Solid Oxide Fuel Cell Market 2026: From Pilot to Prime Power as Data Center Deals Validate Bankability

SOFC Commercial Adoption: Tracking the Shift from Pilots to Megawatt-Scale Projects

Solid Oxide Fuel Cell (SOFC) adoption has fundamentally shifted from a phase of diverse, small-scale validation projects to one defined by large, repeatable, multi-megawatt deployments. This transition is driven by the urgent power demands of specific high-growth sectors, most notably data centers. The execution of these large contracts now serves as the primary indicator of the technology’s commercial maturity and bankability.

- Between 2021 and 2024, industry activity was characterized by R&D-focused partnerships and sub-megawatt pilot projects designed to prove technological viability across various applications. Key examples include the Phillips 66 and Georgia Tech collaboration backed by a $3 million grant to advance reversible SOFCs and the Ceres Power partnership with Alma Clean Power to develop a demonstration 80 k W system for the maritime sector. These efforts were critical for technical de-risking but did not represent significant commercial scale.

- Starting in 2025, the market inflection point became clear with the announcement of massive supply agreements centered on providing resilient, baseload power. Bloom Energy secured a landmark $2.65 billion supply agreement with American Electric Power and a $5 billion partnership with Brookfield to power AI data centers. This was further reinforced by an expanded agreement with Equinix to supply over 100 MW of capacity, demonstrating a move from bespoke projects to standardized, large-scale energy infrastructure procurement.

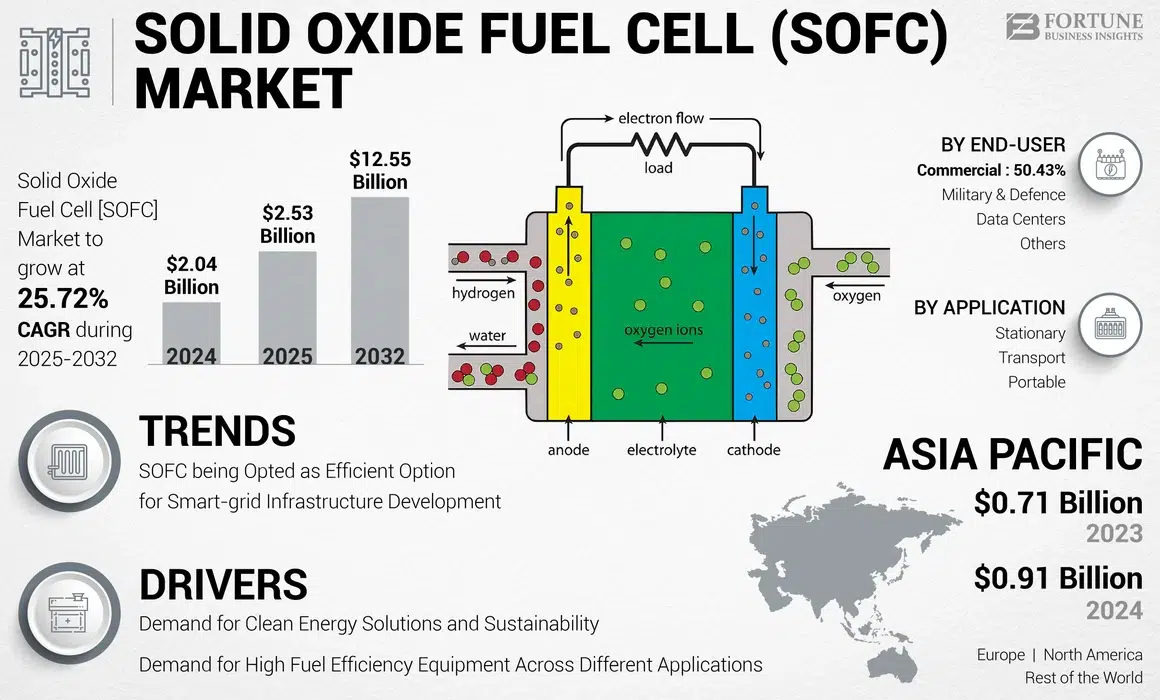

SOFC Market Poised for Major Growth

This forecast quantifies the commercial adoption trend discussed in the section, projecting significant market growth driven primarily by the commercial sector, which includes data centers.

(Source: Fortune Business Insights)

SOFC Investment Analysis: Billion-Dollar Deals Signal Market Confidence in 2026

The scale of financial commitments into SOFC technology has escalated from government-led research grants to multi-billion-dollar private sector supply agreements, confirming its transition into a mainstream power solution. This shift in capital flow validates the technology’s economic case for providing high-efficiency, grid-independent power, attracting infrastructure-level investment rather than just venture funding.

- The prior period of 2021-2024 was marked by foundational investments aimed at technology development, such as the $3 million DOE grant supporting Phillips 66 and Georgia Tech. These figures, while important for innovation, were orders of magnitude smaller than recent commercial commitments and reflected an earlier stage of market development.

- The 2025-2026 timeframe is defined by bankable, long-term offtake agreements that signal market confidence and enable manufacturing scale-up. The $5 billion Bloom Energy and Brookfield partnership to finance data center deployments represents a strategic shift, treating SOFC systems as long-term, revenue-generating infrastructure assets.

- Market forecasts reflect this new commercial reality, with analysts projecting the SOFC market to grow from $2.98 billion in 2025 to $11.61 billion by 2030, a Compound Annual Growth Rate (CAGR) of 31.2%. This growth is directly tied to the successful execution of large-scale commercial contracts.

Table: Key Commercial and Financial Milestones for SOFCs (2021-2026)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Bloom Energy / Brookfield | 2025-2026 | A $5 billion partnership to provide financing for the deployment of SOFCs to power AI data centers, validating the technology as a bankable infrastructure asset. | Bloom Energy Fuel Cell Deals Put AI Data Center Power In … |

| Bloom Energy / American Electric Power | 2025-2026 | A $2.65 billion supply agreement, signaling major utility adoption of SOFCs for reliable, distributed power generation. | Assessing American Electric Power Company’s Valuation … |

| Bloom Energy / Equinix | Feb 2025 | Expansion of a power agreement to supply over 100 MW of capacity, demonstrating a scalable, repeatable model for the data center sector. | Bloom Energy Expands Data Center Power Agreement … |

| Bloom Energy / SK Eternix | Nov 2024 | An 80 MW installation in South Korea, previously the world’s largest fuel cell project, underscoring early large-scale adoption in Asia. | Bloom Energy Announces World’s Largest Fuel Cell … |

| Phillips 66 / Georgia Tech | Jan 2021 | A $3 million grant from the U.S. Department of Energy to advance reversible solid oxide fuel cell (r SOC) technology for hydrogen production and energy storage. | News Releases |

Strategic Partnerships in the Solid Oxide Fuel Cell Supply Chain

The strategic focus of partnerships in the SOFC sector has matured from technology co-development to establishing robust, high-volume manufacturing capabilities. This evolution is essential to meet the demand generated by recent multi-billion-dollar supply agreements and to drive down unit costs through economies of scale, enabling broader market penetration.

- During the 2021-2024 period, partnerships were primarily geared toward R&D and market exploration. Alliances like Elcogen and AVL to develop megawatt-scale electrolyzer modules, or Ceres Power and Delta Electronics for technology licensing, focused on expanding the technical envelope and proving system integration. These were foundational for building market confidence.

- The major shift occurred in late 2025 with the finalization of a major manufacturing license agreement between UK-based Ceres Power and China’s Weichai Power. This deal is designed to mass-produce SOFC systems for the stationary power market in China, representing a critical move to scale production capacity and access a key growth market.

- This trend is mirrored in South Korea, where Doosan Fuel Cell announced plans to target mass production of 50 MW/year of SOFC systems. The explicit focus of this capacity is the data center market, directly aligning manufacturing strategy with the industry’s most significant demand signal.

Table: Analysis of Key SOFC Partnerships and Alliances

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Ceres Power / Weichai Power | Nov 2025 | A major manufacturing license agreement to produce Ceres‘ SOFC technology in China for stationary power systems, enabling high-volume production and market access. | Weichai sign manufacturing licence for SOFC power |

| Elcogen / AVL List Gmb H | Jul 2024 | Partnership to jointly develop megawatt-scale Solid Oxide Electrolyzer Cell (SOEC) stack modules, targeting the green hydrogen production market. | Elcogen partners with AVL to develop cutting-edge … |

| Delta Electronics / Ceres Power | Jan 2024 | A long-term collaboration including technology transfer and licensing for both SOFC and SOEC stack technology, aimed at developing hydrogen energy systems. | Delta Secures License to Hydrogen Energy Technology … |

| Fuel Cell Energy / MHB | Feb 2023 | Collaboration to deliver solid oxide electrolyzers for large-scale green hydrogen production, positioning SOEC technology as a key enabler for the hydrogen economy. | Fuel Cell Energy to Collaborate with MHB to Deliver Solid … |

Global SOFC Deployment: North America and Asia Lead Large-Scale Adoption

The geographic center of gravity for large-scale SOFC deployment has consolidated around North America and Asia. North America leads in securing high-value contracts for grid-independent power, particularly for data centers, while Asia is rapidly building the manufacturing capacity required for global scale-up and regional market dominance.

- Between 2021 and 2024, Europe was a hub of technology innovation and component manufacturing, with companies like Ceres Power (UK) and Elcogen (Estonia) driving key R&D partnerships. However, commercial deployments remained relatively small and fragmented across different regions and applications.

- The period from 2025 to today highlights North America as the dominant end-market for high-value deployments, evidenced by Bloom Energy‘s multi-billion-dollar contracts in the U.S. for data centers and utility support. This concentration is driven by a combination of high energy demand, grid constraints, and corporate decarbonization goals.

- Simultaneously, Asia has emerged as the critical region for manufacturing and supply chain expansion. Weichai Power‘s licensing of Ceres‘ technology in China and Doosan Fuel Cell‘s planned 50 MW/year facility in South Korea are strategic moves to industrialize SOFC production and meet escalating regional and global demand.

SOFC Technology Maturity: Validated at Scale for Baseload Power

Solid Oxide Fuel Cell technology has successfully transitioned from a high-potential R&D subject to a commercially mature and bankable solution for 24/7 baseload power. This maturity is not based on theoretical efficiency but on proven performance in the demanding data center sector, where reliability, efficiency, and predictable operating costs are non-negotiable requirements.

The Core SOFC Electrochemical Process

This diagram illustrates the fundamental technology that has now been validated at scale, providing essential context for the discussion of its commercial maturity and use in baseload power.

(Source: Stanford Materials)

- In the 2021-2024 timeframe, the focus was on proving the economic and technical case for SOFCs. Studies on the Levelized Cost of Energy (LCOE) for integrated systems like PV-SOFC ($0.11/k Wh) versus PV-BESS ($0.16/k Wh) established a competitive financial model. Concurrently, companies like Fuel Cell Energy focused on commercializing reversible solid oxide platforms, expanding the technology’s application to include energy storage and hydrogen production.

- The period since January 2025 has served as the ultimate validation point. The willingness of major corporations and utilities to sign multi-billion-dollar, long-term supply agreements for SOFCs confirms that the technology has met commercial thresholds for cost, durability, and performance. The ability to deliver electrical efficiencies over 60% and total CHP efficiencies exceeding 85% is now a proven, commercially available feature, not a laboratory result.

SWOT Analysis: Market Dynamics of Solid Oxide Fuel Cells

The strategic position of SOFC technology has been significantly strengthened by the recent wave of large-scale commercial contracts, which have validated its core advantages while mitigating long-standing concerns over cost and scalability. This shift has clarified its competitive differentiation and solidified its role in the future energy mix, particularly for high-reliability stationary power.

Table: SWOT Analysis for Solid Oxide Fuel Cells

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High electrical efficiency (up to 60%) and fuel flexibility (natural gas, H₂) demonstrated in pilots and smaller systems. High-quality heat for CHP was a key theoretical advantage. | High efficiency (>60%) and fuel flexibility are now central to multi-billion-dollar contracts. CHP efficiency (>85%) is a commercial selling point for industrial and data center applications. | The technology’s core strengths have been validated at a commercial scale by major customers like American Electric Power and Equinix, moving from a technical specification to a bankable performance guarantee. |

| Weaknesses | High capital cost and long-term degradation concerns were primary barriers to adoption. Perceived as a niche, expensive technology compared to traditional generation or even other fuel cells. | High capital costs are now being absorbed by high-value applications (e.g., AI data centers) where reliability is paramount. LCOE is proven competitive with alternatives like PV+BESS for baseload power. | The “cost” weakness has been reframed as a “value” proposition for mission-critical power. Large supply agreements from companies like Bloom Energy indicate the total cost of ownership is acceptable for key markets. |

| Opportunities | Reversible SOEC mode for green hydrogen production was an emerging opportunity, supported by R&D grants (e.g., Phillips 66). Integration with renewables was explored in techno-economic studies. | The AI boom has created an immediate, massive market for grid-independent power, which SOFCs are uniquely positioned to fill. Reversible technology (r SOC) is now a strategic focus for companies like Noon Energy. | The opportunity has crystallized from broad “energy transition” roles to the specific, urgent need for data center power. This provides a clear path to revenue and scale, funding future expansion into the hydrogen economy. |

| Threats | Competition from rapidly falling costs of Li-ion batteries (BESS) for energy storage and from lower-temperature PEM fuel cells for certain applications. | The competitive landscape has clarified. BESS is dominant for short-duration storage, while PEMFCs lead in transport. SOFCs have solidified their niche in long-duration, high-efficiency stationary power. | The threat of substitution has been reduced by market segmentation. SOFCs are no longer competing directly with batteries for all applications but are winning in their specific value proposition: 24/7 baseload power. |

2026 Outlook for SOFCs: The Path to Broader Infrastructure Deployment

If SOFC manufacturers can successfully execute the current backlog of multi-billion-dollar data center projects, watch for an acceleration of adoption into adjacent industrial and utility markets seeking resilient, high-efficiency power. The key signal is no longer pilot success, but manufacturing execution and the standardization of system deployment.

- If this happens: Leading manufacturers like Bloom Energy meet their delivery schedules for the large-scale data center contracts. Watch this: The operational performance and uptime data from these initial multi-megawatt deployments. This could be happening: Other critical infrastructure sectors, such as hospitals, advanced manufacturing, and financial services, will begin to adopt SOFCs, using the data center model as a template for procurement and financing.

- If this happens: Strategic manufacturing partnerships, particularly Ceres Power‘s collaboration with Weichai Power in China, successfully ramp up to high-volume production. Watch this: Announcements of falling unit costs and reduced lead times for SOFC systems. This could be happening: SOFCs become economically viable for a wider range of applications, including utility-scale peaker plants and community microgrids, expanding the total addressable market beyond premium power users.

- If this happens: The development of reversible solid oxide cells (r SOCs) continues to gain commercial traction, with companies like Fuel Cell Energy and Noon Energy advancing their platforms. Watch this: The first large-scale commercial project that explicitly pairs SOFC/SOEC systems with intermittent renewable generation for grid-scale hydrogen production and energy storage. This could be happening: SOFC technology solidifies its role as a foundational platform for the hydrogen economy, linking the electricity and gas sectors.

Frequently Asked Questions

What is the main reason for the recent growth in the Solid Oxide Fuel Cell (SOFC) market?

The primary driver is the urgent and massive power demand from the AI and data center sector. These facilities require resilient, 24/7 baseload power that the existing grid often cannot provide. This has led to multi-billion-dollar supply agreements, such as Bloom Energy’s deals with Brookfield and American Electric Power, shifting the market from small pilots to large-scale commercial deployments.

Are SOFCs still considered too expensive compared to other technologies?

While the initial capital cost is high, the market now views SOFCs as a high-value solution for mission-critical applications where reliability is paramount. For baseload power, studies show their Levelized Cost of Energy ($0.11/kWh) can be more competitive than solar combined with battery storage ($0.16/kWh). The willingness of financial firms like Brookfield to commit $5 billion to finance deployments confirms that the technology is now considered a bankable infrastructure asset.

How do SOFCs compete with batteries (BESS) or other types of fuel cells?

The market has segmented. SOFCs are not in direct competition with batteries for all uses. Batteries are dominant for short-duration energy storage, while other fuel cells like PEM are leading in transportation. SOFCs have solidified their niche in providing high-efficiency, long-duration stationary power, making them ideal for 24/7 baseload applications like data centers, a role batteries are not suited for.

Which companies and regions are leading the SOFC market?

North America is the dominant end-market for large-scale deployments, with US-based Bloom Energy securing major contracts for data centers and utility support. Simultaneously, Asia has become the critical region for manufacturing scale-up, highlighted by Ceres Power’s licensing deal with Weichai Power in China and Doosan Fuel Cell’s planned 50 MW/year production facility in South Korea.

What has changed in the SOFC market between the 2021-2024 period and today?

The market has fundamentally shifted from a phase of R&D and small-scale pilot projects (2021-2024) to one of large, repeatable, multi-megawatt commercial contracts (2025-2026). The focus has moved from proving technological viability with small grants (like the $3 million for Phillips 66) to executing multi-billion-dollar supply agreements that validate the technology’s bankability and commercial maturity.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.