Top 10 US AI Liquid Cooling Projects of 2025

High-Density Data Center Liquid Cooling: The 2025 Market Pivot

The data center industry is undergoing a fundamental infrastructure shift, with high-capacity liquid cooling emerging as the critical enabler for the immense power densities of Artificial Intelligence (AI) and High-Performance Computing (HPC). An analysis of major 2025 projects reveals that liquid-enabled infrastructure is no longer a niche but a baseline requirement for new hyperscale developments. This trend is underscored by projects like Crusoe’s massive 1.2 GW AI campus and Server Farm’s 500+ MW facility, which is explicitly designed for rack densities exceeding 200 k W. The dominant theme for 2025 is this strategic pivot to advanced thermal management; data center operators are now building cooling capacity at a gigawatt scale to support the next generation of GPU-driven workloads.

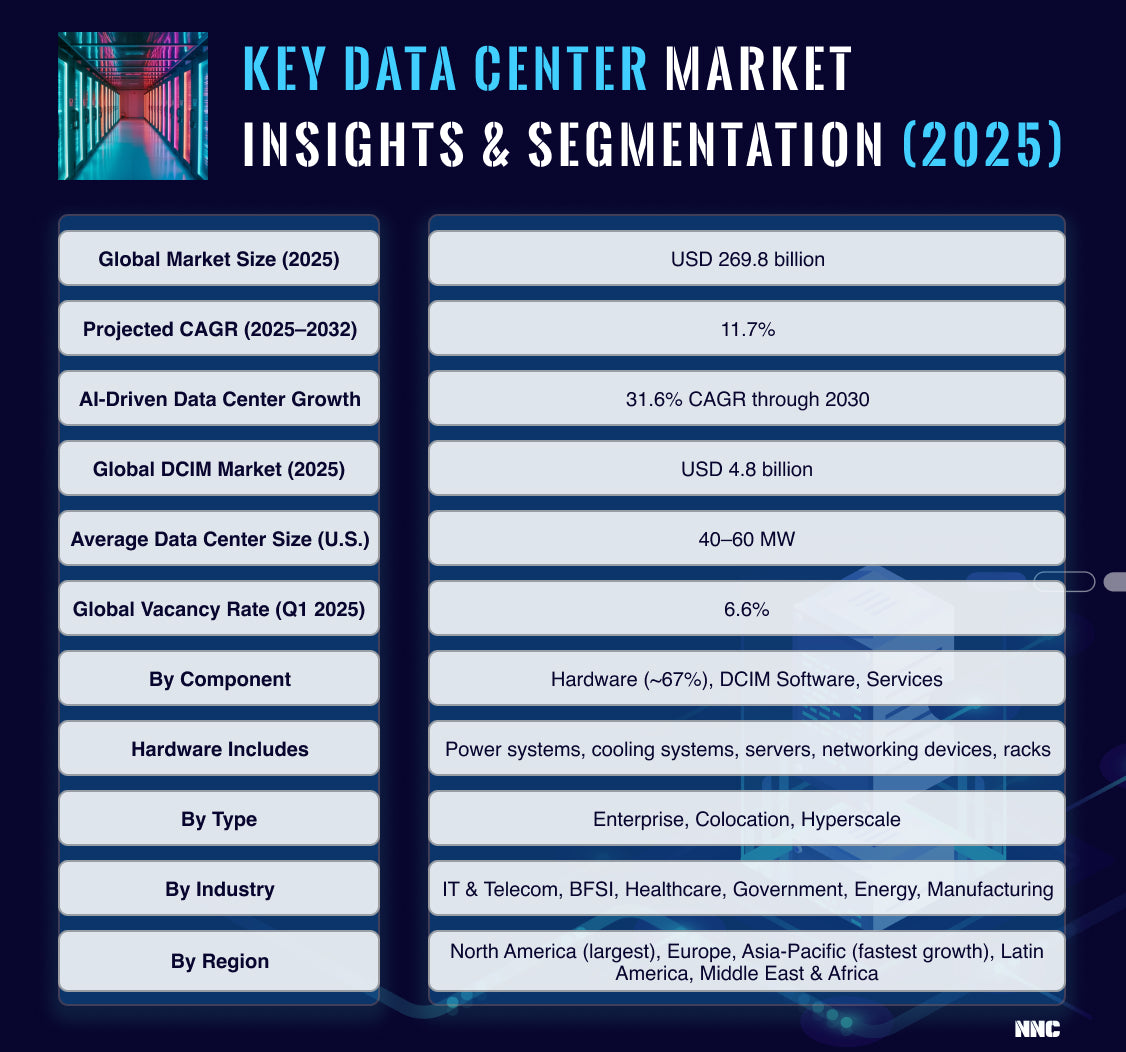

AI Workloads Fuel Data Center Growth

The rise of AI is a primary driver for data center growth and the increasing demand for advanced cooling systems, as highlighted by this market forecast.

(Source: Nassau National Cable)

Top High-Capacity Cooling Deployments of 2025-2026

The following projects, ranked by cooling capacity, illustrate the scale and velocity of this transition towards liquid-cooled, AI-ready data centers.

1. Crusoe AI Data Center Campus Expansion

Company: Crusoe

Capacity: 1, 200 MW (1.2 GW)

Application: Supporting next-generation, high-density AI infrastructure and large-scale GPU clusters.

Source: Crusoe | The AI factory company | Renewable-powered AI …

2. Server Farm AI-Ready Hyperscale Campus

Company: Server Farm

Capacity: 500+ MW

Application: A new hyperscale campus designed with liquid cooling capabilities to support rack densities from 50-200 k W+.

Source: United States Data Centers | AI-Ready Hyperscale …

3. Novva Data Centers “Project Borealis” Campus

Company: Novva Data Centers

Capacity: 300 MW

Application: A five-building campus deploying high-efficiency cooling systems to manage power and water usage in an arid climate.

Source: New Data Center Developments: June 2025

4. Hyperscale AI/HPC Liquid-Cooling Data Center

Company: Unnamed

Capacity: 75 MW

Application: A new facility specifically deployed with liquid-cooling technology for AI and HPC workloads.

Source: US Hyperscale Data Center Market Size & Share Analysis

5. STACK Infrastructure Data Center

Company: STACK Infrastructure

Capacity: 36 MW

Application: A data center designed with a closed-loop water cooling system to minimize environmental impact.

Source: STACK Infrastructure Announces New 36 MW Data Center …

6. Edged Data Centers Site

Company: Edged Data Centers

Capacity: 24 MW

Application: A facility featuring a zero-water cooling system designed to reduce energy and water consumption significantly.

Source: United States Data Center Cooling Market Size and Share

7. Enterprise Cloud Provider Data Center Fit-Out

Company: Unnamed (Integrator: Compu Dynamics)

Capacity: 13.5 MW

Application: A 30, 000 sq. ft. data center fit-out utilizing a high-efficiency liquid cooling solution.

Source: Liquid Cooling for 13.5 MW Data Center

8. DCX FDU V 2 AT 2 for NVIDIA Vera Rubin Deployments

Company: DCX Liquid Cooling Systems

Capacity: 8.15 MW

Application: A Facility Distribution Unit (FDU) designed for 45°C warm-water cooling to support hyperscale AI growth with next-gen GPUs.

Source: DCX Liquid Cooling Systems Announces New 8 MW …

9. Multi-Site AI Data Center FDU Deployment

Company: Unnamed

Capacity: 5 MW

Application: Deployment of a 5-megawatt Facility Distribution Unit (FDU) to serve entire data halls filled with high-density AI server racks.

Source: World’s first 5 MW Coolant Distribution Unit is now …

10. Airedale Turbo Chill™ Air-Cooled Chiller Deployment

Company: Airedale by Modine™

Capacity: 3+ MW

Application: An air-cooled chiller optimized for efficiency and a wide range of water temperatures to support AI data centers.

Source: Airedale by Modine™ Unveils Turbo Chill™ 3+MW …

Table: Top Data Center Cooling Applications (2025-2026)

| Company | Installation Capacity | Applications | Source |

|---|---|---|---|

| Crusoe | 1, 200 MW | High-density AI infrastructure and large-scale GPU clusters | Crusoe | The AI factory company | Renewable-powered AI … |

| Server Farm | 500+ MW | AI-ready hyperscale campus with liquid cooling for 50-200 k W+ racks | United States Data Centers | AI-Ready Hyperscale … |

| Novva Data Centers | 300 MW | Multi-building campus with high-efficiency cooling | New Data Center Developments: June 2025 |

| Unnamed | 75 MW | Hyperscale liquid cooling for AI and HPC workloads | US Hyperscale Data Center Market Size & Share Analysis |

| STACK Infrastructure | 36 MW | Closed-loop water cooling system | STACK Infrastructure Announces New 36 MW Data Center … |

| Edged Data Centers | 24 MW | Zero-water cooling system | United States Data Center Cooling Market Size and Share |

| Unnamed (Integrator: Compu Dynamics) | 13.5 MW | High-efficiency liquid cooling for enterprise cloud fit-out | Liquid Cooling for 13.5 MW Data Center |

| DCX Liquid Cooling Systems | 8.15 MW | Facility Distribution Unit for warm-water cooling of next-gen GPUs | DCX Liquid Cooling Systems Announces New 8 MW … |

| Unnamed | 5 MW | Facility Distribution Unit for high-density AI racks | World’s first 5 MW Coolant Distribution Unit is now … |

| Airedale by Modine™ | 3+ MW | High-efficiency air-cooled chiller supporting AI data centers | Airedale by Modine™ Unveils Turbo Chill™ 3+MW … |

From Niche to Necessity: Liquid Cooling’s Broadening Footprint

The diversity of operators adopting high-capacity cooling signals a profound market-wide acceptance. This trend extends far beyond a handful of hyperscalers. The list includes specialized AI infrastructure developers (Crusoe), hyperscale-focused colocation providers (Server Farm, STACK Infrastructure), and enterprise integrators (Compu Dynamics), demonstrating that liquid cooling is becoming a standardized solution across different market segments. The 13.5 MW enterprise fit-out by Compu Dynamics is particularly telling, as it shows that even smaller, private deployments now require liquid cooling to remain competitive. This widespread adoption is creating a robust ecosystem of technology providers, from firms like Edged Data Centers innovating with zero-water systems to specialists like DCX building industrial-scale distribution units.

Liquid Cooling Market Share Soars

This chart illustrates liquid cooling’s transition from niche to necessity, with its market share projected to quadruple by 2028.

(Source: Data Center Knowledge)

Texas Heats Up: The Geographic Epicenter of AI Cooling

Geographically, Texas has emerged as the undisputed leader in deploying high-density cooling infrastructure. The state is home to four of the top ten projects, including the two largest by an overwhelming margin: Crusoe’s 1.2 GW campus in Abilene and Server Farm’s 500+ MW campus in Houston. This concentration indicates a strategic regional push to capture the AI boom, enabled by factors such as favorable energy markets and proactive development policies. Other key markets are also adapting. In Arizona, Novva’s 300 MW project must incorporate high-efficiency systems to contend with water scarcity. Meanwhile, in established hubs like Chicago, STACK Infrastructure’s deployment of a 36 MW closed-loop water system shows that providers in mature markets are upgrading their cooling technology to support modern AI workloads.

Scaling Up: From Rack-Level Solutions to Data Hall Infrastructure

These deployments reveal a rapid maturation of liquid cooling technology, which is now being implemented at an industrial scale. The market has progressed from cooling individual servers or racks to engineering solutions for entire data halls. The introduction of multi-megawatt Facility Distribution Units (FDUs) is a key indicator of this shift. For example, DCX Liquid Cooling Systems’ new 8.15 MW FDU is not a supplementary component but a core piece of facility infrastructure, capable of managing the thermal load for thousands of high-power GPUs. Its design for 45°C warm-water cooling also points to advanced engineering focused on maximizing energy efficiency. This transition from granular to facility-level systems confirms that high-density liquid cooling is a commercially mature and scalable technology.

Key Vendors for 2025 Infrastructure

The data center ecosystem includes specialized vendors for thermal management, demonstrating how the industry is scaling up to provide facility-wide solutions.

(Source: Nassau National Cable)

The Inevitable Cool-Down: What’s Next for Data Center Thermal Management

The project pipeline for 2025-2026 signals a clear future direction: data center power and cooling are now inseparable strategic elements. The market is defined by gigawatt-scale ambition, with liquid cooling as the non-negotiable prerequisite for entry. Future growth will be dictated not just by access to power but by the ability to dissipate the immense heat generated by next-generation processors. The direct link between cooling technology and upcoming hardware, such as the DCX FDU’s optimization for NVIDIA Vera Rubin deployments, confirms this trajectory. The focus is now on industrializing cooling infrastructure through solutions like multi-megawatt FDUs and hyper-efficient chillers, ensuring that thermal management can scale in lockstep with the exponential demands of AI.

Liquid Cooling Market to Exceed $21B

The global data center liquid cooling market is forecast to grow exponentially, underscoring its critical and inevitable role in future infrastructure.

(Source: Persistence Market Research)

Frequently Asked Questions

Why is liquid cooling becoming a necessity for new data centers?

Liquid cooling is becoming a necessity because of the immense power densities required for Artificial Intelligence (AI) and High-Performance Computing (HPC). Next-generation GPU-driven workloads generate extreme heat that traditional air cooling cannot manage, with new facilities being designed for rack densities exceeding 200 kW.

What are the largest liquid cooling projects mentioned for 2025-2026?

The two largest projects highlighted in the analysis are Crusoe’s 1,200 MW (1.2 GW) AI data center campus and Server Farm’s 500+ MW AI-ready hyperscale campus. These projects illustrate the gigawatt-scale cooling capacity now being built.

Is this shift to liquid cooling limited to just a few large hyperscalers?

No, the trend extends far beyond a handful of hyperscalers. The report shows adoption by specialized AI developers (Crusoe), colocation providers (STACK Infrastructure), and enterprise integrators (Compu Dynamics), indicating that liquid cooling is becoming a standard solution across different market segments.

Which geographic region is leading in the deployment of high-density cooling?

Texas has emerged as the undisputed leader, hosting four of the top ten projects, including the two largest by Crusoe and Server Farm. This concentration points to a strategic regional effort to support the AI boom, driven by factors like favorable energy markets.

How is liquid cooling technology evolving to handle this scale?

The technology is scaling up from cooling individual servers to managing entire data halls. This is demonstrated by the introduction of multi-megawatt Facility Distribution Units (FDUs), such as the 8.15 MW unit from DCX Liquid Cooling Systems, which are designed as core infrastructure to handle the thermal load of thousands of GPUs.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.