US Maritime Fuel Cells: 2025 Commercial Boom

Maritime Fuel Cells: From Demonstration to Commercial Deployment

The year 2025 represents a definitive inflection point for maritime fuel cell systems in the U.S., transitioning the technology from small-scale demonstrations to commercially viable, megawatt-scale deployments. Driven by stringent IMO 2030 emissions targets and substantial policy support, the sector is rapidly adopting hydrogen and methanol fuel cells. Key data confirms this trend, including Ballard Power Systems’ landmark 6.4 MW order for primary propulsion on container vessels and the expansion of zero-emission passenger ferries, as seen with SWITCH Maritime’s new $2 million project in New York. The dominant theme for 2025 is a market bifurcation: PEM fuel cells are now commercially proven for smaller vessels, while megawatt-scale pilots by industry giants like ABB and HDF Energy are de-risking the technology for large, ocean-going ships, setting the stage for exponential growth.

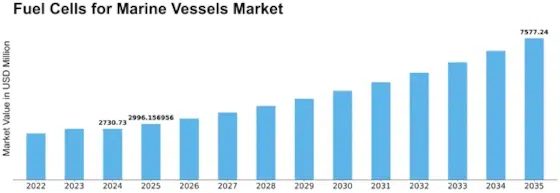

Maritime Fuel Cell Market Projects Explosive Growth

This forecast validates the article’s claim of a 2025 inflection point. The projected growth from approximately $3 billion in 2025 to over $7.5 billion by 2035 visually represents the sector’s shift from demonstration to large-scale commercial deployment.

(Source: Market Research Future)

Key Maritime Fuel Cell Deployments in 2025

The following installations highlight the tangible progress and strategic investments shaping the U.S. maritime fuel cell landscape in 2025.

1. SWITCH Maritime: MV Sea Change Passenger Ferry

Company: SWITCH Maritime / Zero Avia

Installation Capacity: 360 k W fuel cell powertrain

Application: Zero-Emission Propulsion for Passenger Ferry

Source: MV Sea Change: the first commercial 100% hydrogen fuel …

2. SWITCH Maritime: New York H 2 Ferry

Company: SWITCH Maritime

Installation Capacity: $2 Million in funding for development

Application: Hydrogen Fuel Cell-Electric Ferry

Source: SWITCH Maritime bags $2 million for NY’s first hydrogen …

3. ABB & HDF Energy: Megawatt-Scale Auxiliary Power

Company: ABB & HDF Energy

Installation Capacity: Megawatt-scale

Application: Auxiliary Power Systems for Large Vessels

Source: ABB, HDF Energy sign agreement on marine fuel cell …

4. Ballard Power Systems: Propulsion for Short-Sea Shipping

Company: Ballard Power Systems

Installation Capacity: 6.4 MW

Application: Primary Propulsion for Samskip Container Vessels

Source: Ballard announces major 6.4 MW fuel cell order to power …

5. e 1 Marine & Power Cell: Onboard Methanol Reforming

Company: e 1 Marine & Power Cell

Installation Capacity: Commercial system supply

Application: Methanol-to-Hydrogen Onboard Reforming Systems

Source: e 1 Marine to supply hydrogen reformers for Power Cell’s …

6. NEXTCHEM & Siemens Energy: Modular Methanol Solutions

Company: NEXTCHEM & Siemens Energy

Installation Capacity: Modularized systems

Application: High-Temperature Methanol Fuel Cell Solutions

Source: NEXTCHEM (MAIRE) and Siemens Energy will cooperate …

7. Project zero 4 cruise: Powering Cruise Ships

Company: Project zero 4 cruise

Installation Capacity: Development phase

Application: PEM Fuel Cells for Cruise Ship Energy and Propulsion

Source: Fuel cell technology for climate-neutral shipping

8. Bloom Energy: High-Efficiency Auxiliary Power

Company: Bloom Energy

Installation Capacity: 65 k W Marine Power Module (SOFC)

Application: High-Efficiency Solid Oxide Fuel Cell Auxiliary Power

Source: Bloom’s Fuel Cells Provide Highly Efficient Power …

9. Hyundai: Port Decarbonization

Company: Hyundai

Installation Capacity: Pilot fleet of trucks

Application: Fuel Cell Electric Trucks (FCEVs) for Port Drayage

Source: Leading US Seaport Will Trial Fuel Cell Electric Trucks

10. Feadship & ABB: Superyacht Propulsion

Company: Feadship / ABB

Installation Capacity: Multi-megawatt

Application: Superyacht Propulsion & Hotel Power

Source: ABB integrates multi-megawatt marine fuel cell system for the …

11. Hanwha Aerospace: Standardized Marine Modules

Company: Hanwha Aerospace

Installation Capacity: 200 k W Module

Application: Standardized, Type-Approved Modules

Source: Hanwha secures DNV Ai P for hydrogen fuel cells

12. Advent Technologies: Advanced PEM Technology

Company: Advent Technologies

Installation Capacity: Component development

Application: High-Temperature PEM (HT-PEM) for Durability

Source: Advent Speaks at IEA Maritime Fuel Cell Conference 2025

Table: Summary of 2025 Maritime Fuel Cell Installations

| Company / Project | Installation Capacity / Investment | Application | Source |

|---|---|---|---|

| SWITCH Maritime / Zero Avia | 360 k W | Zero-Emission Passenger Ferry | Source |

| SWITCH Maritime | $2 Million | Hydrogen Fuel Cell-Electric Ferry | Source |

| ABB & HDF Energy | Megawatt-scale | Auxiliary Power for Large Vessels | Source |

| Ballard Power Systems | 6.4 MW | Primary Propulsion for Container Vessels | Source |

| e 1 Marine & Power Cell | Commercial System Supply | Methanol-to-Hydrogen Reforming | Source |

| NEXTCHEM & Siemens Energy | Modularized Systems | High-Temperature Methanol Fuel Cells | Source |

| Project zero 4 cruise | Development Phase | PEM Fuel Cells for Cruise Ships | Source |

| Bloom Energy | 65 k W Module | High-Efficiency SOFC Auxiliary Power | Source |

| Hyundai | Pilot Fleet | FCEVs for Port Drayage | Source |

| Feadship / ABB | Multi-megawatt | Superyacht Propulsion & Power | Source |

| Hanwha Aerospace | 200 k W Module | Standardized Marine Modules | Source |

| Advent Technologies | Component Development | High-Temperature PEM (HT-PEM) | Source |

From Niche Ferries to Mainstream Cargo: The Expanding Application Spectrum

The 2025 installations demonstrate a strategic expansion of fuel cell applications, signaling widening industry adoption. The technology is moving beyond its initial proving ground in passenger ferries to tackle the sector’s largest emissions sources. A key pattern is the phased approach to decarbonization: smaller vessels like the *MV Sea Change* and short-sea cargo ships (Samskip) are adopting fuel cells for primary propulsion, while larger ocean-going vessels are initially integrating megawatt-scale systems for auxiliary power, as seen in the ABB and HDF Energy collaboration. This dual strategy allows the industry to gain operational experience while scaling the technology for more demanding propulsion needs. Furthermore, the inclusion of land-based applications like Hyundai’s drayage truck pilot underscores a holistic, “port-to-ship” decarbonization strategy, recognizing that maritime emissions do not stop at the water’s edge.

Passenger Vessels Dominated Early Fuel Cell Adoption

This chart provides historical context, showing passenger vessels were the primary application for hydrogen power until 2024. This supports the section’s narrative that the technology is now expanding from this initial niche to mainstream cargo.

(Source: ScienceDirect.com)

U.S. Ports Emerge as Epicenters for Maritime Decarbonization

Geographically, these deployments are not random; they are concentrated in U.S. coastal regions with strong regulatory drivers and proactive port authorities. The San Francisco Bay Area, home to the pioneering *MV Sea Change*, and New York, targeted for SWITCH Maritime’s next ferry, are leading the way. These projects benefit from a confluence of state-level emissions mandates, available public funding, and a strong political will to establish green shipping corridors. The data confirms market forecasts placing North America at the forefront of the marine fuel cell market. This regional leadership suggests that mainstream adoption will likely accelerate first in areas with a supportive policy ecosystem, creating concentrated hubs of technological expertise and fueling infrastructure that can be replicated in other strategic port locations nationwide.

North America to Lead Maritime Fuel Cell Market

This regional forecast directly supports the section’s thesis that U.S. ports are emerging as epicenters. The projection of North America becoming a billion-dollar market by 2035 underscores the region’s strategic importance and strong growth drivers.

(Source: Market Research Future)

A Tale of Two Technologies: Commercial PEM and Emerging SOFCs

The 2025 projects reveal a maturing and diversifying technology landscape. Proton Exchange Membrane (PEM) fuel cells are now commercially established for marine use. The DNV Type Approval for Ballard’s FCwave™ module and its subsequent 6.4 MW order signify that PEM technology has graduated from demonstration to a bankable, scalable solution for shipbuilders. Concurrently, the market is seeing the strategic rise of alternative fuel cell chemistries. Bloom Energy’s achievement of ABS Type Approval for its Solid Oxide Fuel Cell (SOFC) module is a critical milestone. SOFCs offer higher electrical efficiency and greater fuel flexibility, making them a compelling option for continuous baseload and auxiliary power on large vessels. This technological diversification, which also includes development in High-Temperature PEM (HT-PEM) by firms like Advent Technologies, proves the industry is moving beyond a one-size-fits-all approach to tailor solutions for specific vessel profiles and operational demands.

PEMFC Technology Drives Market to $451M by 2030

This chart quantifies the market where PEMFC is a key technology segment, directly supporting the section’s discussion of PEM’s commercial maturity. It provides a concrete market value and growth rate for the technologies being discussed.

(Source: IndustryARC)

Beyond the Tipping Point: Infrastructure and Standardization Dictate the Next Wave

The deployments of 2025 confirm that maritime fuel cell technology has crossed the commercial tipping point. The central challenge is now shifting from the viability of the fuel cell to the logistics and economics of the fuel. The significant focus on methanol-to-hydrogen reforming, seen in projects by e 1 Marine and NEXTCHEM, is a direct response to the near-term difficulties of storing and bunkering liquid or compressed hydrogen. This pragmatic approach highlights that fuel flexibility is a paramount concern for vessel operators. Perhaps the most critical enabler for future growth is the industry-wide push for standardized, type-approved modules from companies like Ballard, Hanwha, and Bloom Energy. Standardization dramatically reduces integration costs, project timelines, and risk for shipyards, paving the way for mass-market adoption. Looking forward, the pace of decarbonization will be dictated less by fuel cell performance and more by the successful build-out of global green fuel infrastructure and the establishment of a favorable total cost of ownership against both incumbent and alternative technologies.

Frequently Asked Questions

What is the main trend for maritime fuel cells in 2025, according to the article?

The year 2025 represents a major inflection point where maritime fuel cells are transitioning from small-scale demonstrations to commercially viable, megawatt-scale deployments. The market is characterized by a bifurcation: commercially proven PEM fuel cells for smaller vessels and large-scale pilots to de-risk the technology for ocean-going ships.

Are fuel cells only being used for small ferries?

No. While passenger ferries like the MV Sea Change have been key proving grounds, 2025 sees a significant expansion into larger vessels. For example, Ballard Power Systems has a 6.4 MW order for primary propulsion on container vessels, and companies like ABB and HDF Energy are developing megawatt-scale auxiliary power systems for large ships.

What types of fuel cell technologies are being deployed?

The primary technology is the Proton Exchange Membrane (PEM) fuel cell, which is now considered commercially established for marine use. However, other technologies are also emerging, notably Solid Oxide Fuel Cells (SOFCs) from companies like Bloom Energy, which offer high efficiency and fuel flexibility for auxiliary power.

Why are some companies focusing on methanol instead of hydrogen directly?

Companies like e1 Marine and NEXTCHEM are focusing on methanol-to-hydrogen reforming systems as a practical response to the current challenges of storing and bunkering liquid or compressed hydrogen on vessels. This approach allows ships to use the easier-to-handle liquid fuel methanol while still benefiting from a hydrogen fuel cell.

What is enabling the mass-market adoption of marine fuel cells?

A critical enabler for future growth is the industry-wide push for standardization. The development of standardized, type-approved modules by companies like Ballard, Hanwha, and Bloom Energy dramatically reduces integration costs, project timelines, and risks for shipyards, paving the way for broader, mass-market adoption.

Want strategic insights like this on your target company or market?

Build clean tech reports in minutes — not days — with real data on partnerships, commercial activities, sustainability strategies, and emerging trends.

Experience In-Depth, Real-Time Analysis

For just $200/year (not $200/hour). Stop wasting time with alternatives:

- Consultancies take weeks and cost thousands.

- ChatGPT and Perplexity lack depth.

- Googling wastes hours with scattered results.

Enki delivers fresh, evidence-based insights covering your market, your customers, and your competitors.

Trusted by Fortune 500 teams. Market-specific intelligence.

Explore Your Market →One-week free trial. Cancel anytime.

Related Articles

If you found this article helpful, you might also enjoy these related articles that dive deeper into similar topics and provide further insights.

- E-Methanol Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- IMO Decarbonization & Net Zero 2025: Policy Collapse

- Battery Storage Market Analysis: Growth, Confidence, and Market Reality(2023-2025)

- Bloom Energy SOFC 2025: Analysis of AI & Partnerships

- Climeworks 2025: DAC Market Analysis & Future Outlook

Erhan Eren

Ready to uncover market signals like these in your own clean tech niche?

Let Enki Research Assistant do the heavy lifting.

Whether you’re tracking hydrogen, fuel cells, CCUS, or next-gen batteries—Enki delivers tailored insights from global project data, fast.

Email erhan@enkiai.com for your one-week trial.