AI Memory Chip Shortage 2026: Why Manufacturing Capacity Is The Global Tech Bottleneck

Industry Risks: AI Demand Triggers Cross-Sector Supply Chain Crisis in 2026

The explosive demand for Artificial Intelligence infrastructure has created a structural supply crisis in the global memory market, a stark departure from the cyclical fluctuations observed before 2025. The insatiable and non-negotiable requirement for High-Bandwidth Memory (HBM) in AI systems is redirecting global manufacturing capacity, creating severe shortages and price inflation that now threaten industries far beyond data centers.

- Between 2021 and 2024, memory demand was driven by a mix of enterprise, consumer, and nascent AI needs, with supply chains operating in a relatively predictable, cyclical manner. The introduction of Chat GPT in late 2022 was a key inflection point, signaling a future surge in hardware requirements that the market was not prepared for.

- Starting in 2025, the crisis materialized as hyperscalers began consuming a disproportionate share of memory, particularly HBM. This forced manufacturers like Micron Technology and SK Hynix to prioritize high-margin HBM production, which consumes three times more wafer capacity than standard DRAM, creating a supply vacuum for conventional chips.

- The impact on non-AI sectors is now acute. By January 2026, companies like Dell and HP warned of shortages, while the automotive industry faces disruption because its reliance on older, less-profitable DRAM conflicts directly with the production shift toward HBM.

- This structural realignment is quantified by unprecedented price hikes since April 2025, with DDR 4 RAM prices surging by 1, 360% and general memory prices increasing over 50% in Q 1 2026 alone, confirming the crisis has spread from specialized AI hardware to the broader technology ecosystem.

Chart Visualizes the 2026 Memory Price Crisis

This chart directly illustrates the dramatic price surge for memory components into January 2026, perfectly matching the section’s heading and its focus on a price inflation crisis.

(Source: Advisor Perspectives)

Investment Analysis: Unprecedented Capital Flow Aims to Break the Memory Bottleneck

In response to the structural supply deficit, memory manufacturers initiated a massive wave of capital expenditure beginning in late 2025, but these investments will not resolve the shortage before 2027. The two-to-three-year lead time required to build and equip new fabrication plants ensures the current supply-demand imbalance will persist, locking in high prices and supply chain risk for the medium term.

Chart Details Multi-Year Fab Development Timelines

This chart explains the core argument of the section by showing the three-year lead time for new fabrication plants, validating why massive capital investment will not provide immediate supply relief.

(Source: TechRepublic)

- The scale of investment reflects the severity of the crisis, moving from cyclical adjustments before 2024 to emergency capacity expansion. Global AI capital expenditure is projected to grow by 33% in 2026 to reach $480 billion, directly fueling the memory demand cycle.

- Memory producers are leading the spending. Micron Technology announced a $24 billion investment in its Singapore plant in January 2026 specifically to increase the supply of memory chips for the AI sector.

- The investment is not limited to chip production. Chip equipment Cap Ex is forecast to hit a record $156 billion in 2027, demonstrating a system-wide effort to expand every part of the semiconductor manufacturing process to meet AI-driven demand.

Table: Major Capital Investments to Address the AI Memory Shortage

| Company / Forecaster | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Micron Technology | Announced Jan 2026 | Announced a $24 billion investment to expand its Singapore plant to boost NAND flash and DRAM supply, directly targeting the AI-driven memory shortage. | CNBC |

| UBS | 2026 (Forecast) | Projected global AI capital expenditure to reach $480 billion, a 33% increase from 2025, indicating sustained and intense demand for AI hardware including memory. | Semiconductor Digest |

| SEMI | 2027 (Forecast) | Forecasted that AI will drive chip equipment Cap Ex to a record $156 billion, highlighting the broad-based investment across the supply chain to expand manufacturing capacity. | EE Times |

| SK hynix | Announced Apr 2024 | Announced a $14.6 billion investment to build a new memory chip plant in South Korea focused on HBM production to meet exploding AI demand. | Yole Group |

| SK hynix | Announced Apr 2024 | Announced a $3.87 billion advanced packaging facility in Indiana, USA, a critical move to onshore HBM supply chains and support US-based AI development. | SK hynix |

Partnership Analysis: Strategic Alliances Emerge to Secure Scarce Memory Supply

The memory shortage has fundamentally altered procurement strategies, forcing AI leaders to abandon transactional purchasing in favor of multi-billion-dollar, long-term supply agreements to secure a share of the constrained production capacity. This trend, which solidified in late 2025, grants immense market power to memory manufacturers and locks out smaller players.

- Before 2025, relationships between chipmakers and customers were largely standard supplier agreements. The shift is exemplified by Open AI’s landmark $71 billion order for Korean HBM chips announced in October 2025 to support its future AI projects.

- This type of large-scale, long-term commitment effectively reserves a significant portion of future HBM production, exacerbating the shortage for other industries like automotive and consumer electronics that cannot compete with the purchasing power of hyperscalers.

- The formation of these strategic alliances is a clear signal that access to high-performance memory is now a primary competitive battleground, with supply assurance prioritized over cost.

Table: Key Partnerships and Supply Agreements in the AI Memory Market

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Open AI and Korean Memory Suppliers | Announced Oct 2025 | Placed a $71 billion order for HBM chips to secure a massive supply for its Stargate AI supercomputer project, locking in capacity for years. | Light Reading |

| Nvidia, SK Hynix, and TSMC | Ongoing since 2024 | A critical tripartite relationship where SK Hynix supplies HBM and TSMC provides advanced packaging for Nvidia’s AI accelerators. The bottleneck in this supply chain directly impacts global AI hardware availability. | PCMag |

| Micron Technology and U.S. Government | Announced Apr 2024 | Micron is set to receive $6.14 billion in grants from the U.S. CHIPS and Science Act, a government partnership to onshore leading-edge DRAM manufacturing in Idaho and New York. | Semi Wiki |

Geography: Manufacturing Investment Shifts to U.S. and Southeast Asia

The AI memory crisis has catalyzed a significant geographic diversification of semiconductor manufacturing, with massive investments flowing into the United States and Southeast Asia to augment the historically dominant position of South Korea. This shift is driven by a combination of government incentives aimed at supply chain resilience and the urgent need to build new capacity anywhere possible.

- Before 2024, South Korea was the undisputed leader in advanced memory production, with Samsung and SK Hynix controlling the market. While still a dominant force, its leadership is now being supplemented by new, large-scale projects elsewhere.

- Since 2025, the United States has emerged as a major destination for new investment, enabled by the CHIPS and Science Act. Key projects include SK Hynix’s $3.87 billion advanced packaging plant in Indiana and Micron’s planned fabs in Idaho and New York.

- Southeast Asia is also a critical growth region, highlighted by Micron’s $24 billion expansion of its plant in Singapore, announced in January 2026. This investment aims to bolster the supply of both DRAM and NAND flash memory to serve the AI boom.

Technology Maturity: HBM Production Bottleneck Validates Manufacturing Constraints

The AI-driven demand shock has exposed a critical immaturity in the mass production of High-Bandwidth Memory, shifting the primary challenge from technology design to manufacturing scalability. While HBM technology existed before 2024, the unprecedented demand has revealed its complex and resource-intensive production process as the central bottleneck in the entire AI hardware ecosystem.

Forecast Shows HBM Dominance Driving Bottleneck

This chart’s forecast of High-Bandwidth Memory (HBM) market domination visually explains why its production has become the central bottleneck, as described in the section.

(Source: EnkiAI)

- Between 2021 and 2024, HBM was a proven but niche technology used in high-performance computing. The focus was on improving bandwidth and design, with manufacturing volumes being relatively low.

- From 2025 to today, the crisis demonstrated that HBM manufacturing cannot scale quickly. The process of vertically stacking DRAM chips is significantly more complex and consumes approximately three times the wafer capacity per bit compared to standard DRAM, creating a physical production limit.

- The complete sell-out of HBM production capacity for 2026 by major producers like Micron and SK Hynix serves as definitive validation of this manufacturing bottleneck. The industry’s inability to meet demand, despite massive investment, confirms that the technology’s production readiness is lagging far behind market needs.

SWOT Analysis: Strategic Implications of the AI Memory Supercycle

The AI-driven memory shortage has permanently reshaped the semiconductor market, elevating memory from a commoditized component to a strategic asset. This has created immense opportunities for a few key manufacturers while posing significant threats to industries unable to compete for the limited supply.

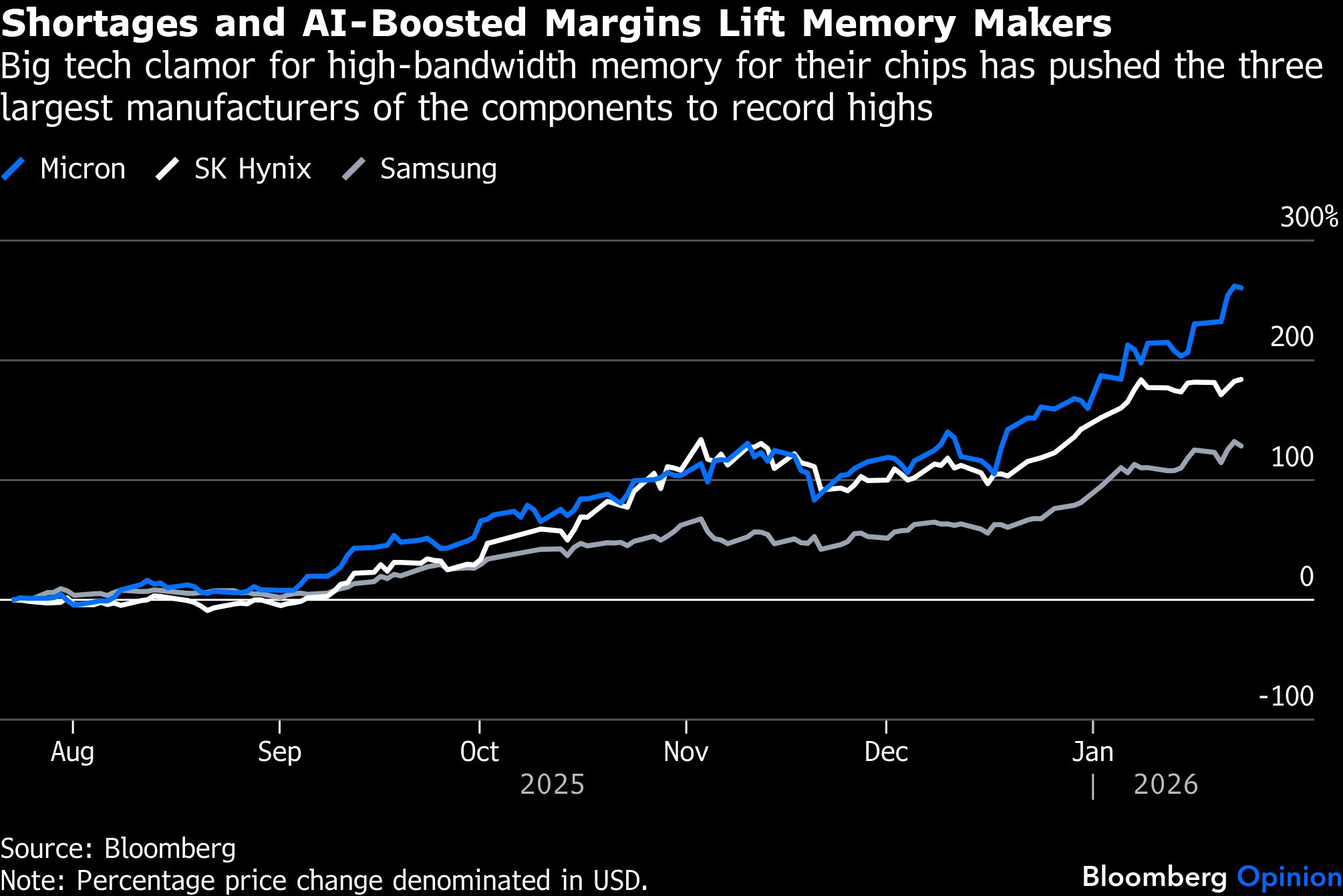

Chart Shows Triple-Digit Growth for Memory Suppliers

This chart quantifies the ‘immense opportunities’ and ‘unprecedented pricing power’ for memory manufacturers mentioned in the SWOT analysis by showing explosive year-over-year revenue growth.

(Source: ASMPT Semiconductor Solutions)

- Strengths and Opportunities are concentrated among memory producers like Samsung, SK Hynix, and Micron, who now have unprecedented pricing power and are benefiting from massive government incentives.

- Weaknesses and Threats highlight the system’s fragility, defined by long manufacturing lead times and the severe risk of production disruptions for non-AI sectors such as automotive and consumer electronics.

Table: SWOT Analysis for the AI-Driven Memory Chip Market

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strengths | Established manufacturing leadership in DRAM/NAND by Samsung, SK Hynix, and Micron. | Unprecedented pricing power with HBM sold out through 2026 and DDR 4 prices up 1, 360%. Control over a critical, non-negotiable AI component. | The market shifted from cyclical and commoditized to a high-margin, structurally undersupplied business. Memory is now a strategic bottleneck. |

| Weaknesses | Cyclical profitability and periods of oversupply. HBM was a low-volume, high-complexity product. | Long fab construction lead times (over two years). HBM production consumes 3 x more wafer capacity, creating an inherent manufacturing bottleneck. | The inability to rapidly scale production was validated. Supply elasticity is extremely low, meaning massive Cap Ex will not bring immediate relief. |

| Opportunities | Early growth in AI server demand. Initial government interest in onshoring (e.g., U.S. CHIPS Act). | Massive capital injections (Micron’s $24 B, SK Hynix’s $14.6 B) and government subsidies. Long-term, high-value contracts (Open AI’s $71 B order). | The AI supercycle created a durable, high-demand market for premium memory products, justifying enormous and previously unjustifiable capital investment. |

| Threats | Standard supply chain disruptions and geopolitical tensions. Risk of cyclical downturns. | Supply vacuum for non-AI sectors (automotive, consumer electronics). Risk of demand destruction in consumer markets due to high prices. Potential for a supply glut post-2027 if Cap Ex overshoots. | The prioritization of AI created a direct resource conflict, validating the threat of a cross-industry supply crisis. The shortage is no longer confined to the AI sector. |

Scenario Modelling: Memory Supply Crisis to Persist Through 2027

The memory supply crisis will define the technology hardware market until at least late 2027, as new manufacturing capacity will not come online in time to meet the sustained demand from the AI sector. For executives and investors, the most critical signals to monitor are not demand forecasts but the execution and yield rates of new HBM and advanced packaging facilities.

Chart Models Persistent Supply-Demand Imbalance

The ‘bullwhip effect’ chart is a perfect conceptual fit for this ‘Scenario Modelling’ section, visually representing a long-term crisis where supply cannot keep pace with volatile demand.

(Source: Gad’s Newsletter – Substack)

Chart Confirms Prolonged DDR4 Memory Undersupply

This chart provides a direct visual confirmation for a key point in the SWOT table, illustrating the ‘structurally undersupplied’ DDR4 market projected through 2026.

(Source: x.com)

- If new fabrication plants, such as Micron’s in Singapore or SK Hynix’s in South Korea, begin production ahead of schedule or achieve higher-than-expected initial yields, it could offer limited relief to the conventional DRAM market sooner than forecast.

- Watch for quarterly earnings reports from Micron, Samsung, and SK Hynix that provide specific figures on HBM production volumes and yield improvements. Additionally, announcements from TSMC regarding its advanced packaging (Co Wo S) capacity are a primary indicator of the true bottleneck for finished AI accelerators.

- These signals could indicate a slight easing of the supply crunch for DDR 4/DDR 5 memory, potentially stabilizing prices for consumer and automotive industries. However, demand from hyperscalers for HBM is expected to absorb any new high-performance capacity, keeping prices for top-tier memory elevated for the foreseeable future.

Frequently Asked Questions

Why is there an AI memory chip shortage in 2026?

The shortage is driven by the explosive demand for High-Bandwidth Memory (HBM) required for AI infrastructure. Manufacturing HBM is resource-intensive, consuming three times more wafer capacity than standard DRAM. This has forced memory producers to shift production away from conventional chips, creating a severe supply crisis and price hikes across the entire technology sector.

How does this shortage affect industries outside of AI, like consumer electronics and automotive?

The shift to HBM production has created a supply vacuum for standard DRAM (like DDR4 and DDR5) used in PCs, smartphones, and cars. As a result, companies like Dell and HP have warned of shortages, and the automotive industry faces disruptions. Prices for these conventional chips have skyrocketed, with DDR4 RAM prices surging by 1,360% since April 2025.

When is the memory shortage expected to end?

The article forecasts that the shortage will persist until at least late 2027. While memory manufacturers like Micron and SK Hynix are making massive capital investments to build new fabrication plants, these facilities require a two-to-three-year lead time to become operational, meaning immediate relief is not possible.

What are the major AI companies doing to secure their memory supply?

Leading AI companies are moving away from traditional purchasing and are instead signing massive, long-term supply agreements to reserve future production. A key example is OpenAI’s $71 billion order for HBM chips. This strategy secures their supply but exacerbates the shortage for other industries that cannot compete with such large-scale purchasing power.

Are there any solutions being implemented to fix the bottleneck?

Yes, memory manufacturers have initiated a huge wave of investment. For instance, Micron announced a $24 billion expansion in Singapore, and SK Hynix is investing over $18 billion in new facilities in South Korea and the U.S. Additionally, governments are providing incentives, like the U.S. CHIPS Act, to help build new manufacturing capacity. However, these solutions will take until at least 2027 to impact the market.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.