AI Data Centers 2026: Why Adani’s $100 B Energy Strategy is Winning India’s Compute Race

AI Data Center Projects in 2026 Signal a Pivot from Colocation to Integrated Power

The primary constraint for AI data center expansion has shifted from securing real estate to guaranteeing massive, reliable, and sustainable power, a structural challenge that vertically integrated energy conglomerates like Adani Group are uniquely positioned to solve. This pivot redefines the competitive arena, favoring entities that control the entire energy and digital infrastructure value chain.

- In the 2021-2024 period, the strategy was centered on establishing a physical data center footprint through the Adani Conne X joint venture formed in February 2021. Initial projects in Chennai and Noida were focused on standard colocation and securing anchor tenants like Flipkart and Google, reflecting a conventional real estate and infrastructure approach.

- From 2025, the strategy scaled dramatically in direct response to the explosive power demands of AI. Adani Group‘s $100 billion investment commitment, announced in February 2026, is explicitly for “renewable-powered” data centers. This strategic shift directly addresses the market’s primary adoption barrier, as global energy shortages are projected to constrain 40% of AI data center growth by 2027.

- The commercial model has evolved from leasing physical space to delivering integrated green power and compute as a unified service. Adani‘s October 2025 agreement to supply clean energy to Google‘s India operations from its Khavda renewable park validates this new model, transforming a property-based business into a green digital utility.

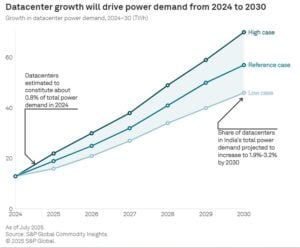

India’s Data Center Power Demand Surges

This chart quantifies the rising power demand in India, supporting the section’s core argument that power, not real estate, is the new primary constraint for expansion.

(Source: CarbonCredits.com)

Investment Analysis 2026: Capital Shifts from Standalone Data Centers to Energy-Linked Ecosystems

Investment in India’s AI data center sector has escalated from funding individual facilities to financing vast, integrated energy and compute ecosystems, with Adani Group‘s $100 billion strategic commitment in 2026 dwarfing earlier, project-specific capital raises. This trend reflects a market realization that compute capacity is directly gated by power availability, making integrated investments more defensible.

- Early investments were tactical and project-focused, exemplified by the $213 million in debt raised by Adani Conne X in June 2023 to finance the construction of its Chennai and Noida data centers. This represented a conventional, asset-by-asset funding approach for a new market entrant.

- A clear acceleration occurred in 2025, with an interim $10 billion investment plan announced in April 2025 for two new 1 GW data centers. This signaled a major shift in ambition toward hyperscale capacity, moving far beyond the scope of initial projects.

- The market’s inflection point arrived in February 2026 with Adani‘s announcement of a $100 billion, decade-long investment plan targeting 5 GW of capacity. This capital is not just for building data centers but for creating a complete ecosystem, including the renewable power generation and transmission infrastructure required to support it, a scale that redefines the investment landscape and challenges competitors like Reliance Industries, which announced its own $110 billion plan.

Table: Major AI and Data Center Investment Commitments in India

| Company | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Reliance Industries | By 2031 (7 years) | Announced a $110 billion investment into AI and renewable energy, signaling a direct competitive response to Adani‘s strategy and initiating a capital-intensive race for digital infrastructure dominance in India. | Nikkei Asia |

| Adani Group | By 2035 | Committed $100 billion to build 5 GW of renewable-powered AI data center capacity. This vertically integrated strategy aims to leverage its energy dominance to create a defensible, low-cost digital infrastructure ecosystem. | Reuters |

| Google (in India) | 2026-2030 (5 years) | Plans to invest $15 billion to build a massive AI data center campus in Visakhapatnam in partnership with Adani Group. This project serves as the anchor for Adani‘s green compute strategy, validating the integrated model. | Domain-B |

| Adani Group (Google Partnership) | 2026-2030 (5 years) | Will co-invest up to $5 billion in the development of Google‘s Visakhapatnam AI data center campus. This investment solidifies its role as the foundational infrastructure partner for a major global hyperscaler. | The Hindu |

Adani AI Data Center Partnerships Evolve from Operations to Green Energy Integration

Strategic partnerships in the AI data center sector have matured from foundational joint ventures for operational expertise to deep, symbiotic collaborations centered on the integrated supply of green power for AI workloads. This evolution demonstrates that hyperscalers now prioritize energy security and sustainability as core criteria when selecting infrastructure partners.

Visualizing the Integrated Data Center Ecosystem

This chart illustrates the interconnected value chain from energy to software, conceptually matching the section’s focus on how partnerships are creating integrated ecosystems.

(Source: MarketsandMarkets)

- The initial, foundational partnership was the Adani Conne X joint venture with Edge Conne X in February 2021. This alliance provided Adani Group with essential global expertise in data center design, operations, and customer acquisition, enabling its market entry.

- The partnership with Google clearly illustrates the strategic evolution of collaborations. It began with a cloud services agreement in March 2022 and a standard facility lease in October 2022. By October 2025, it had transformed into a major development partnership for a gigawatt-scale AI campus, anchored by a dedicated green energy supply agreement.

- Collaborations with other hyperscalers, including Microsoft for projects in Hyderabad and Pune, reinforce this trend. Global tech giants are actively seeking partners who can deliver a comprehensive solution for land, facilities, and a secure, long-term renewable power roadmap in a single, integrated package.

Table: Key Partnerships Driving Adani’s AI Data Center Strategy

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Flipkart | Feb 2026 (Expanded) | Expanded an existing partnership to develop a second high-performance AI data center. This demonstrates a strategy to serve both global hyperscalers and large domestic enterprises with specialized AI compute needs. | Seeking Alpha |

| Microsoft | Feb 2026 (Mentioned) | Working with Adani Group on data center projects in Hyderabad and Pune. This collaboration diversifies Adani‘s hyperscaler client base and expands its geographic footprint across key Indian tech hubs. | The Economic Times |

| Oct 2025 | Announced a landmark development partnership for a gigawatt-scale AI data center campus in Visakhapatnam. This collaboration combines Adani‘s infrastructure and green energy capabilities with Google‘s technology, serving as the flagship project for the integrated model. | Forbes | |

| Edge Conne X | Ongoing (from 2021) | The Adani Conne X 50/50 joint venture is the primary execution vehicle for all of Adani‘s data center projects. It combines Adani‘s local execution strength with Edge Conne X‘s global data center expertise. | [PDF] Adani Energy Solutions |

Geographic Expansion Shifts to Power-Rich Hyperscale Clusters

Data center development in India is shifting from a distributed, multi-city footprint to the creation of massive, power-rich hyperscale clusters in specific regions. This geographic consolidation is driven by the strategic necessity of co-locating immense compute facilities with gigawatt-scale renewable energy generation sources.

- Between 2021 and 2024, Adani Conne X pursued a conventional market-entry strategy by targeting multiple key metro areas to serve major business centers. This included developing initial data center sites in Chennai (now operational), Noida (under construction), and Hyderabad.

- From 2025, the geographic focus has pivoted toward large-scale, integrated campuses located in regions conducive to massive energy and industrial development. The selection of Visakhapatnam for the gigawatt-scale campus with Google exemplifies this, prioritizing land and power availability over simple proximity to end-users.

- Recent commitments, such as the $6 billion plan for a 1 GW data center in Maharashtra and the development of the 30 GW Khavda renewable park in Gujarat to power digital infrastructure, confirm this new geographic logic. The map of India’s future data center landscape is being redrawn around energy availability.

Technology Maturity: From AI-Ready Facilities to Integrated Green Compute Systems

The core technology offering in the data center market has matured from providing standardized colocation space to delivering a highly integrated “green compute” system architecture. This advanced model combines renewable power generation, dedicated transmission, and specialized cooling facilities into a single, cohesive product designed for the unique demands of AI.

Data Centers Shift to Renewable Energy

This chart’s visualization of the growing reliance on renewables directly illustrates the technological maturation from simple facilities to the ‘integrated green compute systems’ described in the section.

(Source: Carbon Brief)

- In the 2021-2024 period, the technological focus was on building “AI-ready” data centers like the ‘Chennai 1’ facility. These projects established operational credibility by delivering reliable colocation infrastructure capable of housing AI hardware.

- The technology advanced to a fully integrated systems level between 2025 and today. The key innovation, commercially validated by the Google partnership, is the direct architectural linkage of hyperscale data centers with dedicated renewable energy projects, solving the dual challenges of power scale and sustainability.

- The explicit inclusion of advanced liquid cooling systems in 2026 strategic announcements marks a further technological progression. It signifies a move from “AI-ready” to “AI-optimized” infrastructure, demonstrating a deeper alignment with the thermal management needs of high-density AI accelerators.

SWOT Analysis: Adani’s Energy Integration Counters a Power-Scarce Market

Adani’s strategic position in the AI data center market has been significantly validated as its primary strength in vertical energy integration directly counters the market’s most significant emerging threat: power scarcity. This transforms a potential weakness, high capital dependency, into a powerful opportunity to dominate a critical infrastructure sector.

AI Workloads Drive Power Demand

This chart highlights how AI is the main driver of the power surge, quantifying the ‘power-scarce market’ threat that the SWOT analysis identifies as a key market dynamic.

(Source: Energy Industry Insights from Avanza Energy – Substack)

- Adani Group‘s core strengths have evolved from general infrastructure and land acquisition expertise to a unique, defensible position as an integrated provider of green energy and compute.

- The primary weakness remains the immense execution risk and capital dependency associated with its $100 billion plan, a risk amplified by intense competition from other well-capitalized players.

- The opportunity has scaled from capturing a domestic digitization trend to building the foundational infrastructure for a global AI hub in India, driven by hyperscalers’ urgent need for sustainable power.

- The competitive threat has intensified from niche data center operators to a direct, capital-intensive race with rival conglomerate Reliance Industries for control of India’s digital future.

Table: SWOT Analysis for Adani’s Integrated AI Data Center Strategy

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strengths | Expertise in infrastructure project execution; land acquisition capabilities; foundational JV with Edge Conne X for operational know-how. | Massive renewable energy portfolio via Adani Green Energy; demonstrated ability to offer integrated power-compute solutions (Google power deal); access to massive capital ($100 B plan). | The core strength was validated and shifted from being a capable builder to being a unique, vertically integrated energy and compute provider, which is now the key market differentiator. |

| Weaknesses | New entrant in the specialized data center market; high capital requirements for entry; reliance on partners (Edge Conne X) for technical expertise. | Extreme capital dependency to fund the $100 billion vision; significant execution risk on complex, gigawatt-scale projects; long-term return-on-investment horizon. | The weakness of capital dependency became more pronounced with the scale of ambition. However, the successful partnerships and financing announcements show a clear strategy to manage this risk. |

| Opportunities | Growing data consumption in India; early demand from e-commerce (Flipkart) and cloud providers for local data centers. | Exponential, AI-driven demand for both compute and power; hyperscalers’ urgent need for sustainable energy to meet ESG goals; establishing India as a global AI hub. | The market opportunity fundamentally changed and expanded from a national digital trend to a central role in the global AI infrastructure race, driven by the power constraint. |

| Threats | Competition from established domestic and international data center operators; regulatory hurdles in land and power acquisition. | Intense, direct competition from another well-capitalized domestic conglomerate (Reliance‘s $110 B plan); global energy and supply chain volatility; capital market fluctuations impacting long-term funding. | The nature of the threat evolved from fragmented competition to a head-to-head, capital-intensive race with another major industrial group, raising the stakes for market dominance. |

Forward Outlook: Execution of Integrated Projects Will Define the Market

If Adani Group successfully executes the initial phases of its integrated power and data center projects, specifically the flagship Visakhapatnam campus with Google, it will establish a new industry standard where data center development is inseparable from dedicated renewable power generation. This will force competitors to replicate the integrated model or risk being marginalized in a power-constrained market.

AI Data Center Market Growth Forecast

This forecast of a $157 billion market provides crucial context for the forward outlook, underscoring the massive financial stakes in defining the future industry standard.

(Source: Market.us)

- The critical signal to monitor is the construction and commissioning timeline of the Visakhapatnam data center campus. On-time delivery will serve as powerful validation of the integrated strategy, while significant delays could signal execution challenges in managing such complex, interdependent projects.

- In response, competitors like Reliance Industries will likely be compelled to move beyond announcing headline investment figures and provide detailed strategies for their own integrated green power supply chains. Watch for major acquisitions of renewable energy assets or large-scale, long-term Power Purchase Agreements (PPAs) as they attempt to counter Adani‘s structural advantage.

- The concept of “green compute” as a unified offering is gaining significant market traction, with the Google partnership as the primary proof point. Further announcements of similar integrated agreements with other major hyperscalers, such as Amazon Web Services (AWS) or Microsoft, would confirm that this model is becoming the definitive path for AI infrastructure expansion in India and beyond.

Frequently Asked Questions

Why is Adani’s energy strategy considered crucial for AI data centers?

The primary constraint for new AI data centers has shifted from real estate to securing massive, reliable power. Adani’s strategy is winning because it is a vertically integrated energy conglomerate. By leveraging its huge renewable energy portfolio, it can offer an integrated package of green power and compute, directly solving the biggest challenge in the industry.

What is the scale of Adani’s investment commitment in this sector?

As of February 2026, Adani Group has committed to a $100 billion investment over the next decade (until 2035). The goal is to build 5 GW of renewable-powered AI data center capacity, which includes not just the data centers but also the supporting renewable energy generation and transmission infrastructure.

Who are Adani’s key partners in its AI data center projects?

Adani’s primary operational partner is EdgeConneX, through their AdaniConneX joint venture. Key strategic partners and clients include Google, with whom they are developing a massive AI data center campus in Visakhapatnam; Microsoft, for projects in Hyderabad and Pune; and large domestic enterprises like Flipkart.

How has Adani’s data center strategy changed since 2021?

Initially (2021-2024), the focus was on a conventional real estate approach, building standard colocation data centers in metro areas. Since 2025, the strategy has pivoted dramatically to focus on integrated, gigawatt-scale, renewable-powered campuses, shifting from leasing space to delivering green power and compute as a unified service.

Who is Adani’s main competitor in the race for India’s AI infrastructure?

The article identifies Reliance Industries as the primary competitor. In response to Adani’s moves, Reliance announced its own larger $110 billion investment plan into AI and renewable energy by 2031, initiating a direct, capital-intensive race for dominance in India’s digital and energy infrastructure.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.