SOFC vs. Traditional Generators: Why 2026 Marks the Tipping Point from Pilots to Profitable Scale

From Pilots to Power Purchase Agreements: SOFC Adoption Hits Commercial Scale

Solid Oxide Fuel Cell (SOFC) adoption has accelerated from strategic pilots and licensing deals before 2025 to large-scale, multi-megawatt commercial deployments across diverse sectors, validating the technology’s economic case in high-value applications. The market has definitively shifted from demonstrating potential to executing bankable projects, a critical signal for investors and asset developers weighing SOFCs against traditional generators.

- Prior to 2025, industry activity was characterized by technology licensing and co-development, such as Ceres Power‘s joint venture with Bosch and Weichai to target the Chinese market and Doosan‘s development of a 10 k W SOFC system. These activities established technical credibility and market access.

- From 2025 onward, the focus pivoted to large-scale commercial contracts. This is confirmed by Bloom Energy’s deployment of over 100 MW for Equinix data centers and WATT Fuel Cell‘s agreement with Hope Gas to lease 7, 250 residential backup power units. These deals represent a move from R&D partnerships to direct customer-supplier relationships for revenue-generating assets.

- The range of applications has also expanded, confirming market pull across multiple verticals. Before 2024, stationary power was the primary target. Now, deployments include data centers (Bloom Energy/Equinix), marine power (HD Hyundai), residential backup (WATT Fuel Cell), and even offshore oil and gas (MODEC/Eld Energy), demonstrating the technology’s versatility and growing acceptance.

SOFC Investment Analysis: Capital Shifts from Factory Scale-Up to Securing Commercial Offtake

Financial commitments to the SOFC sector have evolved from funding manufacturing scale-up before 2025 to securing large-scale supply chain and offtake agreements, indicating a de-risking of investment from technology development to commercial execution. Investors are no longer just financing future capacity; they are backing contracted revenue streams and tangible project pipelines.

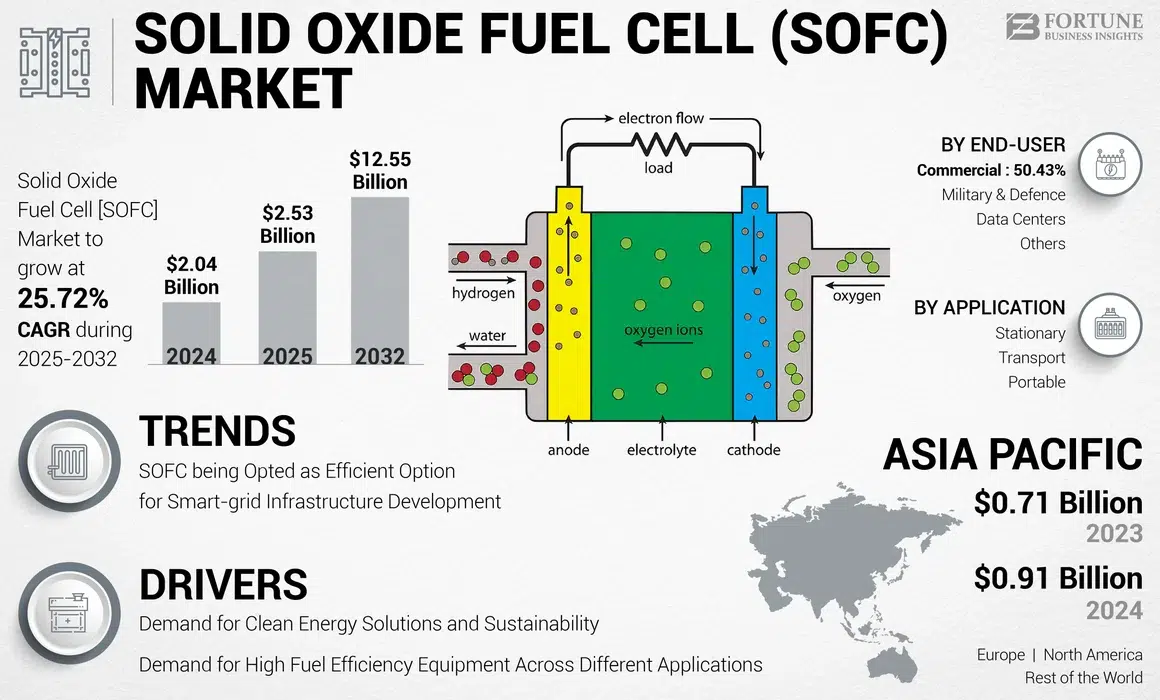

SOFC Market Forecast to Hit $12.5B

This forecast quantifies the market’s commercial maturation, reflecting the investment shift from technology development to backing contracted revenue. The large commercial end-user segment aligns with the section’s focus on securing offtake.

(Source: Fortune Business Insights)

- In the 2021-2024 period, significant capital was directed at enabling future production. For example, Elcogen secured a €24.9 million grant from the EU Innovation Fund in November 2024 to help expand its manufacturing facility to a planned 360 MW capacity. This investment was foundational, aimed at solving future supply constraints.

- In contrast, post-2025 investments are tied to immediate commercial activity. Bloom Energy‘s $43.9 million deal with MTAR Technologies in September 2025 is a direct commercial transaction for the supply of core components (hot boxes and electrolyzers), reflecting secured demand from customers like Equinix.

- The structure of recent agreements further validates this shift. The WATT Fuel Cell and Hope Gas partnership is a commercial leasing program, creating a long-term, recurring revenue model rather than a one-time hardware sale. This structure is more attractive to infrastructure investors seeking predictable returns.

Table: Key SOFC Financial and Supply Agreements

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Bloom Energy / MTAR Technologies | Sep 2025 | $43.9 M supply agreement for SOFC hot boxes and electrolyzer units. This deal secures a key part of the supply chain to meet contracted demand from large-scale deployments. | MTAR Secures $43.9 M Hydrogen Fuel Cell Deal with … |

| Elcogen / EU Innovation Fund | Nov 2024 | €24.9 million grant to support the scale-up of SOFC and SOEC manufacturing. This funding was critical for building the future production capacity needed for commercial expansion. | Elcogen Secures €24.9 M Grant for Green Hydrogen … |

| Bloom Energy | Nov 2024 | Announcement of an 80 MW SOFC project, the world’s largest. This demonstrated the company’s ability to execute utility-scale projects, attracting large-scale investment. | Bloom Energy Announces World’s Largest Fuel Cell … |

Partnership Analysis for SOFC vs. Traditional Generators: Alliances Mature from R&D to Revenue

Strategic partnerships in the SOFC market have matured from technology co-development and regional market-entry alliances (2021-2024) to direct customer-supplier agreements for large-scale system deployment after 2025. This evolution shows that SOFC technology is now a commercially ready product being integrated by end-users, not just a developmental technology requiring industrial partners for validation.

SOFCs Drive Major Shift in Revenue

This chart illustrates the section’s theme of partnerships maturing from R&D to revenue. It shows new technologies like SOFCs becoming the primary drivers of future income, validating their commercial readiness.

(Source: MarketsandMarkets)

- Between 2021 and 2024, key alliances focused on combining expertise for market development. The Ceres Power, Bosch, and Weichai joint venture was designed to penetrate the Chinese market, while the Doosan and KSOE collaboration aimed to develop megawatt-class SOFCs for future marine applications.

- Post-2025, partnerships are structured as direct procurement and service agreements. The Bloom Energy and Equinix collaboration expanded to deploy over 100 MW of on-site baseload power, functioning as a straightforward energy-as-a-service model.

- The WATT Fuel Cell and Hope Gas agreement in June 2025 created a new commercial channel, with a utility leasing SOFC systems directly to residential customers. This moves beyond industrial partnerships to consumer-facing business models, signaling a new phase of market adoption.

Table: Evolution of SOFC Strategic Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| WATT Fuel Cell / Hope Gas | Dec 2025 | Commercial rollout and installation of residential backup power systems. This partnership established a direct-to-consumer channel through a utility partner. | WATT Fuel Cell Advances Commercial Rollout with First 2 … |

| HD Hyundai / European Shipping Companies | Jun 2025 | Joint project to apply SOFC systems on cruise vessels for clean power. This partnership targets the decarbonization of a hard-to-abate sector with commercially available technology. | HD Hyundai Accelerates Entry into European Market with … |

| Ceres Power / Delta Electronics | Jan 2024 | Technology license agreement for Delta to develop its own SOFC solutions. This asset-light licensing model was characteristic of the pre-commercial scaling phase. | Delta Secures License to Hydrogen Energy Technology … |

| Ceres / Bosch / Weichai | Feb 2022 | Joint venture to develop and manufacture SOFC systems for the Chinese market. This alliance was focused on technology transfer and market access, not direct sales. | Ceres Power soars on partnership with Bosch and Weichai … |

Geography: North America Converts Potential into Megawatt-Scale Projects

While Asia-Pacific was identified as the fastest-growing market before 2025 due to strong policy support, recent large-scale commercial deployments in North America confirm its role as the primary region for immediate revenue generation, particularly in the data center and regulated utility sectors.

- In the 2021-2024 period, market forecasts emphasized Asia-Pacific’s high projected CAGR of 39.3%, supported by strategic moves like the Ceres and Weichai joint venture in China. This positioned the region as the long-term growth engine.

- However, from 2025 onwards, the most significant commercial activity has occurred in the United States. Bloom Energy‘s expanded deployment with Equinix covers 19 U.S. data center sites, and WATT Fuel Cell‘s residential rollout with Hope Gas is centered in West Virginia.

- Europe remains a key hub for technology development and manufacturing, confirmed by Elcogen‘s EU-funded factory expansion and HD Hyundai‘s partnership with European shipping firms. This suggests a division where Europe drives manufacturing and marine innovation while North America leads in large-scale stationary power deployment.

Technology Maturity: SOFCs Advance from Efficiency Claims to Proven Commercial Reliability

SOFC technology has transitioned from a state of commercial validation in the 2021-2024 period, marked by efficiency demonstrations and initial production, to proven commercial-scale maturity post-2025, evidenced by multi-megawatt projects and long-term service agreements. The conversation has shifted from theoretical efficiency advantages over traditional generators to demonstrated operational reliability and bankability.

Fuel Cells Show A More Reliable Process

This infographic explains the basis for SOFCs’ proven reliability by contrasting their direct conversion process with the mechanical process of generators. This supports the section’s point about technology advancing beyond mere efficiency claims.

(Source: RedHawk Energy Systems)

- Between 2021 and 2024, the focus was on proving technical viability. Milestones included achieving high electrical efficiencies (over 70% in hybrid SOFC-GT systems), developing smaller-scale systems like Doosan‘s 10 k W SOFC, and initiating volume production, as Bosch did in 2023.

- Since 2025, the evidence points to commercial readiness and durability. Data on low degradation rates (below 0.2% per 1, 000 hours) and claims of zero-maintenance systems (WATT REMOTE™) provide the operational certainty required by commercial customers.

- The ultimate validation point is the scale of recent deployments. A single project like Bloom Energy‘s 100 MW+ deployment for Equinix moves SOFCs beyond the category of emerging technology and establishes them as a reliable alternative to traditional generators for mission-critical baseload power.

2026 SWOT Analysis: SOFCs vs. Traditional Generators

The SOFC market’s strategic position has strengthened significantly, with previous weaknesses like high capital costs now being addressed by clear cost-down trajectories, while opportunities in regulated, high-value markets are being converted into tangible commercial contracts. This has sharpened the competitive line against traditional generators, which retain a cost advantage only in specific, low-utilization applications.

- Strengths: The technology’s core strengths in high efficiency and low emissions have been validated in real-world, large-scale commercial operations, moving from lab data to proven performance.

- Weaknesses: High CAPEX remains the primary weakness, but it has shifted from a deal-breaking barrier to a manageable challenge offset by lower OPEX and clear manufacturing cost-down targets.

- Opportunities: General market growth forecasts have been replaced by specific, high-value opportunities in data centers and residential markets, amplified by government incentives like the U.S. Inflation Reduction Act.

- Threats: The competitive threat from traditional generators has been clarified; they remain dominant for low-CAPEX, low-utilization backup power, but their position in baseload and prime power is now directly challenged by SOFCs.

Table: SWOT Analysis for Solid Oxide Fuel Cell vs. Traditional Generators

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High electrical efficiency (50-65%) and CHP efficiency (>85%) demonstrated in pilots. Fuel flexibility (H 2, NG, biogas) was a key selling point. | Proven reliability in commercial operation with degradation rates under 0.2% per 1, 000 hours. Near-zero NOx/SOx emissions confirmed in large deployments. | The strength shifted from theoretical efficiency to proven operational performance and reliability at a commercial scale, as seen in the Equinix deployment. |

| Weaknesses | High CAPEX was the primary barrier to adoption, limiting projects to subsidized pilots. LCOE was often uncompetitive with grid power or renewables. | CAPEX remains high ($2, 400/k W) but is offset by fuel savings. A clear cost-down path to $900-$1, 300/k W by 2030 has been established. | The weakness of high CAPEX is now contextualized with a credible cost-reduction roadmap and a strong Total Cost of Ownership (TCO) argument for high-utilization applications. |

| Opportunities | Strong market growth forecasts (CAGR >30%). Growing demand for decarbonization and resilient power. | Specific, high-value markets like data centers (Equinix) and residential backup (Hope Gas) are now generating revenue. IRA incentives ($85/ton 45 Q credit) improve economic viability. | General market potential has been converted into specific, bankable projects in targeted sectors. Government incentives are now a direct financial input to project economics. |

| Threats | LCOE competition from low-cost renewables (solar/wind). Lower CAPEX of traditional diesel and gas generators made them the default for most applications. | Traditional generators maintain a CAPEX advantage for low-utilization standby power. The LCOE for SOFCs remains higher than grid-scale renewables for bulk power. | The competitive landscape is now segmented. SOFCs are winning in high-value distributed generation, while traditional generators hold the low-cost backup market. |

Scenario Modelling: CAPEX Reduction is the Final Gate to Mass Market Adoption

If SOFC manufacturers achieve projected capital expenditure reductions to the $900-$1, 300/k W range by 2030, the technology will expand beyond high-value niches and directly challenge gas turbines in a broader set of baseload distributed generation applications. The key signals to watch confirm whether this acceleration is on track.

SOFC Market Projected to Exceed $11B

This market forecast provides a tangible outcome for the scenario modelling, showing the massive scale achievable if CAPEX reductions are met. The $11.6B figure by 2030 quantifies the potential for mass-market adoption.

(Source: MarketsandMarkets)

- If large-scale deployments prove reliable, then adoption in the data center sector will accelerate. Watch for follow-on orders from Equinix or similar hyperscale customers in 2026. This would confirm that SOFCs have met the stringent reliability requirements of mission-critical facilities, de-risking the technology for the entire sector.

- If residential leasing models are profitable, then a vast new distributed energy market will open. Watch the financial performance and customer uptake of the WATT Fuel Cell/Hope Gas program. Success could trigger similar partnerships with other utilities nationwide, fundamentally changing the competitive dynamic with backup diesel generators.

- If manufacturing costs decline as projected, then SOFCs will become competitive in more applications. Watch for company announcements of achieving sub-$1, 500/k W CAPEX milestones. This would be a critical signal that the LCOE is becoming competitive enough to displace traditional generators in industrial and commercial CHP applications without heavy reliance on incentives.

Frequently Asked Questions

Why is 2026 described as the ‘tipping point’ for SOFC technology?

2026 marks the point where the SOFC market shifts from pilot projects and R&D partnerships to executing large-scale, bankable commercial contracts. Before 2025, activity focused on technology validation. From 2025 onward, major deals like Bloom Energy’s 100+ MW deployment for Equinix data centers and WATT Fuel Cell’s leasing program for 7,250 residential units demonstrate that SOFCs are being adopted for revenue-generating, multi-megawatt projects, signaling commercial maturity.

Are SOFCs still too expensive compared to traditional generators?

While the upfront capital cost (CAPEX) of SOFCs remains higher than traditional generators, it is no longer a deal-breaking barrier for all applications. The article explains that in high-utilization scenarios like data centers, the higher CAPEX is offset by lower operating costs, greater fuel efficiency, and a better Total Cost of Ownership (TCO). Furthermore, manufacturers have established a clear cost-reduction roadmap, targeting a CAPEX of $900-$1,300/kW by 2030, which will make them competitive in a much broader market.

What are the key advantages of SOFCs that are driving their adoption?

The primary advantages validated in recent large-scale deployments are high electrical efficiency (50-65%), proven operational reliability with low degradation rates (under 0.2% per 1,000 hours), and near-zero harmful emissions (NOx/SOx). This combination makes them an ideal solution for mission-critical applications like data centers and for markets with strong decarbonization goals, providing clean, continuous, and reliable power.

How have partnerships in the SOFC industry evolved?

Partnerships have matured from technology co-development to direct commercial agreements. Before 2025, alliances like Ceres/Bosch/Weichai focused on technology licensing and market entry. After 2025, partnerships are structured as direct customer-supplier contracts, such as Bloom Energy’s energy-as-a-service model with Equinix, or utility-led commercial rollouts, like the leasing program between WATT Fuel Cell and Hope Gas for residential customers.

Which markets are seeing the most significant commercial adoption of SOFCs right now?

The article identifies North America as the leading region for immediate revenue generation. The most successful applications are in high-value sectors, including data centers (proven by the Bloom/Equinix deployment), regulated residential backup power (as seen with WATT/Hope Gas), and marine power for decarbonizing shipping (highlighted by HD Hyundai’s project with European shipping lines). These sectors value the high reliability, efficiency, and low emissions profile of SOFC technology.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Ceres Power SOFC 2025: Fuel Cell & Hydrogen Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Doosan SOFC 2025: Solid Oxide Fuel Cell Market Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.