Data Center Supply Chain Resilience: Why Risk Mitigation Replaced Cost in 2026 Strategy

From Cost Efficiency to Continuity: How Supply Chain Risk Redefined Data Center Projects

The primary driver for data center projects has fundamentally shifted from minimizing operational and capital expenditures to securing the supply of power and critical equipment. This change was forced by the massive, non-negotiable compute demand from artificial intelligence, which rendered the traditional cost-centric model inadequate and exposed the catastrophic financial risk of project delays and operational downtime.

- Between 2021 and 2024, the industry reacted to post-pandemic disruptions by focusing on visibility. For example, Accenture’s 2021 strategic investment in Interos, an AI-powered risk mapping platform, was aimed at understanding and monitoring vulnerabilities within existing, fragile supply chains. The strategy was largely defensive and analytical.

- Since January 2025, the strategy has become proactive and capital-intensive, prioritizing supply certainty over cost. The $1.9 billion supply capacity agreement between Schneider Electric and Switch in November 2025 is a definitive move from just-in-time procurement to securing a multi-year pipeline of essential power and cooling infrastructure to de-risk future build-outs.

- This strategic pivot is confirmed by new operator priorities. A 2025 Futurum survey shows 50% of data center operators plan to invest in AI and automation for resilience and 42% are focused on faster recovery, demonstrating that uptime, not cost reduction, is the new primary key performance indicator.

- The scale of the problem is now quantified, making long-term planning essential. With global data center infrastructure investment projected to exceed $1.7 trillion by 2030 and critical equipment lead times reaching 2 to 5 years, securing capacity through long-term agreements has become a core survival strategy, not an optional expense.

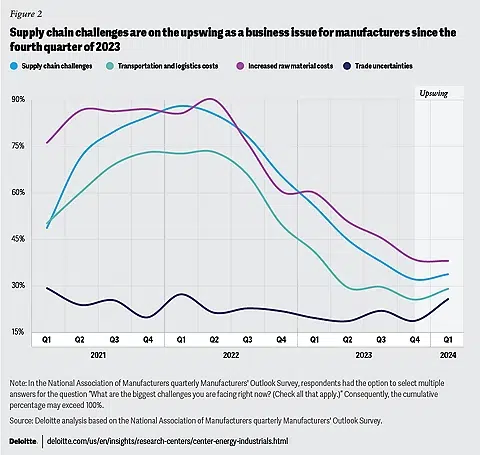

Supply Chain Disruptions Intensified in Early 2024

This chart shows key supply chain challenges for manufacturers increased in late 2023 and early 2024, providing direct evidence for why data center projects shifted focus from cost to supply security during this period.

(Source: Deloitte)

Data Center Investment Analysis: Billions Reallocated to Secure Resilience

Capital allocation has decisively moved from funding lean operations to financing large-scale, long-term resilience initiatives, including direct supply chain agreements and infrastructure insurance programs. This reflects a new financial paradigm where the cost of potential failure far outweighs the savings from a hyper-optimized, but brittle, supply chain.

The Traditional Cost-Optimized Supply Chain Model

This infographic illustrates the traditional cost-reduction funnel, representing the ‘hyper-optimized, but brittle’ model that the new wave of resilience investment is designed to replace.

(Source: Six Sigma)

- Investment focus has evolved from software-based risk management to securing hard assets and capacity guarantees. While Accenture’s 2021 investment in Interos was significant for improving risk visibility, recent financial commitments are orders of magnitude larger and more direct in mitigating physical supply chain bottlenecks.

- Financial institutions are creating new products to underwrite this risk. Aon’s January 2026 expansion of its Data Center Lifecycle Insurance Program to $2.5 billion in capacity shows the insurance market is building frameworks to cover the substantial construction and operational risks associated with modern AI infrastructure.

- National security interests are providing a powerful tailwind for resilience-focused investment. JPMorgan Chase’s October 2025 launch of a $1.5 trillion, 10-year initiative to finance industries critical to security, including digital infrastructure, creates a massive capital pool for projects that strengthen domestic supply chains.

- Hyperscalers are making direct, large-scale investments in resilient infrastructure. Microsoft’s $7 billion investment in two new AI-focused data centers in Wisconsin, announced in September 2025, underscores a strategy that prioritizes supply chain control and community-integrated power solutions.

Table: Major Investments in Data Center Resilience (2025-Present)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Aon | Jan 2026 | Expanded its Data Center Lifecycle Insurance Program to $2.5 billion. The program is designed to insure against construction and operational risks for AI-driven digital infrastructure, directly addressing the financial risks of project delays. | Aon |

| Schneider Electric & Switch | Nov 2025 | A $1.9 billion supply capacity agreement to secure a long-term pipeline of power and cooling equipment. This initiative mitigates supply chain risk by pre-purchasing critical hardware for future AI data center deployments. | PR Newswire |

| JPMorgan Chase | Oct 2025 | Launched a $1.5 trillion, 10-year Security and Resiliency Initiative. The plan facilitates financing and investment in industries critical to national security, with a specific focus on digital infrastructure resilience. | JPMorgan Chase |

| Microsoft | Sep 2025 | Announced a $7 billion investment to construct two hyperscale AI data centers in Wisconsin. The project emphasizes supply chain resilience and local community impact, moving beyond a pure cost-optimization construction model. | Supply Chain Digital |

| Kyndryl | May 2025 | Announced a €100 million investment plan to hire up to 300 experts. The initiative is focused on guiding customers in enhancing their data, AI, and cyber resilience capabilities. | Kyndryl |

Strategic Alliances: How Partnerships Secure Power and Equipment for Data Center Resilience

Data center operators are forming novel, cross-industry partnerships with energy providers, equipment manufacturers, and government agencies to secure their supply chains and de-risk their dependency on public infrastructure. These collaborations have moved beyond traditional IT service integrations to address fundamental physical constraints like power availability and hardware procurement.

- During the 2021-2024 period, partnerships often focused on software and cloud security. For instance, a July 2025 collaboration between Resilience, Crowd Strike, and AWS aimed to reduce cyber risk for cloud users, addressing a critical but non-physical layer of the resilience stack.

- By 2025, partnerships began to directly target physical bottlenecks. The Schneider Electric and Switch agreement in November 2025 exemplifies a strategic alliance between an operator and a manufacturer to guarantee a multi-year supply of essential hardware, treating equipment availability as a contractual deliverable.

- Collaboration with grid operators has become a key strategy for ensuring power stability. Google’s September 2025 partnership with PJM Interconnection, North America’s largest grid operator, uses AI to enhance grid resilience, directly benefiting its data centers by hardening their external power source.

- Public-private partnerships for national security are an emerging trend. The agreement between Ameresco and the U.S. Navy in September 2025 to build an AI-optimized data center at NAS Lemoore highlights the convergence of military readiness and resilient, secure digital infrastructure.

Table: Key Partnerships for Data Center Resilience (2025-Present)

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Schneider Electric & Switch | Nov 2025 | A $1.9 billion supply capacity agreement to secure a long-term supply of power and cooling infrastructure for AI data centers. This partnership directly mitigates hardware procurement risk. | PR Newswire |

| Google & PJM Interconnection | Sep 2025 | Collaboration to use AI to build a stronger, more resilient electrical grid. This enhances power reliability for data centers by making the external grid more stable. | Google Data Centers |

| Ameresco & U.S. Navy | Sep 2025 | Development agreement to build an AI-optimized data center at NAS Lemoore. The partnership focuses on energy resilience and security for critical defense infrastructure. | Ameresco |

| Resilience, Crowd Strike & AWS | Jul 2025 | Collaboration to offer an integrated approach to reduce cyber risk for enterprises using cloud infrastructure. This alliance targets the software and security layer of data center resilience. | Crowd Strike |

Geographic Shift: Sovereign Resilience and Data Center Expansion in North America and Europe

While data center growth remains a global phenomenon, a distinct trend toward “sovereign resilience” is concentrating new, strategic investments in North America and Europe. This shift is driven by government policies designed to secure domestic AI compute capacity and reduce dependence on fragile international supply chains.

Core Factors for Building Supply Chain Resilience

This diagram highlights ‘geographical integration’ as a critical factor for resilience, directly supporting the section’s thesis about the strategic geographic shift to North America and Europe for ‘sovereign resilience’.

(Source: Springer Link)

- Between 2021 and 2024, the geographic focus was on analyzing risks within established global supply chains. Policies like the U.S. White House’s 2021 supply chain review and the UK’s 2023 data infrastructure framework set the stage, but actions were primarily analytical and policy-focused rather than centered on large-scale construction.

- From 2025 onward, this policy has translated into concrete national initiatives. Canada’s January 2026 call for proposals to develop sovereign, large-scale AI data centers is a direct government action to build domestic compute capacity and ensure national control over critical digital infrastructure.

- The United States is seeing major domestic investments linked to resilience. Microsoft’s $7 billion plan for two new AI data centers in Wisconsin, announced in September 2025, directly connects hyperscale expansion to local economic benefits and greater control over the construction supply chain.

- The UK is similarly advancing its national strategy for AI infrastructure, as outlined in a July 2025 report, reinforcing a broader European movement to prioritize data sovereignty and economic security through the development of localized, resilient digital infrastructure.

From Just-in-Time to Just-in-Case: How Resilience Technologies Reached Commercial Scale

Technologies and strategies supporting data center resilience have matured from niche risk management tools into commercially scaled, essential components of infrastructure deployment. This maturation is driven by the financial necessity of guaranteeing uptime in the AI era, where the cost of service interruption is unacceptably high.

Industries Adopt ‘Just-in-Case’ Resilience Strategies

This chart shows various industries adopting specific ‘just-in-case’ tactics like strategic stockpiling, illustrating how the resilience technologies and strategies mentioned in the section have reached commercial scale.

(Source: Springer Link)

- In the 2021-2024 period, the dominant technologies focused on visibility and financial efficiency. AI-powered risk mapping platforms like Interos gained traction, and companies prioritized moving from CAPEX-heavy models to OPEX-based cloud services for agility and cost management.

- Since 2025, the focus has shifted to physical infrastructure and financial instruments that guarantee supply. The Schneider Electric-Switch agreement represents a form of “resilience-as-a-service” at commercial scale, where supply chain certainty is a contracted and funded deliverable.

- The financial model has evolved to prioritize a Total Cost of Ownership (TOTEX) approach that explicitly includes risk. This is validated by the widespread adoption of strategies like strategic stockpiling and bulk pre-purchasing of critical equipment, a trend identified by BCG in January 2025 as a key method for overcoming supply barriers.

- Emerging energy technologies are now central to resilience strategy. On-site power generation, direct Power Purchase Agreements (PPAs), and explorations into Small Modular Reactors (SMRs) have moved from experimental concepts to strategic imperatives for achieving energy independence and de-risking reliance on strained public grids.

SWOT Analysis: The Strengths and Weaknesses of the Data Center Resilience Shift

The strategic pivot to resilience significantly strengthens operational continuity and aligns with national security priorities. However, it also introduces substantial upfront capital costs and creates new dependencies on a concentrated group of large-scale equipment suppliers and energy providers.

A Framework for Supply Chain Resilience Strategies

This diagram outlines the portfolio of resilience strategies available. It visually represents the ‘Strengths’ of the resilience shift discussed in the SWOT analysis by detailing the tools for active control.

(Source: AltexSoft)

- Strengths have progressed from passive risk awareness to active, funded control over the physical supply chain, ensuring greater predictability in project delivery and operations.

- Weaknesses have shifted from the operational fragility of just-in-time models to the significant capital burden required for just-in-case stockpiling and long-term supply agreements.

- Opportunities now exist in developing new markets for resilience-focused financial products, energy infrastructure, and advanced grid-integration services.

- Threats remain centered on escalating geopolitical volatility, which can disrupt even diversified supply chains, and the persistent physical constraints of power generation and manufacturing capacity for critical components.

Table: SWOT Analysis for Data Center Supply Chain Resilience

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Increased supply chain visibility and risk mapping (e.g., Accenture’s investment in Interos). Policy frameworks established for resilience (U.S. and UK governments). | Active control over hardware supply through long-term agreements (Schneider/Switch). Alignment with national security goals (Canada’s sovereign AI initiative). Enhanced operational resilience through new partnerships (Google/PJM). | The strategy evolved from passive monitoring of risk to active, funded control over the physical supply chain, making uptime more predictable. |

| Weaknesses | Over-reliance on just-in-time, single-source, and geographically concentrated supply chains. High vulnerability to disruptions as shown by the pandemic. | High upfront capital expenditures (CAPEX) required for stockpiling and pre-purchasing. Continued long lead times (2-5 years for turbines) remain a structural bottleneck. | The core weakness shifted from operational fragility risk to a significant capital allocation risk. Securing the supply chain is now a major financial commitment. |

| Opportunities | Growth of the supply chain risk management software market. Shift to OPEX cloud models for agility. | Creation of new financial products (Aon’s $2.5 B insurance program). Development of on-site energy solutions (PPAs, SMRs). New service models for grid integration. | The opportunity expanded from software tools to large-scale infrastructure projects, financial services, and energy partnerships. |

| Threats | Event-driven disruptions like the COVID-19 pandemic and initial trade frictions. Unreliable public grids. | Systemic risks from escalating geopolitical tensions fragmenting global trade (Mc Kinsey 2025 survey). Intense competition for finite manufacturing capacity for transformers and switchgear. Strained public energy grids unable to meet demand. | Threats became more structural and predictable, shifting from unforeseen events to known constraints like insufficient grid capacity and geopolitical realignment. |

Forward Outlook: Expect Deeper Integration Between Data Centers and Energy Infrastructure

If the intense demand for AI compute continues on its current trajectory, watch for data center operators to increasingly become de facto energy players. The next phase of resilience strategy involves vertically integrating power generation and storage to secure their most critical operational input, moving beyond just securing hardware.

- The $1.9 billion Schneider-Switch deal is a leading signal that securing the hardware supply chain is a solvable problem. The next, and more challenging, constraint is securing a sufficient and reliable power supply, which will drive future strategy.

- Google’s partnership with grid operator PJM Interconnection shows that hyperscalers are no longer content to be passive energy consumers. Expect this trend to accelerate, with operators becoming active partners in managing grid stability and investing in grid-supportive technologies.

- The strategic consideration of on-site power solutions, including renewables and nascent technologies like SMRs, indicates a clear move toward energy independence. This is no longer just for backup power but is increasingly for primary, predictable power to support massive AI workloads.

- Financial instruments like Aon’s $2.5 billion insurance program will likely expand to cover energy supply risk, creating a new market for guaranteeing power availability. The convergence of digital infrastructure and energy infrastructure is the single most critical trend to watch in the coming year.

Frequently Asked Questions

Why has the main focus for data center projects shifted from cost-cutting to resilience?

The primary driver is the massive and non-negotiable demand for computing power from artificial intelligence (AI). According to the analysis, the catastrophic financial risk of project delays or operational downtime for AI workloads now far outweighs the potential savings from a cost-optimized, ‘just-in-time’ supply chain, making supply security the top priority.

How have investment strategies changed since 2025 to address these new risks?

Before 2025, the focus was on analyzing risk and improving visibility into supply chains. Since 2025, the strategy has become proactive and capital-intensive. Companies are now making large-scale, multi-billion dollar investments to secure physical assets and capacity, such as the $1.9 billion supply agreement between Schneider Electric and Switch to pre-purchase a multi-year pipeline of critical equipment.

What is ‘sovereign resilience’ and how is it affecting data center locations?

Sovereign resilience is a trend where nations focus on building and controlling their own domestic AI compute capacity to ensure national security and reduce dependence on fragile international supply chains. This is leading to a concentration of new, strategic data center investments in North America and Europe, supported by government initiatives like Canada’s call for sovereign AI data centers and large domestic projects like Microsoft’s $7 billion investment in Wisconsin.

What role does energy play in the new data center resilience strategy?

Energy has become a central and critical constraint. With AI driving unprecedented power demand, the reliability of public grids is a major risk. As a result, operators are forming direct partnerships with grid operators (like Google and PJM Interconnection), exploring on-site power generation, and integrating energy security directly into their project planning to guarantee uptime for their massive AI workloads.

Besides buying equipment in advance, what other methods are being used to manage risk?

In addition to pre-purchasing hardware, the industry is developing new financial and partnership-based solutions. Financial institutions like Aon are creating multi-billion-dollar insurance programs specifically to cover construction and operational risks for AI data centers. At the same time, operators are forming strategic alliances with energy providers to stabilize power supply and with cybersecurity firms to protect the software layer of the resilience stack.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.