Data Center Power Crisis 2026: Why On-Site Generation Is Now Mandatory for Growth

From Procurement to Production: Data Center Power Strategy Shifts in 2026

The data center industry’s long-standing strategy of offsetting massive energy consumption with off-site Power Purchase Agreements (PPAs) is now insufficient, rendered inadequate by grid capacity limits and the power demands of AI. This has forced a strategic pivot from passive energy procurement to active, on-site power generation, a shift that is becoming a prerequisite for future expansion.

- Between 2021 and 2024, the dominant sustainability strategy was aggressive renewable energy procurement. Hyperscalers like Amazon, Microsoft, Meta, and Google became the largest corporate buyers, contracting for nearly 50 GW of clean power. This era was defined by mega-deals such as Microsoft’s partnership with Brookfield in May 2024 to develop over 10.5 GW of new renewable capacity.

- Starting in 2025, the strategy evolved due to emerging grid constraints. Industry leaders began pioneering the integration of on-site, 24/7 power sources. This is proven by Equinix’s landmark August 2025 collaboration with advanced nuclear providers Oklo, Radiant, ULC-Energy, and Stellaria, moving beyond procurement to co-development.

- The new approach prioritizes baseload power independent of the grid. Google’s partnership with Fervo Energy to develop enhanced geothermal power in Nevada and its deal with Energy Dome for long-duration storage are direct responses to the intermittency of solar and wind. Similarly, Equinix’s agreement to expand its use of Bloom Energy’s on-site fuel cells to over 100 MW marks a definitive move toward energy self-sufficiency.

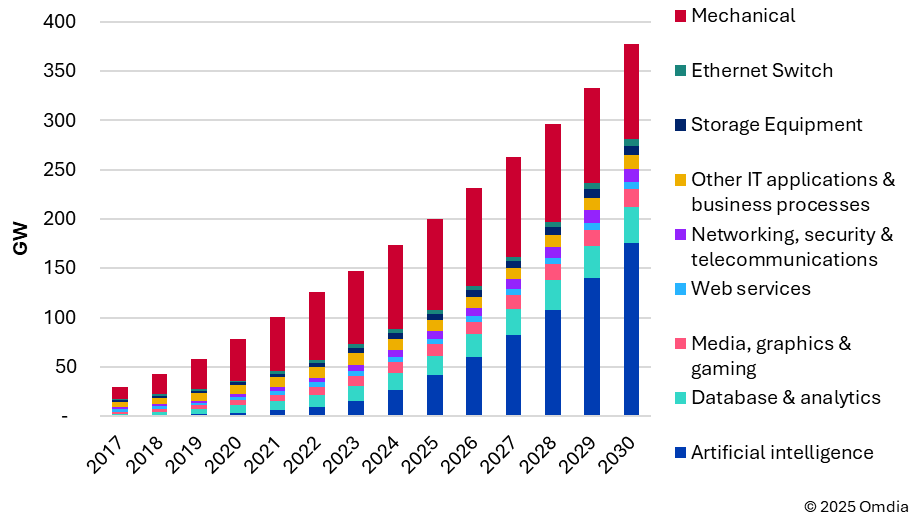

AI to Fuel Data Center Power Consumption

This chart quantifies the core driver behind the strategic shift described in the section, showing that AI workloads are projected to become the single largest component of data center power demand by 2030.

(Source: Omdia – Informa)

Capital Flows: Trillion-Dollar Investments Pivot to Integrated Energy Infrastructure

The enormous capital forecast for data center expansion is no longer just for building IT capacity; it is now funding the creation of a new, decentralized clean energy infrastructure co-located with compute. This pivot redirects investment from simple construction to integrated power systems, fundamentally changing the financial model of the industry.

- The scale of required investment is immense, with Mc Kinsey estimating that up to $7 trillion in cumulative capital expenditures will be needed by 2030 to meet compute demand. This figure reflects the dual challenge of building data centers and the power plants needed to run them.

- Company-specific commitments underscore this trend. Meta’s plan to invest $600 billion in its next generation of AI-ready data centers is a signal that future build-outs are inextricably linked to securing massive new sources of reliable, clean power.

- Financing mechanisms are adapting to this new reality. While Equinix’s $3.7 billion in green bonds issued in 2021 targeted projects like green buildings and renewable energy procurement, the focus of new capital is shifting. The $20 billion strategic partnership announced in December 2024 between Google, Intersect Power, and TPG Rise Climate is designed specifically to synchronize new clean power generation with data center growth, institutionalizing the co-development model.

Table: Major Capital Commitments for Data Center and Energy Infrastructure

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Mc Kinsey Forecast | Through 2030 | Projects a $7 trillion cumulative capital expenditure to scale data center infrastructure, highlighting the massive financial requirement driven by AI. | Mc Kinsey |

| Meta Investment | Not Specified (Announced Nov 2025) | A $600 billion commitment to build next-generation, AI-ready data centers, driving the need for new, scalable power solutions. | Carbon Credits.com |

| Google, Intersect Power, TPG | Announced Dec 2024 | A strategic partnership with potential for $20 billion in investment to develop new renewable energy and storage assets synchronized with new data center growth. | ESG Today |

| Microsoft & Brookfield | Announced May 2024 | A framework agreement valued at over $10 billion to deliver 10.5 GW of new renewable power capacity, representing the peak of the PPA-centric strategy. | Orrick |

| Equinix Green Bonds | 2021 | Issued $3.7 billion in green bonds to fund sustainability projects, establishing an early model for green financing in the sector. | Trellis |

Strategic Alliances: Building New Energy Ecosystems for Data Centers

Recent partnerships confirm a fundamental change in strategy, moving from transactional energy procurement contracts to deep, collaborative alliances aimed at co-developing and integrating next-generation power technologies directly with data center operations.

Framework for Sustainable Data Center Ecosystems

This diagram visually represents the new ‘energy ecosystems’ discussed in the section, illustrating a holistic framework that moves beyond transactional deals to integrated components like sustainable energy, policy, and design.

(Source: ITU)

- The partnership model between 2021 and 2024 was characterized by large-scale PPAs. Deals like Meta’s agreement with RWE for solar power or Microsoft’s with Brookfield were primarily financial and transactional, focused on purchasing renewable energy generated elsewhere.

- In 2025, the nature of alliances shifted toward technology integration. The collaboration between Equinix and four separate advanced nuclear firms is not a procurement deal; it is a technical exploration to embed a new power source into future data center designs.

- These new partnerships aim to solve specific technical challenges. Google’s alliance with Fervo Energy leverages new drilling technology to unlock geothermal as a reliable baseload power source, while its agreement with Energy Dome aims to deploy long-duration storage to solve the intermittency of renewables.

- Even collaborations targeting efficiency show this trend. The partnership between Infosys and Exxon Mobil to scale immersion cooling systems represents a move to integrate advanced thermal management solutions deep within data center architecture.

Table: Key Technology and Energy Development Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google & Fervo Energy | Announced Feb 2026 | Partnership to develop new geothermal energy resources in Nevada, aimed at providing 24/7 carbon-free power directly to data centers. | Brookings |

| Google Cloud & Next Era Energy | Announced Dec 2025 | A strategic partnership to develop and power new GW-scale data center campuses, integrating energy development directly with data center planning. | Next Era Energy |

| Equinix & Advanced Nuclear Partners | Announced Aug 2025 | Collaboration with Oklo, Radiant, ULC-Energy, and Stellaria to explore next-generation nuclear power for AI-ready data centers, signaling a move to secure firm, on-site power. | Equinix |

| Infosys & Exxon Mobil | Latest | Collaboration to deploy advanced immersion cooling systems, directly addressing the increased thermal loads and energy use of AI infrastructure. | Sustainability Magazine |

Geographic Focus: Power Constraints Reshape US and European Data Center Expansion

The geographic strategy for data center expansion is now fundamentally shaped by local grid capacity and regulatory climates, forcing operators to prioritize locations with favorable energy policies and potential for on-site power development over traditional factors like fiber connectivity.

Global Data Center Energy Use by Region

Supporting the section’s ‘Geographic Focus,’ this chart breaks down surging energy consumption by region, visually confirming the Americas as the dominant center of activity and power demand.

(Source: IDC)

- Between 2021-2024, the United States was the clear center of activity, with data centers accounting for over half of all clean energy procurement deals. Expansion was widespread, but early signs of grid strain began to appear in power-constrained markets.

- From 2025 onward, regulatory pressures became a primary driver of location strategy. Germany’s mandate requiring new data centers to use 100% renewable energy by 2027 is a clear example, forcing operators to secure verifiable clean power sources as a condition of entry.

- The United States remains a key growth market, but the strategy is now more granular. The Inflation Reduction Act (IRA) creates strong incentives for co-locating data centers with new clean energy projects. This is visible in Google’s geothermal project in Nevada and its PPA in Ohio, demonstrating a state-by-state approach to securing power.

- The shift to on-site generation allows for a more distributed geographic footprint. Equinix’s plan to deploy over 100 MW of fuel cells across 19+ data centers in six US states demonstrates a strategy to build resilience at a local level, reducing dependence on strained regional grids.

Technology Readiness: On-Site Power Moves from Pilot to Strategic Imperative

The core technologies for 24/7 on-site power, including advanced nuclear, geothermal, and long-duration storage, have progressed rapidly from small-scale pilots to strategic collaborations, indicating the market is preparing for accelerated adoption to overcome grid limitations.

Future Data Center Energy Mix Shifts

This forecast directly aligns with the ‘Technology Readiness’ theme by showing the projected growth of on-site and next-gen power sources like nuclear and renewables, which are set to meet rising demand as fossil fuel use plateaus.

(Source: Carbon Brief)

- In the 2021-2024 period, the technology focus was on scaling mature renewables via PPAs while exploring next-generation solutions in pilots. Microsoft’s tests of green hydrogen fuel cells as a diesel generator replacement were characteristic of this exploratory phase.

- The period from 2025 to today marks a significant acceleration toward commercial validation for on-site power. Equinix’s decision to form a working group with four advanced nuclear companies moves the technology from a theoretical option to a planned component of its infrastructure roadmap.

- The deployment of Bloom Energy fuel cells by Equinix at a scale greater than 100 MW demonstrates that on-site, clean, baseload power is now a commercially viable solution, not just a backup technology.

- Key enabling technologies are also being validated at scale. Google’s partnership with Fervo Energy utilizes advanced drilling techniques to make enhanced geothermal a scalable reality, while its commercial agreement with Energy Dome validates CO 2 battery storage as a solution for ensuring 24/7 carbon-free energy.

SWOT Analysis: The Strategic Shift from Energy Procurement to Generation

The industry’s core strength in capital deployment is being repurposed to mitigate the existential threat of grid failure, creating a new opportunity for data centers to become leaders in decentralized energy systems. This strategic pivot, however, is exposed to significant technology and regulatory risks.

- The primary threat to the data center industry has evolved from reputational risk associated with ESG targets to the tangible, operational risk of insufficient power, which can halt growth entirely.

- The industry’s response has been to turn this threat into an opportunity. By leveraging its immense capital, it can move beyond being a passive energy consumer to an active energy producer, ensuring its own resilience and creating a new competitive advantage.

- This shift validates the weakness of the previous PPA-only model, which failed to account for grid reliability and intermittency, and confirms that on-site generation is the necessary path forward.

Table: SWOT Analysis for Data Centers and Sustainability

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Access to massive capital to fund large-scale renewable PPAs, exemplified by Microsoft’s $10 B deal with Brookfield. | Redirecting massive capital ($7 T market forecast) to fund on-site power and integrated energy systems, such as Equinix’s nuclear collaborations. | The industry validated that its core strength (capital) can be pivoted from buying energy credits to building resilient energy assets, directly addressing the new primary threat. |

| Weakness | High dependency on public grids and intermittent renewable energy sources, creating a mismatch between 24/7 operational needs and power availability. | The transition to on-site generation is still in early-to-mid deployment; most operations remain grid-dependent and exposed to existing constraints. New technologies lack global scale. | The core weakness of grid dependency was exposed and validated. The new strategy of on-site generation is the proposed solution, but it has not yet resolved the weakness at an industry-wide scale. |

| Opportunity | Meet corporate ESG goals and achieve headline carbon neutrality through the purchase of Renewable Energy Credits (RECs) and PPAs. | Become energy producers, de-risk growth from grid constraints, and serve as anchor tenants for next-generation clean tech like SMRs (Equinix) and geothermal (Google). | The opportunity evolved from a reputational benefit to a strategic imperative. Securing power is now directly tied to the ability to grow, creating a much stronger business case for clean tech investment. |

| Threat | Reputational damage from a large carbon footprint and pressure from ESG investors. | Physical grid capacity failure, power shortages stalling AI-driven growth, and restrictive regulations like Germany’s 2027 mandate for 100% renewables. | The threat became tangible, operational, and immediate. It is no longer a future ESG concern but a present-day barrier to expansion, forcing a fundamental change in infrastructure strategy. |

Forward Outlook: The Race to Build Integrated Energy Hubs

The critical path for data center growth over the next 18-24 months is the ability to secure or generate 24/7 carbon-free power. Therefore, the most important signal to watch for is the first firm, legally binding contract for the deployment of an on-site Small Modular Reactor or a multi-hundred-megawatt geothermal project, which will mark the start of a new competitive era.

Renewable Purchasing Was a Top Priority

This 2022 survey illustrates the old strategy of focusing on ‘renewable energy purchasing options’ (i.e., PPAs), which the ‘Forward Outlook’ section explicitly warns against continuing to rely upon.

(Source: Network-King)

Industry Doubted Its Own Sustainability Efforts

This 2021 survey provides a data point for the ‘2021 – 2024’ period in the SWOT table, quantifying the industry’s own view that its prior environmental commitments were ‘not effective’ in reducing energy use.

(Source: Uptime Institute Journal)

- If this happens: The industry continues to rely primarily on off-site PPAs. Watch this: An increase in reports of data center project delays due to grid connection queues and the introduction of more state-level moratoriums on new construction. This could be happening: Data center growth will slow and fragment, concentrated only in the few remaining regions with abundant and accessible grid power.

- If this happens: A hyperscaler or major colocation provider signs a definitive deployment contract for a first-of-a-kind, on-site, next-generation power source. Watch this: A rapid follow-on of similar announcements from competitors, a surge in land acquisition that prioritizes energy resource potential (geothermal, water rights for cooling) over fiber proximity, and the formation of new investment funds dedicated to co-located data and energy projects. This could be happening: The “integrated energy hub” model will be validated, creating a powerful new competitive advantage and unlocking growth in previously power-constrained markets.

Frequently Asked Questions

Why are large-scale Power Purchase Agreements (PPAs) no longer enough for data centers?

The article explains that the PPA strategy is now insufficient due to two main factors: physical grid capacity limits and the massive, 24/7 power demands of AI. The intermittency of renewable sources like solar and wind, which PPAs often rely on, cannot provide the constant baseload power that modern data centers require, creating a critical reliability gap.

What kind of on-site power technologies are data centers adopting?

Data centers are exploring and deploying several next-generation technologies for on-site power. Key examples mentioned include advanced nuclear (Small Modular Reactors) through partnerships like Equinix’s with Oklo and Radiant, enhanced geothermal power being developed by Google and Fervo Energy, on-site fuel cells from Bloom Energy, and long-duration battery storage solutions like Google’s deal with Energy Dome.

How has the financial strategy for data center investment changed?

Capital investment is pivoting from simply funding data center construction to financing integrated energy infrastructure. Instead of just buying renewable energy credits, companies are now directing massive capital—part of a forecasted $7 trillion market—to co-develop and build power plants directly alongside data centers. This turns a simple procurement cost into a long-term capital investment in energy self-sufficiency.

What is the biggest threat to data center growth today?

According to the article’s SWOT analysis, the primary threat has shifted from reputational risk (ESG pressure) to the tangible, operational risk of insufficient power. The main concerns are now physical grid capacity failure and power shortages that can halt expansion, especially for AI-driven growth. This threat is immediate and directly impacts the ability to build and operate new facilities.

What major event should we watch for that would signal this new era has truly begun?

The article’s ‘Forward Outlook’ section states that the most important signal to watch for is the first firm, legally binding contract signed by a hyperscaler or major colocation provider for the deployment of an on-site, next-generation power source, such as a Small Modular Reactor (SMR) or a large-scale geothermal project. This event would validate the ‘integrated energy hub’ model and trigger a competitive race to secure on-site power.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.