Hyperscale Interconnects 2026: Why Manufacturing Scale Defines the Next Trillion-Dollar AI Bottleneck

Commercial Adoption of High-Speed Optics: Hyperscale Projects Shift Focus to Manufacturing Scale

The market for hyperscale optical interconnects has fundamentally shifted from a primary focus on technological novelty to an urgent imperative for manufacturing scale and supply chain resilience. The unprecedented capital deployment for AI infrastructure is forcing hyperscalers to prioritize suppliers who can deliver millions of high-performance optical components reliably and cost-effectively, making production capacity the new defining metric for commercial adoption.

- Between 2021 and 2024, industry adoption was characterized by pilot programs and the technological validation of next-generation concepts like Co-Packaged Optics (CPO) and silicon photonics, led by companies such as Lightmatter and Ranovus. The primary objective was proving the viability of new architectures to overcome the physical limits of copper.

- The period from 2025 to today is defined by massive, concrete infrastructure build-outs, exemplified by Microsoft’s $80 billion AI facility investment and the $5 billion Neom-Data Volt hyperscale project. This transition from R&D to deployment created an immediate, large-scale demand for proven technologies like pluggable optical transceivers.

- The emergence of startups like Mesh Optical Technologies in February 2026, with a stated mission to mass-produce American-made transceivers, is a direct market response to this new reality. Their strategy directly addresses the acute need for a high-volume, onshore supply chain to mitigate geopolitical risks, such as the 25% tariff on Chinese-manufactured optical components.

- The scale of demand has elevated manufacturing targets to a strategic necessity. Mesh Optical’s goal to produce one thousand units per day within a year is designed to meet the rigorous qualification and volume requirements of hyperscalers, who plan procurement cycles for the 2027-2028 timeframe.

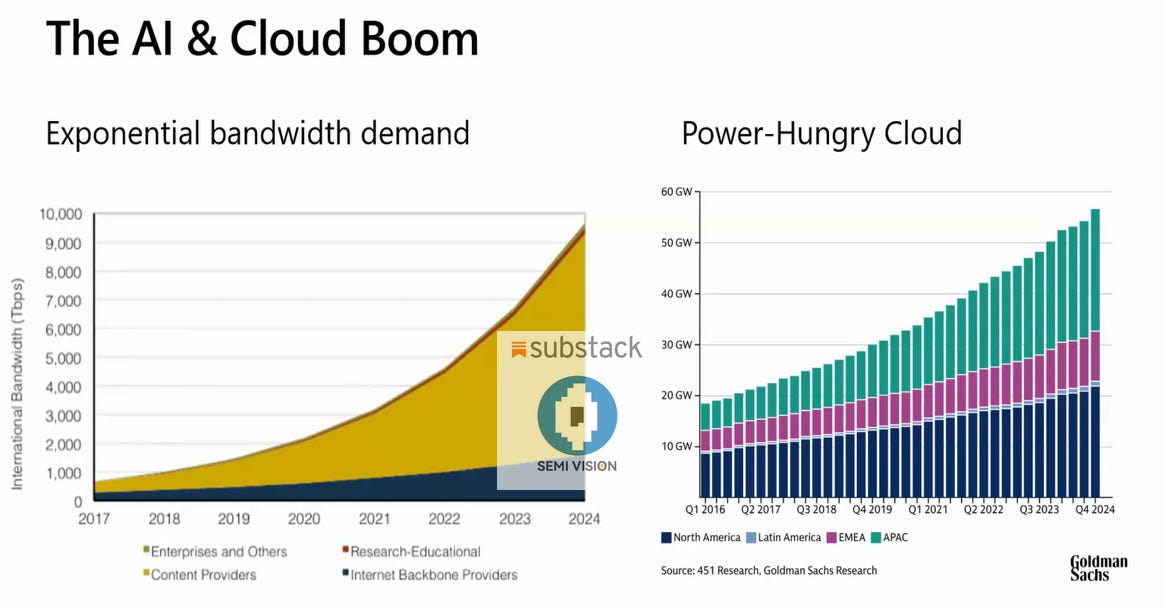

AI & Cloud Boom Drives Bandwidth Demand

This chart illustrates the exponential growth in bandwidth demand, which is the primary driver for the shift to scaled manufacturing of optical interconnects mentioned in the section.

(Source: semivision – Substack)

Investment Analysis: Venture Capital Deploys Billions into Optical Interconnect Manufacturing and Supply Chains

Recent venture capital investment patterns in the optical interconnect sector reveal a decisive pivot from funding purely research-oriented ventures to backing companies with credible, large-scale manufacturing roadmaps. The flow of capital now prioritizes strategies that solve the immediate production and supply chain bottlenecks for AI infrastructure, signaling that investors view manufacturing execution as the primary catalyst for value creation.

- The $50 million Series A funding for Mesh Optical Technologies in February 2026, led by Thrive Capital, epitomizes this trend. The investment is explicitly tied to the company’s objective of mass-producing American-made optical links, a clear signal of investor focus on manufacturing and supply chain de-risking.

- This contrasts with earlier funding cycles, such as Lightmatter’s $80 million Series B in May 2021, which was primarily focused on developing novel photonic AI processors. The new investment thesis targets the less glamorous but more critical challenge of production at scale.

- Sustained investor confidence is evident across the ecosystem, with significant funding for other specialists like silicon photonics startup n Eye ($58 million Series A) and Scintil Photonics ($58 million Series B). However, Mesh Optical’s manufacturing-centric narrative represents a new and critical investment angle.

- These investments are rationalized by the enormous market opportunity. The optical interconnect and transceiver markets are collectively projected to exceed $80 billion by the early 2030 s, driven almost entirely by the non-discretionary build-out of AI data centers.

Table: Recent Investments in the Optical Interconnect Ecosystem

| Company | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Mesh Optical Technologies | Feb 2026 | Raised $50 million in a Series A led by Thrive Capital. The funding is dedicated to mass-producing American-made optical transceivers to address AI data center bottlenecks and supply chain risks. | Silicon Angle |

| Scintil Photonics | Oct 2025 | Secured $58 million in a Series B round. The investment targets the scaling of its silicon photonics technology for high-speed interconnects, demonstrating continued investor interest in foundational optical technologies. | Semiconductor Engineering |

| n Eye | Apr 2025 | Raised $58 million in a Series A round to develop silicon photonics solutions aimed at improving performance and efficiency in AI data centers. | Silicon Angle |

| Lightmatter | May 2021 | Closed an $80 million Series B round to advance its work on photonic AI processors and interconnects. This represented the earlier investment focus on novel compute architectures. | Tech Crunch |

Strategic Partnerships: Hyperscalers and Tech Giants Forge Alliances to Secure Next-Gen Interconnects

In response to extreme demand and supply chain uncertainty, hyperscalers and technology incumbents are forming deep, strategic partnerships to secure the components necessary for their AI infrastructure roadmaps. These collaborations extend beyond traditional procurement to include joint development and infrastructure-level projects, highlighting the system-wide importance of a reliable interconnect supply chain.

Hyperscale Ecosystem Maps Key Alliances

This diagram maps the ecosystem of providers, illustrating the complex web of partnerships and alliances that hyperscalers are navigating to secure supply chains.

(Source: MarketsandMarkets)

- The partnership between Neom and Data Volt to construct a $5 billion, 1.5 GW renewable-powered hyperscale data center illustrates the massive scale of infrastructure projects now underway. Such projects necessitate long-term, reliable supply agreements for all components, including millions of optical interconnects.

- Incumbents like Cisco are actively building ecosystems around their latest technologies. The launch of its 102.4 Tbps networking chip requires partnerships with optical module suppliers capable of meeting the performance and volume demands of its new systems.

- Hyperscalers have a history of collaborating directly with startups to shape technology development, as seen with Celestial AI’s work on its Photonic Fabric. This pattern indicates that new entrants like Mesh Optical Technologies must eventually achieve deep integration with their target customers to succeed.

Table: Key Partnerships and Projects Driving Optical Demand

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Neom and Data Volt | Feb 2026 | Announced a partnership for a $5 billion, 1.5 GW hyperscale data center project. This project creates massive, long-term demand for high-performance networking hardware, including optical interconnects. | Computer Weekly |

| Cisco Silicon One Rollout | Feb 2026 | Unveiled a 102.4 Tbps networking chip and associated systems. This requires a robust ecosystem of optical transceiver partners to enable the high-speed connectivity its platforms are designed to deliver. | Silicon Angle |

| Celestial AI and Hyperscalers | Jun 2023 | Introduced its “Photonic Fabric” interconnect technology after extensive collaboration with hyperscale customers. This highlights the model of deep partnership between innovators and end-users to solve specific infrastructure challenges. | EENews Europe |

Geographic Focus: North America Emerges as a Critical Hub for Optical Interconnect Manufacturing

A significant geographic realignment is underway in the optical component supply chain, driven by a convergence of geopolitical risk, government incentives, and the co-location of hyperscale data center investments. While Asia has been the historical center of production, North America is rapidly emerging as a strategic hub for manufacturing to ensure supply chain stability for critical AI infrastructure.

U.S. Interconnect Market to Surpass $25B

This forecast highlights the massive market opportunity in the U.S., supporting the section’s focus on North America as a critical hub for manufacturing and deployment.

(Source: SNS Insider)

- From 2021 to 2024, the optical transceiver supply chain was heavily concentrated in Asia, with China as a dominant manufacturer. This provided cost efficiencies but exposed hyperscalers to significant supply chain disruptions and geopolitical tensions.

- The period from 2025 to today marks a clear strategic shift toward onshore production. The launch of Mesh Optical Technologies in Los Angeles with an explicit “American-made” strategy is a direct response to risks like the 25% tariff on Chinese optical imports and a broader desire for supply chain control.

- This manufacturing shift is reinforced by the geographic concentration of hyperscale capital expenditure. Massive investments from companies like Microsoft are predominantly located in North America and Europe, creating a powerful economic incentive to develop a local component ecosystem.

- While the manufacturing focus is shifting to North America, demand remains global, as evidenced by major projects in the Middle East like the Neom data center. This requires suppliers to develop a strategy for domestic production first, with a long-term plan for global distribution.

Technology Status: Pluggable Optics Scale to Commercial Production While Next-Gen CPO Remains in Development

The optical interconnect market is advancing on a dual track, where the immediate priority is the mass production of high-speed pluggable transceivers to meet current AI demands, while next-generation architectures like Co-Packaged Optics (CPO) continue to mature for future deployment cycles. This bifurcation confirms that scaling proven technology is the most urgent commercial priority for hyperscalers today.

Pluggable Optics Cost Rises With Speed

The chart shows how the cost of pluggable optics dominates hardware spend at higher speeds, explaining the industry’s focus on scaling their production cost-effectively.

(Source: www.latitudeds.com)

- Between 2021 and 2024, industry discourse was dominated by the promise of CPO, which integrates optics and silicon in the same package to reduce power consumption. Companies like Broadcom and Intel showcased pilots, but the technology was not ready for mass deployment.

- From 2025 onward, the explosive growth of AI clusters has forced the industry to scale what is commercially available now: 800 G and 1.6 T pluggable optical transceivers. This is precisely the market segment Mesh Optical Technologies is addressing, validating its focus on a mature but critically needed technology.

- CPO remains a key part of the long-term roadmap, with the market projected to reach $1.16 billion by 2034. However, it is not the solution for the current 2025-2027 infrastructure build-out, making it a next-generation architecture rather than an immediate commercial reality.

- The $50 million funding for Mesh Optical to produce pluggable modules is a strong market validation signal. It confirms that investors see a massive, immediate commercial opportunity in scaling the incumbent form factor to meet the urgent needs of the current AI super-cycle.

SWOT Analysis: Assessing the Strengths and Risks in the Hyperscale Optical Interconnect Market

The hyperscale optical interconnect market is characterized by the powerful tailwind of AI-driven demand, creating immense strengths and opportunities. However, this is counterbalanced by significant weaknesses and threats related to manufacturing execution and intense competition, making the ability to scale production the decisive factor for success.

Hyperscale Market Growth Nears $335B

This strong global market forecast quantifies the ‘Strengths’ and ‘Opportunities’ discussed in the SWOT analysis, driven by the massive AI tailwind.

(Source: Market.us)

- Strengths have shifted from technology leadership to the sheer scale of non-discretionary market demand.

- Weaknesses are now centered on the industry’s collective inability to rapidly scale manufacturing outside of established Asian supply chains.

- Opportunities are increasingly geopolitical and efficiency-driven, focusing on supply chain diversification and power reduction.

- Threats come from both established incumbents with massive R&D budgets and the fundamental execution risk of building new, high-volume manufacturing operations from the ground up.

Table: SWOT Analysis for Hyperscale Optical Interconnects

| SWOT Category | 2021 – 2024 | 2025 – Today | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Demonstrated technological innovation in silicon photonics and early CPO pilots. Strong R&D capabilities at incumbent firms. | Massive, non-discretionary demand from AI, driving a multi-trillion-dollar infrastructure investment cycle ($1.7 trillion data center capex by 2030). | The primary strength shifted from technological potential to undeniable, massive market demand, making it an execution-driven market. |

| Weaknesses | High power consumption of optical modules. High cost and complexity of advanced optical technologies. | Inability to rapidly scale manufacturing outside of Asia. Significant execution risk for new entrants attempting high-volume production. | The critical bottleneck shifted from technology and cost to manufacturing capacity and supply chain resilience. |

| Opportunities | Cost reduction through silicon photonics. Improving performance with new modulation schemes. | Supply chain diversification away from Asia due to tariffs (25% on Chinese optics) and geopolitical risk. Huge market for power-efficient solutions like Linear Pluggable Optics (LPO). | The opportunity became explicitly strategic and geopolitical, with “American-made” (e.g., Mesh Optical) becoming a key differentiator. |

| Threats | Market dominance by incumbents like Broadcom. Long and difficult qualification cycles with hyperscalers. | Intense competition from incumbents (e.g., Cisco’s 102.4 T chip) and disruptive architectures (CPO). Extreme execution risk for startups to meet production targets. | Threats intensified from market competition to include the existential risk of failing to execute on complex manufacturing scale-up promises. |

2026 Forward Look: Execution on Manufacturing Will Determine Market Winners

The single most critical factor for success in the optical interconnect market over the next 12-24 months will be the demonstrated ability to execute on high-volume, cost-effective manufacturing. Visionary technology roadmaps have become secondary to the practical ability to deliver millions of reliable components to hyperscalers engaged in an unprecedented infrastructure build-out.

Hyperscale Data Center Market Forecast

This growth forecast for the data center market provides a forward-looking view of the infrastructure build-out that will define market winners.

(Source: Global Market Insights)

- If this happens: A new entrant like Mesh Optical Technologies successfully achieves its initial production target of one thousand units per day and subsequently passes the stringent qualification process of a major hyperscale operator.

- Watch this: The first public announcements of bulk purchase agreements or supply contracts between a new, manufacturing-focused optical supplier and a hyperscaler, likely emerging in the 2027-2028 timeframe. Additionally, monitor for defensive M&A activity from incumbents like Broadcom or Marvell to acquire proven manufacturing capabilities.

- These could be happening: A successful scale-up would validate the “manufacturing-first” investment thesis, likely triggering a new wave of investment into supply chain and production-oriented hardware companies. It would put immense pressure on competitors focused solely on future architectures like CPO to demonstrate a viable and near-term path to mass production, solidifying manufacturing scale as the primary competitive advantage in the AI era.

Frequently Asked Questions

Why has manufacturing scale become more important than technological novelty in the optical interconnect market?

Manufacturing scale has become the top priority due to the shift from small-scale pilot programs (2021-2024) to massive, concrete AI infrastructure build-outs by hyperscalers, such as Microsoft’s $80 billion investment. This created an immediate, large-scale demand for millions of proven components, making a supplier’s ability to deliver reliably at high volume the new defining metric for winning contracts, rather than simply having the newest technology.

What is the difference between pluggable optics and Co-Packaged Optics (CPO), and which is more critical today?

Pluggable optics are mature, interchangeable modules (like 800G and 1.6T transceivers) that are commercially available now. Co-Packaged Optics (CPO) is a next-generation technology that integrates optics and silicon into the same package for better power efficiency but is still in development. The article states that pluggable optics are more critical for the current 2025-2027 build-out cycle because the industry needs to scale what is already proven and available to meet urgent AI-driven demand.

How are geopolitical factors influencing the optical interconnect supply chain?

Geopolitical factors, particularly the 25% tariff on Chinese-manufactured optical components and general supply chain risks, are driving a major strategic shift toward onshore production in North America. The historical reliance on Asia for manufacturing is now seen as a significant weakness. This has created a key opportunity for new companies like Mesh Optical Technologies, whose ‘American-made’ strategy directly addresses the hyperscalers’ need for a more resilient and geographically diverse supply chain.

What does the recent $50 million funding for Mesh Optical Technologies indicate about investor strategy?

The investment in Mesh Optical, which is explicitly for mass-producing American-made transceivers, signifies a decisive pivot in venture capital. Investors are shifting focus from funding purely research-oriented ventures to backing companies with credible, large-scale manufacturing roadmaps. It shows that the financial community now views manufacturing execution and solving supply chain bottlenecks as the primary catalyst for value creation in the current AI super-cycle.

What is the biggest challenge for a new company entering the optical interconnect market?

The biggest challenge is execution risk in manufacturing. While market demand is a massive strength, new entrants face the immense difficulty of scaling high-volume production from the ground up while meeting the extremely stringent qualification and volume requirements of hyperscalers. The article highlights that failing to execute on manufacturing promises is an ‘existential risk’ in a market with intense competition from established incumbents.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.