Beyond the PPA: How Clean Transition Tariffs Unlock Geothermal for Data Centers in 2026

From Pilot Projects to Commercial Scale: Geothermal Adoption for Data Centers

Corporate procurement of geothermal energy has transitioned from small-scale technology validation to large-scale commercial deployment, driven by innovative procurement frameworks designed to underwrite new projects and satisfy the immense power demands of data centers.

- Between 2021 and 2024, the primary focus was on proving the viability of next-generation geothermal technology. This period was defined by Google‘s initial partnership with Fervo Energy, culminating in a first-of-its-kind 3.5 MW Enhanced Geothermal System (EGS) pilot project in Nevada that became operational in late 2023.

- The period from 2025 to 2026 marks a definitive shift to commercial scale. This is evidenced by two landmark agreements in Nevada: a deal for 150 MW of conventional geothermal capacity from Ormat Technologies and a significantly expanded 115 MW EGS project with Fervo Energy.

- This acceleration was enabled by a new commercial model, the Clean Transition Tariff (CTT), developed with utility NV Energy. This tariff structure allows a corporate buyer to absorb the technology risk and provide the financial certainty for a utility to approve a large, long-term clean energy asset, creating a scalable pathway that was unavailable in the earlier period.

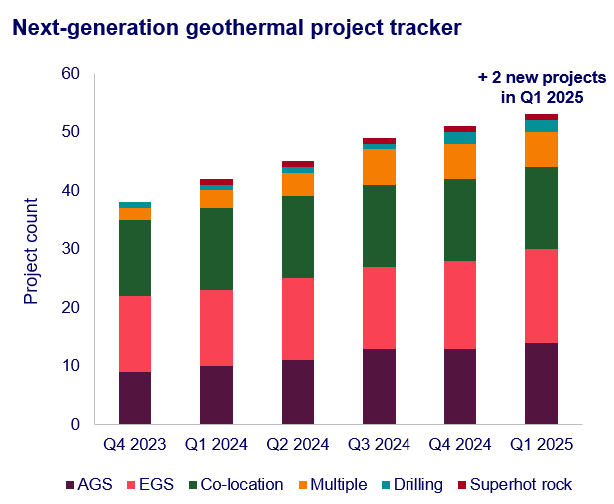

Next-Gen Geothermal Projects Show Growth

This chart shows the rising number of next-generation geothermal projects, visually representing the transition from the pilot phase (2021-2024) to commercial scale described in the section.

(Source: Trellis)

Investment Analysis: Underwriting First-Mover Clean Energy Infrastructure

Capital allocation has decisively shifted from funding ancillary renewable projects to direct, multi-billion-dollar investments in firm power generation and the infrastructure to support it, reflecting a strategic imperative to secure energy supply for AI-driven growth.

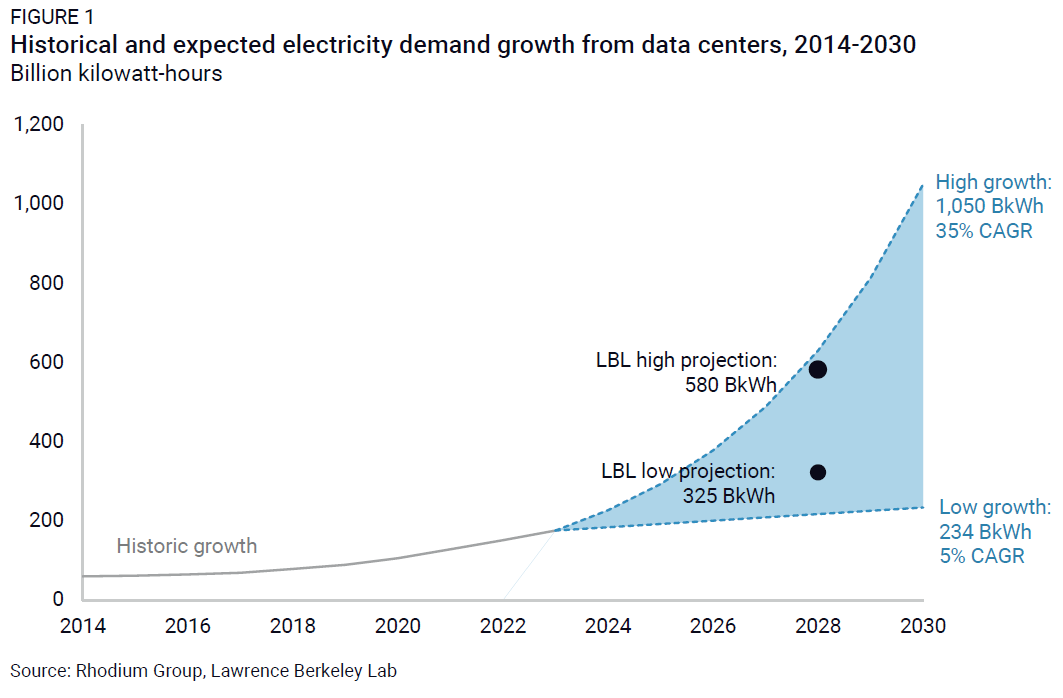

AI Drives Surge in Data Center Power Demand

This chart illustrates the projected surge in electricity demand from data centers, providing the core rationale for the multi-billion-dollar infrastructure investments needed to support AI-driven growth.

(Source: Rhodium Group)

- In December 2024, Google announced a partnership with a potential value of $20 billion to co-locate data centers with gigawatt-scale clean energy generation, signaling an integrated infrastructure strategy where power supply is developed in tandem with demand.

- This follows a series of direct, billion-dollar investments in data center construction throughout 2024, including $2 billion in Indiana, $1 billion in Texas, and $2 billion in Malaysia, establishing the massive load that requires dedicated firm power.

- Earlier strategic investments, such as participating in Fervo Energy‘s $138 million funding round in August 2022, were foundational. These early-stage capital injections de-risked the technology that is now being procured at a commercial scale.

Table: Key Investments in Data Center Power and Enabling Technologies

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Alphabet / Intersect Power Acquisition | Late 2025 | Announced agreement for Alphabet to acquire clean energy developer Intersect Power for a reported $4.75 billion to secure power for data centers and support U.S. investments. | Alphabet, Google’s Parent, Bets $4.75 B on Clean Power for AI Data … |

| Google / Broadwing Energy | October 2025 | First major PPA for electricity from a natural gas plant with carbon capture, supporting up to 400 MW of generation capacity to provide firm, low-carbon power. | Google signs first contract to capture emissions at natural gas plant |

| Google / Brookfield Asset Management | July 2025 | A $3 billion deal to secure up to 3, 000 MW of U.S. hydropower capacity, representing the world’s largest corporate clean power pact for hydroelectricity. | Google inks US$3 billion deal with Brookfield Asset Management |

| Google Investment in Fervo Energy | August 2022 | Participation in Fervo Energy’s $138 million funding round to accelerate the development and deployment of the next-generation geothermal technology that Google is now procuring. | Next-gen geothermal developer Fervo Energy raises $138 million |

Partnership Analysis: The Utility-Corporate-Developer Triad Driving Geothermal Projects

Effective partnerships have evolved beyond a simple bilateral offtake agreement to a tripartite structure including the utility, which is critical for integrating new, large-scale firm power sources like geothermal onto the regulated grid.

- The June 2024 agreement between Google, Fervo Energy, and NV Energy for 115 MW of geothermal power exemplifies this new triad. Google acts as the anchor offtaker, Fervo as the technology developer, and NV Energy as the utility facilitating grid integration through the novel Clean Transition Tariff.

- This model is a significant evolution from the initial 2021 partnership between just Google and Fervo Energy, which was a direct technology development collaboration for a small-scale pilot. The inclusion of the utility is the key enabler for scaling.

- Google‘s strategy is not limited to a single partner, as shown by the February 2026 deal with Ormat Technologies, also through NV Energy, to secure 150 MW of conventional geothermal power, demonstrating a portfolio approach to sourcing technology.

- Further collaborations, such as with SLB and Project Innerspace, indicate a commitment to building the entire geothermal ecosystem, moving beyond direct procurement to accelerate broader industry adoption.

Table: Key Strategic Partnerships for Geothermal Deployment

| Partner / Project | Time Frame | Details and Strategic Purpose | Source |

|---|---|---|---|

| Ormat Technologies, NV Energy | February 2026 | A 15-year portfolio PPA to supply up to 150 MW of new conventional geothermal capacity to power Google’s Nevada data centers, executed under the Clean Transition Tariff framework. | Ormat signs 150 MW geothermal power deal with NV Energy to … |

| Baseload Capital | April 2025 | First geothermal energy deals in Asia, securing 10 MW of geothermal power for Taiwan’s grid to support Google’s local data centers and doubling the country’s geothermal capacity. | Our first geothermal energy deal in Asia – Google Blog |

| NV Energy, Fervo Energy | June 2024 | A commercial agreement to supply 115 MW of enhanced geothermal power to Google’s Nevada data centers, establishing the Clean Transition Tariff model. | Google partners with Nevada utility for geothermal to power data … |

| Fervo Energy | May 2021 | Initial technology development partnership to pilot a next-generation enhanced geothermal power project, which resulted in the operational 3.5 MW plant in Nevada. | Google Using AI to Crack Next-Gen Geothermal Energy… |

Geography: Why Nevada Is the Blueprint for Geothermal-Powered Data Centers

Nevada has become the primary proving ground for scaling geothermal energy for data centers, combining favorable geology, a high concentration of data center load, and a progressive regulatory environment willing to pilot innovative utility tariffs.

Nevada’s Geothermal Potential for Data Centers

This chart quantifies the significant geothermal power potential in US states, directly supporting the section’s focus on why Nevada has become a geographical blueprint for development.

(Source: Rhodium Group)

- Between 2021 and 2024, Nevada was the exclusive location for Google‘s pioneering geothermal efforts, hosting the Fervo Energy pilot project which validated the technical feasibility of EGS technology in the state’s geology.

- From 2025 to 2026, Nevada solidified its role as the epicenter for commercial-scale deployment. The state is home to both the 115 MW EGS project with Fervo and the 150 MW conventional geothermal portfolio with Ormat, both made possible by the NV Energy CTT framework.

- While Nevada is the clear leader, Google‘s April 2025 deal in Taiwan to add 10 MW of geothermal power with Baseload Capital demonstrates an intent to replicate this strategy internationally, adapting the model to different regulatory and geological contexts.

Technology Maturity: EGS Moves from Pilot to Commercially Viable Baseload Power

Enhanced Geothermal Systems (EGS) have matured from a promising but commercially unproven technology into a bankable, scalable solution for firm clean power, a transition directly accelerated by corporate offtake agreements that de-risked the first large-scale projects.

Geothermal PPA Prices Show Commercial Viability

By comparing PPA prices for enhanced geothermal (EGS), this chart validates the section’s point about EGS maturing from a pilot technology into a commercially viable, bankable power source.

(Source: Enverus)

- In the 2021-2024 timeframe, EGS was in the pilot phase. The 3.5 MW Fervo Energy project was a critical field demonstration, using techniques from the oil and gas industry to prove that EGS could deliver reliable, 24/7 power.

- The period from 2025 to 2026 marks the technology’s commercial validation. The commitment to a 115 MW EGS project, approved by a regulated utility, confirms its status as a viable large-scale generation asset, not just a science project.

- This progress for EGS complements the continued use of mature conventional geothermal technology, evidenced by the 150 MW Ormat deal. This dual-track strategy allows Google to scale rapidly with proven technology while simultaneously commercializing next-generation solutions like EGS that dramatically expand the geographic potential for geothermal energy.

SWOT Analysis: Strategic Positioning of Geothermal for Data Centers

The strategic deployment of geothermal energy leverages its inherent strength as a firm power source to mitigate the massive operational risk posed by AI’s energy demand, with the primary opportunity residing in replicating innovative procurement models across new regions.

Geothermal Enables 24/7 Data Center Power

This chart visually demonstrates geothermal’s ability to provide 24/7 ‘load-following’ power, directly illustrating the key “Strength” identified in the section’s SWOT analysis.

(Source: Carbon Credits)

- Strength: The core strength lies in geothermal’s ability to provide 24/7 baseload power, directly addressing the intermittency weakness of solar and wind.

- Weakness: High upfront costs and drilling risks for EGS remain a significant barrier compared to other energy sources.

- Opportunity: The Clean Transition Tariff creates a replicable framework for other corporations and utilities to finance and deploy firm clean energy projects.

- Threat: Competition from other firm, low-carbon technologies, such as advanced nuclear or natural gas with CCS, could limit geothermal’s market share if cost-reduction targets are not met.

Table: SWOT Analysis for Geothermal Data Center Power

| SWOT Category | 2021 – 2024 | 2025 – 2026 | What Changed / Resolved / Validated |

|---|---|---|---|

| Strengths | Geothermal identified as a potential source of 24/7 carbon-free energy (CFE). Initial partnership with Fervo Energy to explore EGS technology. | Geothermal is now a cornerstone of the 24/7 CFE strategy. Procurement of hundreds of megawatts (Ormat, Fervo) of both conventional and EGS power. | The viability of geothermal as a scalable, firm power source for data centers was validated, moving from theory to large-scale PPAs. |

| Weaknesses | EGS was an unproven, high-risk technology with uncertain costs. Procurement was limited to a small 3.5 MW pilot. | EGS LCOE is becoming competitive ($88/MWh) but is still higher than some alternatives. Conventional geothermal remains geographically constrained. | The first commercial EGS project became operational, de-risking the technology, but cost competitiveness against natural gas with CCS or hydropower remains a key hurdle. |

| Opportunities | Applying AI to geothermal drilling to improve efficiency. Proving out a first-of-its-kind EGS project with a corporate partner. | The Clean Transition Tariff (CTT) with NV Energy creates a replicable commercial model. Expansion into new markets like Asia (Taiwan). | A scalable procurement mechanism (the CTT) was created and validated, providing a clear path for other utilities and corporations to follow. |

| Threats | Technical failure of the EGS pilot. Inability to secure utility buy-in for a novel power source. | Competition from other firm power sources being procured by Google, including large-scale hydro (3, 000 MW) and gas with CCS (400 MW). Regulatory hurdles in other states for new tariff models. | The threat shifted from technology failure to market competition. Google’s own diversified strategy shows that geothermal must compete on cost and scalability against other viable firm power options. |

Scenario Modelling: The Future of Corporate Clean Energy Procurement

If utilities and regulators in other data center hubs adopt frameworks similar to Nevada’s Clean Transition Tariff, corporate procurement of firm clean power will accelerate dramatically, fundamentally altering how new generation assets are financed and integrated into the grid.

Geothermal Potential Nears 18 GW

This chart quantifies the future potential of geothermal for data centers, providing context for the scenario modeling of accelerated corporate procurement discussed in the section.

(Source: Rhodium Group)

- If this model gains traction, watch for other technology companies like Meta and Amazon, who are also exploring geothermal, to announce their own large-scale, utility-integrated firm power deals in the next 12-18 months.

- A key signal to monitor is the execution of the 115 MW Fervo and 150 MW Ormat projects in Nevada. A smooth deployment will serve as a powerful proof point for regulators in other states considering similar tariff structures.

- Conversely, a slowdown could occur if the projected cost reductions for EGS do not materialize, or if regulatory bodies in other key states (like Virginia or Arizona) prove resistant to adopting new tariff models, which could make alternatives like natural gas with CCS a more pragmatic near-term choice for firm power.

Frequently Asked Questions

What is a Clean Transition Tariff (CTT) and why is it so important for geothermal projects?

A Clean Transition Tariff (CTT) is a new commercial model, developed with utility NV Energy, that allows a large corporate buyer like Google to absorb the technology risk and provide the financial certainty for a utility to approve a large, long-term clean energy asset. It is a game-changer because it creates a scalable and replicable pathway for financing and integrating firm power sources like geothermal onto the regulated grid, which was a major barrier previously.

How did Google’s geothermal strategy evolve from 2021 to 2026?

Google’s strategy transitioned from small-scale technology validation to large-scale commercial deployment. Between 2021 and 2024, the focus was on a 3.5 MW pilot project with Fervo Energy to prove the viability of Enhanced Geothermal Systems (EGS). From 2025-2026, the strategy shifted to commercial scale, with landmark deals for 115 MW of EGS and 150 MW of conventional geothermal power, both enabled by the new Clean Transition Tariff.

Why has Nevada become the main location for these large-scale geothermal data center projects?

Nevada is the primary proving ground due to a combination of three key factors: favorable geology for both conventional and enhanced geothermal energy, a high concentration of data center load requiring immense power, and a progressive regulatory environment with a utility (NV Energy) willing to pilot innovative frameworks like the Clean Transition Tariff.

Is Google only investing in geothermal energy for its data centers?

No, Google is pursuing a diversified portfolio approach to secure firm, low-carbon power. While the article focuses on geothermal, it also mentions Google’s other major investments, including a 3,000 MW U.S. hydropower deal and a 400 MW PPA for electricity from a natural gas plant with carbon capture. This indicates that geothermal must compete on cost and scalability against other viable firm power options.

What is the difference between the two types of geothermal technology Google is procuring?

Google is using a dual-track strategy. It is procuring 150 MW of conventional geothermal power from Ormat, which is a mature, proven technology. Simultaneously, it is procuring 115 MW of Enhanced Geothermal Systems (EGS) power from Fervo. EGS is a next-generation technology that has recently moved from the pilot phase to being commercially viable, and it dramatically expands the geographic potential for geothermal energy beyond traditional locations.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Google Clean Energy: 24/7 Carbon-Free Strategy 2025

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.