Global Memory Shortage 2026: Why AI Is Breaking the PC & Smartphone Supply Chain

Manufacturing Risk 2026: AI Demand Restructures Global Memory Chip Production

The primary risk to the 2026 consumer electronics market is not a lack of total semiconductor manufacturing capacity, but a strategic reallocation of that capacity away from consumer-grade memory towards high-margin High-Bandwidth Memory (HBM) for AI data centers. This pivot by major manufacturers creates a structural supply shortage for PCs and smartphones, fundamentally different from the cyclical disruptions of the past. The production of a single HBM wafer displaces two or more conventional DRAM wafers due to larger die sizes and greater complexity, creating a net reduction in the global supply of memory bits even as wafer output remains constant.

- Between 2021 and 2024, the memory market was defined by cyclicality, moving from a pandemic-induced shortage to a significant glut and price collapse in 2023. The market dynamic was driven by broad consumer and enterprise demand fluctuations.

- From 2025 to today, the market has been completely restructured by the explosive, non-cyclical demand for AI infrastructure. Projections show data centers will consume as much as 70% of all high-end memory in 2026, a stark inversion from prior years when the industry optimized for consumer devices.

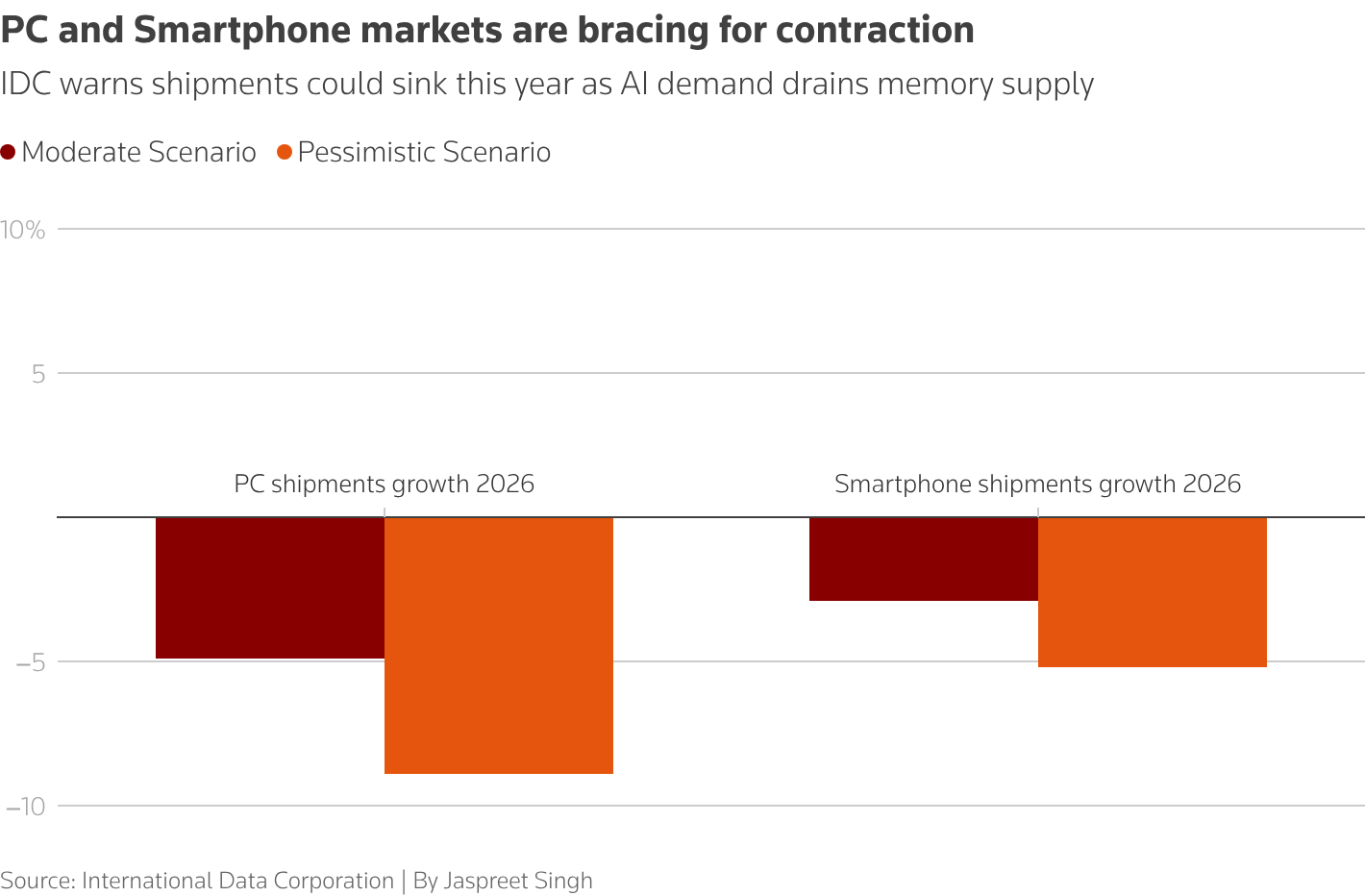

- In response, memory producers like Samsung, SK Hynix, and Micron are aggressively shifting production to HBM, which is sold out through 2026. This strategic choice directly reduces the supply available for conventional DRAM and NAND, threatening to shrink the PC market by up to 9% and the smartphone market by 5% in 2026.

- The economic consequences are severe price increases. Analysts forecast memory prices to rise 40-50% in Q 1 2026 alone, following significant hikes in late 2025. This is a direct result of supply being diverted to the more lucrative AI sector.

PC & Smartphone Shipments to Contract in 2026

The section describes how AI demand is creating a memory shortage for PCs and smartphones. This chart directly visualizes that outcome, forecasting a contraction in shipments for both device categories in 2026 and attributing it to AI demand.

(Source: The Express Tribune)

Semiconductor Investment Analysis: Memory Fabs Race to Meet AI Demand, But Will Arrive Too Late for 2026

In response to the AI-driven demand surge, the world’s leading memory manufacturers are initiating massive, multi-billion-dollar capital expenditure cycles to expand production capacity. These historic investments, however, are a long-term solution. The multi-year lead times required for fab construction and commissioning mean that this new capacity will not come online in time to alleviate the projected supply shortage in 2026, extending the period of high prices and constrained availability for consumer electronics.

- Micron Technology announced a landmark $24 billion investment over ten years for a new fab in Singapore and has committed to building major new facilities in New York and Idaho, backed by $6.14 billion in U.S. CHIPS Act funding. However, initial production from these sites is not expected until 2026 at the earliest, with significant volume arriving closer to 2028.

- SK Hynix is investing $13 billion in a new plant in South Korea and $3.87 billion in an advanced packaging facility in Indiana. The Indiana plant, critical for future HBM production, is not slated for mass production until the second half of 2028.

- Samsung Electronics is increasing its HBM capacity by 50% in 2026 and is developing its $17 billion facility in Taylor, Texas. These efforts are primarily focused on capturing the high-margin AI market, reinforcing the production shift away from conventional memory.

Table: Major Semiconductor Memory Fab Investments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Micron Technology | Jan 2026 | Announced a $24 billion investment over 10 years to build a new advanced wafer fabrication facility in Singapore to boost NAND flash output. Production is slated to begin in H 2 2028. | CNBC |

| SK Hynix | Jan 2026 | Announced a $13 billion investment in a new fabrication plant in Cheongju, South Korea, to meet demand for HBM and other advanced memory chips for AI applications. | CNBC |

| Micron Technology | Apr 2024 | Awarded up to $6.14 billion in CHIPS Act funding to support construction of new memory fabs in New York and Idaho, marking a major push for U.S.-based manufacturing. | U.S. Department of Commerce |

| SK Hynix | Apr 2024 | Announced a $3.87 billion investment to build an advanced chip packaging facility in West Lafayette, Indiana, focusing on next-generation HBM. Mass production is planned for H 2 2028. | SK hynix |

| Micron Technology | Oct 2022 | Announced plans to invest up to $100 billion over 20+ years to build a mega-fab complex in Clay, New York, representing the largest planned semiconductor investment in U.S. history. | Micron |

Geographic Concentration: How US and Asian Supply Chain Policies Shape the 2026 Memory Crisis

While advanced semiconductor manufacturing remains highly concentrated in East Asia, policy-driven investments are initiating a long-term geographic diversification, primarily towards the United States. This shift, however, will not mature in time to alter the supply dynamics of the 2026 memory crisis. For the immediate future, the global electronics supply chain remains critically dependent on the production decisions made at existing fabs in South Korea and the operational stability of the broader Asian semiconductor ecosystem.

- Between 2021 and 2024, the global memory supply chain was firmly anchored in East Asia, with South Korea (home to Samsung and SK Hynix) dominating advanced DRAM and NAND production. This concentration represented a known geopolitical and supply chain risk.

- Starting in 2025, the impact of the U.S. CHIPS and Science Act became visible through a wave of major investment announcements for new fabs on U.S. soil. Key projects include Micron’s facilities in New York and Idaho, SK Hynix’s packaging plant in Indiana, and Samsung’s fab in Texas.

- Despite this U.S. push, Asia remains a critical hub for near-term expansion. Micron’s $24 billion investment in its Singapore fab and SK Hynix’s $13 billion plant in South Korea are designed to meet immediate AI-driven demand, further solidifying the region’s importance through 2026 and beyond.

Technology Maturity: HBM Production Complexities Create a Critical Bottleneck for 2026

Although the underlying DRAM and NAND flash technologies are fully mature, the industry’s rapid pivot to High-Bandwidth Memory (HBM) to serve the AI market has introduced a critical manufacturing bottleneck. The inherent complexity, lower yields, and advanced packaging requirements of HBM constrain the effective growth of memory supply, preventing manufacturers from scaling output fast enough to meet demand from both data centers and consumer devices in 2026.

Notebook Memory Costs to Spike Significantly by 2026

The section explains how HBM production complexity is creating a supply bottleneck. This chart quantifies a direct consequence, showing that the bill of materials cost for notebook memory is forecast to spike significantly through 2026.

(Source: TechPowerUp)

- In the 2021-2024 period, technology development focused on incremental improvements to mature products, such as increasing 3 D NAND layer counts and refining DDR 5 processes. These technologies were at a high Technology Readiness Level (TRL 9), and the main challenge was managing cyclical market demand.

- From 2025 onward, the bottleneck has shifted decisively to HBM production. While HBM itself is a mature technology (TRL 9), its manufacturing process is significantly more complex and resource-intensive than conventional DRAM, with lower yields per wafer. This limits the total volume of memory bits that can be produced from a given amount of silicon.

- The industry is now in a race to mass-produce the next generation, HBM 4, by 2026 to support future AI platforms from companies like NVIDIA. This transition requires even more sophisticated advanced packaging techniques, further straining a part of the supply chain that is already a known chokepoint.

- Simultaneously, the expected debut of the LPDDR 6 standard for mobile devices in 2026 will create another new stream of demand for cutting-edge, low-power memory, adding another layer of complexity to the constrained supply environment.

SWOT Analysis: Navigating the 2026 Memory Market Super-Cycle

The global memory market’s dynamics reveal a clear strength in AI-driven demand and unprecedented pricing power for producers, but this is offset by the inherent weakness of long manufacturing lead times and the significant threat of market contraction in the consumer electronics sector. Government incentives provide a major opportunity for long-term supply diversification, but geopolitical risks remain a persistent threat. The key shift is the validation that AI has created a structural, demand-led “super-cycle, ” overriding the industry’s historical boom-and-bust pattern for the foreseeable future.

AI Demand Drives Memory Maker Price Surge

This section’s SWOT analysis cites AI-driven demand and producer pricing power as key strengths. The chart perfectly illustrates this strength by showing the massive stock price surge for memory manufacturers, fueled by the AI super-cycle.

(Source: Bloomberg.com)

Table: SWOT Analysis for the Global Memory Shortage Crisis and its 2026 Impact

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | – Established high-volume manufacturing capabilities. – Mature DRAM and NAND technologies. |

– Unprecedented pricing power for memory producers. – AI-driven demand creating a high-margin “super-cycle.” – HBM capacity sold out for 2026, ensuring revenue visibility. |

The market shifted from a price-sensitive, cyclical model to a structural, demand-driven model led by AI. Pricing power, once weak, is now a primary strength for memory makers. |

| Weaknesses | – High sensitivity to cyclical downturns in PC/smartphone demand. – History of rapid shifts from shortage to glut. |

– Long lead times (2-3 years) for new fab construction. – HBM production is more complex and has lower bit yield per wafer than conventional DRAM. – Production capacity is finite and being reallocated, not just added. |

The weakness of long construction timelines was validated, proving that new fabs cannot be built fast enough to solve a near-term structural demand shift. HBM complexity emerged as a new, critical constraint. |

| Opportunities | – Growth in data center and cloud computing. – Early development of on-device AI. |

– Massive government subsidies (e.g., U.S. CHIPS Act) de-risk capital expenditures. – Growth of adjacent markets like advanced packaging. – Development of next-gen memory (LPDDR 6, HBM 4). |

Government policy (CHIPS Act) transformed from a proposal into a tangible financial opportunity, triggering tens of billions in confirmed U.S.-based investments from Micron and SK Hynix. |

| Threats | – Geopolitical instability in East Asia (Taiwan, South Korea). – Potential for global economic recession to curb demand. |

– Severe market contraction (up to 9% for PCs, 5% for smartphones) due to high prices. – OEMs forced to raise prices or downgrade device specs. – Potential for significant oversupply post-2027 as new fabs come online. |

The threat of a consumer market downturn was validated by forecasts from IDC and Counterpoint. The theoretical risk of a demand drop became a specific, quantified projection for 2026. |

Forward Outlook: Key Signals for the 2026 Memory Supply Chain

If demand for AI infrastructure continues its current growth trajectory, watch for sustained, double-digit memory price hikes and further downward revisions of PC and smartphone shipment forecasts. These are the primary signals confirming that the structural supply crisis, driven by the reallocation of manufacturing capacity, will persist through 2027. The ability of OEMs to absorb costs versus the willingness of consumers to pay higher prices for new devices will determine the ultimate market impact.

Memory Crunch Slashes 2026 Smartphone Shipment Forecasts

The section identifies “downward revisions of…smartphone shipment forecasts” as a key signal to watch. This chart directly visualizes that signal, showing how forecasts for 2026 have been drastically revised downward into negative territory.

(Source: Bloomberg.com)

- Monitor the Divergence in Financial Performance: A key signal will be the contrast in quarterly earnings reports between consumer electronics OEMs and memory manufacturers. If firms like Dell, HP, and Lenovo report compressing margins and declining revenue while Micron, SK Hynix, and Samsung’s semiconductor divisions post record profits, it will confirm the crisis is playing out as expected.

- Track Fab Commissioning Timelines: Closely watch for any announcements of delays or accelerations for key expansion projects, such as Micron’s $24 billion Singapore fab and SK Hynix’s $13 billion Cheongju plant. Any significant deviation from the H 2 2027 to H 2 2028 operational timeframe will directly impact the duration of the shortage.

- Watch for HBM 4 Production Yields: The successful mass production of next-generation HBM 4 memory by Samsung and SK Hynix in 2026 is a critical catalyst for the next wave of AI accelerators. Progress reports on yields and manufacturing milestones will be a leading indicator of the supply chain’s ability to keep pace with the AI roadmap.

Frequently Asked Questions

Why is there a memory shortage if total semiconductor manufacturing isn’t decreasing?

The shortage is not caused by a reduction in total manufacturing, but by a strategic reallocation of production capacity. Major manufacturers like Samsung, SK Hynix, and Micron are shifting their focus from consumer-grade memory (DRAM and NAND) to more profitable High-Bandwidth Memory (HBM) for AI data centers. Because HBM production is more complex and uses larger die sizes, one HBM wafer displaces the production of two or more conventional DRAM wafers, leading to a net reduction in memory bits available for PCs and smartphones.

How will the 2026 memory shortage affect me when buying a new PC or smartphone?

Consumers will likely face significantly higher prices for new electronics. The article projects memory prices could increase by 40-50% in the first quarter of 2026 alone. This could force manufacturers to raise the retail price of their devices or, alternatively, downgrade the amount of memory included in new PCs and smartphones to keep costs down. The overall PC and smartphone markets are forecast to shrink by up to 9% and 5%, respectively, due to these supply constraints.

Are companies building new factories to solve this problem, and when will the shortage end?

Yes, companies like Micron, SK Hynix, and Samsung are making multi-billion-dollar investments in new fabrication plants. However, these are long-term solutions. It takes multiple years to build and commission a new fab, so this new capacity will not be available in time to fix the 2026 shortage. Significant volume from these new U.S. and Asian facilities is not expected until 2028, meaning the period of high prices and tight supply could last through 2027.

What is HBM and why is it causing this problem?

HBM stands for High-Bandwidth Memory. It is a high-performance memory technology essential for the powerful AI accelerators used in data centers. The problem arises because HBM manufacturing is far more complex, resource-intensive, and has lower yields per wafer compared to the standard DRAM used in consumer devices. This means that as factories pivot to making HBM, they produce a much lower total volume of memory bits from the same amount of silicon, creating a bottleneck that constrains supply for both the AI and consumer markets.

Since manufacturers are investing in new fabs in the U.S., will that help alleviate the 2026 crisis?

No, the new U.S.-based fabs will not be ready in time to alleviate the 2026 crisis. While the U.S. CHIPS Act has spurred major investments, such as Micron’s projects in New York and Idaho and SK Hynix’s plant in Indiana, these facilities are not slated for mass production until 2028 or later. For the immediate future, the global electronics supply chain remains critically dependent on existing fabs in South Korea and the rest of Asia.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Semiconductor Scarcity 2025: Unpacking the AI Chip Crisis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.