Woodside Energy’s AI Blueprint 2025-2026: From Pilot Projects to Profitable Operations

Woodside Energy is strategically embedding Artificial Intelligence (AI) across its value chain, shifting from early-stage pilots to large-scale operational deployment. The company leverages AI to drive efficiency in its core oil and gas business, generating capital to fund a parallel expansion into AI-enabled new energy ventures. This dual approach, supported by a mature data infrastructure and targeted technology partnerships, positions Woodside to optimize current assets while building a lower-carbon portfolio.

Woodside Energy’s Commercial Scale AI Projects Signal Full-Scale Adoption 2026

Woodside has transitioned its AI strategy from foundational exploration in the 2021-2024 period to direct application in core, high-value commercial operations from 2025 onwards.

- In the period between 2021 and 2024, Woodside’s focus was on building foundational capabilities through partnerships with firms like IBM for cognitive computing and Microsoft for citizen developer platforms. This era was defined by pilot projects and strategic investments, such as the collaboration with Heliogen for AI-enabled solar energy and Lanza Tech for AI-driven carbon capture, establishing a portfolio of potential future technologies.

- Starting in 2025, the strategy pivots to large-scale execution, exemplified by the contract for SLB to deliver 18 wells for the $39 billion Trion ultra-deepwater project using AI-enabled drilling capabilities. This move signifies the integration of AI into capital-intensive field operations, aiming for measurable improvements in efficiency, cycle times, and well quality.

- The development of an industrial data fabric and a unified enterprise data platform using Snowflake in 2025 underpins this shift, creating the single source of truth necessary for deploying effective AI models. This foundational work enables tangible operational gains, such as using the Anaplan platform to cut “what-if” scenario generation from two days to less than one hour.

- The company is also preparing to adopt generative AI within the AWS Supply Chain platform, moving beyond process analytics to advanced decision support for identifying bottlenecks and optimizing inventory. This demonstrates a clear progression from analyzing past performance to predicting and shaping future outcomes.

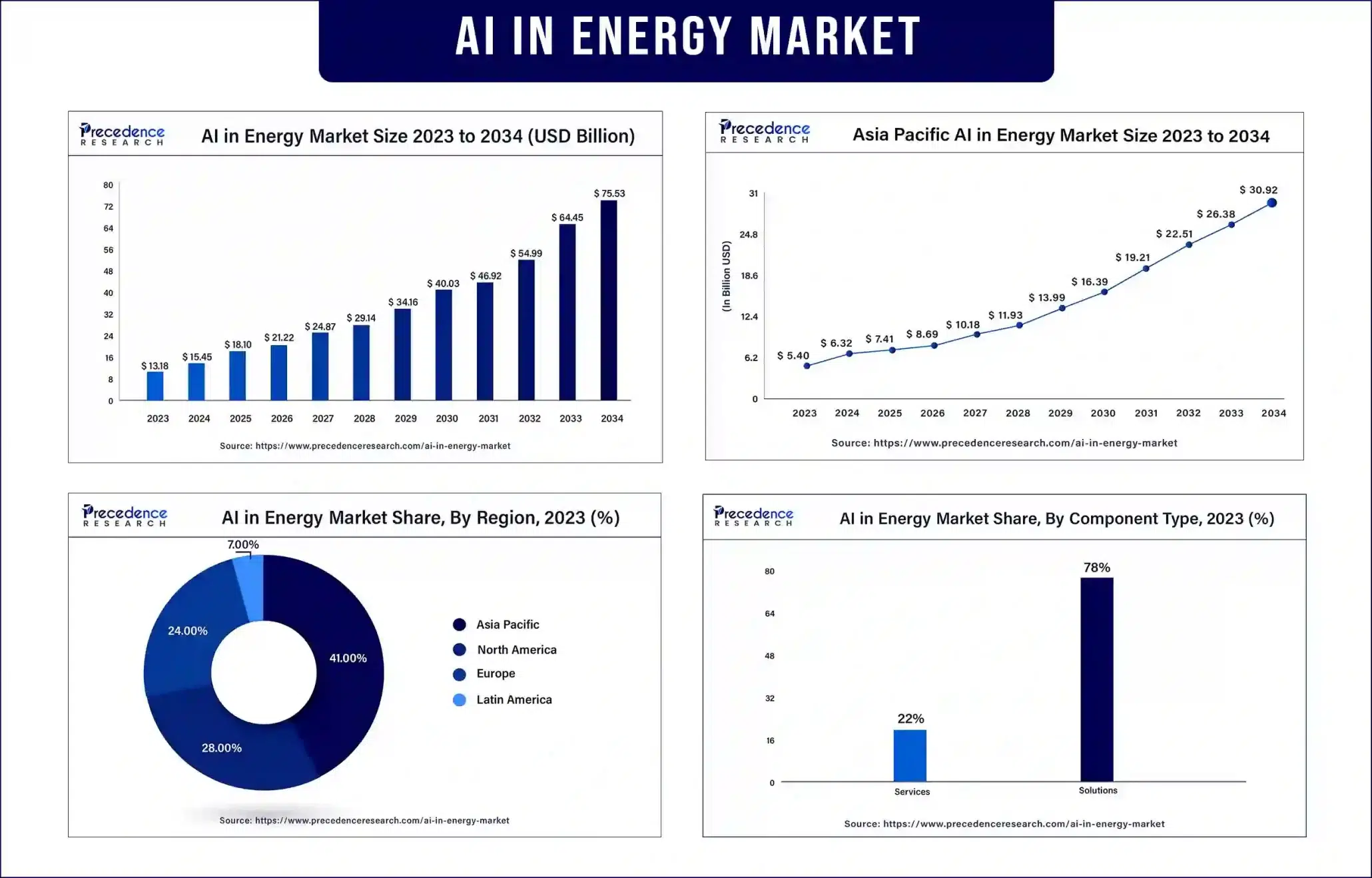

AI in Energy Market to Exceed $75B

This chart provides the market context for Woodside’s strategic shift to AI, illustrating the significant growth that justifies moving from exploration to full-scale adoption.

(Source: Precedence Research)

Woodside Investment Data Reveals Strategic Shift to AI-Enabled Mega-Projects

Woodside’s investment pattern has evolved from funding external technology pilots to financing its own multi-billion-dollar capital projects where AI is a critical internal enabler for execution and efficiency.

- Between 2021 and 2024, Woodside’s investments were targeted at acquiring new energy capabilities through equity stakes in specialized tech firms. This included a $50 million investment in Lanza Tech to accelerate AI-driven carbon capture and a $9.9 million investment in String Bio for technology that converts greenhouse gases to protein.

- From 2025, the investment focus shifts to deploying capital in major growth projects that embed these advanced technologies. The company is advancing a $39 billion project pipeline and made a $17.5 billion final investment decision (FID) for its Louisiana LNG facility, projects where AI-driven efficiency in drilling and operations is integral to achieving financial returns.

- The company’s stated goal to invest US$5 billion in new energy products and lower-carbon services by 2030 bridges both periods, but the recent capital allocations show a clear strategy of using the cash flow from AI-optimized core assets to fund the build-out of new energy infrastructure.

Woodside’s Net Debt to Fund Mega-Projects

The chart directly supports the section’s theme by showing the significant increase in Woodside’s net debt, which is necessary to finance the multi-billion-dollar capital projects mentioned.

(Source: Seeking Alpha)

Table: Woodside Energy Strategic Investments 2021-2026

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| New Energy & Lower-Carbon Services Target | Jan 2026 | A corporate target to invest $5 billion by 2030 in new energy products like hydrogen and CCUS, where AI is a key enabler for process optimization and cost reduction. | Woodside Energy |

| Major Projects Pipeline | Aug 2025 | Allocation of capital to a $39 billion project pipeline, including the Trion deepwater field where AI-enabled drilling is a core part of the execution strategy. | Yahoo Finance |

| Louisiana LNG Facility | Apr 2025 | A $17.5 billion final investment decision for a major LNG facility strategically positioned to meet future energy demand, which Woodside’s CEO links to the growth of power-intensive AI data centers. | Opportunity Louisiana |

| Lanza Tech | Oct 2022 | A $50 million investment to accelerate the commercialization of technology that uses AI and synthetic biology to convert captured carbon into products like ethanol. | Lanza Tech |

| String Bio | Jul 2022 | A $9.9 million equity investment in a biotech firm that recycles greenhouse gases into sustainable protein, supporting Woodside’s carbon capture and utilization goals. | Reuters |

Woodside Energy’s Partnerships Mature From Tech Exploration to Operational Execution

Woodside’s partnership strategy has advanced from collaborating on technology development to contracting for large-scale operational services that have AI capabilities fully integrated.

- During the 2021-2024 period, partnerships were centered on exploring emerging technologies and decarbonization pathways. This included an Mo U with Baker Hughes to explore decarbonizing the gas supply chain and collaborations with Re Carbon and Lanza Tech on a pilot facility for carbon-to-ethanol conversion.

- By 2025, the partnerships reflect a mature strategy focused on execution and capability building. The service contract with SLB for the Trion project explicitly requires the use of AI-enabled drilling, moving AI from a discussion point to a contractual deliverable.

- The collaboration with AWS to modernize supply chains and adopt generative AI, along with the partnership with AGSM @ UNSW to build AI proficiency among its leadership, demonstrates a holistic approach to embedding digital capabilities across the entire organization, not just in field operations.

Table: Woodside Energy Key Technology Partnerships 2021-2026

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| AGSM @ UNSW | Nov 2025 | Education and development partnership to create a leadership program focused on data analytics and AI, ensuring strategic alignment on digital transformation from the top down. | UNSW Business Think |

| AWS | Apr 2025 | Technology adoption partnership to modernize supply chains, with preparations to adopt generative AI features for faster, data-driven decision-making on inventory and logistics. | Medium |

| SLB | Mar 2025 | A major service contract for the Trion project where SLB will use its AI-enabled drilling capabilities to improve the efficiency and quality of 18 ultra-deepwater wells. | SLB |

| Baker Hughes | Mar 2025 | Technology development agreement to create a small-scale, lower-carbon power generation solution using Net Power’s carbon capture technology. | Power Mag |

| Lanza Tech | Oct 2022 | Strategic collaboration to explore commercial-scale Carbon Capture & Utilization (CCU) opportunities, leveraging Lanza Tech’s platform that utilizes AI and machine learning. | Lanza Tech |

Woodside Energy’s Geographic Focus Shifts to the Americas for New Growth

While Australia remains Woodside Energy’s operational hub, the company’s strategic growth and technology deployment are increasingly concentrated in the Americas, particularly the U.S. and Mexico.

- Between 2021 and 2024, Woodside’s technology activities were geographically diverse, including robotic and digital twin development for its Australian offshore assets, AI-solar projects with Heliogen in California, and a biotech investment with String Bio in India.

- From 2025, the center of gravity for new, large-scale projects has decisively shifted to North America. The most significant application of AI in operations is the Trion ultra-deepwater project in Mexico, a cornerstone of the company’s growth strategy.

- Simultaneously, the United States is the site of the $17.5 billion Louisiana LNG project, a massive capital investment that Woodside strategically links to future energy demand from the U.S. technology sector, including AI data centers.

Woodside Energy’s AI Technology Matures From R&D to Core Operational Standard

Woodside Energy has successfully advanced its AI applications from pilot and R&D stages to commercially scaled, business-critical functions, establishing a mature technology stack.

- The 2021-2024 timeframe was characterized by the adoption of proven enterprise AI like IBM Watson for data analysis, while simultaneously investing in emerging technologies like AI-enabled solar (Heliogen) and CCU (Lanza Tech) at the demonstration or pilot level.

- By 2025-2026, AI is no longer just an exploratory tool but a standard component of major project execution. The mandating of AI-enabled drilling in the SLB contract for the Trion project validates the technology’s move from a “nice-to-have” innovation to a “must-have” for capital efficiency.

- The implementation of enterprise-wide platforms like Snowflake for data unification and Anaplan for accelerated planning demonstrates that the underlying digital infrastructure has reached a state of maturity capable of supporting widespread, sophisticated AI deployment across the organization.

Dashboard Unifies Data for AI-Driven Insights

This diagram visually represents the mature technology stack described in the section, showing how a central platform turns operational data into business-critical intelligence.

(Source: AiThority)

SWOT Analysis of Woodside Energy’s AI Strategy 2026

Woodside’s AI strategy has successfully transitioned from building foundational strengths through partnerships to applying those capabilities for significant operational advantage, though scaling remains a key challenge.

- The company’s primary strength has evolved from making strategic, de-risked AI investments to embedding AI in core, multi-billion-dollar operations to drive tangible efficiencies.

- A key opportunity is the convergence of its LNG business with the immense energy demand from the AI sector, a market narrative Woodside is actively promoting.

- The main threat remains execution risk on these large-scale, technologically complex projects and the challenge of scaling new energy ventures to a level of profitability that rivals the core business.

GenAI Power Demand Forecasted to Surge

This chart directly quantifies the key opportunity identified in the SWOT analysis, showing the ‘immense energy demand from the AI sector’ that Woodside is positioned to serve.

(Source: MarketWatch)

Table: SWOT Analysis for Woodside Energy’s AI Integration

| SWOT Category | 2021 – 2024 | 2025 – Present | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Pragmatic partnership strategy (IBM, Microsoft, Heliogen) to access external AI expertise and de-risk technology adoption. Patented AI for seismic imaging. | Mature data infrastructure (Snowflake) enabling scaled deployment. Demonstrated quantifiable impact on efficiency (Anaplan). AI embedded in core capital projects (Trion with SLB). | The strategy has been validated, moving from partnering for capabilities to deploying those capabilities in-house and with contractors on high-value projects. |

| Weakness | Reliance on external partners for cutting-edge technology. Most new energy AI applications were at pilot or demonstration scale. | High capital dependency on a few mega-projects (Trion, Louisiana LNG). The success of the AI strategy is now tied to the flawless execution of these projects. | The weakness has shifted from a lack of scaled applications to a concentration of risk. The success or failure of AI’s contribution is now highly visible and financially material. |

| Opportunity | Use AI and robotics to create “Intelligent Assets” and reduce operating expenses in core business. Build a portfolio of new energy options (hydrogen, CCU). | Supply the growing energy demand from AI data centers with LNG. Use generative AI (with AWS) to revolutionize supply chain management. Set industry standard for AI in deepwater drilling. | The opportunity has expanded from internal cost-saving to capturing a new, high-growth external market (powering the AI industry itself). |

| Threat | Pilot projects failing to scale commercially. Inability to integrate disparate data sources effectively. Pace of technology development outstrips adoption. | Execution risk on the Trion and LNG projects. A failure to deliver promised AI-driven efficiencies could lead to significant cost overruns and shareholder scrutiny. Competitors could leapfrog to newer AI technologies. | The threat has become more acute and focused. It is no longer about whether the technology works, but whether it can deliver results under pressure on multi-billion-dollar projects. |

Forward-Looking Insights: Woodside Energy’s AI Execution Under Scrutiny in 2026

The primary focus for Woodside Energy in the coming year will be demonstrating tangible returns from its AI investments, particularly through the flawless execution of the Trion drilling program and the maturation of its supply chain modernization.

- The progress of the Trion deepwater project will be the most critical validation point. The industry will be watching for key metrics like drilling times and non-productive time reduction to see if SLB’s AI-enabled technology delivers the promised gains in capital efficiency.

- The full integration of generative AI into the AWS Supply Chain platform is a key development to monitor. Success here would provide a powerful case study for cost savings and operational resilience, setting a new benchmark for logistics management in the energy sector.

- Continued commentary and, more importantly, new offtake agreements for the Louisiana LNG project that are linked to powering data centers will be a strong signal. This would validate Woodside’s strategic positioning and confirm a new, synergistic demand driver for its core product.

- Expansion of the company’s digital twin and data fabric capabilities to its next wave of operational assets, like the Scarborough project, will indicate how deeply this AI-first approach is being embedded across the entire portfolio.

Frequently Asked Questions

How has Woodside Energy’s AI strategy changed over time?

Woodside’s AI strategy has transitioned from a period of foundational exploration (2021-2024), which involved pilot projects and partnerships with firms like IBM and Microsoft, to a period of large-scale execution (2025 onwards). The current focus is on embedding AI directly into core, high-value commercial operations to drive measurable efficiency gains.

What are the main examples of Woodside using AI in its major projects?

The most significant example is the $39 billion Trion ultra-deepwater project in Mexico, where Woodside has contracted SLB to use AI-enabled drilling capabilities for 18 wells. Additionally, AI-driven efficiency is integral to the financial returns of its $17.5 billion Louisiana LNG facility.

What is Woodside’s dual approach to AI and business strategy?

Woodside’s dual approach uses AI to enhance efficiency and profitability in its core oil and gas operations. The capital generated from this optimized core business is then used to fund a parallel expansion into AI-enabled new energy ventures, such as hydrogen and carbon capture, supporting its goal to build a lower-carbon portfolio.

Who are Woodside’s key technology partners in its current AI push?

For its 2025-2026 execution phase, Woodside’s key partners include SLB for AI-enabled deepwater drilling, AWS for modernizing its supply chain with generative AI, Snowflake for its unified enterprise data platform, and Anaplan for accelerated scenario planning.

How does Woodside see its LNG business connecting with the growth of AI?

Woodside’s CEO strategically links the company’s investment in the $17.5 billion Louisiana LNG facility to the future energy demand from the technology sector. The company is positioning itself to supply LNG to power the growing number of energy-intensive AI data centers, creating a synergistic opportunity between its core product and the AI industry’s expansion.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.