Gas-Fired Power: The Key to Data Center Reliability Amid Grid Failures in 2026

Commercial Adoption of On-Site Gas Power for Data Centers Accelerates as Grid Constraints Mount

On-site gas generation has shifted from a secondary backup solution to a primary power strategy for new hyperscale data centers, a change driven by severe grid interconnection delays and the urgent, massive power demands of artificial intelligence. This strategic pivot reflects a pragmatic response to infrastructure limitations that threaten to stall the multi-trillion-dollar AI expansion.

- Between 2021 and 2024, the primary industry focus was on integrating renewables and using gas or diesel generators for emergency backup to achieve sustainability targets. The model prioritized grid-supplied power, with on-site generation seen as an insurance policy rather than a core operational component.

- From 2025 onward, this model has inverted due to market realities. The International Energy Agency (IEA) projects natural gas demand for U.S. data centers will grow by 35 billion cubic meters by 2030, a direct consequence of AI’s power needs. Developers now face interconnection queues of 1-3 years, making grid reliance a critical bottleneck.

- In response, commercial activity has intensified around dedicated on-site power. Companies like Wärtsilä are providing fast-ramping grid balancing engines, while advanced technologies like Bloom Energy’s Solid Oxide Fuel Cells (SOFCs) are now considered technically sound solutions for providing cleaner, high-efficiency power directly at the data center.

- The most significant signal of this shift is the move by major energy firms like Exxon and Chevron, which are now planning to build dedicated gas-fired power plants specifically to serve AI data centers, effectively bypassing the public grid to ensure supply.

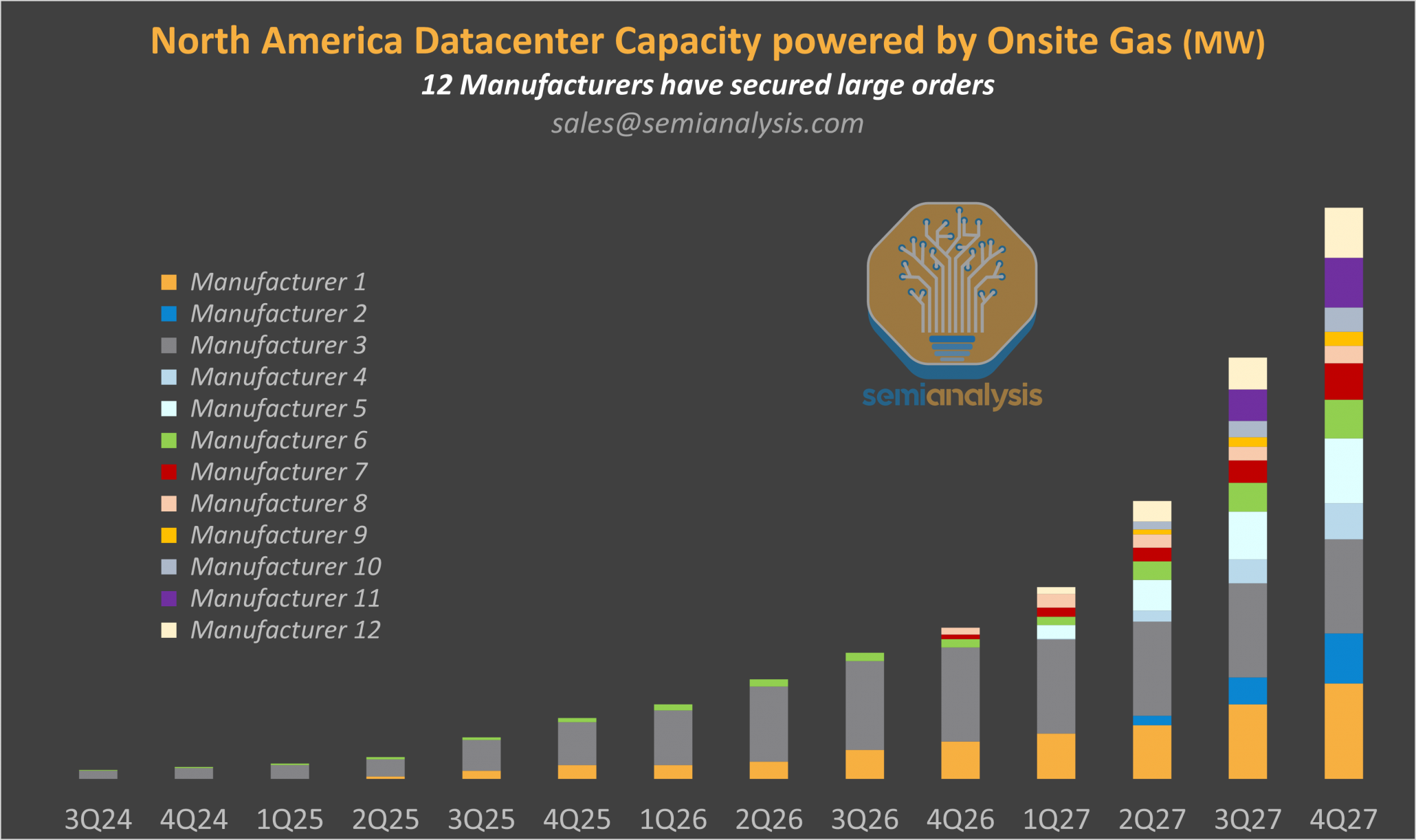

On-Site Gas Capacity For Datacenters Surges

This chart’s forecast of accelerating on-site gas capacity directly visualizes the trend of commercial adoption driven by grid constraints and AI demand mentioned in the section.

(Source: SemiAnalysis)

Investment Surges into Gas Generation as a Lower-Risk Bet on Firm Data Center Power

Capital is flowing into gas generation assets dedicated to data centers, as financial models show gas is a lower-risk investment for providing firm capacity compared to renewables, which are more sensitive to volatile financial markets and rising interest rates. This makes gas a more bankable solution for the non-negotiable reliability data centers require.

- Economic analysis from 2025 shows that a 2% rise in interest rates increases the levelized cost of energy (LCOE) for renewable projects by 20%, compared to a more manageable 11% for gas-fired plants. This financial resilience makes gas generation more attractive for securing the firm capacity needed for “five-nines” uptime.

- The economic case for gas is further strengthened by rising costs for alternatives. A 2026 outlook from Deloitte projects that the phaseout of manufacturing incentives will increase solar costs by 36% to 55% and onshore wind by 32% to 63%, directly challenging their cost-competitiveness for large-scale, reliable power.

- Addressing critical supply chain bottlenecks, Siemens Energy announced a $150 million investment in February 2024 to expand its U.S. power transformer manufacturing. This move directly supports the build-out of new energy infrastructure, including the on-site gas power plants that data centers increasingly depend on.

Table: Strategic Financial Signals for Gas-Powered Data Centers

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Deloitte Renewable Cost Outlook | 2026 | Projected solar cost increases of 36%-55% and onshore wind increases of 32%-63% due to policy shifts, improving the relative economic position of gas for firm power. | Deloitte |

| Reuters Interest Rate Sensitivity Analysis | 2025 | Analysis shows renewable projects’ LCOE is nearly twice as sensitive to interest rate hikes (20% increase) as gas-fired plants (11% increase), making gas a lower-risk investment for firm capacity. | Reuters |

| Siemens Energy Investment | Feb 2024 | A $150 million investment to expand U.S. power transformer production addresses a critical supply chain constraint for deploying new generation, including on-site gas plants for data centers. | Siemens Energy |

Hyperscalers and Energy Firms Forge Alliances to Secure Data Center Power Reliability

Strategic partnerships are forming between technology hyperscalers, data center operators, and energy companies to secure reliable, long-term power. While these alliances show significant interest in future technologies like nuclear Small Modular Reactors (SMRs), they underscore the immediate and non-negotiable industry requirement for firm power, a role currently filled by natural gas.

Partnerships Enable Gas-Powered Data Centers

This infographic’s focus on partnerships between energy, tech, and finance companies perfectly illustrates the alliances being formed to secure reliable data center power.

(Source: FuelCell Energy)

- In March 2024, Amazon Web Services (AWS) acquired a data center campus directly connected to the Susquehanna nuclear station. This move signaled a clear strategy of co-locating critical infrastructure with existing sources of firm, carbon-free power to mitigate grid reliability risks.

- Furthering this long-term strategy, AWS announced in October 2024 its backing for the deployment of 5 GW of new SMR projects with X-energy by 2039. This long-range commitment highlights the strategic importance hyperscalers place on securing future baseload power.

- Microsoft followed a similar path, revealing in September 2023 that it was hiring a director to implement a global SMR and microreactor strategy. This initiative is explicitly designed to power its cloud data centers in the future, confirming that the largest tech companies view on-site, firm power as essential.

Table: Key Partnerships for Data Center Power Security

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| AWS & X-energy | Oct 2024 | AWS is backing the deployment of 5 GW of SMRs by 2039, a long-term strategic move to secure carbon-free, firm power for its future data center fleet. | Power Magazine |

| AWS Susquehanna Campus Acquisition | Mar 2024 | AWS acquired a data center campus with a direct connection to a nuclear power plant, a move to guarantee reliable, high-capacity power by bypassing grid congestion and intermittency issues. | Power Engineering |

| Microsoft SMR Strategy | Sep 2023 | Microsoft began hiring for a principal program manager to lead its global SMR and microreactor strategy, signaling its intent to develop a long-term plan for powering data centers with dedicated, firm energy sources. | Data Center Dynamics |

North America Leads On-Site Gas Power Deployment for Data Centers, Driven by U.S. AI Boom

The United States is the undisputed epicenter of on-site gas generation for data centers, a trend driven by the nation’s explosive AI-related power demand, strained grid infrastructure, and a development environment that favors speed to market. This geographic concentration highlights where the tension between digital growth and physical infrastructure is most acute.

Texas Power Grid Cannot Meet Demand

This chart provides a stark, real-world example of the ‘strained grid infrastructure’ in the U.S. that is driving the shift to on-site generation in North America.

(Source: SemiAnalysis)

- Before 2024, on-site generation projects were more scattered and often supplementary. The current era, beginning in 2025, shows a clear consolidation of this trend in the U.S., which is expected to account for a 35 bcm increase in natural gas consumption for data centers by 2030.

- Analysis of North American data center capacity reveals a continuous and sharp increase in on-site gas power, with a projected growth trajectory extending from Q 3 2024 through Q 4 2027. This confirms a sustained, multi-year build-out of gas-powered infrastructure.

- Regional grid constraints are the primary catalyst. In Texas, for example, new large load requests to the ERCOT grid reached approximately 37, 000 MW in April 2025, while approved energization was only 473 MW. This massive disparity makes on-site generation a necessity, not a choice, for developers on tight timelines.

Gas Turbines: A Commercially Mature Technology Underpinning Data Center Uptime

Gas turbines and reciprocating engines are fully mature, commercially available technologies at a Technology Readiness Level (TRL) of 9, providing the high availability and rapid response times essential for data center reliability. While emerging gas technologies like SOFCs offer a cleaner pathway, established combustion technologies from major OEMs are the current workhorses ensuring uptime.

Data Centers Prioritize Reliability Above All

This infographic establishes the critical need for extreme reliability, explaining why mature, commercially available technologies like gas turbines are essential for ensuring data center uptime.

(Source: Enverus)

- Between 2021 and 2024, gas generation was proven but often positioned against diesel for backup, while SMRs were a distant prospect, with the first design from Nu Scale Power only receiving U.S. approval in late 2022.

- From 2025, gas turbines from providers like GE Vernova (with its 7 F, 6 F.03, and modular H-Class series) and fast-acting engines from firms like Wärtsilä are being deployed at scale as primary or firming power sources. Their TRL 9 status provides the operational certainty and bankability required for these capital-intensive projects.

- Advanced technologies are also proving viable. A 2025 analysis of an LNG-based system reported an energy efficiency of 63.44% and a competitive LCOE of $0.0872/k Wh, while SOFCs from Bloom Energy are gaining market acceptance as a high-efficiency, low-emission solution.

- This contrasts sharply with nuclear SMRs, which remain at a lower TRL of 6-8. Despite strong interest from hyperscalers, their long permitting timelines, high initial CAPEX, and supply chain immaturity make them a solution for the 2030 s, not for meeting today’s urgent power needs.

SWOT Analysis: Gas-Fired Power for Data Centers in 2026

The strategic position of gas-fired power for data centers is defined by its unmatched reliability (Strength) and its role in bypassing grid constraints (Opportunity). However, it faces challenges from emissions regulations (Weakness) and long-term competition from next-generation firm power technologies like nuclear SMRs (Threat).

Data Centers Drive Gas Power Demand

This conceptual diagram visually represents the ‘Opportunity’ within the SWOT analysis, showing how new data center demand is a primary market force favoring gas generation.

(Source: Enverus)

- Strengths are centered on dispatchability and technological maturity, which are non-negotiable for ensuring uptime.

- Weaknesses revolve around environmental impact and commodity price exposure, which create long-term financial and regulatory risk.

- Opportunities are driven by infrastructure failures, where gas provides a crucial speed-to-market advantage by circumventing grid-related delays.

- Threats come from the strategic push by major customers toward carbon-free, firm power sources, even if those technologies are not yet mature.

Table: SWOT Analysis for Gas-Fired Power in Data Centers

| SWOT Category | 2021 – 2023 | 2024 – 2025 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strength | Proven reliability as a backup power source, competing with diesel. High availability and established maintenance schedules. | Critical dispatchability for primary power. Rapid ramp rates to firm intermittent renewables. TRL 9 technology provides bankability for large projects. | The role of gas generation evolved from an insurance policy to a core strategic enabler for deploying AI infrastructure on schedule. |

| Weakness | General ESG pressure and carbon emissions profile. Perceived as a less sustainable option than renewables. | Direct exposure to natural gas price volatility for baseload power models. Near-zero tolerance for criteria pollutants (NOx, SOx) in permitting. | As gas shifts from backup to primary power, its economic model becomes more exposed to fuel market volatility and its emissions profile comes under greater scrutiny. |

| Opportunity | Supplementing renewable energy sources to improve overall grid stability. Use in hybrid microgrids. | Bypassing multi-year grid interconnection queues, enabling faster speed-to-market. Securing power for >100 MW data centers where grid capacity is unavailable. | The failure of grid infrastructure to keep pace with demand created a multi-trillion-dollar opportunity for on-site generation as the fastest path to revenue for data center operators. |

| Threat | Competition from falling costs of renewables paired with short-duration battery storage (BESS). Corporate pressure to adopt 100% renewable solutions. | Long-term strategic commitments by hyperscalers like AWS and Microsoft to nuclear SMRs as the preferred future source of firm, carbon-free power. | The long-term threat shifted from renewables/BESS to nuclear SMRs, which are now backed by the largest data center customers as the endgame for reliable, clean power. |

Forward Outlook: Gas Generation as the Indispensable Bridge to a Stable Data Center Power Future

The critical path forward for powering the AI revolution involves a hybrid energy model where on-site gas generation provides the firm, dispatchable capacity needed to operate reliably today. This approach enables data centers to deploy quickly and avoid crippling grid delays while next-generation clean technologies and grid infrastructure mature over the next decade.

Natural Gas to Dominate Power Mix

This forecast directly supports the ‘Forward Outlook’ by showing natural gas becoming the dominant power source for data centers, visually confirming its role as an indispensable bridge fuel.

(Source: Natural Gas Intelligence)

- If this happens: Grid interconnection queues remain longer than 24 months and AI-driven power demand continues its exponential growth trajectory.

- Watch this: An increase in the number of data centers filing for air permits to build on-site gas generation plants, particularly those rated over 100 MW. Also, monitor for new partnerships between data center developers and midstream gas companies to secure long-term fuel supply.

- These could be happening: An acceleration of the “Energy-as-a-Service” (Eaa S) model, where third-party operators build and manage on-site gas microgrids for data centers. Turbine manufacturers like GE Vernova and Siemens Energy will likely report order backlogs specifically for data center applications, confirming this trend is gaining commercial momentum.

Frequently Asked Questions

Why are data centers suddenly turning to on-site gas power?

On-site gas power has become a primary strategy due to two main factors: severe grid interconnection delays, which can be 1-3 years long, and the massive, urgent power demands of artificial intelligence. Relying on the grid has become a critical bottleneck, so data centers are building their own power sources to get online faster and ensure the reliable, ‘five-nines’ uptime that AI workloads require.

Isn’t gas power a step back from sustainability goals and renewable energy?

While gas power does have an emissions profile, it is currently seen as a necessary ‘bridge’ technology. The article highlights that renewables are more sensitive to financial market volatility and rising interest rates, and their costs are projected to increase by 32% to 63% by 2026. Gas provides the ‘firm,’ dispatchable power that renewables with battery storage cannot yet guarantee at the scale and reliability required by hyperscale data centers. It’s a pragmatic choice to meet immediate needs while long-term solutions like nuclear SMRs are developed.

What is the long-term power strategy for major tech companies like AWS and Microsoft?

The long-term strategy for hyperscalers is to secure firm, carbon-free power, with a significant focus on nuclear Small Modular Reactors (SMRs). The article notes that AWS is backing the deployment of 5 GW of SMRs by 2039, and Microsoft is hiring specialists to lead its own global SMR strategy. However, SMRs are considered a solution for the 2030s due to long permitting times and technological immaturity, which is why natural gas is the indispensable solution for the current decade.

What makes gas a better financial investment than renewables for powering data centers right now?

According to the article, gas generation is a lower-risk and more ‘bankable’ investment for providing the firm capacity data centers need. A 2025 analysis shows that a 2% rise in interest rates increases the cost of renewable projects by 20%, compared to only 11% for gas plants. Furthermore, a 2026 Deloitte outlook projects that the phasing out of manufacturing incentives will increase solar and wind costs significantly, improving the relative economic position of gas for reliable, large-scale power.

What are the main risks associated with using gas-fired power for data centers?

The primary risks, as identified in the SWOT analysis, are environmental and financial. The ‘Weakness’ is its carbon emissions profile and exposure to natural gas price volatility, which creates long-term regulatory and cost uncertainty. The main ‘Threat’ is long-term competition from next-generation firm power technologies, specifically nuclear SMRs, which are strongly backed by major customers like AWS and Microsoft as the preferred future solution for clean, reliable power.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.