Fuel Cell Boom 2025: Asia & Europe Lead Heavy-Duty Pivot

The Heavy-Duty Pivot: How Fuel Cells are Redefining 2025 Transportation

The 2025 transportation fuel cell market is decisively shifting its focus from the hyper-competitive passenger vehicle segment to heavy-duty applications where its technical advantages provide a clear commercial edge. This strategic pivot is driven by the technology’s superior energy density, longer range, and rapid refueling capabilities, which are critical for trucking, public transit, and maritime sectors. The data shows significant early-stage commercial deployments, with China’s heavy truck market seeing deliveries of over 700 hydrogen trucks in December 2025 alone and European hydrogen bus registrations surging by 426% in the first half of the year. The dominant theme for 2025 is a pragmatic realignment toward commercial viability, moving beyond pilot projects to establish a strong foothold in markets where battery-electric vehicles cannot effectively compete.

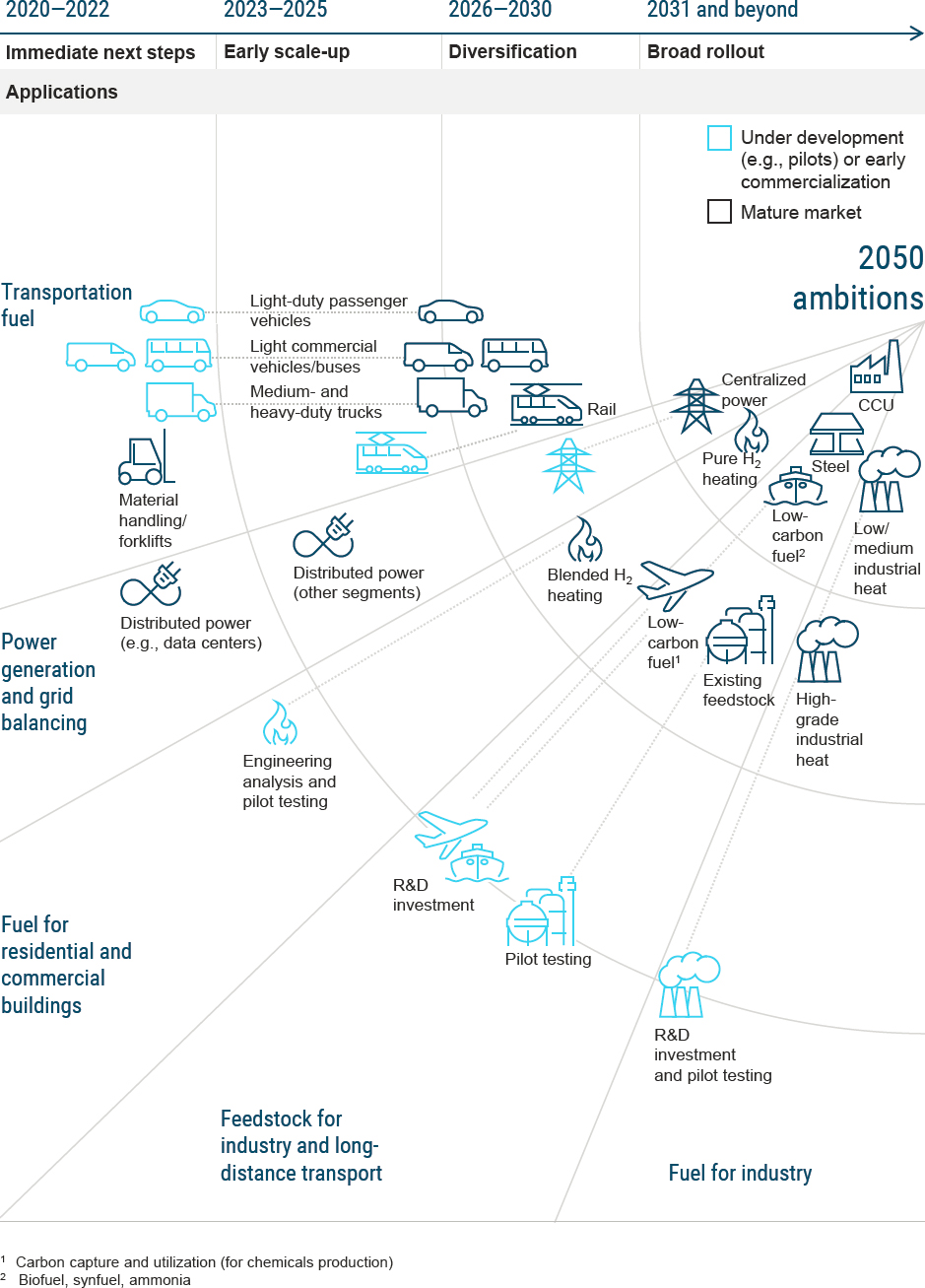

Hydrogen Roadmap Confirms Heavy-Duty Scale-Up

This roadmap visually confirms the article’s central thesis, showing heavy-duty trucks entering the ‘Early scale-up’ phase around the article’s focus year of 2025.

(Source: National Academies of Sciences, Engineering, and Medicine)

Key Fuel Cell Transportation Installations in 2025

The following installations highlight the strategic investments and commercial deployments shaping the fuel cell transportation landscape in 2025.

1. Chinese OEMs Drive Massive Heavy-Duty Truck Scale-Up

Company: Various Chinese OEMs

Installation: Over 700 hydrogen fuel cell trucks delivered in a single month (December 2025), with orders for an additional 1, 400 units.

Application: Long-Haul & Heavy-Duty Trucking

Source: China Expands Hydrogen Trucking, Total Energies CEO …

2. Hyundai HTWO Deploys 1, 000 Trucks in Guangzhou

Company: Hyundai (HTWO)

Installation: A strategic agreement to deploy 1, 000 hydrogen-powered logistics vehicles by 2025.

Application: Heavy-Duty Trucking

Source: Hyundai’s HTWO Inks Deal for 1000 Hydrogen Trucks in …

3. Hyroad Energy Acquires Nikola Trucks for California Routes

Company: Hyroad Energy

Installation: Acquisition of 113 Nikola hydrogen fuel-cell trucks for deployment on key California freight routes.

Application: Heavy-Duty Trucking

Source: Hyroad Energy Forms Strategic Partnership to Accelerate …

4. AZETEC Project Validates Long-Range Trucks in Canada

Company: Alberta Zero-Emissions Truck Electrification Collaboration (AZETEC)

Installation: Validation of two long-range fuel cell electric trucks in real-world operations.

Application: Heavy-Duty Trucking (Validation)

Source: Alberta Zero-Emissions Truck Electrification Collaboration …

5. Daimler Truck Targets Series Production and Liquid Hydrogen

Company: Daimler Truck

Installation: Strategic goal of series production and establishing a liquid hydrogen supply chain in Europe.

Application: Heavy-Duty Trucking

Source: Daimler Truck, HHLA and Kawasaki Heavy Industries …

6. Toyota’s Hino Begins Mass Production in Japan

Company: Toyota (Hino)

Installation: Commencement of mass production for heavy-duty fuel cell trucks in late 2025.

Application: Heavy-Duty Trucking

Source: Hydrogen fuel-cell trucks set to be mass produced in Japan …

7. European Hydrogen Bus Market Sees 426% Growth

Company: Various European OEMs

Installation: Registration of 279 hydrogen buses in the first half of 2025, a 426% year-over-year increase.

Application: Public Transit & Coach Buses

Source: Fuel cell bus projects in the world: what’s going on?

8. Hyundai and Wonder Mobility Partner for 2, 000 Buses in South Korea

Company: Hyundai & Wonder Mobility

Installation: Landmark deployment of 2, 000 hydrogen fuel cell buses.

Application: Public Transit

Source: 2025 Fuel Cell Innovations: Top Breakthroughs & Milestones

9. ABB and HDF Energy Develop Megawatt-Scale Marine System

Company: ABB & HDF Energy

Installation: Joint development agreement for a megawatt-scale fuel cell unit to power large ships.

Application: Maritime & Shipping

Source: ABB and HDF Energy to Develop High-Power Fuel Cell Unit

10. Ballard Power Systems Secures 6.4 MW Marine Order

Company: Ballard Power Systems

Installation: A significant order for 6.4 MW of its FCwave™ fuel cell engines to power Samskip’s zero-emission vessels.

Application: Maritime & Shipping

Source: Ballard announces major 6.4 MW fuel cell order to power …

11. NEXTCHEM and Siemens Energy Collaborate on Methanol Fuel Cells

Company: NEXTCHEM (MAIRE) & Siemens Energy

Installation: Collaboration to develop high-temperature methanol fuel cells that reform methanol to hydrogen onboard ships.

Application: Maritime & Shipping

Source: NEXTCHEM (MAIRE) and Siemens Energy will cooperate …

12. Hyundai Adapts Fuel Cell Tech for Marine Applications

Company: Hyundai Motor Company

Installation: Partnership with HD KSOE and Pusan National University to adapt its automotive fuel cell technology for maritime use.

Application: Maritime & Shipping

Source: Hyundai Motor Company Joins Forces with HD KSOE and …

13. Port of Oakland Deploys Fuel Cell Drayage Trucks

Company: Port of Oakland Project

Installation: Deployment of 30 fuel cell electric drayage trucks for port and regional operations.

Application: Drayage & Port Operations

Source: Zero-Emission Regional and Drayage Operations with Fuel …

14. Symbio and Savage Develop Lightweight Drayage Truck

Company: Symbio & Savage

Installation: Collaboration to develop the lightest drayage fuel cell truck to optimize performance and cost.

Application: Drayage & Port Operations

Source: The Lightest Drayage Fuel Cell Truck by Symbio and Savage

15. Honda and GM Recalibrate Passenger Vehicle Strategy

Company: Honda & GM

Installation: Announcement of the shutdown of their Michigan fuel cell joint venture by 2026, citing weak passenger demand.

Application: Passenger Vehicles (Strategic Shift)

Source: Honda-GM fuel cell venture ends as EV priorities reshape

16. Honda Launches First Plug-In Hybrid FCEV

Company: Honda

Installation: Launch of the CR-V e:FCEV, the first plug-in hybrid fuel cell vehicle in the U.S.

Application: Passenger Vehicles

Source: 8 Vehicle Manufacturers Working on Hydrogen Fuel Cell …

17. Toyota Advances Fuel Cell System Efficiency

Company: Toyota

Installation: Introduction of its third-generation fuel cell system, offering 1.2 times greater energy efficiency.

Application: Passenger Vehicles (Technology Advancement)

Source: Hydrogen-Powered Vehicles: A Clean Energy Alternative …

18. Horizon Fuel Cell Group Enters Indian Rail Market

Company: Horizon Fuel Cell Group & BHEL

Installation: Exclusive partnership to develop hydrogen-powered trains for the Indian rail network.

Application: Rail & Locomotives

Source: Horizon Fuel Cell signs Exclusive Hydrogen Train …

19. HD Hyundai Develops Hydrogen-Powered Excavator

Company: HD Hyundai

Installation: Development of a 14-ton hydrogen-powered wheeled excavator.

Application: Specialty & Off-Road Vehicles

Source: 2025 Fuel Cell Innovations: Top Breakthroughs & Milestones

20. Project Newborn Targets Next-Gen Aviation Fuel Cells

Company: Project Newborn (13 European partners)

Installation: A collaborative R&D initiative to develop next-generation fuel cell stacks for aircraft.

Application: Aviation (R&D)

Source: Next Generation Fuel Cell Stack Development in Project …

21. MIT Engineers Develop High-Density Aviation Fuel Cell

Company: MIT

Installation: Development of a novel fuel cell claimed to offer three times the energy density of lithium-ion batteries.

Application: Aviation (R&D)

Source: New fuel cell could enable electric aviation

22. Toyota and Rehlko Power Hydrogen Infrastructure

Company: Toyota & Rehlko

Installation: Exclusive agreement for Toyota to supply fuel cell modules for stationary power generators at refueling stations.

Application: Stationary Power for Transport Infrastructure

Source: Rehlko Signs Exclusive Agreement with Toyota to Supply …

23. Fuel Cell Energy Deploys Tri-Generation System

Company: Fuel Cell Energy

Installation: A Tri-gen system that produces electricity, heat, and up to 1, 200 kg of hydrogen per day.

Application: Stationary Power for Transport Infrastructure

Source: Tri-gen Receives U.S. Department of Energy 2025 Better …

24. Utility Global and Symbio Target Refuse Truck Ecosystem

Company: Utility Global & Symbio North America

Installation: Strategic alliance to create a circular ecosystem of zero-emission fuel cell refuse trucks.

Application: Light Commercial Vehicles (LCVs)

Source: Utility Global and Symbio North America Announce …

Table: 2025 Key Fuel Cell Transportation Deployments

| Company/Entity | Installation/Capacity | Application | Source |

|---|---|---|---|

| Chinese OEMs | 700+ trucks delivered, 1, 400 ordered | Heavy-Duty Trucking | Source |

| Hyundai (HTWO) | 1, 000 logistics vehicles | Heavy-Duty Trucking | Source |

| Hyroad Energy / Nikola | 113 Nikola FCEV trucks | Heavy-Duty Trucking | Source |

| European OEMs | 279 hydrogen buses (426% growth) | Public Transit | Source |

| Hyundai / Wonder Mobility | 2, 000 hydrogen buses | Public Transit | Source |

| Ballard Power Systems | 6.4 MW fuel cell order | Maritime & Shipping | Source |

| Port of Oakland | 30 FCEV drayage trucks | Drayage & Port Operations | Source |

| Horizon Fuel Cell / BHEL | Partnership for hydrogen trains | Rail & Locomotives | Source |

Beyond the Hype: Where Fuel Cells are Finding Commercial Traction

The diversity of applications, from Class 8 trucks to maritime vessels and off-road excavators, confirms that fuel cells are a targeted solution, not a universal replacement for all vehicle types. Industry adoption is highest in “hard-to-abate” sectors where battery technology faces fundamental limitations. The most significant commercial traction is in long-haul trucking (Hyroad Energy’s acquisition of 113 Nikola trucks), public transit with extensive routes (Hyundai’s 2, 000-bus deployment in South Korea), and marine shipping (Ballard’s major 6.4 MW order). This pattern reveals a clear market-pull strategy: focusing on segments where the value proposition of long range, high payload, and fast refueling outweighs the challenge of nascent infrastructure. Even niche deployments, like the 30 drayage trucks at the Port of Oakland, highlight a tactic of targeting controlled, return-to-base environments to simplify early refueling logistics and prove economic viability.

The Global Race: Asia Leads, North America and Europe Strategize

Geographically, Asia is the undisputed leader in deployment scale, driven by aggressive industrial policy. China’s delivery of hundreds of trucks in a single month and Hyundai’s 1, 000-truck deal in Guangzhou represent early commercial rollouts, not just pilot programs. South Korea and Japan are leveraging their strong industrial and automotive foundations, demonstrated by Hyundai’s bus deployments and Toyota/Hino’s move to mass production. The partnership between Horizon Fuel Cell Group and India’s BHEL signals a major market entry into rail, a sector with immense potential. In contrast, North America’s approach is more project-based and policy-driven, concentrated in hubs like California and focused on validating performance in specific use cases, such as the AZETEC project in Alberta. Europe is focusing on building an integrated ecosystem, from hydrogen supply chains (Daimler Truck’s liquid H 2 initiative) to vehicle deployment and next-generation R&D like Project Newborn for aviation.

Asia Leads Global Fuel Cell Vehicle Deployments

This chart directly supports the section’s geographical analysis by showing that Asia, particularly South Korea and China, dominates the global share of fuel cell vehicles.

(Source: ERA Environmental)

From Lab to Road: Fuel Cell Technology Comes of Age

The 2025 installations reveal a technology reaching maturity in specific, high-value segments. Commercialization is a reality for heavy-duty trucking and buses. Mass production announcements from major OEMs and large-scale fleet orders indicate that the technology has moved firmly beyond the demonstration phase. The simultaneous retreat from the passenger car market, highlighted by the closure of the Honda-GM joint venture, underscores this application-specific maturity. Maritime and rail applications are now in an advanced development and early commercial stage; Ballard’s 6.4 MW marine order is a landmark commercial deal, while partnerships like ABB/HDF Energy are focused on scaling up the megawatt-class systems required for large vessels. Aviation remains in a longer-term R&D phase, with efforts at MIT and within Project Newborn focused on the fundamental breakthroughs in energy density needed for flight.

Data Shows Heavy-Duty Dominates Fuel Cell’s Future

This chart visualizes the technology’s maturation in specific sectors by highlighting the strategic shift toward heavy-duty trucks over passenger vehicles.

(Source: Nature)

The Road Ahead: Ecosystem Economics and Commercial Imperatives

The fuel cell transportation industry in 2025 has found its commercial identity by pragmatically embracing its most viable markets. The data points conclusively to a strategic pivot away from a head-to-head battle with BEVs in the passenger segment and toward dominating heavy-duty applications. The central challenge is no longer just core technology but ecosystem economics. The success of these large-scale deployments is now inextricably linked to the build-out of reliable and cost-effective hydrogen refueling infrastructure. Innovative solutions like Fuel Cell Energy’s Tri-gen system, which co-produces hydrogen and power on-site, are emerging as a key strategy to de-risk infrastructure investment. The future viability of fuel cells in transportation will be measured not by new car models, but by the number of zero-emission tons-per-mile hauled, passengers carried, and containers shipped.

Transport Fuel Cell Market Forecasted to Grow

This forecast provides economic context for ‘The Road Ahead,’ projecting the transport-specific market will grow to $14.1 billion and underscoring the commercial imperatives discussed.

(Source: Global Market Insights)

Frequently Asked Questions

What is the biggest trend in fuel cell transportation for 2025?

The main trend is a decisive shift away from the competitive passenger car market and towards heavy-duty applications. The industry is focusing on trucking, public transit, and maritime sectors, where the technology’s long range, fast refueling, and high payload capacity offer a clear advantage over battery-electric vehicles.

Why are fuel cells better than batteries for trucks and ships?

For heavy-duty applications, fuel cells offer superior energy density, allowing vehicles to travel longer distances without the significant weight penalty of large batteries. This preserves payload capacity. Additionally, their rapid refueling times (minutes instead of hours) are critical for minimizing downtime and meeting the demands of commercial logistics and transport.

Which countries or regions are leading in fuel cell adoption?

Asia, particularly China and South Korea, is the undisputed leader in deployment scale. The article cites China’s delivery of over 700 hydrogen trucks in one month and Hyundai’s deployment of thousands of vehicles. In contrast, North America’s approach is more project-based (e.g., California drayage trucks), while Europe is focused on building an integrated ecosystem, including supply chains and R&D.

If the focus is on trucks, what is happening with fuel cell passenger cars?

The industry is largely retreating from the passenger vehicle segment due to weak demand and the strong market position of battery-electric cars. The blog post highlights the shutdown of the Honda-GM fuel cell joint venture as evidence of this strategic pivot. While some niche models like the Honda CR-V e:FCEV exist, the main commercial momentum is no longer in passenger cars.

What is the biggest challenge for the growth of fuel cell transportation?

The central challenge has shifted from core vehicle technology to ‘ecosystem economics’—specifically, the build-out of reliable and cost-effective hydrogen refueling infrastructure. The success of the large-scale truck and bus deployments mentioned is now dependent on solving the logistics of supplying hydrogen, which is why solutions like Fuel Cell Energy’s on-site hydrogen production system are becoming crucial.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Fuel Cells Data Centers: 2025 AI Power Trends Analysis

- Carbon Engineering & DAC Market Trends 2025: Analysis

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.