Grid Bypass 2026: Why Fuel Cells Are Winning the Race to Power AI Data Centers

From Pilot to Prime Power: How Grid Delays Fueled Commercial Adoption of Fuel Cells for AI Data Centers

The adoption of fuel cells in the data center sector has fundamentally shifted from small-scale backup power pilots to gigawatt-scale primary power deployments, a change driven almost entirely by the inability of national power grids to meet the energy demands of artificial intelligence. With grid connection queues extending three to five years, data center operators are now bypassing utilities and procuring on-site fuel cell systems as the fastest path to market, transforming the technology from a niche application into a critical enabler of AI infrastructure.

- Between 2021 and 2024, fuel cell adoption was characterized by exploratory pilots focused on proving technological viability for backup power. For instance, Microsoft and Caterpillar demonstrated a hydrogen fuel cell system could power a data center for 48 hours, and Equinix began testing a single hydrogen fuel cell unit in Dublin. These projects established technical proof points but did not represent a significant commercial trend.

- Starting in 2025, the market dynamic inverted as the AI-driven power crisis intensified. The focus shifted from technical validation to rapid deployment at scale. Bloom Energy secured a landmark agreement with American Electric Power (AEP) in January 2026 to deploy up to 1 GW of its Solid Oxide Fuel Cells (SOFCs) specifically for data centers, signaling utility-scale acceptance of fuel cells as a primary power solution.

- This shift is further evidenced by hyperscaler and colocation partnerships moving from demonstration to commercial volume. In August 2025, Bloom Energy expanded its collaboration with Equinix to deploy over 100 MW of SOFCs across 19 data centers. This contrasts sharply with the earlier single-unit pilot, indicating a strategic decision to use fuel cells for capacity expansion where grid power is unavailable.

- The economic driver for this change is the immense opportunity cost of waiting for grid connections. An AI cloud can generate billions in annual revenue per gigawatt, making the premium for a rapidly deployable on-site power solution, such as a fuel cell system deliverable in 90 days, a sound financial decision compared to waiting years for a utility hookup.

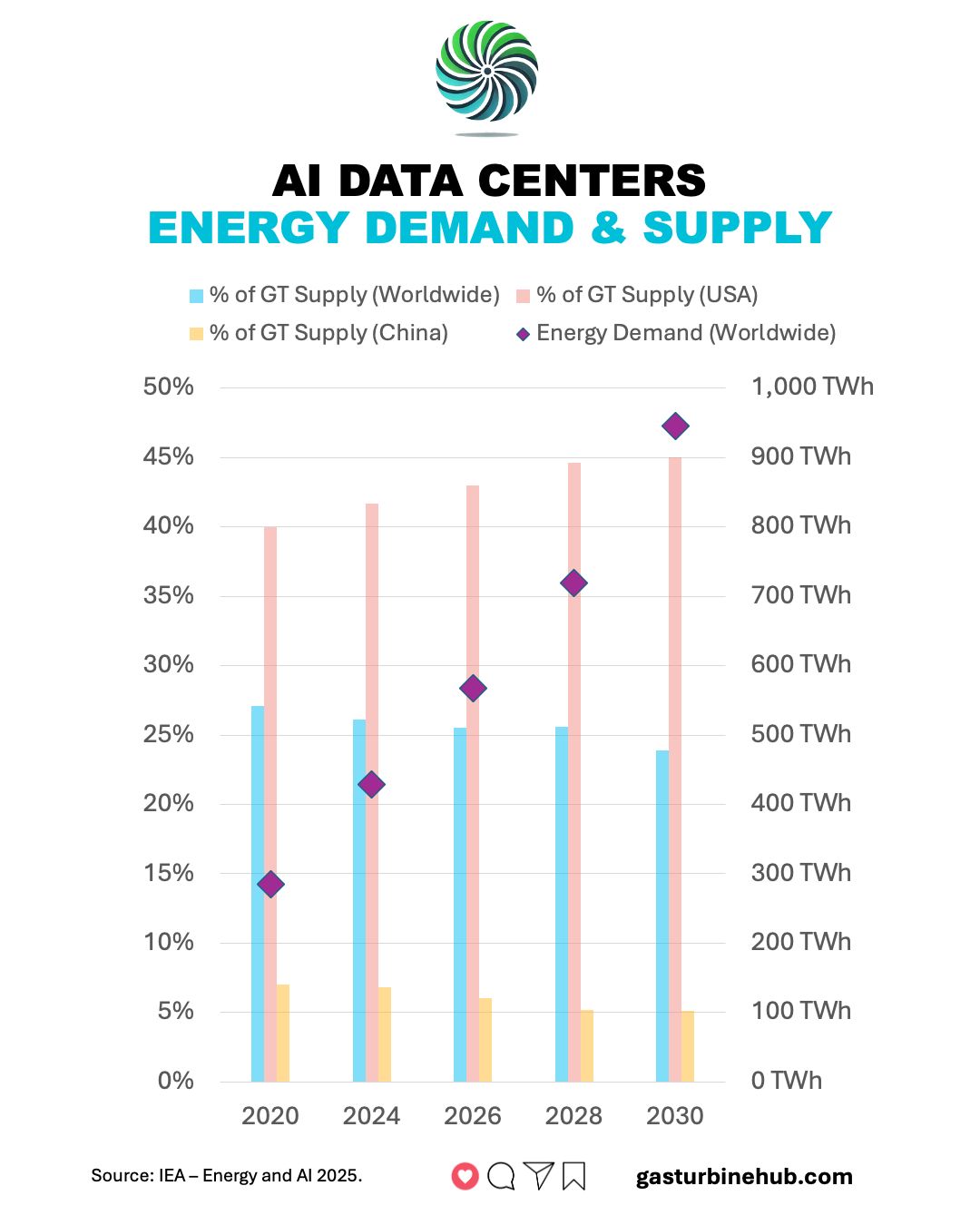

AI Power Demand Overwhelms Global Grids

This section explains how AI’s power demand is forcing a shift to fuel cells. The chart perfectly illustrates the core problem by forecasting the tripling of AI energy demand, which directly causes the grid delays mentioned.

(Source: GasTurbineHub)

Investing in Grid Independence: How Multi-Billion Dollar Deals are Financing Fuel Cell Deployments

The transition to fuel cells as primary data center power has been unlocked by massive, structured financing from major infrastructure investors, which allows data center operators to procure power as an operating expense rather than a prohibitive capital expenditure. These multi-billion-dollar commitments validate fuel cells as a bankable asset class and create a scalable model to fund the gigawatts of new capacity required by the AI industry.

Fuel Cell Market Becomes a Bankable Asset

The section highlights multi-billion dollar investments in fuel cells. This chart quantifies that financial validation, projecting the stationary market to reach $7.8 billion and confirming it as a bankable asset class for infrastructure investors.

(Source: EnkiAI)

- The most significant financial signal was the strategic partnership announced in October 2025 between Bloom Energy and Brookfield Asset Management. The up to $5 billion agreement provides a dedicated financing vehicle to deploy Bloom’s SOFC technology at data centers, effectively creating an Energy-as-a-Service model for hyperscalers.

- Following this trend, Fuel Cell Energy established a strategic collaboration in January 2026 with Sustainable Development Capital LLP (SDCL). This partnership aims to deploy up to 450 MW of fuel cell systems for AI-driven data centers, providing Fuel Cell Energy with a critical financing mechanism to compete in the high-growth data center market.

- Prior to the 2025 acceleration, investments were smaller and more speculative. The market’s growth was projected to be steady but modest, with forecasts predicting the data center fuel cell market would reach around $400 million by 2030. The recent multi-billion dollar financing deals completely reset these expectations, pointing to a much larger and more rapidly growing market.

Table: Key Financial Commitments for Data Center Fuel Cell Deployment

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 20, 2026 | Strategic collaboration to finance and deploy up to 450 MW of fuel cell systems for AI data centers, providing a scalable financing model to address grid constraints. | Sustainable Development Capital LLP and Fuel Cell Energy Forge … |

| Bloom Energy & Brookfield Asset Management | Oct 13, 2025 | Up to $5 billion strategic partnership to finance and deploy Bloom’s SOFC technology. This creates a powerful Energy-as-a-Service model for hyperscalers, removing the upfront CAPEX barrier. | Brookfield and Bloom Energy Announce $5 Billion Strategic AI … |

| ECL Texas Campus | Sep 25, 2024 | Plans for an $8 billion, 1 GW hydrogen-powered data center campus, with AI cloud company Lambda as the first tenant. Represents a major private investment in off-grid, hydrogen-based data center infrastructure. | Texas to Host $8 Billion Off-Grid Hydrogen-Powered Data … |

Strategic Alliances Reshaping Energy for AI: Fuel Cell and Data Center Partnerships

The market has rapidly matured from technology-proving collaborations to large-scale, commercially-driven alliances between fuel cell providers, utilities, and data center operators. These partnerships are no longer about demonstrating feasibility but are structured to deliver hundreds of megawatts of power, fundamentally reconfiguring the energy supply chain for the digital economy.

- In January 2026, Bloom Energy and American Electric Power (AEP) announced a landmark agreement to deploy up to 1 GW of SOFCs. This partnership is strategically significant because it involves a major utility directly procuring fuel cells as a solution for serving data center load, validating the technology as a key part of the utility toolset for managing grid strain.

- The partnership between Fuel Cell Energy and SDCL, announced in January 2026 for up to 450 MW, marks Fuel Cell Energy’s aggressive pivot into the data center market. It provides the company with the financial backing and deployment structure needed to compete for large-scale projects.

- In contrast, partnerships in the 2021-2024 period were focused on R&D and small-scale testing. The collaboration between IBM and Fuel Cell Energy in November 2023 to use AI to improve fuel cell longevity, and the Microsoft-Caterpillar hydrogen pilot, were about advancing the technology itself, not deploying it at commercial scale to solve an immediate power crisis.

Table: Major Strategic Partnerships in the Data Center Fuel Cell Market

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Fuel Cell Energy & SDCL | Jan 20, 2026 | A strategic collaboration to deploy up to 450 MW of fuel cell systems globally for AI-driven data centers, signaling Fuel Cell Energy’s major push into the market. | Sustainable Development Capital LLP and Fuel Cell Energy Forge … |

| Bloom Energy & AEP | Jan 9, 2026 | A landmark agreement to deploy up to 1 GW of SOFCs at data center sites, demonstrating utility-scale adoption of fuel cell technology to solve grid capacity shortfalls. | Driving Microgrid Implementation Across Global Data Centres |

| Bloom Energy & Equinix | Aug 14, 2025 | Expansion of an existing partnership to deploy over 100 MW of SOFCs across more than 19 Equinix data centers, moving from pilot phase to scaled deployment. | Equinix Collaborates with Leading Alternative Energy Providers to … |

| Bloom Energy & Core Weave | Jul 16, 2024 | Partnership to power Core Weave’s AI cloud data centers with on-site, reliable fuel cell-generated electricity, highlighting the need for high-quality power for AI workloads. | Bloom Energy and Core Weave Partner to Revolutionize AI Data … |

North America Leads the Charge: The US Epicenter of Fuel Cell Growth for Data Centers

North America, particularly the United States, has become the undisputed global epicenter for fuel cell adoption by data centers due to a unique convergence of factors: the world’s largest concentration of AI-driven data center development, severe and well-documented grid capacity constraints in key markets, and supportive federal policy. While earlier pilots occurred globally, the massive commercial-scale deals driving the market today are almost exclusively centered in the U.S.

US Leads Global Data Center Power Surge

This section identifies the US as the epicenter for fuel cell adoption. The chart directly supports this by showing the US data center market growing at a much faster rate than the rest of the world.

(Source: EnkiAI)

- Between 2021 and 2024, fuel cell activity was more geographically dispersed, with notable pilot projects in Europe, such as Equinix’s hydrogen fuel cell demonstration in Dublin, Ireland, and Microsoft’s green hydrogen pilot with ESB. These projects reflected a focus on long-term decarbonization goals.

- From 2025 onwards, the focus has dramatically shifted to the U.S., driven by acute grid-related commercial pressures. The 1 GW Bloom Energy and AEP agreement is targeted at data centers in AEP’s U.S. service territory. Similarly, ECL’s planned 1 GW hydrogen-powered campus is located in Texas, a major data center hub facing grid challenges.

- The concentration of activity in the U.S. is a direct response to the FERC’s warning that five-year load growth forecasts have nearly doubled, primarily due to data centers in regions like Virginia, California, and Texas. This creates an “energy Wild West” where on-site generation is the only viable path forward for rapid capacity expansion.

- Federal policy, specifically the 30% Investment Tax Credit (ITC) for fuel cell projects under the Inflation Reduction Act, provides a crucial financial tailwind that makes the U.S. a more economically attractive market for these large-scale deployments compared to other regions.

Beyond Backup: SOFC Technology Matures to Commercial Scale for Data Center Prime Power

Solid Oxide Fuel Cell (SOFC) technology has matured from a promising but niche high-efficiency system into a commercially proven, rapidly deployable prime power solution for the data center industry. The technology’s high electrical efficiency, fuel flexibility, and modular scalability have made it the leading choice for operators seeking to bypass grid constraints, a marked evolution from its earlier perception as a future-facing or backup-only option.

How Fuel Cells Scale for Datacenters

The section describes the maturation and scalability of SOFC technology. This diagram visually explains that process, showing how modular fuel cells scale up to create the multi-megawatt farms needed for prime power.

(Source: Fuel Cells Works)

- In the 2021-2024 period, the market was still evaluating different fuel cell types, with significant attention on Proton Exchange Membrane (PEMFC) technology for its potential to run on pure hydrogen, as seen in the Microsoft-Caterpillar tests. However, these were primarily demonstrations focused on long-term zero-carbon goals.

- The period from 2025 to today has seen SOFCs emerge as the dominant, commercially ready technology for immediate deployment. SOFC systems from providers like Bloom Energy and Elcogen offer electrical efficiencies of 60-75% using readily available natural gas, a significant advantage over diesel generators (30-35%) and a key factor in their selection for gigawatt-scale deployments.

- The validation of SOFC maturity is evident in the scale of recent commitments. A utility like AEP committing to procure up to 1 GW of SOFCs demonstrates that the technology is considered reliable and bankable for primary, continuous power generation, moving it far beyond the pilot stage.

- Furthermore, the speed of deployment has become a critical feature. The ability to install and commission SOFC systems within months, as highlighted by the Oracle and Bloom Energy collaboration aiming for a 90-day delivery timeline, confirms the technology’s readiness to solve the immediate power-to-market crisis faced by AI developers.

SWOT Analysis: Fuel Cell Deployment for AI Data Center Power in 2026

The strategic position of fuel cells in the data center market has been transformed by the AI-driven power crisis, shifting the technology’s core value proposition from clean energy to speed and reliability. This SWOT analysis, comparing the market dynamics before and after the AI power demand shock, reveals how grid unavailability became the primary catalyst for commercial adoption.

Grid Instability Creates Fuel Cell Opportunity

The SWOT analysis identifies power quality as a key strength for fuel cells. This chart visualizes the grid instability and ‘Bad Harmonics’ in a data center hub, demonstrating the exact problem that makes fuel cell power quality so valuable.

(Source: Corinex)

- Strengths have shifted from efficiency and low emissions to speed-to-deployment and power quality.

- Weaknesses like high upfront cost, while still present, are now offset by the immense opportunity cost of grid delays.

- Opportunities have exploded from a niche backup power market to a primary power market enabling a multi-trillion-dollar AI expansion.

- Threats now include fuel price volatility and competition from other dispatchable, on-site power sources like natural gas turbines and future small modular reactors.

Table: SWOT Analysis for Fuel cell groups ride AI wave as data centres strain the power grid

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | High electrical efficiency (~60%); low emissions compared to diesel generators; fuel flexibility (natural gas, hydrogen). | Speed of deployment (months vs. years for grid); high-quality, reliable power for sensitive AI workloads; modular scalability. | The value proposition shifted from environmental benefits to commercial necessity. Speed became the most critical strength, validated by Bloom’s 90-day deployment goal with Oracle. |

| Weaknesses | High capital cost (CAPEX) compared to diesel generators; reliance on natural gas infrastructure; long-term durability questions for some technologies. | High CAPEX remains, but is now mitigated by financing models (e.g., Brookfield deal); continued reliance on natural gas presents carbon footprint challenges. | The high CAPEX weakness was addressed by the creation of third-party financing vehicles, turning a capital expense into an operating expense for data center customers. |

| Opportunities | Niche market for replacing diesel backup generators; pilots for green hydrogen-powered data centers (e.g., Microsoft pilots). | Massive primary power market for grid-constrained data centers; Energy-as-a-Service (Eaa S) contracts; integration into utility-scale “AI Power Parks.” | The opportunity grew from a small backup market to a primary power market enabling the entire AI expansion. This was validated by the 1 GW AEP deal and $5 B Brookfield partnership. |

| Threats | Competition from improving battery storage technology (BESS); slow development of green hydrogen supply chain. | Competition from mature natural gas turbines for large-scale prime power; future competition from Small Modular Reactors (SMRs); volatility in natural gas prices. | The competitive threat shifted from other clean technologies to other dispatchable, on-site power sources that can also solve the immediate power availability problem. |

2026 Outlook: The Fuel Cell Trajectory for AI Data Centers

The trajectory for fuel cells in the data center market is now directly tied to the persistence of grid interconnection delays and the pace of AI infrastructure build-out. If grid queues remain at three or more years and AI power demand continues its exponential growth, expect to see a rapid acceleration of large-scale, multi-hundred-megawatt financing and deployment partnerships between infrastructure funds, utilities, and fuel cell manufacturers.

Surging Demand Shapes Fuel Cell Outlook

This section outlines the future trajectory for fuel cells, which is tied to growing power needs. The IEA chart authoritatively projects the surge in data center electricity demand, providing the foundational evidence for the section’s outlook.

(Source: Carbon Brief)

- If this happens: Data center developers continue to face 3-5 year waits for grid power. Watch this: More infrastructure investors, following Brookfield’s lead, announcing dedicated financing vehicles for on-site power assets, specifically targeting fuel cells. Also, watch for more utilities like AEP signing large-scale procurement agreements to use fuel cells as a grid management tool.

- If this happens: The cost of natural gas remains stable or decreases, while the LCOE from fuel cells proves competitive with volatile grid power prices in constrained regions. Watch this: A rapid increase in the backlog and production capacity of leading SOFC manufacturers like Bloom Energy, which is already expanding capacity from 1 GW to 2 GW by the end of 2026.

- This could be happening: The “Energy-as-a-Service” model becomes the standard for powering new AI data centers. The success of the Brookfield-Bloom financing structure will likely be replicated by competitors like Fuel Cell Energy and its partner SDCL, making it easier for hyperscalers to adopt on-site power without massive upfront capital investment. This trend is gaining significant traction and is poised to define the market in the coming years.

Frequently Asked Questions

Why are fuel cells suddenly being adopted for AI data centers instead of just using the power grid?

The primary reason is that national power grids cannot meet the massive energy demands of AI quickly enough. With grid connection queues extending three to five years, data center operators are using on-site fuel cells, which can be deployed in a few months, to bypass the grid and get their revenue-generating AI services to market faster.

Aren’t fuel cells very expensive? How are companies affording to deploy them at such a large scale?

While the upfront capital cost is high, multi-billion dollar financing partnerships, such as the one between Bloom Energy and Brookfield Asset Management, have been established. These deals create an “Energy-as-a-Service” model, allowing data center operators to pay for power as a recurring operating expense instead of a prohibitive upfront capital investment.

What is the main difference between how fuel cells were used in data centers before 2025 versus now?

Before 2025, fuel cells were used in small, exploratory pilot projects to test their viability for backup power. Since 2025, their role has shifted to being a primary, continuous power source. The deployments are now commercial and at a gigawatt scale, driven by the immediate need to power AI infrastructure where grid capacity is unavailable.

What type of fuel cell technology is leading this trend?

Solid Oxide Fuel Cell (SOFC) technology is the dominant choice for current large-scale deployments. SOFCs are favored for their high electrical efficiency (60-75%), reliability for continuous operation, and fuel flexibility, as they can run on readily available natural gas. Companies like Bloom Energy are leading the market with this technology.

Is this a global trend, or is it concentrated in a specific region?

The current wave of large-scale commercial deployment is overwhelmingly concentrated in North America, particularly the United States. This is due to a combination of factors: the world’s largest concentration of AI data center development, severe grid constraints in key U.S. markets, and supportive federal policies like the Investment Tax Credit (ITC) for fuel cells.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.