Top 10 US Fuel Cell CHP Projects of 2025 for the AI Boom

Fuel Cell CHP: Powering Mission-Critical Infrastructure in 2025

Fuel cell Combined Heat and Power (CHP) has decisively transitioned from a niche technology to a cornerstone of modern energy strategy, driven by the insatiable power demands of the AI boom and the urgent need for grid-independent resilience. An analysis of 2025 market activities reveals that fuel cells are being deployed at an unprecedented scale to provide clean, reliable, and efficient baseload power for the nation’s most critical infrastructure. The primary evidence for this shift includes a landmark gigawatt-scale procurement agreement for data centers by American Electric Power, a 450 MW strategic collaboration targeting the same market by Fuel Cell Energy and SDCL, and a market-wide expansion of commercial CHP systems that surpassed 450 MW this year. The dominant theme for 2025 is the strategic use of distributed fuel cell CHP to bypass lengthy grid interconnection queues and deliver high-availability power, with waste heat recovery being a critical component for maximizing efficiency in sectors from data centers to healthcare.

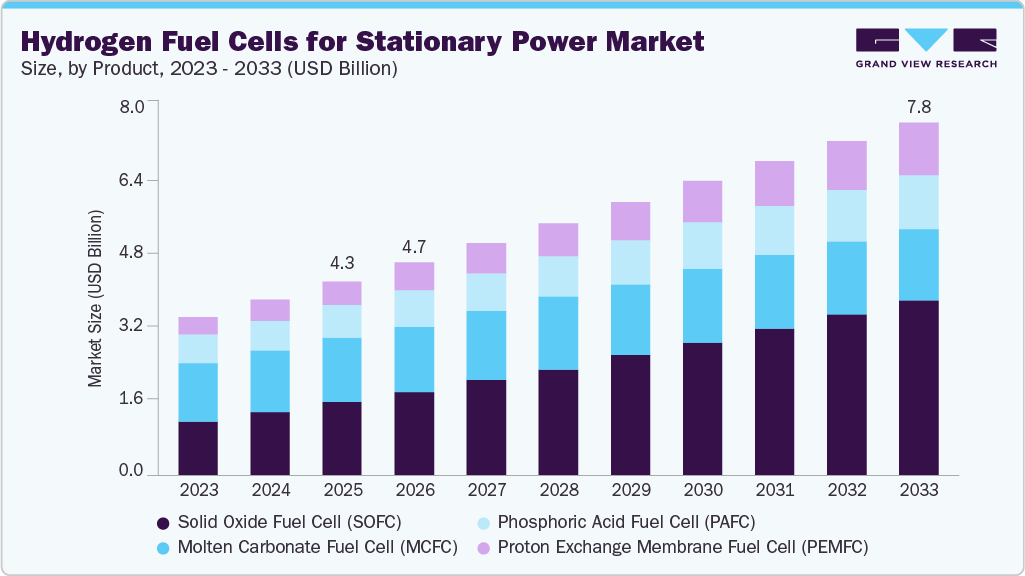

Fuel Cell Market Reaches $4.3B in 2025

This chart validates the article’s premise by forecasting significant market growth, with a projected value of $4.3 billion in 2025, the year of focus.

(Source: EnkiAI)

Top 10 Fuel Cell CHP Installations and Initiatives of 2025

The following projects, ranked by capacity and strategic importance, highlight the key trends and major players shaping the fuel cell CHP landscape in the United States.

1. AEP Data Center Power Initiative

Company: American Electric Power (AEP), Bloom Energy

Installation Capacity: Up to 1 gigawatt (GW)

Applications: Baseload power for data centers, with waste heat captured for cooling via absorption chillers to improve Power Usage Effectiveness (PUE).

Source: How Fuel Cells Help Solve the Growing Data Center and …

2. Fuel Cell Energy & SDCL Data Center Collaboration

Company: Fuel Cell Energy, Sustainable Development Capital LLP (SDCL)

Installation Capacity: Up to 450 MW

Applications: Turnkey, financed power solutions for the data center market using an energy-as-a-service (Eaa S) model to accelerate adoption.

Source: Sustainable Development Capital LLP and Fuel Cell Energy …

3. Bloom Energy & Equinix Colocation Data Center Program

Company: Bloom Energy, Equinix

Installation Capacity: Over 100 MW

Applications: Power resiliency and thermal management across 19 colocation data centers in six U.S. states to ensure uptime and meet sustainability goals.

Source: Top Companies in Solid Oxide Fuel Cell Market

4. Charter Oak Urban CHP Project

Company: Hy Axiom Inc., Scale Microgrids

Installation Capacity: 9.6 MW

Applications: The nation’s first multi-megawatt, multi-story fuel cell installation, providing low-emission power and thermal energy in a dense urban environment.

Source: Scale Microgrids Secures Financing To Deliver Reliable …

5. Calistoga Community Resilience Hydrogen Microgrid

Company: Plug Power, Energy Vault, Pacific Gas and Electric (PG&E)

Installation Capacity: 8 MW

Applications: Community-scale grid resilience in a wildfire-prone area, utilizing green hydrogen for backup power with potential for CHP to support local facilities.

Source: This hydrogen microgrid is the first of its kind. Is…

6. Conagra Foods Industrial Processing Facilities

Company: Bloom Energy, Conagra

Installation Capacity: Approximately 6 MW

Applications: Providing 75% of the annual electricity for two food production facilities, with CHP used for process heat and reducing natural gas consumption in boilers.

Source: debunking common fuel cell myths

7. Kaiser Permanente Hospital Microgrid

Company: Kaiser Permanente

Installation Capacity: Not specified (largest U.S. hospital-based renewable microgrid)

Applications: Ensuring continuous power for patient safety and critical operations, with CHP for heating, cooling, sterilization, and hot water.

Source: Onsite Power | POWERGEN 2026

8. District Energy St. Paul Hydrogen CHP Demonstration

Company: Caterpillar, District Energy St. Paul

Installation Capacity: Demonstration scale

Applications: A demonstration proving the viability of using 100% hydrogen fuel in a CHP system for a district energy network, offering a decarbonization pathway for urban heating.

Source: Caterpillar and District Energy St. Paul Demonstrate …

9. Lawrence and Memorial Hospital Resiliency Project

Company: Lawrence and Memorial Hospital (powered by Bloom Energy)

Installation Capacity: Not specified

Applications: Achieving energy sovereignty and operational continuity in healthcare, with CHP providing reliable electricity and thermal energy for extensive hospital needs.

Source: Bloom Energy Fuel Cells: Powering Hospitals in 2025

10. Commercial & Retail Complex CHP Systems

Company: Multiple (including Bloom Energy, Fuel Cell Energy, Hy Axiom)

Installation Capacity: Market-wide installations exceeded 450 MW in 2025

Applications: Baseload electricity and waste heat utilization for space heating, hot water, and absorption chilling in large retail stores, office parks, and mixed-use developments.

Source: Combined Heat and Power (CHP) Market Size, Share & …

Table: 2025 U.S. Fuel Cell CHP Project Highlights

| Company/Project | Installation Capacity | Applications | Source |

|---|---|---|---|

| American Electric Power (AEP), Bloom Energy | Up to 1 GW | Data center baseload power and cooling | fchea.org |

| Fuel Cell Energy, SDCL | Up to 450 MW | Financed data center power solutions (Eaa S) | markets.businessinsider.com |

| Bloom Energy, Equinix | Over 100 MW | Power resiliency for 19 colocation data centers | marketsandmarkets.com |

| Hy Axiom Inc., Scale Microgrids | 9.6 MW | Urban multi-story CHP | finance.yahoo.com |

| Plug Power, Energy Vault, PG&E | 8 MW | Community resilience hydrogen microgrid | canarymedia.com |

| Bloom Energy, Conagra | ~6 MW | Industrial manufacturing power and process heat | manufacturingdive.com |

| Kaiser Permanente | Not specified | Hospital microgrid for power and thermal loads | powergen.com |

| Caterpillar, District Energy St. Paul | Demonstration scale | 100% hydrogen district energy CHP | fuelcellsworks.com |

| Lawrence and Memorial Hospital | Not specified | Healthcare resiliency and energy sovereignty | enkiai.com |

| Multiple Companies | Over 450 MW (market-wide) | Commercial and retail complex baseload power/heat | snsinsider.com |

From Data Centers to Hospitals: A Diversifying Application Portfolio

The 2025 project pipeline reveals a significant diversification in the adoption of fuel cell CHP, cementing its role across multiple mission-critical sectors. The most dominant application is unequivocally data centers, with the top three initiatives from AEP, Fuel Cell Energy, and Equinix collectively representing over 1.5 GW of announced capacity. For these facilities, CHP is not an afterthought; the ability to use waste heat for absorption chilling is a strategic advantage that directly improves PUE and reduces operational costs. Beyond data centers, healthcare has emerged as a key growth sector. Landmark projects at Kaiser Permanente and Lawrence and Memorial Hospital demonstrate a strategic pivot toward energy sovereignty to guarantee uninterrupted power for life-support systems, with CHP efficiently managing the high thermal loads required for sterilization and HVAC. This trend is mirrored in industrial settings, where the Conagra project exemplifies how CHP provides predictable energy costs while integrating process heat to displace fossil fuels used in boilers. Finally, applications are expanding into public infrastructure, with the Charter Oak project showing viability in dense urban environments and the Calistoga microgrid proving its value for community resilience.

Fuel Cells Double Power For Data Centers

This chart demonstrates how fuel cells can dramatically increase a site’s power capacity without increasing emissions, a critical factor for the data center applications discussed in this section.

(Source: FuelCell Energy)

National Footprint with Key Regional Hubs

While the drivers for fuel cell CHP adoption are national, distinct regional leadership is apparent. California stands out as a hotspot for resilience-driven projects, exemplified by the Calistoga community microgrid, which directly addresses the threat of wildfire-related grid outages. This is reinforced by the state’s supportive policies and the significant presence of Equinix‘s multi-site data center deployment. In the Northeast, Connecticut’s Charter Oak project highlights an innovative solution to the challenges of deploying energy infrastructure in land-scarce urban areas, likely driven by regional emissions reduction goals and high energy prices. The Midwest is emerging as an industrial and forward-looking hub. The Conagra installations in Ohio represent the technology’s strong business case in the manufacturing belt, while the District Energy St. Paul demonstration in Minnesota points to a proactive strategy for decarbonizing district heating in cold climates. However, the largest agreements with AEP and Fuel Cell Energy/SDCL are national in scope, underscoring that the primary drivers—the AI-driven power crunch and grid capacity shortfalls—are a systemic, nationwide challenge that fuel cell CHP is uniquely positioned to address.

North America Emerges as Key Fuel Cell Hub

This chart reinforces the section’s focus on regional leadership by identifying North America as a significant market, aligning with the discussion of hotspots in California and the Northeast.

(Source: Stellar Market Research)

From Demonstration to GW-Scale Commercialization

The 2025 projects illustrate a clear maturation curve across different fuel cell technologies. Solid Oxide Fuel Cells (SOFCs), leveraged by Bloom Energy, are at the vanguard of commercial scale. The 1 GW supply agreement with AEP is a watershed moment, moving the technology from megawatt-scale projects to gigawatt-scale procurement and confirming its readiness for baseload power in the most demanding environments. Similarly, Fuel Cell Energy’s Molten Carbonate Fuel Cells (MCFCs) are achieving scale through innovative financing models. In parallel, mature technologies like Hy Axiom’s Phosphoric Acid Fuel Cells (PAFCs) are finding new life in specialized applications like the multi-story Charter Oak project. At the other end of the spectrum are the critical demonstrations pushing the industry toward a zero-carbon future. The District Energy St. Paul project using 100% hydrogen with Caterpillar technology and Plug Power’s hydrogen microgrid in Calistoga are vital for proving decarbonization pathways. While not yet at the commercial scale of their natural gas-fed counterparts, these projects are building the technical and operational confidence needed for the next wave of clean energy infrastructure.

Large-Scale Systems Drive Fuel Cell Market Growth

This forecast validates the trend of GW-scale commercialization, showing that market expansion is driven by large-scale systems (over 50 kW), which aligns perfectly with the projects discussed.

(Source: Global Market Insights)

Forward-Looking Insights: The Future is Resilient, Distributed, and Financed

The 2025 market landscape signals that fuel cell CHP has become an essential tool for enabling both the digital and green energy transitions. It is simultaneously solving the immediate, practical problem of powering the AI revolution while building a foundation for a more resilient and decentralized energy future. Three forward-looking trends are particularly significant. First, the rise of the ‘Energy-as-a-Service’ (Eaa S) model, exemplified by the Fuel Cell Energy and SDCL collaboration, will be a major catalyst for adoption. By removing the upfront capital expenditure barrier, this model makes multi-megawatt CHP systems financially accessible to a broader range of customers. Second, fuel cells are increasingly being used as a strategic grid bypass. The sheer scale of the AEP initiative is a direct response to grid interconnection delays that can stall large projects for years; fuel cells offer a pragmatic way to bring massive power loads online faster. Finally, the role of hydrogen is clarifying. While natural gas-powered fuel cells are driving today’s commercial scale, projects in Calistoga and St. Paul are establishing hydrogen’s value proposition in long-duration storage for resilience and as a zero-carbon fuel for thermal networks, setting the stage for a future-proof energy system.

Frequently Asked Questions

Why are fuel cells becoming so popular for data centers in 2025?

According to the analysis, the surge in adoption is driven by two main factors: the massive power demands of the AI boom and the need to bypass long grid interconnection queues. Fuel cells offer a way to quickly deploy clean, reliable, and grid-independent baseload power, which is critical for bringing new data center capacity online without waiting years for grid upgrades.

What are the main advantages of using Fuel Cell CHP over traditional grid power?

The primary advantages are reliability, efficiency, and speed to deployment. Fuel Cell CHP provides grid-independent resilience, ensuring continuous power for mission-critical operations. It is also highly efficient because the waste heat is captured and used for other purposes, such as cooling data centers (improving PUE) or providing process heat in factories. This ‘grid bypass’ strategy also allows facilities to come online much faster than waiting for traditional grid upgrades.

Are these fuel cells environmentally friendly if they use natural gas?

While many of the large-scale commercial systems in 2025 are powered by natural gas, they offer higher efficiency and lower criteria pollutant emissions than traditional combustion. The report also highlights a clear pathway to a zero-carbon future. Projects like the District Energy St. Paul demonstration are successfully using 100% hydrogen, and the Calistoga microgrid utilizes green hydrogen, proving the technology’s role in future decarbonization.

Besides data centers, what other sectors are using Fuel Cell CHP?

The technology is diversifying across several mission-critical sectors. Healthcare is a major adopter, with hospitals like Kaiser Permanente using fuel cells to ensure energy sovereignty for patient safety. The industrial sector, as shown by the Conagra Foods project, uses it for reliable power and process heat. It’s also being used for community resilience in wildfire-prone areas (the Calistoga microgrid) and in dense urban environments (the Charter Oak project).

What is the ‘Energy-as-a-Service’ (EaaS) model and why is it important for fuel cells?

Energy-as-a-Service (EaaS) is a financing model where a customer pays for power as a service without having to purchase the fuel cell system outright. As highlighted by the Fuel Cell Energy and SDCL collaboration, this model removes the significant upfront capital expenditure. This makes multi-megawatt fuel cell projects more financially accessible to a wider range of customers and is considered a major catalyst for accelerating their adoption.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.