Grid Lock: Why Fuel Cells Are the Essential On-Site Power Solution for AI Data Centers in 2026

From Backup to Baseload: How Grid Delays Forced Commercial Scale Fuel Cell Adoption for Data Centers

The adoption of fuel cells in data centers has decisively shifted from niche backup pilots to baseload, commercial-scale deployments, a transition driven almost entirely by the inability of electrical grids to meet the power demands of artificial intelligence. This pivot became undeniable after 2024, as multi-year grid interconnection delays created a power gap that only on-site generation could fill.

- Between 2021 and 2024, industry adoption was characterized by validation pilots, such as Microsoft‘s successful test of a 3 MW hydrogen fuel cell system for 48 hours of backup power. These projects proved technical feasibility but were not yet a widespread commercial strategy for primary power.

- Starting in 2025, the market rapidly scaled from megawatt-scale pilots to multi-hundred-megawatt commercial agreements for primary power. This change is demonstrated by Bloom Energy expanding its partnership with Equinix to surpass 100 MW of primary power deployments and securing a landmark $5 billion partnership with Brookfield to power new AI data centers.

- The market now shows a clear segmentation of applications, moving beyond a single use case. Projects range from primary on-site power (Bloom Energy, Equinix), to large-scale backup pilots (Power Cell), and even off-grid power using captured methane (Fuel Cell Energy, Diversified Energy), indicating that operators are deploying fuel cells as a versatile solution to different infrastructure challenges.

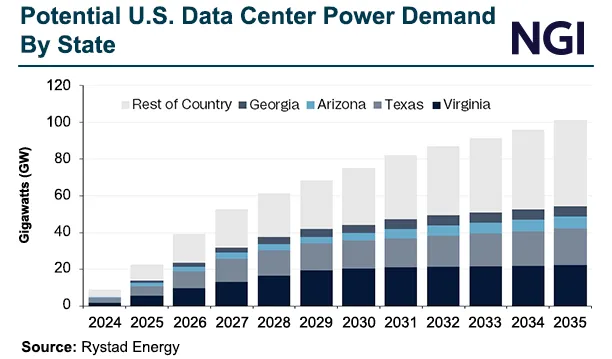

Data Center Power Demand to Surge

This chart illustrates the dramatic rise in power demand from data centers, which is the primary driver forcing the adoption of on-site fuel cells as described in the section.

(Source: Natural Gas Intelligence)

Strategic Capital Inflow: Analyzing the Multi-Billion Dollar Investments in Fuel Cell Infrastructure for Data Centers

Capital deployment has fundamentally shifted from technology-focused venture funding to large-scale infrastructure financing, signaling strong investor confidence in the commercial viability of fuel cells for powering data centers. The scale and structure of investments announced since 2025 confirm that the market now views fuel cells as a bankable asset class critical for enabling data center growth.

Fuel Cell Market to Reach $15B

This forecast quantifies the multi-billion dollar market opportunity, directly reflecting the strategic capital inflow and large-scale infrastructure financing discussed in the section.

(Source: Market Research Future)

- The $5 billion strategic partnership between Brookfield Asset Management and Bloom Energy announced in October 2025 represents a pivotal shift. This is not a technology investment but an infrastructure financing deal designed to secure power for planned AI data centers, directly tying capital to asset deployment.

- The scale of available capital is further highlighted by KKR‘s $50 billion partnership with ECP to develop data center and power infrastructure. While not exclusively for fuel cells, it underscores the massive capital mobilization underway to solve the data center power crisis, creating a favorable environment for proven on-site solutions.

- Investment is also targeting global expansion and diverse fuel sources. The collaboration between Fuel Cell Energy and Sustainable Development Capital LLP (SDCL) to explore up to 450 MW of deployments shows a model for financing projects internationally, moving beyond the domestic U.S. market.

Table: Key Investments and Financial Commitments

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| KKR & ECP | Oct 2024 | A $50 billion partnership was formed to accelerate the development of data center and power generation infrastructure, signaling major capital allocation toward alternative power solutions. | KKR signs $50 bn partnership with ECP for data center and … |

| Brookfield & Bloom Energy | Oct 2025 | A strategic partnership valued at up to $5 billion was announced to deploy Bloom Energy‘s SOFCs to provide primary power for Brookfield‘s planned AI data centers. | Brookfield and Bloom Energy Announce $5 Billion … |

| Equinix | Jun 2021 | The company opened its $142 million SV 11 facility powered by fuel cells, establishing an early precedent for integrating the technology into new data center builds. | Equinix Opening New $142 M Fuel Cell Powered Data Center |

Powering AI: Key Partnerships Driving Fuel Cell Deployment in Data Centers

Recent partnerships reveal a strategic convergence of fuel cell manufacturers, data center operators, and energy asset managers, creating integrated power ecosystems that operate independently of traditional utility constraints. These alliances are structured to deliver power at the scale and speed required by AI, a fundamental shift from the technology-centric collaborations seen before 2025.

Partnership Model Powers Off-Grid Data Centers

This diagram shows an example partnership model for deploying fuel cells, aligning perfectly with the section’s focus on the strategic alliances driving adoption.

(Source: FuelCell Energy)

- The agreement between utility American Electric Power (AEP) and Bloom Energy in November 2024 to secure up to 1 GW of SOFCs for data centers is a critical validation. It shows that even established utilities recognize fuel cells as a necessary, utility-scale solution to serve large industrial customers when grid capacity is insufficient.

- Hyperscale data center operators are now driving partnerships directly. Oracle‘s strategic partnership with Bloom Energy and Google‘s collaboration with Intersect Power demonstrate that the largest end-users are proactively sourcing their own on-site power, making fuel cells a core part of their infrastructure strategy.

- The collaborative model is expanding globally and across the value chain. Fuel Cell Energy‘s MOU with Inuverse for a 100 MW AI data center in South Korea and its collaboration with Diversified Energy to use waste gas for power show a clear trend toward customized, localized energy solutions.

Table: Strategic Partnerships for Data Center Fuel Cell Deployment

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 2026 | Strategic collaboration to explore deploying up to 450 MW of fuel cell systems to support data centers globally, establishing a financing and deployment model. | Sustainable Development Capital LLP and Fuel Cell Energy … |

| AEP & Bloom Energy | Nov 2024 | Agreement for AEP to secure up to 1 GW of Bloom‘s SOFCs, validating fuel cells as a utility-scale solution for powering data centers. | AEP Leveraging Fuel Cell Technology to Power Data … |

| Ballard & Vertiv | Jun 2024 | Strategic technology partnership to develop PEM fuel cell powered standby power applications, aiming to replace traditional diesel generators. | Ballard and Vertiv announce strategic technology partnership … |

| Google & Intersect Power | Dec 2024 | Partnership to co-locate “gigawatts of data center capacity” with new clean power generation, confirming the strategy of integrating power and data infrastructure. | A new approach to data center and clean energy growth |

Global Power Race: Mapping the Geographic Expansion of Fuel Cells for Data Centers

While North America remains the epicenter of fuel cell deployment for data centers due to its concentration of hyperscale operators and severe grid constraints, projects announced since 2025 in Asia signal the beginning of a global expansion. This geographic diversification is driven by the same power-supply challenges facing data center hubs worldwide.

- Between 2021 and 2024, market activity was heavily concentrated in the United States. Key events included Equinix‘s fuel cell-powered SV 11 data center in California and Microsoft‘s backup power pilot in Wyoming, establishing the U.S. as the primary market for validation and early commercial adoption.

- Since 2025, the U.S. market has matured from early adoption to massive scale-up, evidenced by multi-hundred-megawatt and gigawatt-scale agreements involving entities like AEP, Brookfield, and major tech companies that are predominantly focused on domestic data center fleets.

- The first concrete signs of international expansion emerged in July 2025 with Fuel Cell Energy‘s Memorandum of Understanding with Inuverse. This agreement to explore a 100 MW deployment for an AI data center in South Korea is significant, as it targets another major data center market facing similar energy and land constraints.

Commercial Readiness: SOFCs and PEM Fuel Cells Achieve Scale for Data Center Power

Fuel cell technology has definitively transitioned from a developmental stage to a state of commercial maturity for specific, high-value data center applications. Solid Oxide Fuel Cells (SOFCs) are now a proven solution for primary baseload power, while Proton Exchange Membrane (PEM) fuel cells have been validated as a reliable, clean replacement for backup diesel generators.

SOFCs Lead Stationary Fuel Cell Growth

The chart highlights the market dominance and growth of SOFCs, validating the section’s point that this technology has achieved commercial readiness for baseload power.

(Source: Grand View Research)

- The period from 2021 to 2024 was defined by successful large-scale demonstrations that proved technical viability. The landmark event was Microsoft‘s 48-hour continuous test of a 3 MW PEM fuel cell system in January 2024, which confirmed its suitability as a diesel generator replacement.

- After 2024, the focus shifted from validation to scaled deployment and operational excellence. Bloom Energy‘s announcement in February 2025 that it had surpassed 100 MW of SOFC deployments with Equinix confirmed the technology’s readiness for continuous primary power in mission-critical facilities.

- Technical specifications now meet commercial requirements. SOFCs from leading manufacturers deliver electrical efficiencies of 60-75%, far exceeding gas turbines, and are engineered for up to “five nines” (99.999%) availability, a non-negotiable standard for data centers.

- While long-term durability was previously a concern, SOFCs now target degradation rates of less than 1% per 1, 000 hours, making them economically viable for long-term power purchase agreements and resolving a key barrier to widespread adoption.

Strategic Analysis: SWOT for Fuel Cell Adoption in the Data Center Market

The strategic position of fuel cells in the data center market is defined by a powerful combination of market pull from the AI-driven power crisis and compelling technological strengths, though this is balanced by dependencies on natural gas infrastructure and high upfront capital costs. The market opportunity has expanded dramatically since 2024, shifting from a niche backup solution to a critical enabler of core data center expansion.

Fuel Cells Dramatically Cut Emissions

This chart visualizes a key strength from the SWOT analysis—low emissions—providing a concrete example of the strategic advantages fuel cells offer compared to traditional power sources.

(Source: FuelCell Energy)

- Strengths like high efficiency and rapid deployment have been validated at a commercial scale, directly addressing the grid-related delays that are stalling data center construction.

- The primary Weakness has shifted from technology risk to fuel supply risk, as most current large-scale deployments rely on natural gas, exposing projects to price volatility and emissions concerns.

- The Opportunity has grown exponentially with the AI boom, with government incentives like the U.S. Investment Tax Credit further improving project economics.

- A key Threat is potential competition from other on-site power technologies and regulatory uncertainty surrounding natural gas as a transition fuel.

Table: SWOT Analysis for Fuel Cells in Data Centers

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High efficiency in pilot projects; potential for clean backup power (Microsoft 3 MW test). | Proven “five nines” (99.999%) reliability for primary power; rapid deployment (under 1 year) vs. grid (2+ years); high power density (33 MW/acre). | Reliability and speed were validated at commercial scale by deployments from Bloom Energy and Fuel Cell Energy, becoming a core value proposition. |

| Weaknesses | High capital costs; questions around long-term durability and stack degradation. | High upfront cost remains a factor, though TCO is competitive; primary weakness is reliance on natural gas infrastructure for fuel. | While cost remains, durability concerns were mitigated by long-term commercial deployments. The key weakness shifted from technology risk to fuel supply and its associated emissions. |

| Opportunities | Niche market replacing diesel backup generators; small-scale on-site generation. | Primary power for the multi-trillion-dollar AI data center buildout; 30% U.S. Investment Tax Credit; global expansion to power-constrained markets like South Korea. | The market opportunity expanded from a small backup power segment to the entire primary power market for new data centers, driven by grid failure. |

| Threats | Incumbent technology (diesel generators); slow adoption by risk-averse operators. | Natural gas price volatility; negative public perception of using a fossil fuel; future competition from other dispatchable clean power like SMRs or advanced geothermal. | The primary threat shifted from competition with legacy technology to risks associated with the fuel source and the emergence of other next-generation on-site power solutions. |

Forward Outlook: Key Signals for Fuel Cell Growth in the Data Center Sector

If grid interconnection queues and power deficits persist as the primary bottleneck for data center growth, the adoption of on-site fuel cells for primary power will continue to accelerate. The most critical signal to monitor is the formation of new, large-scale financing partnerships, as access to project capital is now the main enabler for deploying this commercially-proven technology at the necessary scale.

Fuel Cell Data Center Market Nears $14B

This market projection provides a clear “forward outlook,” visualizing the strong growth potential for fuel cells in the data center sector by 2035.

(Source: EnkiAI)

- If this happens: Major utility territories continue reporting multi-year backlogs for high-voltage interconnections, and data center developers publicly cite power availability as the top constraint for new projects.

- Watch this: The announcement of new financing vehicles or partnerships structured like the Brookfield and SDCL collaborations. These deals, which are designed to fund hundreds of megawatts of assets, are a direct indicator of market depth and investor confidence.

- These could be happening: Fuel cell providers may increasingly secure long-term natural gas supply contracts to de-risk projects from commodity price swings. Furthermore, watch for an increase in partnerships focused on co-locating fuel cells with sources of biogas or dedicated green hydrogen production to create fully decarbonized on-site power hubs.

- Traction is clearly gaining for multi-hundred-megawatt primary power agreements, making small, experimental pilots less relevant. The market has moved past asking *if* fuel cells can power data centers and is now focused on *how* to finance and deploy them at a global scale.

Frequently Asked Questions

Why have fuel cells suddenly become a primary power source for data centers, instead of just for backup?

According to the text, the shift is driven almost entirely by the failure of electrical grids to meet the power demands of AI. Multi-year grid interconnection delays, which became a major issue around 2024, created a power gap that only on-site generation like fuel cells could fill quickly enough, forcing a transition from niche backup pilots to baseload, commercial-scale deployments.

What are the different types of fuel cells being used and what are their applications in data centers?

The article identifies two main types with distinct applications. Solid Oxide Fuel Cells (SOFCs) are being deployed for primary, baseload power, valued for their high efficiency (60-75%) and proven ‘five nines’ (99.999%) reliability. In contrast, Proton Exchange Membrane (PEM) fuel cells have been validated as a clean replacement for backup diesel generators, as shown in Microsoft’s 3 MW test.

Are these fuel cell deployments truly ‘clean’ if they rely on natural gas?

The article identifies this as a primary weakness. The SWOT analysis points out that most current large-scale deployments depend on natural gas, which exposes them to emissions concerns and price volatility. However, it also notes a trend toward mitigating this by using alternative fuels like captured methane (Fuel Cell Energy & Diversified Energy) and exploring future partnerships for co-locating with biogas or green hydrogen sources.

Why are companies investing billions of dollars into fuel cells now?

Capital deployment has shifted from technology-focused venture funding to large-scale infrastructure financing because investors now see fuel cells as a ‘bankable asset class.’ The article highlights that these investments, like the $5 billion Brookfield and Bloom Energy partnership, are not to prove the technology but to directly finance the deployment of power assets needed for the AI data center buildout, solving the critical bottleneck of power availability.

Is the use of fuel cells for data centers only a trend in the United States?

While North America is the epicenter of deployment, the trend is beginning to expand globally. The article states that the first concrete signs of international expansion emerged in July 2025 with an agreement to explore a 100 MW fuel cell deployment for an AI data center in South Korea. Furthermore, the collaboration between Fuel Cell Energy and SDCL aims to support data centers globally, indicating a move beyond the domestic U.S. market.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.