and is now focused on execution and deployment speed.

- Techno-economic analyses confirm the strategic value proposition. While studies note the higher Levelized Cost of Energy (LCOE) for SOFCs compared to utility-scale gas turbines, the critical advantage is the rapid time-to-power for data centers, which offsets the higher initial capital expenditure and makes on-site generation economically superior to project delays.

Table: Key Strategic Investments in Natural Gas SOFC Deployment

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Bloom Energy / Brookfield | Oct 2025 | Up to $5 billion investment and financing partnership to deploy natural gas-ready SOFCs. The purpose is to provide rapid, reliable on-site power for AI data centers, bypassing grid connection delays. | Data Center Dynamics |

| Ceres Power / Weichai Power | Nov 2025 | A manufacturing license agreement to produce SOFCs in China. Weichai Power estimates the systems will supply up to 1 GW of distributed power for data centers and commercial use, signaling a major investment in regional production capacity. | Fuel Cells Works |

| Edge Mode | Jan 2026 | Commissioned a feasibility study for a 300 MW AI data center campus in Spain. The project is evaluating hydrogen-ready SOFCs powered by natural gas, a signal of investor interest in deploying SOFCs at scale in Europe. | Business Insider |

| American Electric Power (AEP) | Nov 2024 | Agreement to secure up to 1 GW of Bloom Energy’s SOFCs. This long-term commitment from a major utility validates SOFCs as a key technology to serve data center growth within its service territory. | AEP |

SOFC Partnerships Evolve from Tech Validation to Giga-Scale Deployment Alliances

Strategic partnerships have evolved from technology co-development to large-scale deployment alliances that pair SOFC manufacturers with infrastructure investors and major energy consumers. This new ecosystem is structured to overcome the primary barriers to adoption: high upfront capital costs and the logistical challenges of deploying energy infrastructure at the speed and scale demanded by the AI boom.

Chart Shows Key Competitors Driving SOFC Alliances

This chart identifies the major corporate players, including Bloom Energy and Cummins, who are forming the large-scale deployment alliances described in the text, visualizing the competitive ecosystem.

(Source: Global Market Insights)

- The alliance between technology provider Bloom Energy and infrastructure investor Brookfield is the blueprint for this new model. It combines manufacturing expertise with massive capital to deliver power-as-a-service, enabling data center operators to procure reliable power without the typical balance sheet impact of large infrastructure projects.

- Cross-industry partnerships are enabling market entry in hard-to-abate sectors. The collaboration between MOL, Samsung Heavy Industries, and Bloom Energy to install a 300 k W SOFC on an LNG carrier demonstrates a viable pathway for the maritime industry to use its existing LNG fuel infrastructure to reduce emissions.

- Manufacturing partnerships are localizing supply chains to meet regional demand. Ceres Power’s licensing agreement with China’s Weichai Power aims to establish a significant production base to serve the Asian data center and commercial markets, reducing logistical costs and accelerating deployment in a key growth region.

- Utility partnerships have also matured. Earlier collaborations like Bloom Energy’s microgrid project with So Cal Gas proved the concept, while newer agreements like the one with AEP for up to 1 GW of capacity show utilities are now integrating SOFCs into their strategic planning to manage grid constraints and serve large customers.

Table: Key Strategic Partnerships for Natural Gas SOFCs

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| WATT Fuel Cell / Hope Gas | Dec 2025 | Launched the ‘WATT HOME’ leasing program in West Virginia for residential backup power. This partnership creates a scalable business model to overcome the upfront cost barrier for homeowners by leveraging a utility’s customer base. | WATT Fuel Cell |

| Bloom Energy / AEP | Nov 2024 | AEP, a major US utility, signed an agreement to facilitate up to 1 GW of SOFC deployments for data centers. The partnership positions SOFCs as a non-wires alternative to manage grid load and serve new, large-scale customers. | AEP |

| Alma Clean Power / Odfjell / DNV | Oct 2023 | A partnership to test an 80 k W natural gas-fueled SOFC system on a chemical tanker. The project aims to validate SOFCs as a viable technology for reducing emissions in deep-sea shipping using existing LNG infrastructure. | Offshore Energy |

SOFC Deployment Hotspots Align with Data Center Growth and Grid Congestion

While North America and Asia remain the dominant markets for natural gas SOFCs, deployment strategy has become highly targeted, concentrating on geographic regions with a combination of high power demand, significant grid congestion, and a booming data center construction pipeline. This geographical focus underscores that SOFC adoption is less about broad energy policy and more about solving acute, localized infrastructure bottlenecks.

North American SOFC Market Shows Strong Growth

This chart supports the section’s focus on deployment hotspots by illustrating the strong forecasted market growth in North America, a key geographical region identified in the text.

(Source: Global Market Insights)

- Between 2021-2024, SOFC deployments were geographically dispersed across the U.S. and South Korea, with projects like AEP’s utility collaborations and SK Eternix’s early power plants demonstrating the technology’s versatility. These projects laid the commercial groundwork in key markets.

- From 2025 to today, deployment activity has consolidated in major data center hubs. The U.S. leads this trend, driven by AI power demand in states like Virginia, Ohio, and Texas. In Europe, Edge Mode’s planned 300 MW campus in Spain, powered by natural gas SOFCs, signals a similar strategy to build large-scale AI infrastructure where power is available, even if it requires on-site generation.

- Asia remains a critical growth engine, with South Korea and China leading. Bloom Energy’s construction of an 80 MW installation in South Korea, the world’s largest, highlights the country’s commitment to fuel cells for clean, distributed power. The Ceres Power and Weichai partnership is positioned to meet anticipated demand from China’s own rapidly expanding data center market.

Natural Gas SOFCs Achieve Commercial Maturity, Shifting Focus to Giga-Scale Manufacturing

Natural gas-powered SOFC technology has reached full commercial maturity, with the market’s focus shifting decisively from proving technical viability to optimizing for large-scale manufacturing and rapid, repeatable deployment. The technology is now treated as a bankable, off-the-shelf solution for mission-critical power, validated by multi-gigawatt supply agreements and industrial-scale projects.

Diagram Details SOFC Natural Gas Conversion Process

This process diagram illustrates the established, multi-stage method for converting natural gas to power, visually reinforcing the section’s claim that the technology has achieved commercial maturity.

(Source: POWER Magazine)

- The period of 2021-2024 was defined by real-world validation. Projects like So Cal Gas’s successful year-long operation of SOFC microgrids and numerous pilots proved the technology’s high electrical efficiency (exceeding 60%), operational reliability on natural gas, and low criteria pollutant emissions profile.

- Since 2025, the conversation has moved from performance to industrial scale. The existence of a $5 billion deployment fund from Brookfield and a 1 GW supply agreement with AEP confirms that financial and industrial partners no longer see technology risk. The challenge has shifted to supply chain management and manufacturing capacity to meet a surge in demand.

- The industry has successfully addressed long-term decarbonization concerns by standardizing “hydrogen-ready” systems. Recent projects, including Bloom Energy’s latest offerings and the Edge Mode data center study, explicitly feature the ability to blend hydrogen or convert to 100% hydrogen in the future. This feature protects the asset value against future climate regulations and solidifies the SOFC’s role as a practical bridge technology.

SWOT Analysis: Grid Bypass a Key Strength for Natural Gas SOFCs

The strategic value of natural gas SOFCs is anchored in their ability to bypass grid constraints with high-efficiency, low-emission on-site power, although this strength is balanced by high capital costs and an underlying reliance on a fossil fuel. Recent market dynamics, particularly the power crisis in the AI sector, have amplified the technology’s strengths and opportunities while creating clear pathways to mitigate its weaknesses and threats.

SOFCs Demonstrate Superior Electrical Efficiency

This chart directly validates a key ‘Strength’ from the SWOT analysis, showing SOFCs’ 60% electrical efficiency is significantly higher than traditional power generation methods.

(Source: Bosch)

- Strengths like high electrical efficiency and fuel flexibility have been validated at a commercial scale, making SOFCs a proven solution.

- Weaknesses related to high CAPEX are being reframed as a necessary cost of doing business for industries where time-to-power is paramount.

- Opportunities are immense, driven by an AI power demand that shows no signs of slowing, creating a captive market for reliable, distributed generation.

- Threats from regulations are being actively managed through the “hydrogen-ready” design of new systems, positioning them as future-proof assets.

Table: SWOT Analysis for Natural Gas Solid Oxide Fuel Cells (2026)

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Validated |

|---|---|---|---|

| Strengths | Demonstrated high electrical efficiency (~60%) and CHP potential (>90%) in pilots. Showcased low emissions of NOx/SOx and fuel flexibility with natural gas and biogas in projects with So Cal Gas and UConn. | High efficiency and reliability are now bankable features driving multi-billion dollar investments. Fuel flexibility is a core part of the value proposition, with systems being marketed as “hydrogen-ready.” | The technology’s core performance strengths were validated at commercial scale, shifting the market perception from a promising alternative to a proven, primary power solution for critical applications. |

| Weaknesses | High capital expenditure (CAPEX) and a higher Levelized Cost of Energy (LCOE) compared to conventional gas turbines, as noted in techno-economic studies. This limited adoption to niche or subsidized applications. | CAPEX remains high, but it is increasingly seen as a justifiable expense for data centers to avoid multi-year grid connection delays. The economic calculation now includes the immense opportunity cost of being offline. | The strategic need for rapid, reliable power in the AI sector has effectively neutralized the high CAPEX as a primary barrier to adoption for high-value customers. |

| Opportunities | Growing demand for resilient, distributed power. Leveraging existing natural gas infrastructure was identified as a key logistical advantage. Potential for carbon capture integration was noted. | The explosive, inelastic power demand from AI has become the single largest market driver. The inadequacy of the electrical grid is no longer a future risk but a present reality, creating a massive, immediate opportunity. | The data center power crisis moved from a forecast to an acute, market-defining opportunity. This transformed the SOFC market from steady growth to an exponential expansion trajectory. |

| Threats | Volatility in natural gas prices. Long-term risk from climate policies aimed at phasing out fossil fuels. Competition from improving battery storage and declining renewable energy costs. | The “hydrogen-ready” design of new SOFCs directly mitigates the threat of future fossil fuel regulations. The ability to run on RNG, biogas, or hydrogen blends provides a clear decarbonization pathway. | The industry validated its primary defense against the threat of stranded assets by commercializing fuel-flexible systems, positioning SOFCs as a transitional technology compatible with a future hydrogen economy. |

Scenario for 2026: SOFCs Become Standard for New Data Center Power

If the power deficit for AI data centers continues to outpace grid expansion, expect natural gas SOFCs to become a standardized, default power solution for new large-scale deployments. The market will likely shift toward pre-packaged, rapidly deployable multi-megawatt power blocks, turning SOFC manufacturers into critical infrastructure providers for the digital economy.

SOFC Market Forecasted to Explode by 2034

This chart’s projection of explosive growth to over $32 billion strongly supports the future scenario where SOFCs become a standardized power solution for new data centers.

(Source: Precedence Research)

- If this happens: Watch for SOFC manufacturers to announce standardized, modular data center power offerings in the 10-100 MW range, designed for rapid deployment and integration. These offerings would signal a move from customized projects to a product-based approach.

- Watch this: The execution of the Bloom Energy/Brookfield partnership will be the primary bellwether. Successful, on-schedule deployments at multiple sites will validate the scaled delivery model and trigger more infrastructure investors to enter the market. Any significant delays could indicate supply chain or integration bottlenecks.

- Watch this: The financial performance and forward guidance of public SOFC companies like Bloom Energy and Ceres Power. Sustained revenue growth and improving gross margins throughout 2026 will confirm the profitability of the data center strategy and attract further investment.

- This could be happening: Other energy-intensive industries facing similar grid constraints, such as advanced manufacturing and biotechnology, will begin adopting the SOFC-as-a-service model pioneered in the data center sector to ensure power security and predictable energy costs.

Frequently Asked Questions

Why are data centers suddenly turning to natural gas fuel cells?

Data centers, especially those for AI, require massive amounts of power immediately. Waiting for new grid connections can take years, creating extreme project delays. Natural gas-fueled SOFCs bypass these ‘grid lock’ delays by providing rapid, reliable on-site power using existing natural gas pipeline infrastructure.

Aren’t fuel cells expensive? Why are they a good investment now?

While SOFCs have a high initial capital cost, the economics have changed for the data center industry. The opportunity cost of waiting years for a grid connection is now considered far greater than the higher upfront cost of an SOFC. This has transformed them into a ‘bankable’ asset, as proven by multi-billion-dollar financing partnerships like the one between Bloom Energy and Brookfield.

Does using natural gas for fuel cells conflict with climate goals?

The industry is addressing this concern by designing new SOFC systems to be ‘hydrogen-ready.’ This means they can operate on blends of natural gas and hydrogen, or eventually switch to 100% green hydrogen. This feature positions them as a practical ‘bridge technology’ that provides immediate power while offering a clear pathway to future decarbonization, protecting the investment from becoming a stranded asset.

What is the main difference between SOFC projects before 2025 and now?

Before 2025, SOFC projects were mainly smaller-scale pilots across various sectors (e.g., residential, utility microgrids) focused on validating the technology’s performance. Since 2025, the market has pivoted to large, multi-megawatt commercial deployments specifically targeting the power-intensive AI data center market, with supply agreements now reaching the gigawatt scale.

Who are the major players involved in this SOFC boom for data centers?

Key players include SOFC manufacturers like Bloom Energy and Ceres Power. They are forming large-scale deployment alliances with infrastructure investors like Brookfield (for financing), manufacturing partners like Weichai Power (to scale production), and major utilities like American Electric Power (AEP) to fund, build, and deploy power solutions for data centers.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.