Illinois AI Data Center Boom Hits a Wall: Energy Grid Constraints and Policy Shifts in 2026

Illinois AI Data Center Growth Confronts Energy Reality: A Shift from Expansion to Regulation

Illinois’ strategy of using aggressive tax incentives to attract AI data center investment successfully fueled a multi-billion-dollar boom through 2024, but by 2025, this rapid growth precipitated an energy and environmental crisis, forcing a state-level policy reversal from unchecked expansion to managed, regulated development.

- Between 2021 and 2024, the state’s Data Center Investment Program, which offers tax exemptions for projects with a minimum $250 million investment, acted as a powerful catalyst. This program attracted a wave of hyperscale projects from companies like Meta, Prime Data Centers, and T 5 Data Centers, leading to projections of a 900% increase in power demand in the Chicago area alone.

- The consequences of this success became clear in 2025, as analyses revealed the immense strain on the electrical grid. Projections from the Union of Concerned Scientists showed data center growth would add $24 billion to $37 billion in electricity system costs by 2050, prompting Governor JB Pritzker to propose a two-year suspension of the tax incentive program, effective July 1, 2026.

- In direct response to the escalating energy and water consumption concerns, Illinois lawmakers introduced the “Protecting Our Water and Energy Resources Act” (POWER Act) in early 2026. This legislation aims to establish comprehensive environmental regulations for new hyperscale data centers, representing a fundamental shift from purely incentivizing growth to actively managing its systemic impacts.

- Regulatory and community pushback, largely absent in the earlier period, intensified significantly. By 2026, the Illinois Attorney General was filing objections with the Federal Energy Regulatory Commission (FERC) over utility agreements with Com Ed, while residents in communities like Pekin organized to oppose projects due to risks to local water aquifers.

Illinois Data Center Power Demand Skyrockets

This chart’s projection of a 150% increase in power demand directly illustrates the ‘energy reality’ confronting Illinois, as described in the section. It perfectly captures the tension between the state’s growth strategy and its energy constraints.

(Source: Deloitte)

Analyzing Illinois’ $15.8 B Data Center Investment Wave and Proposed Incentive Pause

Illinois successfully secured over $15.8 billion in data center investments, driven by hyperscalers and major AI-specific projects, but the proposed suspension of state tax incentives in 2026 marks a significant change in the financial and risk calculation for future developments.

- The state attracted $10.7 billion in AI-specific investment, projecting the creation of 35, 500 permanent jobs, and was included in major national expansion plans, such as Mitsubishi’s $15 billion US strategy for AI data centers.

- The high value of data center assets in Illinois was highlighted by the $40 billion acquisition of Aligned Data Centers by a consortium including NVIDIA and Microsoft, as well as by individual large-scale projects like Cyrus One’s $500 million development in Sangamon County.

- This influx of capital was directly linked to the state’s Data Center Investment Program, which provided critical tax exemptions that lowered the cost of development and made Illinois a top-tier market. The proposed pause of this program directly challenges the financial model that fueled the initial boom.

Table: Major Data Center Investments in Illinois

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| State AI Investment | Jan 2026 | Total AI-specific investment secured by Illinois reached $10.7 billion, projected to create 35, 500 permanent jobs and solidifying the state’s focus on AI infrastructure. | St. Louis Business Journal |

| Mitsubishi Expansion | Nov 2025 | A $15 billion national expansion plan for AI data centers confirmed that projects in Illinois are included, signaling continued international investor interest in the state. | W.Media |

| Cyrus One | Oct 2025 | Began a $500 million project to build the first modern data center in central Illinois (Sangamon County), indicating geographic expansion beyond the crowded Chicago market. | Illinois Times |

| Aligned Data Centers Acquisition | Oct 2025 | A consortium including NVIDIA, Microsoft, and Black Rock acquired the data center operator for $40 billion, underscoring the high valuation of operators with a significant Illinois presence. | CNBC |

| T 5 Data Centers | May 2024 | Announced plans for a massive 480 MW campus in Grayslake, with a potential investment of up to $6 billion, demonstrating the large scale of AI-ready projects planned before the policy shift. | Canary Media |

| Prime Data Centers | Nov 2022 | Broke ground on a $1 billion, 175 MW campus in Elk Grove Village, one of the key early projects that established the momentum of the Chicago-area data center boom. | PR Newswire |

Powering the Boom: Strategic Energy and Tech Partnerships in Illinois’ AI Ecosystem

To address the immense energy requirements of AI data centers, hyperscalers and technology firms in Illinois are forming critical partnerships focused on securing large-scale, 24/7 clean energy and developing innovative on-site power solutions to bypass grid constraints.

- In a landmark deal announced in 2025, Meta signed a 20-year power purchase agreement with Constellation to procure 1.1 GW of carbon-free nuclear energy. This move signals a strategic pivot by hyperscalers to secure reliable, baseload clean power directly from generators to support their massive AI workloads.

- Data center operators are also aggressively pursuing renewable energy. Digital Realty partnered with Summit Ridge Energy to source solar power, helping it achieve 100% renewable energy for its 11 Illinois data centers, while Google signed a power offtake agreement with a Swift Current solar farm.

- To enhance power resiliency and circumvent grid limitations, companies are deploying on-site generation. Core Weave partnered with Bloom Energy to install solid oxide fuel cells at its Volo data center, a practical application of microgrid technology for mission-critical AI compute.

- The state’s academic institutions are central to this innovation. The University of Illinois Urbana-Champaign (UIUC) is working with software firm Xendee to develop a platform for integrating on-site power sources like small modular reactors (SMRs), directly addressing future energy challenges.

Table: Key Energy and Technology Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Meta & Constellation | Jun 2025 | Meta signed a 20-year PPA for 1.1 GW of nuclear power from the Clinton Clean Energy Center. This secures a massive, 24/7 carbon-free power source for its Illinois AI data centers, starting in 2027. | Carbon Credits |

| Digital Realty & Summit Ridge Energy | May 2025 | Digital Realty announced a solar energy agreement to power its Illinois data centers, helping it achieve its goal of matching 100% of its portfolio’s electricity use with renewable sources. | Summit Ridge Energy |

| IBM & State of Illinois | Dec 2024 | Partnered with the state and the University of Chicago to establish the National Quantum Algorithm Center, anchored by an IBM quantum computer, further strengthening the state’s high-tech ecosystem. | IBM Newsroom |

| Core Weave & Bloom Energy | Jul 2024 | Core Weave is deploying Bloom Energy’s solid oxide fuel cells for on-site, resilient power at its Volo AI data center, a move to ensure power availability independent of grid constraints. | Data Center Frontier |

From Chicagoland to Central Illinois: Data Center Expansion and Geographic Constraints

While the Chicago metropolitan area remains the epicenter of Illinois’ data center market due to its superior connectivity and power infrastructure, development is expanding into central Illinois as developers search for land and power capacity, a trend that now confronts localized resource and community opposition.

- Between 2021 and 2024, development was heavily concentrated in Chicago’s suburbs. Projects from Meta (De Kalb), Prime Data Centers (Elk Grove Village), and Cyrus One (Aurora) leveraged the area’s dense fiber networks and access to Com Ed’s electrical grid, establishing it as a top-five global market.

- By 2025, the search for large land parcels and substation capacity began pushing development into new territories. Cyrus One’s decision to build a $500 million facility in Sangamon County marked the first major hyperscale project in central Illinois, signaling a significant geographic expansion.

- This outward migration is not frictionless. In 2026, organized community opposition emerged in Pekin to block a proposed data center planned near a critical regional aquifer. This highlights how local environmental factors and resource availability are becoming primary constraints on site selection, a new challenge not widely present in the earlier boom.

AI Power Solutions: From Grid Reliance to Nuclear PPAs and On-Site Generation

The technology for powering AI data centers in Illinois has matured rapidly, evolving from a simple reliance on traditional grid power and renewable energy credits to the commercial-scale adoption of direct nuclear power purchase agreements and the deployment of on-site generation like fuel cells to ensure resiliency.

- In the 2021-2024 period, the standard power strategy involved connecting to the grid and purchasing renewable energy credits or participating in community solar programs to meet sustainability targets. This model, used by operators like Digital Realty, was sufficient for the initial wave of data center growth.

- The extreme power density of AI workloads rendered this model inadequate by 2025. Meta’s landmark PPA with Constellation for 1.1 GW of nuclear power represents a major technological and commercial maturation, establishing a new precedent for securing massive, 24/7 carbon-free baseload power.

- In parallel, on-site generation technology has moved from concept to commercial deployment. Core Weave’s installation of Bloom Energy fuel cells in 2024 is a validated commercial strategy to achieve power resilience, reduce dependence on a strained grid, and ensure uptime for high-value AI compute.

- The technology pipeline is already focused on the next phase, with research partnerships like the one between Xendee and UIUC developing platforms to integrate future technologies like SMRs, indicating that the industry is planning for a future where grid capacity is a permanent constraint.

SWOT Analysis: Illinois’ AI Data Center Strategy at a Crossroads

Illinois’ strengths in state-led incentives and existing infrastructure successfully drove its data center boom, but the enormous energy demand created by this success has exposed critical weaknesses and systemic threats, forcing a policy pivot that now creates new opportunities for sustainable energy development.

Illinois Electricity Prices Surge Amid Boom

This chart directly quantifies a ‘threat’ or ‘weakness’ central to the SWOT analysis. The 15.8% price spike is a tangible consequence of the energy demand issues discussed, making it a perfect illustration for this section.

(Source: CNBC)

- Strengths: The state’s key strength has evolved from its tax incentive program to its physical energy assets, specifically the nation’s largest nuclear power fleet.

- Weaknesses: The underestimation of cumulative energy demand has become an acute weakness, leading to grid strain and rising cost concerns.

- Opportunities: The market opportunity has shifted from simply attracting data centers to leveraging their immense capital to finance and build next-generation clean energy infrastructure.

- Threats: The primary threats are now internal, stemming from regulatory backlash, grid instability, and potential community opposition, rather than external competition.

Table: SWOT Analysis for Illinois and AI Data Centers

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Aggressive tax incentives via the Data Center Investment Program; robust fiber and power grid in the Chicago area. | The state’s large nuclear power fleet (e.g., Clinton Clean Energy Center) is recognized as a primary asset for 24/7 carbon-free power for AI. | The core strategic advantage shifted from financial incentives to physical energy assets as power became the main constraint. |

| Weaknesses | A policy framework that incentivized growth without fully accounting for cumulative energy, water, and environmental impacts. | An electrical grid nearing capacity limits; projections of $24 B-$37 B in new system costs; reliance on older fossil-fuel peaker plants to meet demand. | The latent weakness of unsustainable growth became an acute, system-level crisis, forcing a policy correction. |

| Opportunities | Attract billions in investment from hyperscalers like Meta and Microsoft to become a top-tier data center market. | Use hyperscaler demand to underwrite new, large-scale clean energy projects (nuclear, solar) and grid modernization; pioneer on-site power solutions (fuel cells, SMRs). | The opportunity evolved from attracting data centers to using their demand to build the next-generation energy infrastructure needed to power them. |

| Threats | Competition for data center projects from other states and regions with similar incentive programs. | Regulatory backlash (proposed incentive pause, POWER Act); community opposition (e.g., Pekin); grid instability; failure to meet state climate goals. | Threats became primarily internal and self-inflicted (policy uncertainty, grid strain) rather than external (market competition). |

2026 Outlook: Will Illinois Regulate or Derail its AI Data Center Boom?

The critical path for Illinois in 2026 is whether it successfully implements a regulatory framework, such as the POWER Act, to manage data center energy demand. Failure to establish a clear and predictable system for sustainable growth risks creating investment uncertainty, grid instability, and a slowdown in development.

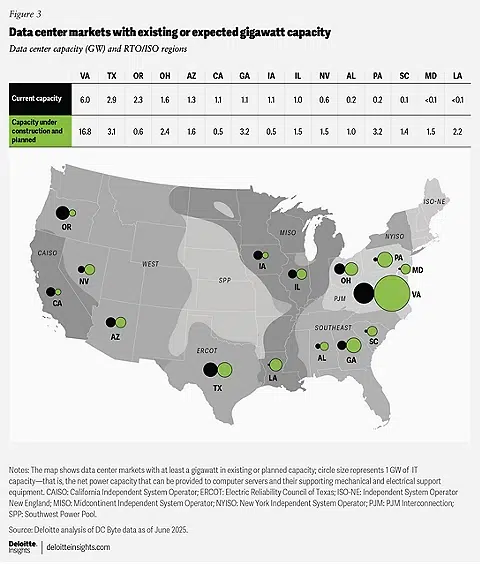

Chicago’s Data Demand Ranks Third Nationally

This chart establishes the high stakes for the 2026 outlook by showing the massive scale of Chicago’s energy demand. Ranking third in the U.S. provides crucial context for why Illinois must successfully regulate its data center boom.

(Source: Inside Climate News)

- If the state enacts robust regulations during the proposed incentive pause, watch for a new wave of investments directly tied to the co-development of dedicated clean energy generation, following the Meta-Constellation nuclear PPA as a blueprint for future projects.

- A key signal confirming this trajectory would be announcements from other hyperscalers like Microsoft, Google, or Amazon signing their own large-scale, long-term PPAs for nuclear or new-build renewable energy in Illinois.

- Conversely, if the incentive pause is lifted without meaningful new rules, watch for an increase in utility-developer conflicts filed at FERC, more widespread community opposition to new projects, and utilities publicly announcing the reactivation of fossil fuel peaker plants to manage grid load.

Frequently Asked Questions

Why did Illinois become a major hub for AI data centers?

Illinois attracted over $15.8 billion in data center investments primarily due to its Data Center Investment Program, which offered significant tax exemptions for projects with a minimum $250 million investment. This financial incentive made the state highly attractive to hyperscalers and AI-specific projects between 2021 and 2024.

What is the main problem caused by the data center boom in Illinois?

The main problem is the immense strain on the electrical grid. The rapid growth of data centers is projected to increase power demand in the Chicago area by 900%, potentially adding $24 billion to $37 billion in electricity system costs by 2050. This has led to an energy and environmental crisis, prompting a re-evaluation of the state’s growth strategy.

How is the Illinois state government responding to the energy crisis?

In response to the crisis, the government has shifted its policy from incentivizing growth to managing it. Governor JB Pritzker proposed a two-year suspension of the tax incentive program starting July 1, 2026. Additionally, lawmakers introduced the “Protecting Our Water and Energy Resources Act” (POWER Act) to establish comprehensive environmental regulations for new data centers.

How are companies like Meta and CoreWeave addressing their huge power needs?

Companies are securing their own power sources to bypass grid constraints. Meta signed a 20-year deal to buy 1.1 GW of carbon-free nuclear power directly from Constellation. Meanwhile, CoreWeave is deploying on-site solid oxide fuel cells from Bloom Energy at its data center to ensure a resilient, independent power supply for its AI operations.

What is the proposed “POWER Act” and what does it aim to do?

The Protecting Our Water and Energy Resources Act (POWER Act) is legislation introduced in early 2026 in direct response to the escalating energy and water consumption from data centers. It represents a fundamental policy shift from simply incentivizing growth to actively managing its environmental and systemic impacts by establishing comprehensive regulations for new hyperscale projects.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.