Data Center Power Regulation 2026: Why States Are Trading Incentives for Accountability

From Incentives to Accountability: The 2026 Regulatory Shift for Data Center Power Projects

State regulators are fundamentally shifting their approach to data center development, moving from a model of unconditional incentives to a framework where large-load customers are held directly accountable for their grid impact. This transition is a direct response to the massive electricity demand from AI and cloud computing, which threatens grid stability and ratepayer equity. The old paradigm of competing for projects with generous tax breaks is being replaced by sophisticated policies that mandate cost responsibility and clean energy integration.

- Between 2021 and 2024, the primary regulatory tool was financial attraction, with over half of U.S. states offering tax incentives to lure data center investments. This strategy treated data centers as generic economic development projects, largely ignoring their unique and immense energy footprint.

- Starting in 2025, a sharp policy recalibration began as the true cost of this energy demand became apparent. Illinois proposed a two-year suspension of its data center tax incentive program specifically to control soaring power bills for residents, signaling a major reversal from its previous pro-incentive stance.

- This new accountability model is solidifying in 2026, with states like Washington and Oregon advancing legislation that explicitly requires data centers to pay for the grid infrastructure upgrades their facilities necessitate. Virginia, a dominant data center market, now ties its tax exemptions directly to corporate commitments to procure renewable energy, making environmental performance a condition for financial benefit.

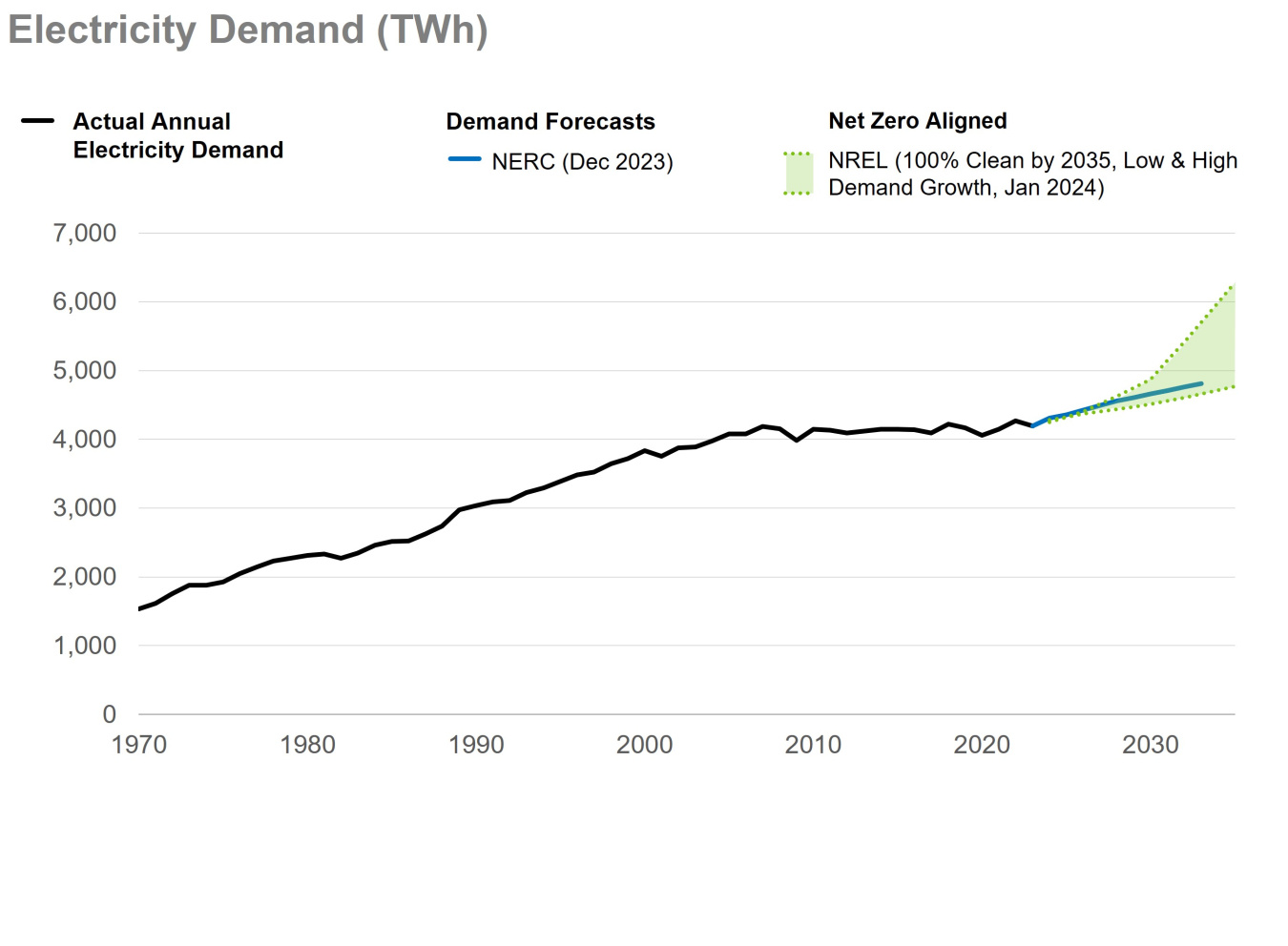

Electricity Demand Forecasts Signal Unprecedented Growth

This chart’s projection of accelerating electricity demand directly illustrates the core problem driving the regulatory shift discussed in the section. The surge in consumption is the reason states are moving from incentives to accountability for data centers.

(Source: Department of Energy)

Financial Impact: How New Levies and Suspended Tax Breaks Are Reshaping Data Center Project Economics in 2026

The transition toward accountability introduces direct financial risks and new operational costs for data center developers, altering the core economics of project development. The sudden removal of long-standing subsidies creates a “subsidy cliff” that impacts the Net Present Value (NPV) and Internal Rate of Return (IRR) of projects, while new levies add direct costs tied to grid consumption. This forces operators to factor regulatory risk and direct infrastructure costs into their financial models, a consideration that was secondary in the previous incentive-driven era.

- The proposed suspension of tax incentives in Illinois, effective July 1, 2025, creates a significant Subsidy Cliff for projects that had factored these tax breaks into their long-term financial planning. This introduces major uncertainty and can negatively affect the payback period for capital-intensive facilities.

- Alberta, Canada, is implementing a direct cost-recovery mechanism with a new policy effective December 31, 2026. It imposes a 2% levy on computer hardware for any grid-connected data center drawing 75 MW or more, functioning as a targeted tax to offset the facility’s impact on the grid.

- New York’s proposed Senate Bill S 6394 A aims to eliminate indirect subsidies by preventing utilities from offering discounted electricity rates to data centers that use fossil fuel-based power purchase agreements. This policy directly targets the energy procurement strategy, increasing costs for operators not aligned with state clean energy goals.

Strategic Energy Partnerships: How Data Centers are Securing Clean Power via PPAs in 2026

In response to growing regulatory pressure and the need for massive, reliable power, data center operators are increasingly executing large-scale corporate Power Purchase Agreements (PPAs) with renewable energy providers. This strategy allows them to secure long-term price certainty, meet corporate ESG mandates, and de-risk their energy supply in a volatile market. States with favorable renewable resources and competitive energy markets, like Texas, have become primary hubs for these multi-billion-dollar deals.

State Net-Zero Mandates Drive Clean Energy Partnerships

This map shows which states have clean energy mandates, providing the regulatory context for why data centers are pursuing PPAs to meet ESG goals. It explains the external pressure behind the strategic partnerships discussed.

(Source: Mondaq)

- The scale of these partnerships is demonstrated by Google’s agreement with Total Energies in February 2026 to procure 1, 000 MW of solar capacity in Texas. This 15-year PPA provides the financial backing for new renewable projects while guaranteeing a stable power source for Google’s data centers.

- Meta has been particularly active, signing a series of major solar PPAs in Texas throughout 2025 and 2026. These include deals with ENGIE North America for 600 MW (a $900 million agreement), Enbridge for another 600 MW (also valued at $900 million), and Zelestra for 176 MW.

- This trend represents a market-driven solution to a regulatory problem. By directly contracting for clean power, companies like Meta and Google can better control their energy costs and carbon footprint, reducing their exposure to both grid constraints and policy shifts that penalize fossil fuel consumption.

Table: Recent Data Center Clean Energy Partnerships

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Google / Total Energies | Feb 2026 | Signed a 15-year PPA for 1, 000 MW of solar capacity in Texas to power data centers, providing long-term price stability and supporting renewable energy development. | Total Energies |

| Meta / Zelestra | Feb 2026 | Signed a long-term PPA for 176 MW of solar capacity in Texas, continuing Meta’s strategy of powering its operations with renewable energy. | DCD |

| Meta / ENGIE North America | Oct 2025 | A $900 million PPA for 600 MW of solar power from the new Limestone wind and solar farm in Texas to support Meta’s data center operations. | Power Systems Technology |

| Meta / Enbridge | Jul 2025 | Another $900 million PPA for 600 MW of solar power from the Clear Fork Solar project in Texas, further expanding Meta’s renewable energy portfolio. | Utility Dive |

Geographic Hotspots: How State Regulations are Redrawing the Data Center Map in 2026

The divergence in state regulatory approaches is creating a fragmented geographic landscape, with clear winners and losers in the race for data center investment. States that impose new costs and regulatory hurdles without providing clear pathways for clean energy procurement are becoming less attractive. In contrast, regions with abundant renewable resources and market structures that facilitate direct power procurement are emerging as preferred locations for new hyperscale development.

Data Center Power Demand Creates Geographic Hotspots

These maps perfectly illustrate the section’s theme of a ‘redrawing data center map’ by visualizing current and future load clusters. They show exactly where the geographic hotspots of power demand are emerging.

(Source: POWER Magazine)

- Between 2021 and 2024, states like Virginia dominated by offering generous tax incentives, creating highly concentrated data center alleys. The main driver was the availability of subsidies and land, with less regulatory focus on the corresponding energy demand.

- From 2025 onward, this map is being redrawn by policy. Illinois’ move to suspend tax breaks introduces significant risk, potentially cooling development in the Chicago market. Virginia is attempting to balance its existing dominance with new clean energy mandates, a move that could increase operational complexity for developers.

- California is leading regulatory stringency with its SB 253 and SB 261 climate disclosure laws, which impose significant reporting burdens and make it a more challenging environment for new builds despite its proximity to tech headquarters.

- Texas has emerged as a major beneficiary of this shift. Its competitive electricity market and vast solar resources make it an ideal location for the large-scale PPAs that hyperscalers now favor, positioning it as a primary growth market for data centers seeking to control their energy supply.

Regulatory Maturity: From Basic Incentives to Advanced Clean Energy Frameworks for Data Centers

The regulatory toolkit for managing data center energy demand is evolving from blunt financial instruments to sophisticated policies designed to integrate advanced energy technologies. During the 2021-2024 period, state efforts were largely confined to offering tax abatements. The current period, from 2025-2026, shows a marked increase in regulatory maturity, with a focus on enabling firm, 24/7 carbon-free power sources and treating data centers as potential grid assets rather than just passive loads.

Framework Outlines Advanced Data Center Energy Solutions

This framework visualizes the ‘sophisticated policies’ and ‘advanced energy technologies’ that define the regulatory maturity described in the section. It represents the strategic toolkit states and developers are now using.

(Source: Department of Energy)

- The early period (2021-2024) was characterized by a one-dimensional approach focused on tax incentives, as seen in policies across more than half of U.S. states. The goal was simply to attract investment, with little consideration for the specific technological needs or grid impacts of data centers.

- In 2025 and 2026, regulators are adopting more advanced frameworks. Alberta’s Bill 8, introduced in November 2025, explicitly allows data centers to build and operate their own power generation, a significant step toward energy independence and reducing grid strain.

- There is a growing recognition that intermittent renewables alone cannot power data centers 24/7. This has led to an exploration of firm clean power sources, exemplified by Microsoft’s deal to procure nuclear power for its Virginia data centers. This signals a strategic diversification beyond solar and wind PPAs.

- The most forward-looking policies, currently under discussion, involve turning data centers into flexible grid assets. This includes incentivizing demand response capabilities and on-site battery storage, which would allow data centers to support grid stability rather than just consume power.

SWOT Analysis: Navigating the Evolving Regulatory Framework for Data Center Power

The transition from an incentive-led to an accountability-focused regulatory environment presents a new set of strategic challenges and opportunities for data center operators, utilities, and clean energy developers. The market is moving toward a more sustainable but complex model where energy strategy is inseparable from site selection and project finance. This SWOT analysis identifies the key factors shaping success in this new regulatory era.

Table: SWOT Analysis for State Energy Regulatory Approaches to Powering Data Centers

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Validated |

|---|---|---|---|

| Strengths | Widespread tax incentives reduced upfront and operational costs, making development financially attractive in many states. | Direct power procurement via large-scale PPAs provides long-term price certainty and budget stability, insulating operators from volatile electricity markets. | The model shifted from relying on unpredictable public subsidies to securing stable, private-sector energy contracts, giving operators more control. |

| Weaknesses | Massive, unmanaged load growth led to significant strain on local grids and rising electricity costs for all ratepayers, as seen in Virginia. | “Policy whiplash, ” such as Illinois’ proposed suspension of incentives, creates a “subsidy cliff” that threatens the financial viability of projects already in development. | The weakness of relying on incentives was validated when states began revoking them due to budget and grid pressures, revealing the model’s unsustainability. |

| Opportunities | States competed to offer the most generous tax breaks, creating a “race to the top” for developers seeking the best financial package. | The insatiable demand for clean power creates a generational opportunity for renewable energy developers, backed by massive PPAs from companies like Meta and Google. | The opportunity shifted from chasing tax breaks to developing new energy infrastructure, creating a massive, stable revenue source for the clean energy sector. |

| Threats | A lack of long-term grid planning meant that new data centers faced potential power shortages and interconnection delays once built. | Regulatory fragmentation and permitting bottlenecks are now the primary threats. Data centers can stand empty while awaiting power connections, as seen in Silicon Valley. | The primary threat is no longer a lack of incentives but the physical and regulatory barriers to getting power, a much harder problem to solve. |

2026 Outlook: The ‘Growth Pays for Growth’ Scenario for Data Center Energy Regulation

If states continue to adopt “growth pays for growth” policies, data center development will increasingly concentrate in regions with clear regulatory pathways for direct clean power procurement and robust grid infrastructure. The most critical indicator to watch is the adoption rate of policies that assign the full cost of grid upgrades to the large-load customers that necessitate them. This will force a more disciplined and strategic approach to site selection, rewarding jurisdictions that offer regulatory certainty and abundant energy resources over those that simply offer temporary tax relief.

Projected Demand Concentration To Overwhelm State Grids

This forecast map supports the ‘2026 Outlook’ by showing where data center demand will concentrate and strain local grids. This visualization provides the rationale for the ‘growth pays for growth’ policies discussed in the section.

(Source: CarbonCredits.com)

- If this happens: More states follow the lead of Washington, Oregon, and Alberta in implementing policies that ensure data centers bear the infrastructure costs their operations require. Watch this: The number of states proposing or enacting legislation to create specialized tariffs or infrastructure fees for high-density loads. This signals a nationwide shift toward the “user-pays” principle. This could be happening: Data center developers will prioritize sites with existing grid capacity or in states with streamlined permitting for on-site generation, even if those locations offer fewer tax incentives.

- If this happens: Hyperscalers accelerate their use of multi-billion-dollar PPAs as their primary strategy to de-risk energy supply. Watch this: The volume and size of corporate PPAs announced by companies like Meta, Google, and Microsoft, particularly in markets like Texas and the Midwest. This could be happening: A two-tiered market develops, where large operators with the capital to fund their own energy infrastructure thrive, while smaller players struggle with grid access and volatile power costs.

- If this happens: The political and economic benefits of unconditional tax incentives come under greater scrutiny. Watch this: Other states launching formal reviews of their data center incentive programs, similar to the action taken by the Illinois governor. This could be happening: The era of states competing on tax breaks definitively ends, replaced by competition based on regulatory stability, grid readiness, and access to clean, firm power.

Frequently Asked Questions

Why are states changing their approach to regulating data center power usage?

States are shifting from offering financial incentives to demanding accountability because the massive electricity demand from AI and cloud computing is threatening grid stability and increasing power costs for residential ratepayers. The old model treated data centers like any other business, but their unique, immense energy footprint now requires policies that make them directly responsible for the costs and grid upgrades they necessitate.

What is the ‘subsidy cliff’ and how does it impact data center projects?

The ‘subsidy cliff’ refers to the sudden financial shock a project experiences when long-standing tax incentives are suspended or removed, as proposed in Illinois starting in July 2025. Developers who factored these subsidies into their financial models face significant uncertainty, potentially making their projects unprofitable by negatively affecting their Net Present Value (NPV) and extending their payback period.

How are companies like Google and Meta responding to these regulatory changes?

In response to regulatory pressure and the need for reliable power, companies like Google and Meta are proactively securing their energy supply by signing large-scale, long-term corporate Power Purchase Agreements (PPAs) with renewable energy providers. For example, Google signed a 1,000 MW solar PPA in Texas, and Meta has multiple large solar deals in the same state. This strategy provides them with price certainty, helps them meet clean energy goals, and reduces their exposure to grid constraints.

Which US state is emerging as a preferred location for data centers under this new regulatory landscape, and why?

Texas is emerging as a major beneficiary and a preferred location. Its competitive electricity market, abundant solar and wind resources, and regulatory framework make it ideal for the large-scale Power Purchase Agreements (PPAs) that hyperscale data center operators now favor. This allows them to secure massive amounts of clean power directly, providing cost and supply certainty in a way that states with more restrictive energy markets cannot.

What does the ‘growth pays for growth’ outlook mean for the future of data centers?

The ‘growth pays for growth’ model means that data centers will be increasingly required to pay for the new grid infrastructure their operations demand, rather than having those costs subsidized by other ratepayers. If this trend continues, developers will prioritize sites in states with clear regulatory rules for direct power procurement and existing grid capacity, like Texas. The focus will shift from chasing temporary tax breaks to securing long-term energy and regulatory stability.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.