Top 12 Space-Based AI Data Center Companies to Watch in 2025

The explosive growth of Artificial Intelligence is forcing a strategic offloading of its immense infrastructural burden from Earth to space, creating a new frontier for data processing. This shift is no longer theoretical; it is a direct response to the escalating crisis of terrestrial resources, where a single AI-focused hyperscale data center can consume the same power as 100, 000 homes. The in-orbit data center market, valued at $500 million in 2025, is projected to reach an astounding $39.09 billion by 2035, fueled by the convergence of skyrocketing AI compute demand and rapidly falling launch costs. The dominant theme for 2025 and 2026 is the industry’s rapid transition from conceptualization to in-orbit validation, as key players race to launch prototype satellites and prove the economic viability of this transformative technology.

Key Projects and Companies Shaping the Orbital Data Market

The following initiatives represent the vanguard of the space-based data center revolution, spanning from platform development and launch logistics to the critical enabling hardware.

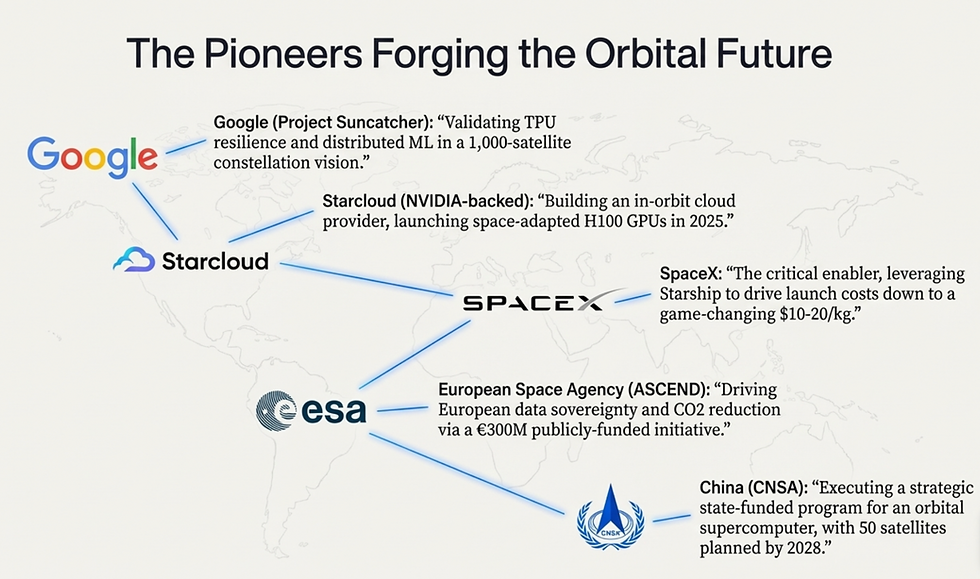

Pioneers Forging the Orbital Computing Future

This chart maps the key corporate actors in the orbital data market, which directly aligns with this section’s role as an introduction to the main projects and companies.

(Source: AI News Hub)

1. Google (Project Suncatcher)

Company: Google

Installation Capacity: Constellation of AI-powered satellites; two initial prototypes planned

Applications: Scalable, space-based AI infrastructure using proprietary Tensor Processing Units (TPUs)

Source: Exploring a space-based, scalable AI infrastructure system …

2. Starcloud

Company: Starcloud

Installation Capacity: Dedicated orbital data centers; successfully trained first AI model in space in December 2025

Applications: AI model training at 10 x lower energy costs compared to terrestrial grids

Source: Nvidia-backed Starcloud trains first AI model in space …

3. Aetherflux (Galactic Brain Project)

Company: Aetherflux

Installation Capacity: First AI-equipped satellite launch planned by 2027

Applications: Establishing a network of orbital AI data centers to leverage space-based solar power

Source: Startup announces ‘Galactic Brain’ project to put AI data …

4. Space X

Company: Space X

Installation Capacity: Dominant launch service provider for orbital infrastructure

Applications: Providing cost-effective and reliable access to space, the primary enabler for the entire market

Source: Space X Has 2 Big Advantages in the Race to Put AI Data …

5. Blue Origin

Company: Blue Origin

Installation Capacity: Long-term vision for gigawatt-scale data centers in space

Applications: Developing foundational technology for large-scale orbital data infrastructure

Source: Bezos and Musk Race to Bring Data Centers to Space

6. Planet

Company: Planet

Installation Capacity: Two test spacecraft to be launched by early 2027 in partnership with Google

Applications: Satellite operations and validation of in-orbit computing hardware for Project Suncatcher

Source: Planet bets on orbital data centers in partnership with Google

7. NVIDIA

Company: NVIDIA

Installation Capacity: Supplier of GPUs and foundational AI hardware with 90% market share

Applications: Providing the core AI processing technology for space-based systems and fostering startups like Starcloud

Source: What Are the 3 Top Artificial Intelligence (AI) Stocks to Buy …

8. Axiom Space

Company: Axiom Space

Installation Capacity: Development of orbital data center nodes for integration with commercial space stations

Applications: Secure data storage and processing for national security, commercial, and international customers

Source: Axiom Space to Launch Orbital Data Center Nodes …

9. AMD

Company: AMD

Installation Capacity: Supplier of high-performance CPUs and GPUs

Applications: Providing essential computing hardware for AI workloads in both terrestrial and emerging space-based markets

Source: AMD AI Solutions

10. Lone Star Data Holdings

Company: Lone Star Data Holdings

Installation Capacity: First orbital facilities planned to be operational by 2028

Applications: Establishing AI data centers in Earth orbit and on the lunar surface for deep-space data infrastructure

Source: Data centers in outer space emerge as solution to AI’s …

11. Orbits Edge

Company: Orbits Edge

Installation Capacity: High-performance micro data centers in Low Earth Orbit (LEO)

Applications: Enabling space-based edge computing to process data in orbit, reducing latency and ground station bandwidth

Source: In-Orbit Data Centers Market Report 2025: Key Players like

12. Intellistake & Orbit AI

Company: Intellistake & Orbit AI

Installation Capacity: Development of satellite data centers and a supporting financial trust layer

Applications: Creating an independent verification layer to validate data and operations, establishing commercial viability

Source: Intellistake Strengthens AI Infrastructure Platform With Entry …

Table: Key Space-Based AI Data Center Projects (2025-2026)

| Company | Installation Capacity | Applications | Source |

|---|---|---|---|

| Google (Project Suncatcher) | Constellation of AI-powered satellites; two initial prototypes planned | Scalable, space-based AI infrastructure using proprietary Tensor Processing Units (TPUs) | Exploring a space-based, scalable AI infrastructure system … |

| Starcloud | Dedicated orbital data centers; successfully trained first AI model in space in December 2025 | AI model training at 10 x lower energy costs compared to terrestrial grids | Nvidia-backed Starcloud trains first AI model in space … |

| Aetherflux (Galactic Brain Project) | First AI-equipped satellite launch planned by 2027 | Establishing a network of orbital AI data centers to leverage space-based solar power | Startup announces ‘Galactic Brain’ project to put AI data … |

| Space X | Dominant launch service provider for orbital infrastructure | Providing cost-effective and reliable access to space, the primary enabler for the entire market | Space X Has 2 Big Advantages in the Race to Put AI Data … |

| Blue Origin | Long-term vision for gigawatt-scale data centers in space | Developing foundational technology for large-scale orbital data infrastructure | Bezos and Musk Race to Bring Data Centers to Space |

| Planet | Two test spacecraft to be launched by early 2027 in partnership with Google | Satellite operations and validation of in-orbit computing hardware for Project Suncatcher | Planet bets on orbital data centers in partnership with Google |

| NVIDIA | Supplier of GPUs and foundational AI hardware with 90% market share | Providing the core AI processing technology for space-based systems and fostering startups like Starcloud | What Are the 3 Top Artificial Intelligence (AI) Stocks to Buy … |

| Axiom Space | Development of orbital data center nodes for integration with commercial space stations | Secure data storage and processing for national security, commercial, and international customers | Axiom Space to Launch Orbital Data Center Nodes … |

| AMD | Supplier of high-performance CPUs and GPUs | Providing essential computing hardware for AI workloads in both terrestrial and emerging space-based markets | AMD AI Solutions |

| Lone Star Data Holdings | First orbital facilities planned to be operational by 2028 | Establishing AI data centers in Earth orbit and on the lunar surface for deep-space data infrastructure | Data centers in outer space emerge as solution to AI’s … |

| Orbits Edge | High-performance micro data centers in Low Earth Orbit (LEO) | Enabling space-based edge computing to process data in orbit, reducing latency and ground station bandwidth | In-Orbit Data Centers Market Report 2025: Key Players like |

| Intellistake & Orbit AI | Development of satellite data centers and a supporting financial trust layer | Creating an independent verification layer to validate data and operations, establishing commercial viability | Intellistake Strengthens AI Infrastructure Platform With Entry … |

From Cloud to Constellation: A New Infrastructure Class Emerges

The range of applications reveals a sophisticated and rapidly segmenting industry. This is not a monolithic push but the formation of a complete value chain in orbit. We see platform developers like Google and Aetherflux targeting the hyperscale AI training market, aiming to replicate terrestrial cloud capabilities in space. Simultaneously, “picks and shovels” players like Space X and Blue Origin are focused on the critical logistics of getting mass into orbit, which remains the single largest cost driver and barrier to entry. This diversity is a strong indicator of a maturing market, moving beyond a single use case to a full-stack ecosystem. Specialized ventures are already carving out niches, such as Orbits Edge focusing on space-based edge computing to process satellite data at the source, and Lone Star Data Holdings pioneering deep-space archival storage on the Moon. The emergence of entities like Intellistake & Orbit AI, which are building a financial “trust layer, ” signals the final step toward commercialization: turning orbital compute into a verifiable, investable asset class.

The New Space Race: Silicon Valley vs. New Space Titans

Geographically, the race to build orbital data centers is overwhelmingly concentrated in the United States. This is not a traditional state-versus-state competition but a battle between two distinct American industrial bases: Silicon Valley and the New Space sector. Tech giants like Google, chipmakers like NVIDIA and AMD, and VC-backed startups like Starcloud and Aetherflux bring the AI expertise, software stacks, and capital. In parallel, aerospace leaders like Space X, Blue Origin, and Planet provide the launch capabilities and satellite operations know-how. This convergence of venture capital, deep AI research, and advanced aerospace engineering in the US creates a powerful ecosystem that is difficult to replicate, positioning it to dominate the early market. While international partners are involved in component supply, the strategic leadership and core intellectual property reside firmly within the US.

USA Dominates Global Data Center Infrastructure

This chart shows the US’s lead in terrestrial data centers, providing direct context for the section’s point that the new orbital space race is overwhelmingly concentrated in the US.

(Source: Brightlio)

From Blueprint to Orbit: The Phased Rollout of a Celestial Industry

The industry’s technology is currently in a critical Demonstration Phase (2025-2027). The primary goal is proving that complex computing hardware can survive launch and operate effectively in the harsh environment of space. Starcloud’s successful training of an AI model in orbit in late 2025 was a landmark achievement, and the upcoming Google/Planet prototype launch in 2027 will be another key validation point. The underlying technologies—reusable rockets from Space X and high-performance GPUs from NVIDIA—are already mature. The core innovation lies in the systems integration, thermal management, and radiation hardening required for orbital deployment. Following this phase, the market will enter an Early Commercialization Stage (2028-2030), characterized by the deployment of specialized micro data centers and initial constellations serving high-value niche customers before scaling to the gigawatt-level facilities envisioned post-2030.

Forward-Looking Insights: The Inevitable Trajectory of Off-Planet Computing

The move to space is not a speculative venture but an economic and environmental imperative driven by AI’s insatiable appetite for power and water. The projects announced in 2025 and 2026 signal that the business case is now viable. Looking forward, we can anticipate several key developments. First, the vertical integration demonstrated by Space X—controlling launch, and potentially the data center platform itself—offers a formidable competitive advantage. Second, the financialization of this sector, as pioneered by Intellistake, will unlock new capital flows by treating orbital compute as a tangible, bankable asset. Finally, the strategic focus will shift from technical feasibility to commercial leadership. The market’s projected growth to over $75 billion by 2035, capturing 10-15% of new data center investments, underscores the magnitude of the opportunity. The key question is no longer *if* data centers will move to space, but *who* will dominate this new celestial economy.

Frequently Asked Questions

Why are companies looking to move AI data centers into space?

The primary motivation is to offload the immense infrastructural burden of AI from Earth. A single terrestrial AI data center can consume the power equivalent of 100,000 homes. Space offers a solution with abundant solar power and a natural vacuum for cooling, addressing the escalating crisis of terrestrial energy and resource consumption.

Who are the main companies leading this new industry?

The article identifies several key players, including platform developers like Google (Project Suncatcher) and startups like Starcloud and Aetherflux. Critical enablers include launch providers SpaceX and Blue Origin, and hardware suppliers like NVIDIA and AMD. Other important companies are Planet, Axiom Space, and Lone Star Data Holdings.

Is this technology operational today, or is it still a future concept?

The technology is in a critical ‘Demonstration Phase’ (2025-2027). According to the article, a major milestone was reached in December 2025 when Starcloud successfully trained the first AI model in orbit. While full-scale commercial operations are still a few years away, the transition from concept to in-orbit validation is happening now, with initial commercialization expected between 2028 and 2030.

What is the projected market size for space-based AI data centers?

The market is projected to grow rapidly. It was valued at $500 million in 2025 and is forecasted to reach $39.09 billion by 2035. The article’s forward-looking analysis even suggests a potential valuation of over $75 billion by 2035.

What are the different roles companies are playing in this ecosystem?

The industry is segmenting into a full value chain. Some companies, like Google and Starcloud, are platform developers focused on AI training. Others, like SpaceX, are ‘picks and shovels’ players providing the essential launch logistics. Hardware suppliers like NVIDIA and AMD provide the core processing units, while specialized ventures like Orbits Edge focus on niche applications like space-based edge computing.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks 2025: DAC Market Analysis & Future Outlook

- Carbon Engineering & DAC Market Trends 2025: Analysis

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Climeworks- From Breakout Growth to Operational Crossroads

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.