Chevron’s 2025 CCUS Strategy: Analyzing Project Performance and New Market Creation

Chevron CCUS Projects: A Shift from Internal Decarbonization to Commercial Market Creation in 2025

In 2025, Chevron’s Carbon Capture, Utilization, and Storage (CCUS) strategy evolved from primarily decarbonizing its own assets to an active pursuit of building new commercial service lines for third-party industrial emitters. This shift is marked by the development of large-scale hubs and integrated energy systems, moving beyond the troubled performance of its legacy operational projects.

- Between 2021 and 2024, Chevron’s CCUS efforts were largely defined by its investment in its own operational assets, such as the San Joaquin Valley projects, and the persistent underperformance of the Gorgon CCS project in Australia.

- The period from 2025 to today shows a strategic change with the advancement of the Bayou Bend CCS project as a commercial hub and a novel partnership with Engine No. 1 and GE Vernova to build 4 GW of CCS-ready power plants specifically for the data center market.

- This transition from internal focus to external market creation demonstrates Chevron’s intent to establish CCUS as a profitable business line, offering decarbonization as a service to industrial clients, particularly in high-growth sectors like AI.

- However, the contrast between the ambition of new projects and the operational reality of Gorgon, which recorded its lowest annual CO 2 capture amount in 2025, highlights a significant execution risk in its strategy.

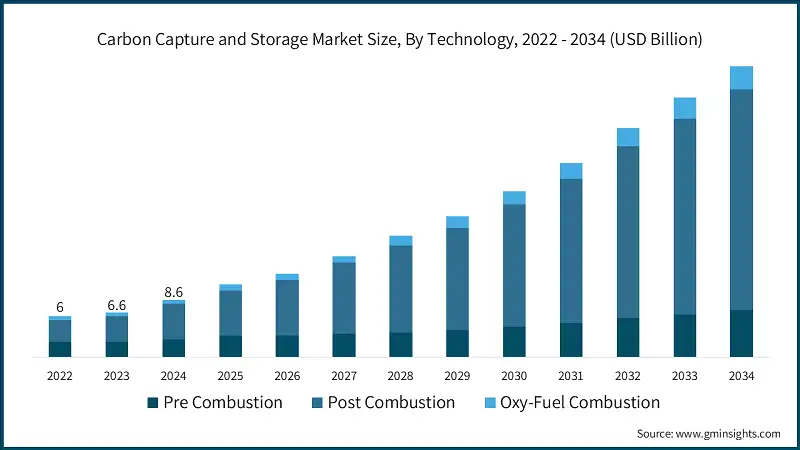

Global Carbon Capture Market Poised for Growth

The global market for carbon capture is projected to expand significantly through 2034, with post-combustion technologies expected to dominate the sector. This forecast highlights the commercial opportunity Chevron is targeting with its strategic shift.

(Source: Global Market Insights)

Chevron’s CCUS Investment Analysis: Dual Strategy of Large-Scale Capex and Targeted Venture Capital

Chevron’s investment strategy is twofold, combining multi-billion-dollar capital expenditures for infrastructure development with targeted venture investments in next-generation technologies to lower costs and de-risk its long-term plans. This dual approach signals a commitment to building a full value chain business while actively addressing the primary economic barriers to CCUS adoption.

- Chevron plans to invest $1.5 billion in 2025 on projects aimed at lowering carbon intensity, part of a larger $10 billion commitment to lower-carbon initiatives through 2028.

- The company’s annual capital expenditure guidance of $18 to $21 billion per year includes sustained funding for these new energy ventures, including the planned $5 billion Project Labrador blue hydrogen facility.

- To address the high cost of capture, Chevron made a strategic $45 million venture investment in ION Clean Energy in 2025 for its advanced solvent technology. This follows earlier investments in companies like Svante and Carbon Clean.

Table: Chevron’s Key CCUS and Low-Carbon Investments (2021-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Annual Capital Expenditure Guidance | 2026-2030 | Guidance of $18 to $21 billion per year to fund business growth, including CCUS and other new energy businesses. | Chevron Outlines Plan for Sustained Cash Flow Growth at … |

| Project Labrador | Post-2025 | Planned $5 billion blue hydrogen and ammonia facility in Texas integrating steam-methane reforming with carbon capture. | Chevron Plans $5 B Blue Hydrogen and Ammonia Project … |

| 2025 Low-Carbon Capex | 2025 | $1.5 billion allocated for projects to lower carbon intensity and expand new energy businesses like CCUS. | Chevron Carbon Capture Initiatives for 2025: Key Projects … |

| Investment in ION Clean Energy | May 2025 | A $45 million venture investment to advance development of lower-cost solvent technology for post-combustion CO 2 capture. | Chevron Carbon Capture 2025: A Bold Strategy Unveiled |

| Investment in Svante Inc. | Dec 2022 | Lead investor in a $318 million funding round to scale manufacturing of Svante’s solid sorbent-based carbon capture filters. | Chevron Invests in Carbon Capture and Removal … |

Chevron’s Strategic Alliances: Building a Global CCUS Ecosystem in 2025

Chevron is building a global CCUS business by creating a web of partnerships with technology innovators, industrial players, and international energy companies to de-risk projects and create new markets. These alliances are fundamental to developing the shared infrastructure and cross-border value chains necessary for large-scale deployment.

- In 2025, Chevron formed a key joint development with investment firm Engine No. 1 and GE Vernova to build CCS-ready power plants for U.S. data centers, a new market creation strategy.

- The company is also advancing the Bayou Bend CCS LLC joint venture with major energy partners Equinor and Total Energies to create a large-scale carbon storage hub on the U.S. Gulf Coast.

- Internationally, Chevron joined an industry consortium in August 2025 with steelmakers like Arcelor Mittal Nippon Steel India to study CCUS hub development across Asia, building on earlier MOUs with companies like JX Nippon.

Table: Chevron’s Key CCUS Partnerships and Collaborations (2021-2025)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Industry Consortium | Aug 2025 | Participating in a study with Arcelor Mittal Nippon Steel India, JSW Steel, and others to assess CCUS hub development in Asia. | Global industry leaders launch CCUS Hub Study to … |

| Bayou Bend CCS LLC | Jun 2025 | Joint venture with Equinor and Total Energies to develop a large-scale CO 2 transportation and storage hub in Southeast Texas. | Bayou Bend project aims to advance carbon dioxide … |

| Engine No. 1 and GE Vernova | Jan 2025 | Joint development to build up to 4 GW of natural gas-fired power plants for data centers, designed for CCS integration. | engine no. 1, chevron and GE vernova to power U.S. data … |

| JERA | Mar 2023 | MOU to explore co-development of CCS projects in the U.S. and Australia to create a large-scale, cost-effective value chain. | Chevron and JERA sign MOU to explore carbon capture … |

| Talos Energy and Carbonvert | May 2022 | Chevron joined the JV, taking a 50% equity stake to operate and develop the Bayou Bend offshore CCS hub in Texas. | Chevron joins JV for development of offshore carbon … |

Chevron’s Geographic Focus: A Decisive Shift from Australia to the U.S. Gulf Coast

Chevron’s CCUS activities show a clear geographic pivot from its long-standing but troubled operations in Australia to a concentrated development focus on the U.S. Gulf Coast, supplemented by exploratory efforts in Asia. This strategic shift aligns investment with regions that offer supportive regulatory frameworks, dense industrial corridors, and favorable geology.

- From 2021 to 2024, Chevron’s most prominent CCUS asset was the Gorgon facility in Western Australia, which became synonymous with operational challenges and missed targets.

- In 2025, the U.S. Gulf Coast has become the center of gravity for Chevron’s future plans, home to the flagship Bayou Bend hub in Texas, the Pascagoula CCS project in Mississippi, and the planned $5 billion Project Labrador.

- The company is also pursuing growth in Asia, evidenced by its 2025 participation in a consortium to study CCUS hubs and its earlier MOUs with Japanese firms to explore capturing emissions from Japan for storage in the region.

Chevron’s Technology Maturity: Proven in Pilots, but Unvalidated at Commercial Scale

While Chevron is successfully piloting a range of next-generation capture technologies, its ability to execute and operate CCUS cost-effectively at a commercial scale remains a critical uncertainty. The consistent underperformance of its largest operational project, Gorgon, overshadows the progress being made in earlier-stage technology validation.

- Between 2022 and 2024, Chevron established pilot programs for various technologies, including Svante’s solid sorbent filters and Carbon Clean’s modular Cyclone CC, aiming to de-risk and lower the cost of capture.

- In 2025, this strategy continued with an investment in ION Clean Energy’s advanced liquid amine solvents, further diversifying its technology portfolio to find economically viable pathways.

- However, the ongoing failures at the Gorgon project, which in fiscal year 2024-25 captured only 25% of reservoir CO 2 at a high cost of US$176 per ton, demonstrate a significant gap between technological promise and reliable, large-scale commercial operation.

Chevron SWOT Analysis: Balancing Strategic Ambition Against Execution Risk in 2025

Chevron’s CCUS position in 2025 is defined by a powerful strategic vision for market creation that is directly challenged by its own history of operational shortcomings. The company’s strengths in project management and capital access are counterbalanced by the reputational and financial risks stemming from its flagship project’s failures.

- Strengths in large-scale project execution are being leveraged to build new business lines, but its primary Weakness is the demonstrated inability to meet performance targets at the Gorgon project.

- Major Opportunities have emerged in 2025 with the plan to power data centers and develop CCUS hubs, but these are met with the Threat of high costs and competition from peers like Exxon Mobil.

Table: SWOT Analysis for Chevron’s CCUS Strategy

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Core competencies in subsurface geology and large-scale project management. Significant capital allocation with a $10 B lower-carbon target. | Leveraging core competencies to develop large-scale hubs (Bayou Bend) and integrated energy systems (power for data centers). | The 2025 partnerships with Engine No. 1 and Total Energies validate the strategy of applying core skills to new commercial CCUS markets. |

| Weakness | Consistent underperformance and technical issues at the flagship Gorgon CCS project, failing to meet capture targets. | Gorgon’s performance hit a new low in 2025, capturing only 25% of reservoir CO 2 at a cost of US$176/t CO 2. | The weakness in operational execution was not resolved but instead validated and amplified by Gorgon’s record-poor performance in 2025. |

| Opportunity | Growing policy support for CCUS (e.g., Inflation Reduction Act). Nascent demand from hard-to-abate industrial sectors. | Proactive market creation by partnering to power AI and data centers with CCS-ready natural gas plants. Development of CCUS hubs as a service. | The opportunity to create new markets was validated in January 2025 by the joint development agreement with Engine No. 1 and GE Vernova. |

| Threat | High cost of capture technology remains a barrier to profitability. Competitors like Exxon Mobil are also aggressively pursuing CCUS hubs. | Reputational damage from Gorgon’s failure undermines stakeholder confidence in future projects. Risk that new hub projects will face similar operational issues. | The threat of execution risk became more acute, as Gorgon’s 2025 failures provide a powerful counter-narrative to Chevron’s ambitious growth plans. |

Chevron’s 2025 Outlook: Execution of Hub Projects is the Definitive Test

The success of Chevron’s entire low-carbon transition now hinges on its ability to move from ambitious announcements to proven, cost-effective execution on its next-generation CCUS hub projects. The company must demonstrate that it has overcome the fundamental engineering and operational challenges that have plagued its most significant CCUS asset to date.

- The most critical indicator to watch is the progress toward a Final Investment Decision (FID) for the Bayou Bend CCS hub, which would signal the start of large-scale capital deployment.

- Further developments on the $5 billion Project Labrador will be a key test of Chevron’s ability to integrate CCUS with new low-carbon fuel production at a commercial scale.

- Concrete site selections or construction starts for the planned 4 GW of CCS-ready power plants for data centers will validate the company’s innovative market-creation strategy.

- Any announced technical fixes or performance improvements at the Gorgon project will be crucial for restoring confidence in Chevron’s operational capabilities in the CCUS sector.

Frequently Asked Questions

What is the major change in Chevron’s CCUS strategy in 2025?

In 2025, Chevron’s CCUS strategy evolved from primarily decarbonizing its own assets to actively creating a commercial business offering carbon capture as a service to third-party industrial emitters. This is demonstrated by its development of large-scale hubs like Bayou Bend and its partnership to build power plants for the data center market.

Why is the Gorgon project a concern for Chevron’s new strategy?

The Gorgon project is a major concern because its persistent underperformance and technical issues highlight a significant execution risk. In 2025, the project recorded its lowest annual CO2 capture amount, capturing only 25% of reservoir CO2 at a high cost of US$176 per ton, which undermines confidence in Chevron’s ability to successfully operate its new, ambitious commercial projects.

What are some of Chevron’s key new CCUS projects and partnerships in 2025?

In 2025, Chevron’s key initiatives include advancing the Bayou Bend CCS project, a joint venture with Equinor and TotalEnergies to create a large-scale carbon storage hub, and a joint development with Engine No. 1 and GE Vernova to build up to 4 GW of CCS-ready power plants for data centers.

How is Chevron investing to lower the cost of carbon capture?

Chevron is making targeted venture capital investments in technology companies to address the high cost of capture. For example, in 2025, it invested $45 million in ION Clean Energy for its advanced solvent technology, following earlier investments in companies like Svante and Carbon Clean to help develop and scale lower-cost solutions.

What is the geographic focus of Chevron’s new CCUS projects?

Chevron’s geographic focus has decisively pivoted from its troubled operations in Australia to the U.S. Gulf Coast. This region is now the center of its future plans, hosting the flagship Bayou Bend hub in Texas, the Pascagoula CCS project in Mississippi, and the planned Project Labrador blue hydrogen facility.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.